Payments Guide

May 2013

Table of Contents

1 Overview 5

A. Additional Resources 7

Basic Guides 8

Online Help 8

CitiDirect Customer Support 8

B. Sign-on to CitiDirect BE

SM

9

2 Payments 11

A. Local Language Availability 13

B. Payment Methods 15

C. Payment Types 17

D. Payments Setup 19

3 CitiDirect Libraries 21

A. Library Maintenance 23

B. Payment Libraries 25

4 My Preferences 29

A. Available Preference Criteria for Payments 31

B. Library Lookup Favorites 33

5 Payment Forms 35

A. Payments Summary Form 37

Tabs 39

Action Buttons 39

Submit Button 39

New Button 40

Delete Button 40

Go to Details Button 40

Other Options Button 40

B. Payment Detail Form 42

Payment Method 43

Payment Type 44

Payment Amount 44

Subsidiary Identifier/Name 44

Transaction Reference Number 45

Value Dates 45

Library Lookup Favorites Button 45

Multiple-Line Button 45

Sub-Forms 46

Actions Buttons 46

Submit Button 46

Submit and Create Preformat Button 47

Submit and Copy Button 47

Table of Contents

Copy Button 47

Delete Button 47

Next Button 48

Return to Summary Button 48

Other Options Button 48

6 Outgoing and Incoming Payments 50

A. Outgoing Payment Methods 52

B. Incoming Payment Methods 55

7 Create Payments from Preformats 57

8 Create Payments Using Quick Entry from Preformats 63

A. Correct Quick Entry from Preformat Transactions with Errors 66

9 Create New Outgoing Payments 68

10 Create New Incoming Payments 72

11 Create New Incoming/Outgoing Payments Using Copy 77

12 View Payment Details 82

13 Delete Payments 86

14 Modify Payments 90

15 Verify Payments 94

A. Verify Payments from the Verification Required Tab 96

Require Detail-Level Verification 100

B. Verify Payments from the Payment Detail Form 102

16 Authorize Payments 105

A. Authorize Payments from the Authorization Required Tab 107

Require Detail-Level Authorization 111

B. Authorize Payments from the Payment Detail Form 112

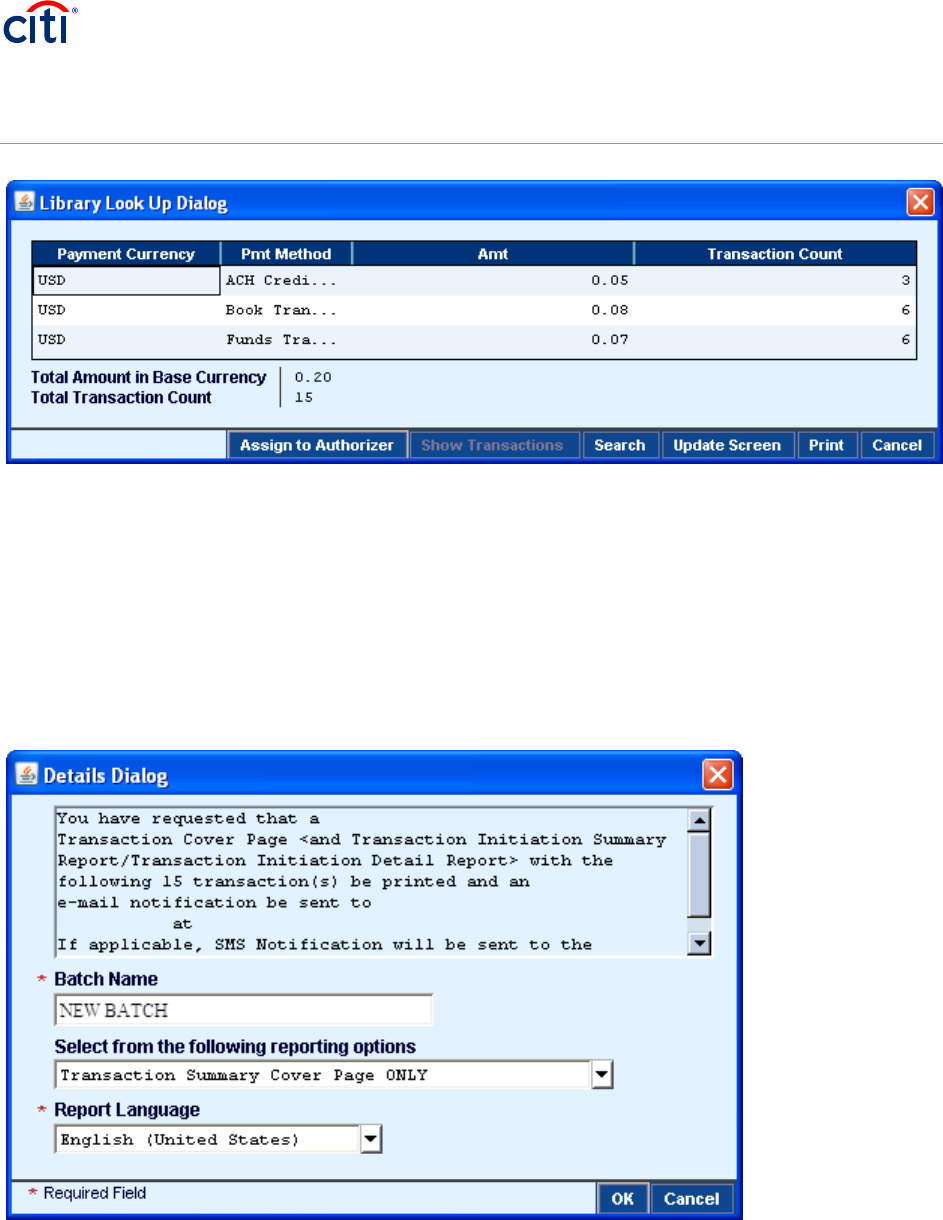

C. Authorize Batches of Payments 115

New Batches Button 119

Update Screen button 119

D. Authorize Offline 121

E. Offline Authorization Tab—Action Buttons 129

17 Release Payments 132

A. Release Payments from the Release Required Tab 134

B. Release Payments from the Payment Detail Form 139

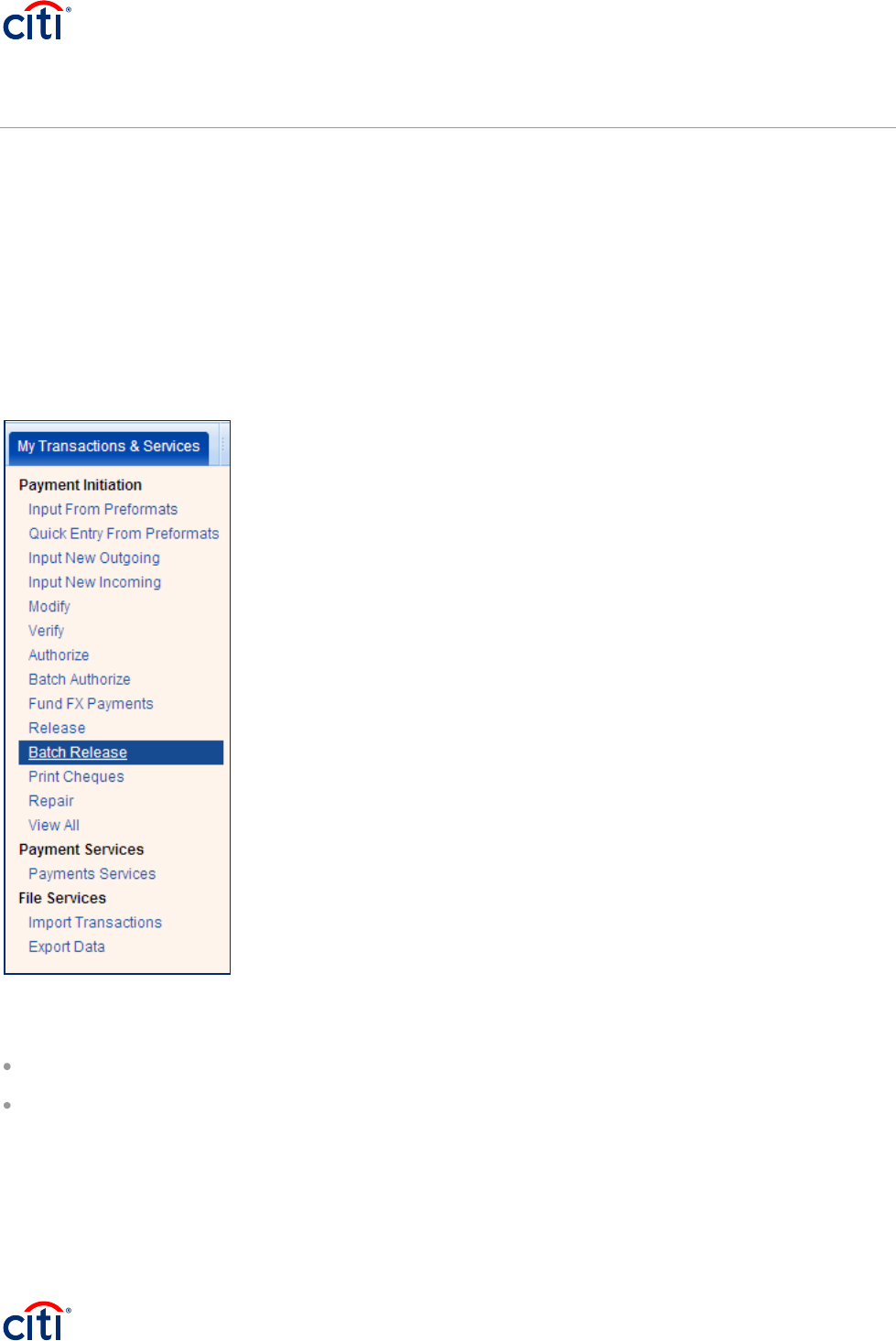

C. Release Batches of Payments 143

New Batches 146

Update Screen 146

Table of Contents

18 Repair Payments 148

19 Print On-Site Cheques 152

A. Print On-Site Cheques from the Print Cheques Tab 154

B. Print On-Site Cheques from the Payment Detail Form 158

20 Void On-Site Cheques 161

A. Void On-Site Cheques from the Print Cheques Tab 163

B. Void On-Site Cheques from the Payment Details Form 165

21 Search/Sort the Payments on a Summary Form 168

Operators 170

22 Print a Summary List of Payments 172

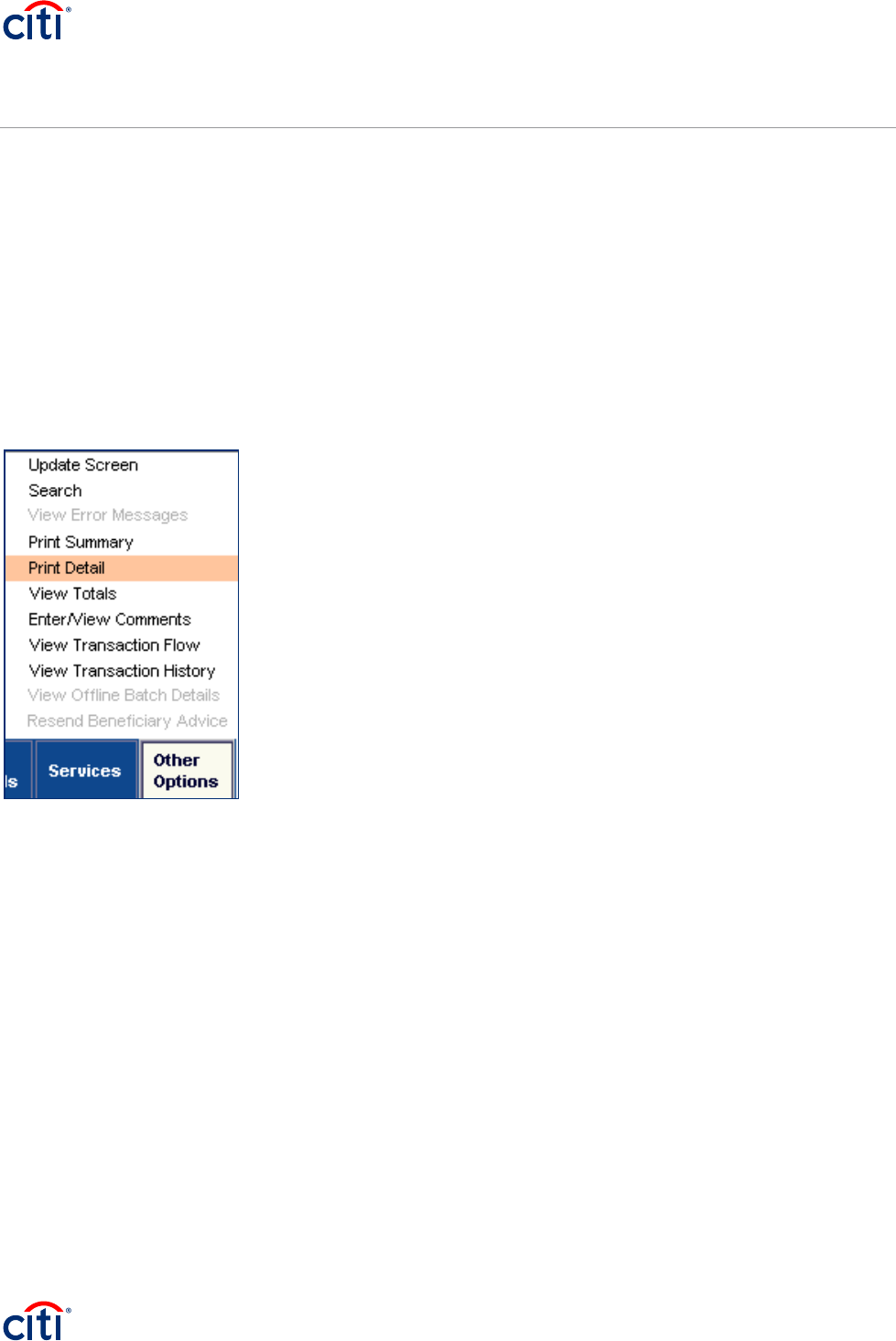

23 Print Payment Details from a Summary Form 174

24 View Payment Totals 176

25 Enter New or View Existing Comments 178

26 View Transaction Flow 181

27 View Transaction History 184

28 Payments Reports and Inquiries 187

A. Reports 189

Report Service Classes 190

Cash Balance Reports 190

Cash Statements Reports 191

Cash Transaction Initiation Reports 192

Offline Authorization Report 193

B. Inquiries 194

Cash Statement Inquiries 195

Canada ACH Inquiries 196

Bank Search Inquiry 196

WorldLink Inquiries 196

1

1 Overview

Overview

This guide provides an overview of the Payments capability in CitiDirect BE

SM

. Descriptions of the major

payment methods currently supported and procedures for creating, verifying, authorizing, modifying, deleting,

repairing and releasing payments for processing are presented.

Also presented are an overview of the process flow that CitiDirect clients can specify for their payment

transactions and descriptions of the reports, inquiries and libraries that support CitiDirect Payments services.

In addition, this guide provides the procedures required to set your preferences for:

1. Default values for information required on payments, report and inquiry forms.

2. The debit and/or credit accounts that appear on your Library Lookup Favorites list.

2

A. Additional Resources

Additional Resources

Basic Guides

In conjunction with this Payments guide, you are encouraged to read the CitiDirect Basics guides, available in

the CitiDirect Basics section of the Learning Center at www.citidirect.com.

The CitiDirect Basics guides provide an overview of CitiDirect, including installation, sign-on procedures,

basic navigation and procedures for customizing the CitiDirect navigation bar and summary forms, specifying

your global user preferences, running reports and submitting inquiries.

Online Help

For general questions while working in CitiDirect BE

SM

, you can use Online Help. Online Help, a

