Office for Publications of the European Union

L-2985 Luxembourg

EN

Case No COMP/M.6828 - DELTA AIR LINES/ VIRGIN

GROUP/ VIRGIN ATLANTIC LIMITED

Only the English text is available and authentic.

REGULATION (EC) No 139/2004

MERGER PROCEDURE

Article 6(1)(b) NON-OPPOSITION

Date: 20/06/2013

In electronic form on the EUR-Lex website under document

number 32013M6828

Office for Publications of the European Union

L-2985 Luxembourg

Commission européenne/Europese Commissie, 1049 Bruxelles/Brussel, BELGIQUE/BELGIË - Tel. +32 22991111

EUROPEAN COMMISSION

Brussels, 20.6.2013

C(2013) 3983 final

To the notifying parties:

Dear Sir/Madam,

Subject: Case No COMP/M.6828 – Delta Air Lines/ Virgin Group/ Virgin Atlantic

Limited

Commission decision pursuant to Article 6(1)(b) of Council Regulation

No 139/20041

(1) On 15 May 2013, the European Commission received a notification of a proposed

concentration pursuant to Article 4 of the Merger Regulation by which the

undertakings Delta Air Lines, Inc ("Delta", the United States of America) and Virgin

Group Holdings Limited ("Virgin Group", the British Virgin Islands) acquire within

the meaning of Article 3(1)(b) of the Merger Regulation joint control of the

undertaking Virgin Atlantic Limited ("Virgin Atlantic", the United Kingdom) by way

of purchase of shares ("the Transaction").

2

1. THE PARTIES

(2) Virgin Group is the holding company of a group of companies active in a wide range

of products and services worldwide, such as gyms, health care, mobiles and

transport. Virgin Group already owns 51 per cent of the shares of Virgin Atlantic

Airways Limited ("Virgin").

(3) Virgin flies to 34 destinations worldwide, including locations across North America,

the Caribbean, Africa, the Far East and Australia. Some of its most recent additions

to its flying network include in particular Cancun. Virgin does not have any integrated

joint venture and is not a member of any global airline alliance.

OJ L 24, 29.1.2004, p. 1 ("the Merger Regulation"). With effect from 1 December 2009, the Treaty on

the Functioning of the European Union ("TFEU") has introduced certain changes, such as the

replacement of "Community" by "Union" and "common market" by "internal market". The terminology

of the TFEU will be used throughout this decision.

2

Publication in the Official Journal of the European Union No C 143, 23.5.2013, p.7.

MERGER PROCEDURE

PUBLIC VERSION

In the published version of this decision, some

information has been omitted pursuant to Article

17(2) of Council Regulation (EC) No 139/2004

concerning non-disclosure of business secrets and

other confidential information. The omissions are

shown thus […]. Where possible the information

omitted has been replaced by ranges of figures or a

general description.

2

(4) Delta serves more than 160 million customers each year. Delta and the Delta

Connection carriers offer service to nearly 357 destinations in 66 countries on six

continents. Headquartered in Atlanta, Delta employs 80,000 employees worldwide

and operates a mainline fleet of more than 700 aircraft. A founding member of the

SkyTeam global alliance, Delta participates in the trans-Atlantic joint venture with

Air France-KLM and Alitalia. Including its worldwide alliance partners, Delta offers

customers more than 13,000 daily flights, with hubs in Amsterdam, Atlanta,

Cincinnati, Detroit, Memphis, Minneapolis-St. Paul, New York-LaGuardia, New

York-JFK, Paris-Charles de Gaulle, Salt Lake City, and Tokyo-Narita.

2. CONCENTRATION

(5) By the Transaction, Delta together with Bluebottle Investments (UK) Limited, an

indirect subsidiary of the Virgin Group acquire joint control over Virgin Atlantic

within the meaning of Article 3(1)b for the purpose of Article 3(2) of the EU Merger

Regulation by way of a purchase of shares. Virgin Atlantic is the indirect holding

company of Virgin and Virgin Holidays Limited (VHols). Virgin Atlantic is

currently for the purposes of Article 3(2) of the EU Merger Regulation jointly

controlled by the Virgin Group and Singapore Airlines Limited (Singapore Airlines).