comprehensive self-service capability, contains detailed information and descriptions of terms for all

functionality and services offered through CitiDirect.

You can access Online Help by pressing F1 on your keyboard or by clicking the Help button at the bottom of

the CitiDirect navigation bar.

For help with your current task, click anywhere on the CitiDirect form displayed in your workspace to ensure

that it is active, and then access Online Help.

CitiDirect Customer Support

In addition to Online Help, the following CitiDirect customer support resources are available to you:

www.citidirect.com contains frequently asked questions (FAQs) addressing both the use of the application

and the website. The website also features the Learning Center section where you can access training

support materials anytime.

Customer Service Centers You can contact our CitiDirect BE

SM

Service Representatives, who are available to

support your technical needs, as well as to assist you with general CitiDirect questions. For a list of

representatives in your area, go to the Contacts section of .

3

B. Sign-on to CitiDirect BE

SM

Sign-on to CitiDirect BE

SM

In order to follow all the procedures included in this Payments guide, you must successfully sign on to

CitiDirect BE

SM

.

For sign-on procedures, see the CitiDirect Basics: Getting Started guide, available in the Learning Center at

www.citidirect.com.

4

2 Payments

Payments

The Payments service class in CitiDirect BE

SM

provides you with the convenience of a broad range of

payment methods and real-time access to important transactional information.

Use Payments to enter, modify, delete, verify, authorize, release, repair and/or view payments.

5

A. Local Language Availability

Local Language Availability

CitiDirect BE

SM

lets you view details, execute transactions, produce information reports and perform inquiries

in many local languages. A complete list of the local languages supported by CitiDirect is available on

www.citidirect.com under the About CitiDirect tab in the CitiDirect Platform section.

6

B. Payment Methods

Payment Methods

The Payments service class supports multiple specific payment methods, with each method having one or

more forms depending upon the Local (country- and region-specific) and Global variations.

Subject to the processing capabilities of the Citibank branch, you can enter the following outgoing and

incoming payments from one single point of input.

Outgoing Payment Methods

Incoming Payment Methods

ACH

Cr

edit

/

GIR

O

ACH

Debit

Book

T

r

ans

f

e

r

Advice

to

Receive

Cheque

Book Debit

Cross-Border Funds

T

r

ans

f

e

r

Dr

a

wdo

wn/

ChargeWire

Domestic Funds

T

r

ans

f

e

r

Due

C

u

s

t

omer Adjus

tment

Due Citibank Adjus

tment

Incoming Domestic Funds

T

r

ans

f

e

r

Funds

T

r

ans

f

e

r

Due

C

u

s

t

omer Adjustment Incoming

Mexico Tax

P

a

yment

On-Site Cheque

Pan European ACH

Payroll Cards

Window Payment

SEPA

Faster Payment

7

C. Payment Types

Payment Types

Payment types are variations of a particular payment method. Cashier’s Cheque and Managers Cheque are

examples of payment types that may be available when Cheque is the selected payment method.

Payment types vary depending on the payment method and region or country where the payment is

processed. For a description of the payment types associated with specific payment methods, please refer to

CitiDirect Online Help.

Notes:

The availability of payment methods can vary based on the CitiDirect BE

SM

services assigned to each client,

the access profile assigned to each user and the Citibank branch processing capabilities.

The branch where a payment is processed and the payment method of the transaction determine the

payment types that are available for that transaction.

Once you enter the required key details common to all payment methods, CitiDirect automatically determines

which payment methods and payment types are available to you, as well as the forms and sub-forms that are

needed to process your transaction.

The payment forms and sub-forms presented to you, reflect the particular requirements of a specific

transaction and the country in which the transaction will be processed.

Standard payment methods are presented in this guide. Region-, country- and product-specific payment

methods are presented in the Online Help and in individual guides that are available in the Learning Center at

www.citidirect.com.

8

D. Payments Setup

Payment Setup

CitiDirect lets users customize its services to suit their business needs. Access to many of the services

required to set up CitiDirect is restricted to local Security Managers only. Your assigned access profile

determines whether or not you have access to a CitiDirect service.

When CitiDirect BE

SM

is installed, local Security Managers:

1. Set client preferences, which apply to all users. Examples are base currency, auto-save frequency,

whether or not transaction reference numbers are automatically generated and whether or not the

subsidiary name/ID appears on the Payment Detail form;

2. Specify the flow each payment must follow before it is sent to Citibank for processing. Verification

Required, Authorization Required and Release Required are examples of flow-control requirements;

3. Establish users and assign their access profiles;

4. Ensure that records are created and saved in the CitiDirect Payments libraries that are used for data

input and validation. To see a list of libraries, refer to the Payments Libraries section of this guide.

9

3 CitiDirect Libraries

CitiDirect Libraries

Libraries are separately maintained tables within the CitiDirect database that store information needed to

support data input, validation and processing rules. All Payments-related service classes reference various

CitiDirect BE

SM

libraries.

When you select information from a library lookup list, the relevant information automatically populates the

current field and any related fields, reducing typing time and eliminating typing errors. For example, when you

select a bank name from the Bank Library Lookup list, the related bank address fields are automatically

populated.

Most library lookup lists provide a search feature to enable you to search for and retrieve an entry from a

library.

My Preferences, the CitiDirect service that allows you to set your preferences and customize CitiDirect to

meet your specific needs, provides a feature that enables you to create a Library Lookup Favorites list of the

account numbers that you use most often. For more information, see the Selecting Debit/Credit Account

Library Lookup Favorites section of this guide.

10

A. Library Maintenance

Library Maintenance

Citibank maintains libraries that store information used by all CitiDirect clients. The Currency, Country,

Payment Method, Branch and Account libraries are examples of Citibank-maintained libraries.

Local Security Managers maintain the libraries that store information specific to their client entity. The Account

Familiar Name, Preformat and Ordering Party libraries are examples of client-maintained libraries.

All client-maintained libraries should be populated before you begin using the CitiDirect services that support

Payments. For a description of many of the client-maintained libraries referenced by Payments- related

service classes, see the Payments Libraries section of this guide.

Notes:

1. The libraries list presented in this guide does not include Payments libraries that are region-,

country- or product-specific. Refer to CitiDirect Online Help for a description of any libraries not

included in this guide.

2. If preferences have been set in Client Preference or My Preferences, some fields are pre-populated

when you access the CitiDirect forms used to create a new payment, run a report or submit

an inquiry.

3. Client Preference settings apply to all CitiDirect users within an organization.

4. My Preference settings apply to your sign-on name and ID only.

5. For information about accessing My Preferences to set your preferences, see the Set Your

6. Preferences for Payments section of this guide.

11

B. Payment Libraries

Payment Libraries

An alphabetical list of some of the CitiDirect libraries that support data input and validation for the Payments

service class is provided below. Library availability varies based on product, country, and/or region. Refer to

Online Help for a description of region, country and product specific libraries.

Library Name

Description

Maintenance Responsibilities

Account

Stores all of your entitled Citibank accounts that can be debited or

credited. This library includes a description of the account type, account

number and other information required for transaction processing. The

data stored in this library is used to process transactions and to

allocated credit and expenses.

Citibank enters information into this

library, but clients can add data to some

fields.

Account

Familiar Name

Stores all client-defined familiar names for entitled internal Citibank

accounts (not funding accounts or non-Citibank-managed accounts).

This library identifies the account name that you want to see on reports,

which replaces the legal account name on reports.

Clients maintain this library and all

records are private.

Account Grouping

Stores all group names that clients have defined to group accounts

(debit accounts) for reporting purposes. Certain CitiDirect reports may

be run for account groups when present.

Clients maintain this library and all

records are private.

Account Type

Stores the account types that are available for each country/region. It is

used to support the lookup of account types during payment creation.

Citibank maintains this library.

Bank (Beneficiary

Bank)

Stores information about various banks required for use in transactions.

Data includes bank name and location, as well as routing information.

By providing the processing center with complete details about the non-

Citibank bank parties involved in a transaction, this library is used by

transaction classes to improve straight-through processing.

Beneficiary

Stores the names of all of a client’s beneficiaries (payees) and supports

lookup in the beneficiary fields when creating payments.

Clients maintain this library and all

records are private.

Business Days

Stores information about the business days in each country where

Citibank has branch operational capability.

Citibank maintains this library.

Cheque Number

Maintenance

Stores all the cheque numbers available for on- site cheque payment

transactions. Each library profile lists the available cheque number

range for a specific client/company combination. Use

this library to define input for new cheque number ranges, or to modify,

repair and review existing cheque number ranges.

Clients maintain this library and all

records are private.

Cheque Stock

Maintenance

Stores client-defined cheque stock forms. Each stock form can be

named, the stock print form can be identified and the logo and micro-

line information printed on the cheques can be defined.

Citibank maintains this library.

Customer EAN

Stores all client-defined customer EAN descriptions. It is used to

support lookup of customer EAN descriptions and default values on

payment input forms.

Clients maintain this library and all

records are private.

Date Rolling

Stores the way a payment value date should be rolled, forward or

backward, when it falls on a holiday, weekend, or after cutoff time as

defined by a CitiDirect client. The library uses the types of payments

(e.g., salary payments and tax payments), defined by Citibank in the

Document Type library, to define date-rolling library records.

Clients maintain this library and all

records are private.

Delivery Method

Stores the cheque delivery methods available by country and branch. It

is used to support the lookup of delivery methods during payment

creation.

Clients maintain this library and all

records are private.

Document

Description

Stores the document types that are available for cheques that can be

included with payment transactions. It is used to support the lookup of

document types during payment creation.

Clients maintain this library and all

records are private.

Document Type

Stores the document types that are available for cheque processing. It

is used to support the lookup of document types during payment

creation.

Citibank maintains this library.

Employee

Stores the names of all client employees, who can be paid with a salary

payment. This library is used to validate the employee-related detail

information that is needed when creating a salary payment transaction.

Clients maintain this library and all

records are private.

12

Payment Libraries (Cont'd)

Library Name

Description

Maintenance Responsibilities

Holiday (Branch/

Legal Vehicle)

Stores holidays in various branches and/or legal vehicles. It is used by

transaction services to evaluate processing availability and to establish

value and process-date parameters.

Citibank maintains this library.

Holiday

(Country)

Stores holidays in various countries. It is used by transaction services to

evaluate processing availability and to establish value and process-data

parameters.

Citibank maintains this library.

Holiday

(Currency)

Stores currency holidays. It is used to prevent a payment from

processing on a currency holiday. This library is currently being used by

Europe and Canada.

Citibank maintains this library.

Instruction

Code

Stores the instruction codes (and corresponding descriptions) that can

be used in the Instruction Code field for a branch and a payment

method. This library is used to support lookup in the Instruction Code

field when creating payments for Domestic Fund Transfers, Cross-

Border Fund Transfers and Book Transfers for European branches.

Citibank maintains this library.

Invoice Type

Stores all client-defined invoice forms, which are used to format the

invoice data entry form and define any expressions or totals that apply

to that form for invoice information that is included with

a payment. Based on back-end processing system functionality and/or

requirements, the number of columns that can be defined may vary by

region or country.

Clients maintain this library and all

records are private.

K-Symbol

Stores descriptive text corresponding to K-Symbol codes (indicating

economic nature). It is used

to select valid K-Symbol codes when creating payments.

Citibank maintains this library.

Licensee

Stores licensee names and corresponding licensee IDs. It is used to

select valid licensee IDs and names for a payment.

Citibank maintains this library.

Location (Payable

at Location)

Stores cheque-delivery locations, other than Citibank branches, that are

available for a country or region. It is used to support the lookup of

locations when creating payments.

Citibank maintains this library.

Nature of

Payment

Stores nature of payment code descriptions, which are used to codify

the nature of a payment for Central Bank Reporting purposes in Europe.

Citibank maintains this library.

Holiday

(Country)

Stores holidays in various countries. It is used by transaction services to

evaluate processing availability and to establish value and process-data

parameters.

Citibank maintains this library.

Holiday

(Currency)

Stores currency holidays. It is used to prevent a payment from

processing on a currency holiday. This library is currently being used by

Europe and Canada.

Citibank maintains this library.

Instruction

Code

Stores the instruction codes (and corresponding descriptions) that can

be used in the Instruction Code field for a branch and a payment

method. This library is used to support lookup in the Instruction Code

field when creating payments for Domestic Fund Transfers, Cross-

Border Fund Transfers and Book Transfers for European branches.

Citibank maintains this library.

Invoice Type

Stores all client-defined invoice forms, which are used to format the

invoice data entry form and define any expressions or totals that apply

to that form for invoice information that is included with

a payment. Based on back-end processing system functionality and/or

requirements, the number of columns that can be defined may vary by

region or country.

Clients maintain this library and all

records are private.

K-Symbol

Stores descriptive text corresponding to K-Symbol codes (indicating

economic nature). It is used

to select valid K-Symbol codes when creating payments.

Citibank maintains this library.

Licensee

Stores licensee names and corresponding licensee IDs. It is used to

select valid licensee IDs and names for a payment.

Citibank maintains this library.

Location (Payable

at Location)

Stores cheque-delivery locations, other than Citibank branches, that are

available for a country or region. It is used to support the lookup of

locations when creating payments.

Citibank maintains this library.

13

Payment Libraries (Cont'd)

Library Name

Description

Maintenance Responsibilities

Nature of

Payment

Stores nature of payment code descriptions, which are used to codify

the nature of a payment for Central Bank Reporting purposes in Europe.

Citibank maintains this library.

Non-Citibank

Managed

Accounts

Stores Non-Citibank customer accounts that Citibank Asia manages. It

is used to identify customers debiting their Citibank Funding Account.

Clients in Asia use this library when creating payments from non-

Citibank accounts.

Citibank maintains this library.

Ordering Party

Stores the name, address, ID type and ID for various ordering parties,

which are used when creating payments. The ordering party is the party

on whose behalf the payment is being made. This may be

a party that is making the payment from its own account or from the

account of another entity to which the ordering party has access.