(6) Delta is acquiring the 49% shareholding in Virgin Atlantic which is currently held by

Singapore Airlines while the remaining 51% of Virgin Atlantic will continue to be

held by the Virgin Group. Virgin and VHols are wholly owned indirect subsidiaries

of Virgin Atlantic and therefore under Virgin Atlantic's ultimate control. Delta and

Virgin Atlantic also agreed to enter into a metal neutral

3

profit sharing joint venture

in relation to services between the UK and the US, Canada and Mexico. For the

purpose of the assessment of the Transaction under the EU Merger Regulation,

account is taken of both the acquisition of the 49% shareholding in Virgin Atlantic

and the creation of the metal-neutral profit sharing joint venture.

(7) In the Commission's Decision in case COMP/M.1855 Singapore Airlines/Virgin

Atlantic concerning the situation of control over Virgin, the Commission found that

although the Virgin Group controlled a majority of shares in Virgin and nominated

the majority of the members on the board, Singapore Airlines had joint control of the

Virgin through its veto rights and the arbitration procedure which was provided for

the case of disagreement in certain strategic business decisions. The Commission

concluded that considering those rights as a whole, Singapore Airlines and the Virgin

Group

exercised joint control over Virgin.

(8) The Parties claim that Delta will have materially the same rights as Singapore

Airlines currently has

4

and that therefore Delta and the Virgin Group will jointly

control Virgin Atlantic and hence Virgin. In particular, the Parties explain that Delta

will have veto rights over (i) the employment of key personnel and (ii) the

appointment of executive directors as well as (iii) the right to force an independent

review of the budget and business plan. In the Parties view, this will oblige Delta and

the Virgin Group to cooperate in respect of key strategic governance decision for

Virgin Atlantic.

3

Metal neutrality indicates that partners in the joint venture are indifferent as to which operates the

"metal"( ie. the aircraft) when they jointly market services.

4

Section 3, paragraph 3 of the Form CO. [Information regarding other Virgin Group businesses]

3

(9) Under paragraph 65 of the Commission Consolidated Jurisdictional Notice (the

Jurisdictional Notice)

5

, joint control may exist even where there is no equality

between the two parent companies in votes or in representation in decision-making

bodies. This is the case where minority shareholders have additional rights which

allow them to veto decisions which are essential for the strategic commercial

behaviour of the joint venture. Such veto rights must be related to strategic decisions

on the business policy of the joint venture and must go beyond the veto rights

normally accorded to minority shareholders in order to protect their financial

interests as investors. Veto rights which confer joint control typically include

decisions on issues such as the budget, the business plan, major investments or the

appointment of senior management.

(10) Under the shareholders' agreements between Delta and the Virgin Group, Virgin

Atlantic cannot undertake various matters without the prior written consent of Delta

and the Virgin Group. These rights include for instance the appointment of key

personnel which includes the executive directors and persons with ultimate

responsibility for amongst others the following divisions: commercial, finance, flight

operations and corporate services. If there is no agreement on these issues, the matter

in question is suspended and the issue is referred to the CEO's of Delta and the

Virgin Group for consideration

6

. It therefore appears that Delta will indeed have a

veto right as regards the appointment of senior management.

(11) The decision making process on the approval of the annual budget is as follows.

[Information regarding Virgin Atlantic's governance structures]

(12) However, under paragraph 82 of the Jurisdictional Notice, there can be joint control

even if only one of the parent companies has a casting vote and "if the mutual

interdependence of the parent companies would make the exercise of the casting vote

unlikely."