Clients maintain this library and all

records are private.

Payment

Description

Stores standard payment descriptions text that you can access easily at

run-time by simple entering a code, which then expands to the text held

in this library. This library is used to support lookup of description text

during payment creation.

Clients maintain this library and all

records are private.

Payment Type

Stores the payment types that are available for each country or region.

It is used to support the lookup of payment types when creating

payments.

Citibank maintains this library.

Purpose of

Funds

Store the purpose of funds codes, the description and a detailed

explanation of the code, which is used during payment creation.

Citibank maintains this library.

Purpose of

Funds Sub-Code

Stores the purpose of fund sub-codes, the description and a detailed

explanation of the code, which is used during payment creation.

Citibank maintains this library.

Preformat

Stores information about a payment that can be re-used to create future

payments. This library supports the lookup and selection of preformats.

There are three types of preformats: Full, Beneficiary and Template.

Clients maintain this library and all

records are private.

Preformat

Group

Stores the group names that clients have defined to group multiple

preformat records. It is used to support preformat creation and

organization.

Clients maintain this library and all

records are private.

Priority

Stores the priority codes that are available for each country or region,

which are used to support the lookup of priority codes when creating

payments.

Citibank maintains this library.

Reason Code

Stores reason code descriptions, which are used to support the lookup

of reason codes when creating payments.

Citibank maintains this library.

Subsidiary

Identifier

Stores information about subsidiaries, including

their unique identifiers, name and address. It is used when creating

preformats.

Clients maintain this library and all

records are private.

Tax Category

Stores the tax categories that are available for each country or region,

which are used to support the lookup of tax categories when creating

payments.

Citibank maintains this library.

Tax Code

Stores the tax codes that are defined for each country or region, which

are used to support the lookup of tax codes when creating payments.

Citibank maintains this library.

Transaction

Code

Stores transaction codes that are available for each country, which are

used during payment creation.

Citibank maintains this library.

Transaction

Nature

Stores transaction nature codes and their descriptions, which are used

during payment creation.

Citibank maintains this library.

Transaction

Type

Stores transaction types that are available for each country or region,

which are used to support look up of transaction types when creating

payments.

Citibank maintains this library.

VAT Type

Stores value-add tax (VAT) types that are available for each country or

region. It is used to support lookup of VAT types when creating

payments.

Clients maintain all records in this

library.

WHT Type

Stores withholding tax (WHT) types that are available for each country

or region. It is used to support lookup of WHT types when creating

payments.

Clients maintain this library and all

records are private.

14

4 My Preferences

My Preferences

Use My Preferences to set your preferences for the Payments service class and to create a Library Lookup

Favorites list of the debit and credit accounts that you use most often.

Notes:

For step-by-step procedures for setting your preferences, please refer to the CitiDirect Basics: Setting Your

Preferences guide, available in the Learning Center at www.citidirect.com.

Make sure that you set your Global preferences, which include date format, amount format, default menu and

default application.

All preferences that you define are specific to your CitiDirect sign-on name and ID and cannot be shared with

or viewed by others.

15

A. Available Preference Criteria

for Payments

Available Preference Criteria for Payments

The preference criteria available on the My Preferences form for payments are listed in the table below.

Preference Category

Available Preference Criteria

Description

CitiDirect Default Settings

Edit Defaults

Debit Account

The Account Familiar Name and Account

Number that appears on payments forms.

Not Specified

Credit Account

The Account Familiar Name and Account

Number that appears on payments forms.

Not Specified

Company

The default company that appears on the

Payment Detail form.

Not Specified

Ordering Party

The Ordering Party Name that appears on the

Payment Detail form.

Not Specified

Default Subsidiary

Identifier

The Default Subsidiary Identifier that appears

on the Payment Detail form. This option is

available if set in Client Preferences.

Not Specified

Use This Currency

For Next Payment

The currency that is to be used for the next

payment when the indicator is selected.

Not Specified

Other

Confidential

Payments

Select the Confidential Payments checkbox if

you want to be able to indicate that a payment

is confidential. If Confidential Payments is not

selected, the Confidential Payments checkbox

does not appear on the payments forms. Only

entitled users can change this preference-

criteria setting.

No (not selected)

Override Payables

Preference Matrix

Select the Override Payables Preference Matrix

checkbox if you want to have the ability to

override the Payables Preference Matrix. If

Override Payables Preference Matrix is not

selected, you will not be able to change any

payable preferences on Payments forms.

No (not selected)

Retain Data Between

Transactions

Select the Retain Data Between Transactions

checkbox if you want CitiDirect to use the same

payment method form, the same checks from

the same account and the same payment data.

No (not selected)

Auto-generate

WorldLink® reports

Select one or several reports to be auto-

generated.

Not Specified

Include Latin American

Creation Methods from

Outside CitiDirect

Includes payment methods that are specific to

Latin America, not CitiDirect.

Yes

Library Lookup

Favorites

Credit Account

Select one or several accounts to add to your

Favorites list on the Payment Detail form.

Not Specified

Debit Account

Select one or several accounts to add to your

Favorites list on the Payment Detail form.

Not Specified

16

B. Library Lookup Favorites

Library Lookup Favorites

The Library Lookup Favorites feature, available as criteria on the My Preferences form, allows you to create a

list of frequently used debit and credit account numbers that you can easily access when you are entering

payment details.

When you set your Library Lookup Favorites, a blue down arrow will appear in the Library Lookup button

next to the debit or credit account fields on the Payment Detail form, indicating that you have created a list of

library lookup favorites.

17

5 Payment Forms

Payment Forms

All processes are performed using a summary form that displays key fields of information or a detail form that

contains all of the information required to make a payment to a beneficiary (payee). You can also access

various sub-forms to enter additional information for a specific payment transaction.

18

A. Payments Summary Form

Payments Summary Form

Summary forms present data in a tabular format, much like a spreadsheet. Individual payment records are

displayed in rows within the table, and individual data elements related to each payment are displayed as

columns.

Use the Payments Summary form to input, view and act on a batch of transactions or an individual

transaction.

1. The tabs within the summary form are determined by the actions that must be taken on a payment or

a group of payments.

2. The entitlements included in the access profile assigned to you by your local Security Managers

determine the tabs that you see and the payment transactions that you can take action on.

19

Payments Summary Form (Cont’d)

Tabs

Click a tab to activate it. All payments that are in the same state within your Payments flow-control process

are listed on the appropriate tab. Your access profile determines the tabs that you see when you are working

in Payments.

Action Buttons

The action buttons displayed on the Payments Summary form can vary based on the active tab. (The buttons

shown in this example appear on the Input/Modify tab.)

Submit Button

Click the Submit button to create one or more payment transaction records in the Payments database.

1. Each selected payment is assigned a system- or user-defined transaction reference number, and the

payment details are validated against CitiDirect validation rules.

2. If the payment passes validation, it moves to its next state as determined by your payment flow-

control requirements. If a payment fails validation, its status is updated to Invalid and the payment

record appears in red text on the Input/Modify tab.

20 21

Payments Summary Form (Cont’d)

3. If your flow-control settings indicate that verification, authorization and release are required, the

system automatically releases the payments to the processing branch and updates the status of each

payment to Released.

New Button

Click the New button to create a new payment transaction. Your access profile determines the creation

methods you can use to create new payments:

1. From Preformat

2. Quick Entry From Preformat

3. New Outgoing

These options are also available directly on the navigation bar.

Delete Button

Click the Delete button to delete the selected payment transactions.

Go to Details Button

Click the Go to Details button to view all of the details for the selected payment transactions. The Payment

Detail form appears. All details of the first selected payment are displayed. For more information, see the

Payment Detail Form section of this guide.

Other Options Button

The Other Options button that appears in the lower right of the Payments Summary form contains a menu

that provides additional actions you can perform.

22 23

Payments Summary Form (Cont’d)

1. Click the Other Options button and select the Update Screen command to refresh the summary form

list with the most recent data.

2. Other Options menu options are presented throughout this guide. Menu options can vary based on

the status of a transaction and the tab within the Payments Summary form where the payment

transaction is listed.

24

B. Payment Detail Form

Payment Detail Form

The Payment Detail form displays all the details of the payment, along with any corresponding actions that

you may need to perform on that payment. Below is an example of the Book Transfer Payment Detail form.

Note: The fields in the below screen can vary based on the Payment Initiation Incoming or Outgoing or

Payment Method and other parameters.

1. Use the Payment Detail form to enter and submit the details of new payments and to manage and act

on individual payments.

2. The Payment Detail form can only be accessed from a summary form. However, once in a detail

form, you can move between multiple payments by clicking the Next button.

For every payment that you create, you are required to enter several key details that are common to all

payments. A red asterisk identifies required key detail fields.

Payment Method

The details you enter enable CitiDirect to automatically determine exactly which processing options (payment

methods) are available to you, as well as the specific forms and sub-forms that are needed for each available

payment method.

All available processing options appear as selections when you click the dropdown arrow in the Payment

Method field on the Payment Detail form. Once the payment method is selected, CitiDirect is able to

25 26

Payment Detail Form (Cont’d)

determine the available payment types, load the appropriate Payment Detail form and sub-forms, apply the

appropriate edits, and determine the appropriate product-processing system.

Payment Type

The Payment Type field is located in the payment-method selection section of the Payment Detail form.

1. The selected payment method determines whether or not the payment type field is available.

2. The list of payment types may vary based on region or country.

3. Payment types are displayed in the language you selected when you signed on to CitiDirect.

Payment Amount

The Payment Amount field is formatted for the number of decimal places required for the selected payment

currency, and it is checked against any amount limits that may be specified in your access profile. Amounts

are evaluated using the exchange rate of the currencies.

Region and/or country level limits can also be defined for the payment amount. The most common region- or

country-specific requirement is a maximum number of digits for the payment amount value. This maximum

value limitation is performed when you click the Submit button to submit the payment for processing, not

when you enter the value in the Payment Amount field. You cannot enter a negative amount in this field.

Subsidiary Identifier/Name

This subsidiary information is used to identify a client subsidiary within a payment transaction. This

information allows you to group payment transactions on payment-transaction initiation reports by subsidiary.

A client preference setting determines whether or not the Subsidiary Identifier/Name fields appear on the

Payment Detail form.

27

Payment Detail Form (Cont’d)

Transaction Reference Number

To identify the payment, each CitiDirect payment transaction must have a transaction reference number. The

method by which the transaction reference number is determined may vary by region. The following rules are

consistent across all regions:

The transaction reference number assignment is dictated by a client preference setting, which indicates

whether it is fully system-assigned, partially system-assigned or manually entered.

If the transaction reference number is fully system-assigned, the reference number is generated and stored

when you click the Submit button on the Payment Detail form; however, the assigned reference number is not

visible until the transaction is displayed on a different tab within the Payments Summary form (e.g.

Authorization Required).

If the transaction reference number is partially system-assigned, it is composed of a combination of a

predetermined set of characters, based on a client preference setting, and a suffix that you must enter in the

appropriate field on the Payment Detail form when you create a new payment transaction.

If the transaction reference number is manually entered, you must enter it in the appropriate field on the

Payment Detail form when you create a new payment transaction.

Note:

To avoid duplicate reference numbers, CitiDirect generates a new internal reference number when a payment

selected on the Repair Required tab is repaired and resubmitted.

Value Dates

As part of the payment creation process, CitiDirect automatically computes a default value date for each

payment based upon parameters, such as cutoff time or number of disposition days that apply to the

combination of branch, payment method and currency of the payment.

Library Lookup Favorites Button

If the library lookup button for the debit and/or credit account field contains a blue down-arrow, a Library

Lookup Favorites list has been created. This feature enables you to select from a list of the account numbers

that you use most frequently. For more information, see the Select Debit/Credit Account Library Lookup

Favorites section of this guide.

28 29

Payment Detail Form (Cont’d)

Multiple-Line Button

Each field on a Payment Detail form can display a specific number of characters. When a field, such as

Payment Details or Bank Details, contains more information than is currently visible, a multiple-line button

appears next to that field. When the multiple-line button is present, click it to see all information in the field.

Sub-Forms

Sub-forms allow you to enter additional information pertaining to a payment. In general, the display of a sub-

form is triggered when you click a show sub-form link or button. For example, CitiDirect users in certain

regions and countries have the option to enter bank details, central bank reporting information and detail

information about invoices being paid.

1. When a sub-form link or button is clicked, the sub-form is displayed in a separate window to allow you

to enter the additional information.

2. In certain cases where you can choose one of a specific set of sub-forms, the available sub-forms are

displayed in a dropdown list. To access the sub-form, select the desired sub-form first and then click

the adjacent link.

Actions Buttons

The action buttons displayed on the Payment Detail form can vary based on the tab within the Payments

Summary form from which the detail form was accessed. The action buttons shown in this example appear

when the Payment Detail form is accessed from the Input/ Modify tab.

Submit Button

Click the Submit button to create one or more payment transaction records in the Payments database. Each

payment is assigned a system- or user-defined transaction reference number, and the payment details are

validated against CitiDirect validation rules.

1. If the payment passes validation, it moves to its next state as determined by your payment flow-

control requirements (e.g., Verification Required, Authorization Required, or Release Required).

2. If your flow-control settings indicate that verification, authorization and release are required, CitiDirect

automatically releases the payment to the processing branch and updates its status to Released.

30

Payment Detail Form (Cont’d)

Submit and Create Preformat Button

If you are entitled to submit payments and create preformats, the Submit and Create Preformat button is

available at the bottom of the Payment Detail form.

1. When you click the Submit and Create Preformat button, the payment information is validated.

2. Once validated, the payment proceeds to its next state in your payments process, as determined by

your flow-control requirements. The payment details are saved as a preformat record.

3. The preformat record moves to its next state as determined by your preformat library authorization

requirements.

4. After the preformat record passes all authorization requirements, it is stored in the preformat library,

where it can be selected and used as a template for creating new payments.

Submit and Copy Button

Click the Submit and Copy button to submit the current transaction for processing and to copy all payment

details, except the value date. The Payment Detail form remains open to allow you to submit another payment

transaction containing the copied payment details. If the transaction reference number is not automatically

generated, you must update it for the new payment transaction.

Copy Button

Click the Copy button to copy the payment details that are currently displayed on the Payment Detail form,

without submitting the current transaction. All of the payment details are copied except the value date. You

can then modify payment details as required to create a new payment transaction. If the transaction reference

number is not automatically generated, you must update it. Once you are sure that all payment details are

correct, click the Submit button to submit the new payment for processing.

Delete Button

Click the Delete button to delete the payment transaction that is currently displayed on the Payment Detail

form.

The Delete button is not active when you are using the Payment Detail form to create new payment

transactions, or when you have accessed the Payment Detail form from the View tab.

31

Payment Detail Form (Cont’d)

Next Button

Click the Next button to see the details of the next selected payment. This button is active when multiple

payments were selected on a tab within the Payments Summary form. If the Payment Detail form contains the

details of the last selected payment, clicking the Next button returns you to the active tab.

Return to Summary Button

Click the Return to Summary button to return to the active tab within the Payments Summary form.

If you are entering new payments or modifying or repairing existing payments, the Save? Dialogue box

appears.

Click the Yes button to save any changes. The statuses of new payments are changed to Input, and they are

listed on the Input/Modify tab. If you are modifying existing payments, the payment information is listed in

orange text to indicate that the payment details may be outdated.

Other Options Button

Click the Other Options button to access a menu. The available menu items, which are described in the

following table, may vary based on the tab from which the Payment Detail form is accessed.

33 32

Payment Detail Form (Cont’d)

Menu Option

Select

t

o

Edit Account Number

Change

the Debit Account Number

s

t

or

ed

in a

preformat

.

Ent

e

r

/

V

i

e

w Comments

Enter new or view existing comments that are

at

t

ached

to

a p

a

yment

.

Print

De

t

ail

Print the

de

t

ails

of

the payment

tr

ansaction.

Run TI

De

t

ail

R

epor

t

f

or

Single

It

em

Runs the Transaction Initiation

De

t

ail

R

epor

t

for

the selected

tr

ansaction.

View Error Messages

View any errors associated with the payment

tr

ansaction.

View Offline

B

a

t

ch

De

t

ails

View

de

t

ails

of

the

offline b

a

t

ch,

including the b

a

t

ch name, creation

time

,

s

t

at

us

and authorizer name.

View Submission

S

t

at

us

De

t

ails

View the submission

s

t

at

us

of

the payment, including the user ID

of the

user who

submit

t

ed

the transaction, the date and time

of

submission, and any

sub-s

t

a

t

u

s

.

View Transaction Flow

View a

list of

transaction flow

s

t

at

e

s

that the transaction

mus

t

go through, based

upon the current data values

of

the payment, before it is sent

to

Citibank

for

processing (including its current

s

t

at

e

)

.

View Transaction

His

t

ory

View the his

t

ory

of

all actions

t

a

k

en

on a payment, including the name o

f

the

CitiDirect user who performed each action and the date and time

the

action was

t

a

k

en.

34

6 Outgoing and Incoming Payments

Outgoing and Incoming Payments

The major difference between the Payment Detail forms for incoming and outgoing payments is that a debit

account must be selected for outgoing payments, while a credit account must be selected for incoming

payments.

35

A. Outgoing Payment Methods

Outgoing Payment Methods

ACH Credit/ GIRO Transfer — Payments made electronically to the beneficiary’s bank, which are routed

through local clearing systems that traditionally handle either small or large value but large volumes of

transactions. ACH is primarily known as a clearing method for USD transactions; however, countries with

similar clearing systems may refer to these transactions as ACH payments, GIRO payments, direct payments,

etc. For this document, the term ACH is used to refer to all of these local clearing systems, regardless of

country.

Book Transfer — A specific type of a Funds Transfer transaction where a transfer is made between two

accounts in the same Citibank branch. By definition, this type of transfer is a local transaction because it

occurs within a single country and currency. Since a Book Transfer generally occurs within a single Citibank

branch, the bank name and branch information needed for a typical Funds Transfer transaction are not

required.

Notes:

In some cases, a Book Transfer can occur between accounts held at Citibank within the same country, not

necessarily same branch.

In some cases, Book Transfers cannot be done between branches in a single country.

Book Transfers in the United States can be for more than two parties. A payment can be considered a Book

Transfer when the first account number after the debit account branch and the debit account branch are from

the same branch.

Cheque — Paper-based payments generated from an electronic instruction. All cheques generated through

Payments result in the creation of a:

1. WorldLink® Payment Services cheque;

2. PayLink® cheque printed at a Citibank processing center and sent directly to the beneficiary or to the

initiating customer;

3. Bank Draft in Canada

All cheques are drawn on local branches around the world.

Cross-Border Funds Transfer — Payments made electronically to the beneficiary’s bank. They can be

routed through several standard methods, depending on the currency being paid and the bank that is

processing the transaction.

Domestic Funds Transfer — Payments made electronically to the beneficiary’s bank using a domestic/ local

processing system to process the transaction.

Due Citibank Adjustment — A WorldLink® Payment Services payment method used to send additional

funds to Citibank. It is normally used due to an under-remittance on an earlier foreign exchange transaction.

Funds Transfer — A payment made electronically to a beneficiary which can be routed through several

standard methods.

Mexico Tax Payment — A payment method used to make annual and provisional tax payments using a

dynamic template provided by the Mexican Government.

36 37

Outgoing Payment Methods (Cont’d)

On-Site Cheque — A paper-based payment generated from an electronic instruction. On-Site cheques will

be printed at the customer’s location rather than at a Citibank processing center.

Pan-European ACH — A payment method used to create low-value, high-volume, non-urgent transactions in

Europe. It is based on the Domestic Funds Transfer and Cross-Border Funds Transfer transactions. Pan-

European ACH payments are rerouted through the Step 2 clearing system and are used for creating

transactions for values lower than or equal to EUR 12,500.

Payroll Cards — Customers instruct Citibank to debit the customer’s account (in local currency) and credit

one or more individual (employee) card local accounts.

Notes:

1. To use the Payroll Card payment method, you must first create a Domestic Funds Transfer for the

sum of the payroll payments. On the same day, create a Payroll Card payment that specifies the

individual accounts to be paid.

2. Payroll Card payments are specific to Kazakhstan, Romania, Russia and the Ukraine.

SEPA — A credit transfer or priority payment made electronically to a beneficiary bank within the SEPA

(Single Euro Payments Area).

Notes:

1. The SEPA zone comprises the 31 countries of the Greater European Area, as listed: Austria,

Belgium, Britain, Bulgaria, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany,

Greece, Hungary, Iceland, Ireland (Republic of Ireland), Italy, Latvia, Liechtenstein, Lithuania,

Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovenia, Spain, Sweden and

Switzerland.

2. Under SEPA, a basic credit transfer in Euro must have a maximum execution timeframe of three

banking days.

Faster Payment — A payment method where same-day payments are processed in near-real-time to reduce

clearing times on electronic payments. This is available in the United Kingdom.

Window Payments — A payment method used to initiate a cash-based payment within Mexico, where the

funding currency is the same as the payment currency. Cash-based payment instructions are sent to the bank

with details about the intended transaction and the order can be delivered to the specified branch.

38

B. Incoming Payment Methods

Incoming Payment Methods

The incoming payment methods in CitiDirect BE

SM

are described below.

ACH Debit — Incoming payments made electronically from a debit party to the Citibank customer. The

payments are routed through local clearing systems that traditionally handle large volumes of transactions of

either small or large value.

Advice to Receive — Incoming payment method that allows customers to initiate an electronic message to a

beneficiary bank advising them of funds to be received on a particular day. The customer initiates an Advice

to Receive. CitiDirect creates and sends a message to the back-end systems for forwarding to the appropriate

beneficiary bank.

Book Debit — Payment instructions to Citibank are made electronically to the debit party account using a

domestic/local processing system to process the transaction.

Drawdown/ChargeWire — An incoming payment request made electronically from a debit party to the

Citibank customer, using a domestic or local processing system to process the transaction.

Due Customer Adjustment — A WorldLink® Payment Services payment method that can be initiated as a

result of an FX Contract Sell Back transaction, or as a mechanism for the customer to instruct Citibank on

what to do with a balance that is external to CitiDirect BE

SM

(e.g., from the stop or cancellation of an FX

payment that was created outside of CitiDirect).

Incoming Domestic Funds Transfer — Payments made electronically from a debit party’s bank to a

CitiDirect customer using a domestic or local processing system to process the transaction.

Note:

The CitiDirect services assigned to each client and the access profiles assigned to each CitiDirect user

determine the available incoming and outgoing payment methods. Payment methods are also limited by the

processing capabilities of each Citibank branch.

Due Customer Adjustments Incoming — A WorldLink Payment Services payment method that is:

1. An instruction to Citibank regarding a balance which is external to Citibank;

2. A result of a Stop or Cancellation of an FX payment transaction that was created outside of CitiDirect;

3. An adjustment that is a result of an FX contract Sell Back transaction.

39

7 Create Payments from Preformats

Create Payments from Preformats

Preformats, or templates, help users initiate repetitive payments more efficiently. In order to create payments

from preformats, valid preformats must exist in the preformat library. Preformats are created and saved

directly in the preformat library or by clicking the Submit and Create Preformat button on the Payment Detail

form when creating new payments.

CitiDirect supports the following types of preformats:

Full – Limited Modifications — All data fields, with the exception of Value Date or Processing Date (as

applicable), Payment Amount, Payment/Addenda Details, Beneficiary Reference, and Bank Details, are

protected/locked and cannot be modified.

Predefined Beneficiary — All fields containing beneficiary-related data items are protected/locked and cannot

be modified.

Editable Template — All fields are populated with the values saved with the preformat, but they can be

modified.

Notes:

1. Flow-control requirements for payments created from preformats apply to payment transactions

created from full preformats only. A payment created from a beneficiary preformat or a template

preformat is subject to the flow-control requirements defined for free-form entry payment transactions.

2. Your assigned access profile determines whether or not you can create preformats and the types of

preformats you can create.

Create a new payment from preformats by following the steps below.

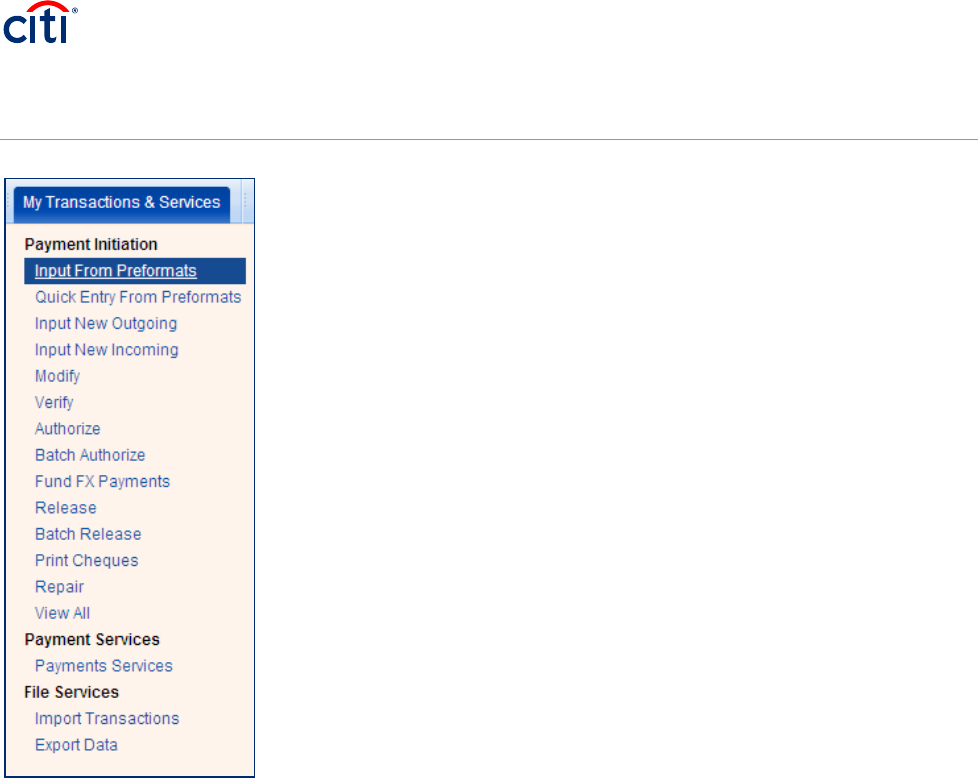

1. On the CitiDirect navigation bar, click Payments and then click Input From Preformats. You can also

access this option by clicking the New button on the Input/Modify tab.

40

Create Payments from Preformats (Cont’d)

A Search Definition Dialog box appears.

41

Create Payments from Preformats (Cont’d)

2. Enter search criteria to find the preformats you want to use to create new payments and click the Run

Search button.

1. A Library Look Up Dialog box displays that shows all preformats that match your search criteria.

Select the desired preformat and click the OK button.

The Payments Summary form displays with the Input/Modify tab active.

42

Create Payments from Preformats (Cont’d)

2. Proceed with one of the following steps:

Modify fields directly on the Input/Modify tab as required, then select all completed transactions and

click the Submit button. Modifiable fields will vary based on the type of preformat you are using.

Click the Go to Details button. The details of the first selected preformat are displayed on the

Payment Detail form. Make any necessary changes and click the Submit button to submit the

current payment for processing. The details of the next selected preformat appear. Repeat this

process until all payments are submitted.

To change the debit account information stored in the preformat

On the Payment Detail form, click the Other Options button.

Select the Edit Account Number command. The Edit Account Number dialog box appears.

Click the library lookup button, select a new debit account number and click the OK button.

Notes:

1. Your organization may have defined a maximum allowable payment amount for preformats. If the

preformat you selected to create this payment is subject to a maximum allowable payment amount

and the payment amount exceeds that maximum, an error message is displayed. You must change

the payment amount before the payment can be submitted for processing.

43 44

Create Payments from Preformats (Cont’d)

2. If you decide that you do not want to create a payment using the details of the preformat that is

currently displayed on the Payment Detail form, click the Next button to view the details of the next

selected preformat.

3. If the details of the last selected preformat are displayed, clicking the Next or Submit buttons returns

you to the Input/Modify tab.

4. For procedures for using the Submit and Create Preformat and Submit and Copy features on the

Payment Detail form, please refer to the Create New Outgoing Payments section of this guide.

45

8 Create Payments Using Quick Entry

from Preformats

Create Payments Using Quick Entry from

Preformats

If you are entitled to create payments from preformats Quick Entry From Preformats appears on the

CitiDirect navigation bar. Use this feature to create numerous repetitive payments quickly and efficiently.

Your assigned access profile determines the preformats you can access.

Create new payments using Quick Entry From Preformat by following the steps below.

1. On the CitiDirect navigation bar, click Payments, and then click Quick Entry From Preformats.

You can also access this option by clicking the New button on the Input/Modify tab.

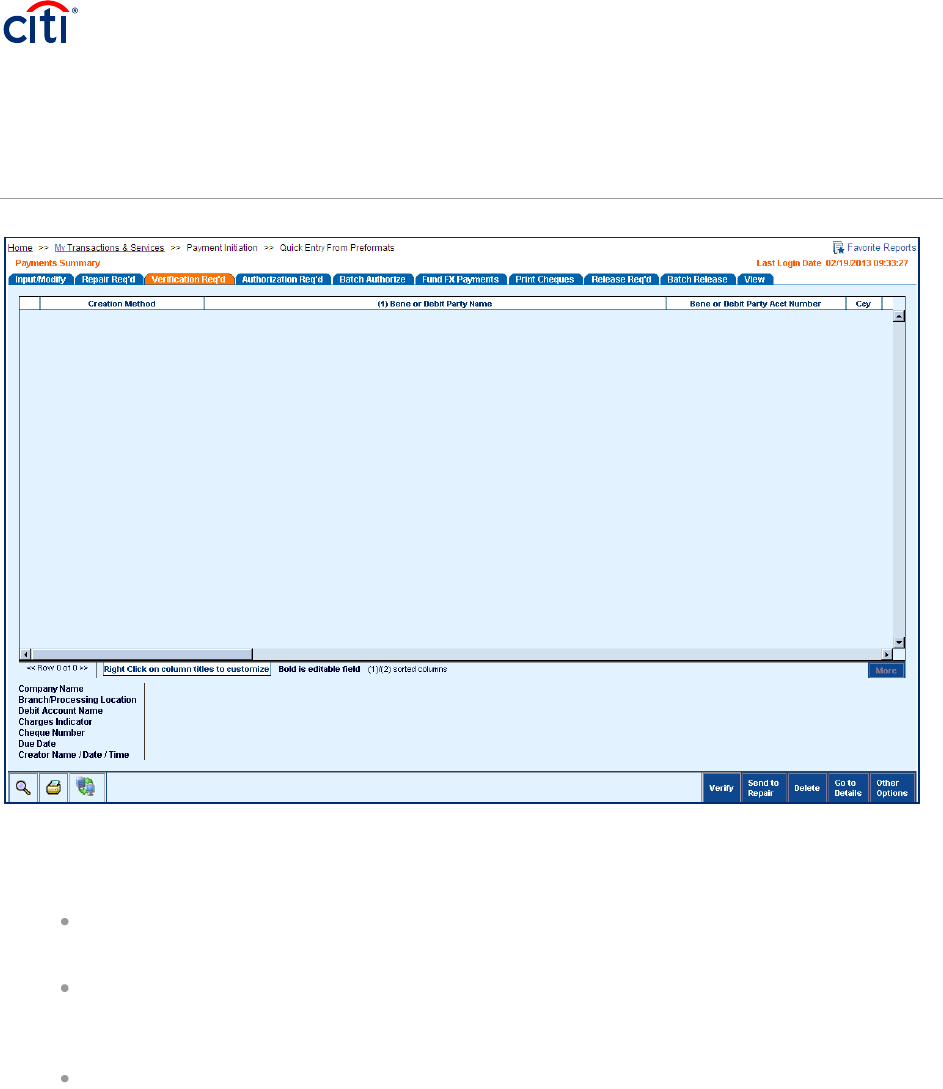

A new Input/Modify form appears.

46

Create Payments Using Quick Entry from

Preformats (Cont’d)

2. In the Preformat Code field, enter the code of the preformat you want to use to create the

payment. You must enter a valid preformat code (for a preformat stored in the preformat library).

3. Enter payment details in the appropriate fields on the Input/Modify form. Press the tab key to

move from field to field. When you have entered information in the last field in one row, pressing

the tab key moves you to the next row.

4. When the details of all payments have been entered, click the Submit All button. All valid

payments move to the next step in the payment process, as defined by your flow-control

requirements.

47

A. Correct Quick Entry from Preformat

Transactions with Errors

Correct Quick Entry from Preformat

Transactions with Errors

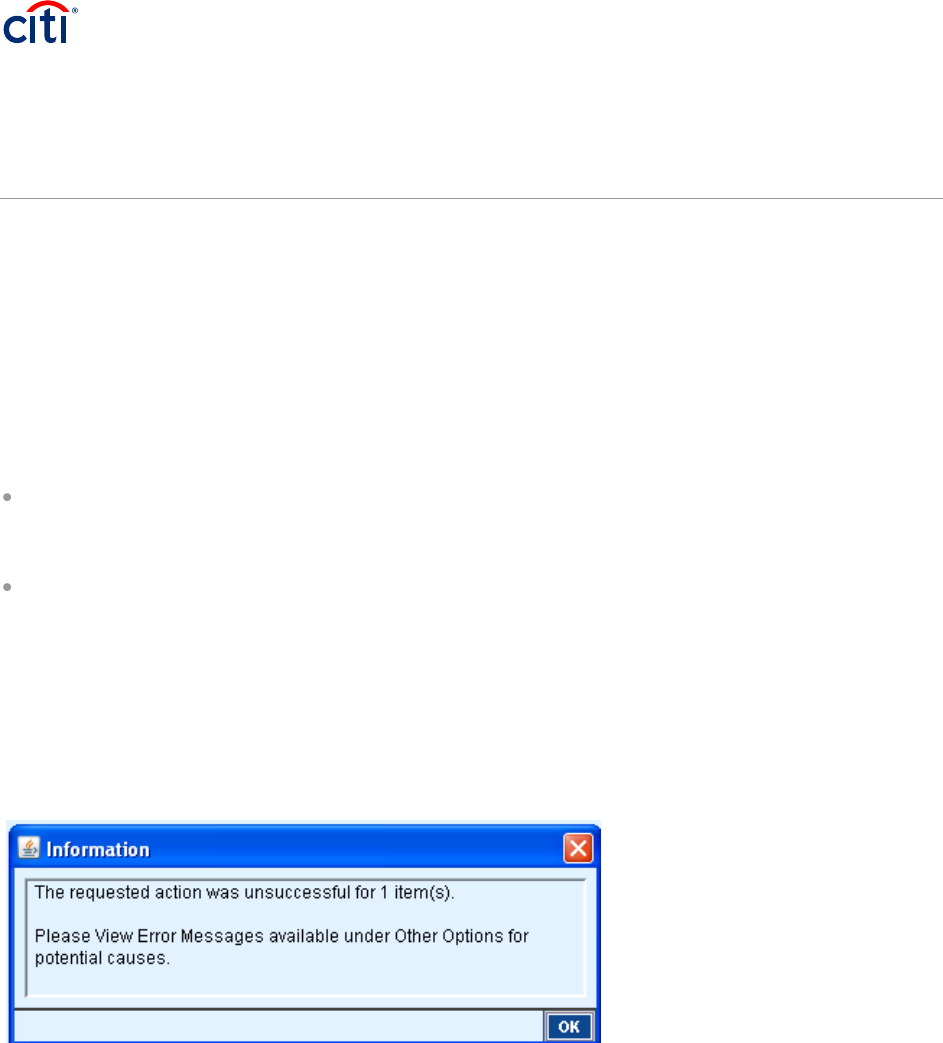

After you click the Submit All button, any payments containing errors remain on the Input/Modify form,

and the payment information appears in red text.

1. On the Input/Modify form, select the row containing the payment.

2. Click the Other Options button, and then click the View Error Messages command.

3. Review any errors in the payment.

4. Make any required changes directly on the Input/Modify form.

5. If necessary, repeat steps 2, 3 and 4 to correct all payments with errors (listed in red).

6. Click the Submit All button to resubmit all corrected payments.

48

9 Create New Outgoing Payments

Create New Outgoing Payments

Your assigned access profile determines whether or not you can create new outgoing payments as well

as the accounts, payment methods, payment types, currencies, etc. that you can access.

Create a new outgoing payment by following the steps below.

1. On the CitiDirect navigation bar, click Payments and then click Input New Outgoing. You can also

access this option by clicking the New button on the Input/Modify tab.

A Payment Detail form appears.

2. The Preformat Code field should be left blank when creating a new outgoing payment; however, if

you are going to submit and create a preformat, a preformat code is required.

3. The Debit Account Number/Currency/Name field defaults to the value previously specified in your

preferences. If you are entitled to multiple accounts and you want to change the debit account,

clear the field, click the library lookup button and select a different account number.

4. The Payment Currency field defaults to the value previously specified in your preferences. If you

are entitled to create payments for multiple currencies and you want to change the payment

currency, clear the field, click the library lookup button and select a different currency. The

Currency Library Lookup will only list currencies that are supported by the branch of the debit

account.

5. In the Payment Amount field, enter the amount of the payment in the selected currency.

6. In the Payment Method field, click the library lookup button. A Payment Method dialog box

appears.

49

Create New Outgoing Payments (Cont’d)

Note: Your Solution Package, Access Profile, Payment Currencies and process capabilities of Citibank

branch will the available payment methods for you.

1. Select a payment method and click the OK button. The Payment Detail form expands to display

data input fields specific to the selected payment method.

2. Based on the selected payment method, currency, etc., the Payment Type field may be available.

If so, click the dropdown arrow and select a payment type, if applicable.

3. The Subsidiary Identifier/Name field defaults to the value previously specified in your preferences.

If you are entitled to select multiple subsidiaries, clear the field, click the library lookup button and

select a different subsidiary identifier/name. These fields are only available if set in client

preferences.

4. Complete all required fields and any optional fields for the payment. A red asterisk (*) identifies all

required fields. Step-by-step procedures for completing the Payment Detail form for each

payment method, by region and country, are available in CitiDirect Online Help.

Notes: For procedures for specifying your preferences for the debit account, payment currency,

subsidiary identifier / name, etc., refer to the Set Your Preferences for Payments section of this guide.

Proceed with one of the following steps.

Click the Submit button. CitiDirect validates each data item. Once validated, the payment moves to the

next step in the payment process flow, as defined by your flow-control requirements. If the payment

does not pass CitiDirect validation, its status is changed to Invalid and it is listed on the Input/Modify

tab.

Click the Submit and Copy button to submit the current payment transaction for processing and to

copy all transaction details, except the value date. The payment details remain on the Payment Detail

form to allow you to create a new payment using the copied transaction details. If the transaction

reference number is not automatically generated, you must update it for the new payment transaction.

Click the Submit and Create Preformat button to submit the payment for validation and to save the

payment information as a preformat. If you select this option, a valid preformat code is required. The

Save Preformat dialog box appears. Your access profile determines whether or not you can create

preformats.

50

Create New Outgoing Payments (Cont’d)

Select the preformat type, complete all required fields, select the appropriate checkboxes and then click

the Save button. Both the payment and the preformat move to the next step in their respective processes,

as defined by your flow-control requirements.

51

10 Create New Incoming Payments

Create New Incoming Payments

Your assigned access profile determines whether or not you can create new incoming payments, and the

accounts, payment methods, currencies, etc., that you can access.

Create a new incoming payment by following the steps below.

1. On the CitiDirect navigation bar, click Payments and then click Input New Incoming. You can also

access this option by clicking the New button on the Input/Modify tab.

The Payment Detail form appears.

52

Create New Incoming Payments (Cont’d)

2. The Preformat Code field should be left blank.

3. The Credit Account Number/Currency/Name field defaults to the value previously specified in

your preferences. If you are entitled to multiple accounts and you want to change the credit

account, clear the field, click the library lookup button and select a different account.

4. The Payment Currency field defaults to preference settings or the currency of the last payment if

the checkbox is selected. If you are entitled to create payments in multiple currencies, clear the

field, click the library lookup button and select a different currency.

5. The Use This Currency For Next Payment checkbox defaults to the value previously specified in

your preferences. Select this checkbox, if applicable.

6. In the Payment Amount field, enter the amount of the payment in the selected currency.

7. In the Payment Method field, click the library lookup button. A Payment Method dialog box

appears.

53

Create New Incoming Payments (Cont’d)

8. Select a payment method and click the OK button. Your solution package, access profile, the

payment currency and the processing capabilities of the Citibank branch determine the available

payment methods. The Payment Detail form expands to display detail fields for the selected

payment method.

9. Based on the selected payment method, currency, etc., the Payment Type field may become

available. If so, click the dropdown arrow and select a payment type, if applicable.

10. The Subsidiary Identifier/Name field defaults to the value previously specified in your preferences.

If you are entitled to select multiple subsidiaries, clear the field, click the library lookup button and

select a different subsidiary identifier/name. These fields are only available if set in client

preferences.

11. Complete all required fields and any optional fields for the payment. A red asterisk (*) identifies all

required fields. Step-by-step instructions for completing the Payment Detail form for each

payment method, by region and country, are available in CitiDirect Online Help.

12. Proceed with one of the following steps.

Click the Submit button. The payment is sent to CitiDirect. Each data item is validated. Once

validated, the payment moves to the next step in the payment process flow, as defined by your

flow-control requirements. If the payment does not pass CitiDirect validation, its status is

changed to Invalid and it is listed on the Input/Modify tab.

Click the Submit and Copy button to submit the current payment transaction for processing and

to copy all transaction details, except the value date. The payment details remain on the

Payment Details form to allow you to create a new payment using the copied transaction

details. If the transaction reference number is not automatically generated, you must update it

for the new payment transaction.

Click the Submit and Create Preformat button to submit the payment for validation and to save

the payment information as a preformat. If you select this option, the Save Preformat dialog box

appears and a valid preformat code is required. Your access profile determines whether or not

you can create preformats.

54

Create New Incoming Payments (Cont’d)

Select the Preformat Type, complete all required fields, select the appropriate checkboxes, and then click

the Save button. Both the payment and the preformat move to the next step in their respective processes,

as defined by your flow-control requirements.

Note: For procedures for specifying your preferences for the credit account, payment currency, subsidiary

identifier/name, etc., refer to the Set Your Preferences for Payments section of this guide.

55

11 Create New Incoming/Outgoing

Payments Using Copy

Create New Incoming/Outgoing Payments

Using Copy

The CitiDirect Copy feature enables you to select existing payment transactions and copy all of the

payment details, except the value date, to create and submit new transactions. CitiDirect automatically

computes a default value date for each transaction based upon parameters that apply for the combination

of branch, payment method and currency (e.g., cutoff time, number of disposition days).

Select the payments you want to copy and create new payment transactions using the Copy feature by

following the steps below.

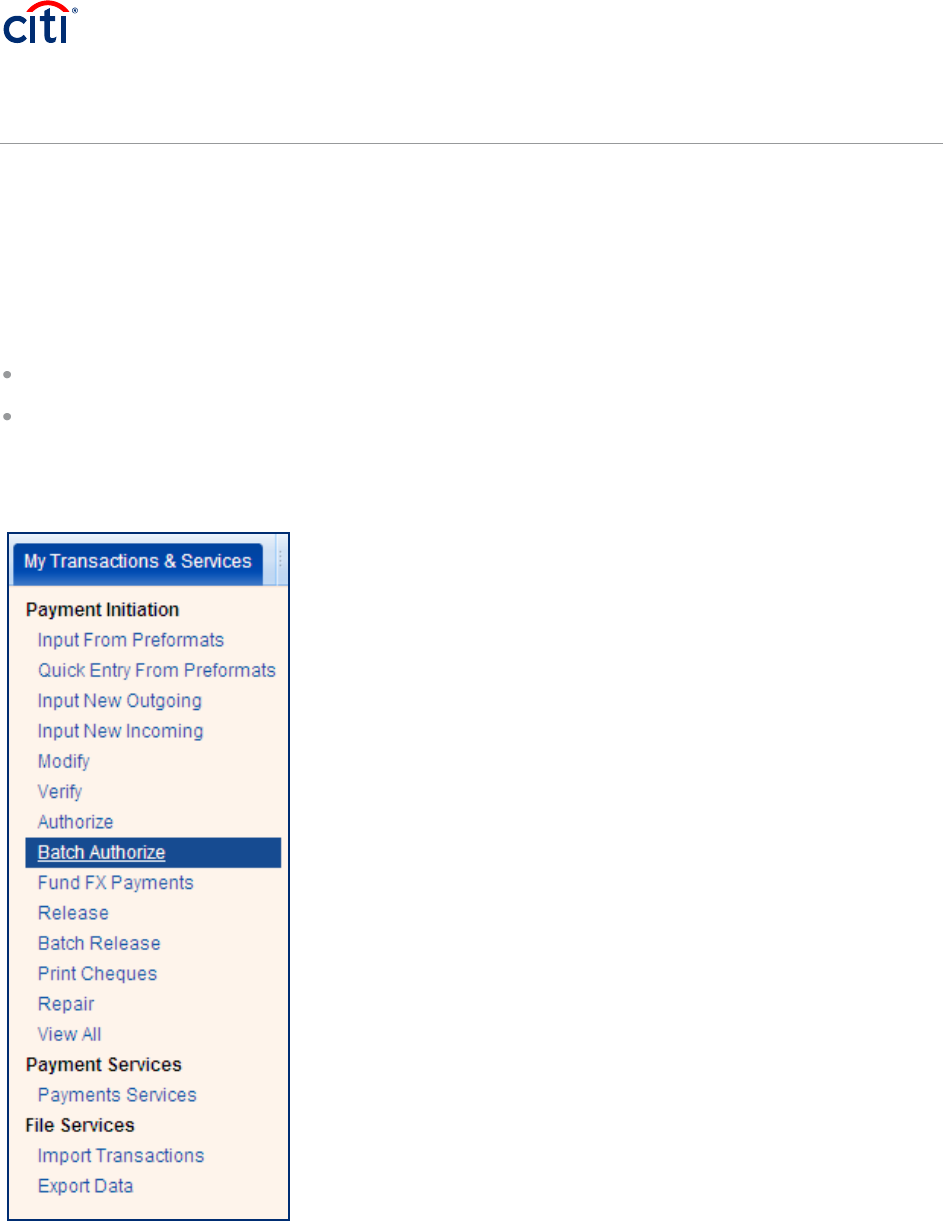

1. On the CitiDirect menu, click on Modify under My Transactions & Services as shown below:

2. To find the transactions you want to copy, click the Search button at the bottom left or click the

Other Options button and select the Search command on the bottom right side of the screen.

56

Create New Incoming/Outgoing Payments

Using Copy (Cont’d)

A Search Definition Dialog box appears.

3. Enter search criteria to find the payment transactions you want to copy, and then click the Run

Search button. You can specify criteria to find transactions that are assigned a Released status,

which are not available for modify or delete. All payment transactions that match your search

criteria are listed on the Input/Modify tab.

57

Create New Incoming/Outgoing Payments

Using Copy (Cont’d)

4. On the Input/Modify tab, select the payment transaction that you want to copy and then click the

Go to Details button. The Payment Detail form appears. The details of the first payment

transaction selected on the Input/Modify tab are displayed.

5. Click the Copy button. An Information dialog box appears.

58

Create New Incoming/Outgoing Payments

Using Copy (Cont’d)

6. All details are copied, except for the transaction reference number and value date.

7. Enter/modify payment details as required. If the transaction reference number is not automatically

generated, you must update it for this new payment transaction.

8. Click the Submit button. The new payment moves to the next step as defined by your flow-control

requirements. The details of the next payment transaction selected on the Input/Modify tab

appear.

9. Repeat steps 5, 6, 7 and 8 to create and submit additional new payments using the Copy feature.

Notes:

1. Click the Submit and Create Preformat button to submit the current payment for validation and to

save the payment information as a preformat. If you select this option, a preformat code is

required. Both the payment and the preformat move to the next step in their respective

processes, as defined by your flow-control requirements for payment transactions and library

records. Your access profile determines whether or not you can create preformats.

2. Click the Submit and Copy button to submit the current payment for validation and to copy all

details except the value date. The Payment Detail form remains open to allow you to make any

necessary changes to create and submit a new transaction.

3. If you do not want to copy the payment details that are currently displayed on the Payment Detail

form, click the Next button. The details of the next selected payment transaction appear. When

the Payment Detail form displays the details of the last selected payment transaction, clicking the

Next button returns you to the Input/Modify tab.

59

12 View Payment Details

View Payment Details

Select payments and view all payment details by following the steps below.

1. On the CitiDirect navigation bar, click Payments and then click View All.

The View tab of the Payments Summary form appears.

60

View Payment Details (Cont’d)

2. Select one or more payments, and click the Go to Details button. Click the Search button to find

specific payments. Your assigned access profile determines the payments that you can view. For

procedures for using the Search function, refer to the Search/Sort the Payments on a Summary

Form section of this guide.

Note: The availability of the Services button on the View tab is determined by the processing capabilities