(13) The Commission considers that the commercial context in which the Parties would

operate in particular in view of Delta's acquisition of the shareholding in Virgin

Atlantic as well as the fact that Delta and Virgin will establish a contractual joint

venture for air transport services (metal neutral joint venture), Delta and the Virgin

Group will be mutually interdependent. Indeed the joint venture agreement is part of

the notified concentration and, as explained in paragraph 37 of the Form CO, the

Parties intend to "cooperate across the board on routes in the joint venture, for

example, in relation to network planning, sales, marketing, pricing and passenger

services (e.g. frequent flyer programmes). The parties will reach consensus decisions

in relation to aspects of the joint venture such as network and capacity planning."

(14) Taking into account the joint venture agreement, the Commission concludes that the

transaction confers joint control on the Parties over Virgin Atlantic

7

. The Transaction

5

Commission Consolidated Jurisdictional Notice under Council Regulation (EC) No 139/2004 on the control of

concentrations between undertakings, OJ C95, 16.04.2008 p. 1.

6

Clause 4.1 and 4.5 of the Shareholder's Agreement relating to Virgin Atlantic.

7

Regarding the EU air transport licensing provisions, the Parties consider that "it is not unusual for different tests of

control to be applied under different legal measures, for example, under the EU Merger Regulation and the air

transport licensing provisions." (Form CO, paragraph 89). Pursuant to paragraph 23 of the Jurisdictional Notice,

"The concept of control under the Merger Regulation may be different from that applied in specific areas of

Community and national legislation concerning, for example, prudential rules, taxation, air transport or the media.

4

thus constitutes a merger within the meaning of Article 3(1)(b) of the Merger

Regulation.

3. UNION DIMENSION

(15) The undertakings concerned Delta, Virgin Group and Virgin Atlantic, have a

combined aggregate world-wide turnover of more than EUR 5 000 million.

8

Each of

them has a Union-wide turnover in excess of EUR 250 million. [Explanation why the

"two-thirds rule" is not met]. The methodology used by the Parties to calculate their

turnover is the "point of sale" methodology, although in any event the thresholds

would also be met under the "point of origin" or "50/50 split" methods.

9

The notified

concentration therefore has a Union dimension within the meaning of Article 1(2) of

the Merger Regulation.

4. RELEVANT

PRODUCT AND GEOGRAPHIC MARKETS

(16) The activities of Virgin and Delta overlap in air transport of passengers, air transport

of cargo, supply of seats to tour operators

10

and maintenance, repair, and overhaul

services ("MRO").

11

4.1. Air transport of passengers

4.1.1. O&D approach

(17) The Commission has traditionally defined the relevant market for scheduled

passenger air transport services on the basis of the "point of origin/point of

destination" (O&D) city-pair approach.

12

Such market definition reflects the demand-

side perspective whereby customers consider all possible alternatives of travelling

from a city of origin to a city of destination which they do not consider substitutable

to a different city-pair. As a result, every combination of a point of origin and a point

of destination is considered to be a separate market.

(18) The Parties do not object to the O&D approach. They however claim that the market

for scheduled passenger air transport services increasingly has a network dimension,

particularly on the demand-side for corporate customers, frequent flyer program

customers and connecting passengers on transatlantic routes. According to the

Parties, on the supply-side, carriers with larger networks can optimize their

operations in response to price differentials across different O&D routes. In

particular, the Parties submit that a substantial hub presence at London Heathrow is a

significant competitive advantage in the context of access to connecting passengers.

The interpretation of ‘control’ in other areas is therefore not necessarily decisive for the concept of control under

the Merger Regulation [emphasis added]."

8

Turnover calculated in accordance with Article 5(1) of the Merger Regulation.

9

These three methodologies are explained in COMP/M.4439 - Ryanair/Aer Lingus, 27 June 2007, recitals 13 et seq.

10

As regards the sale of seats to tour operators in the UK, the Parties estimate that Virgin has a share around [10-

20]% while Delta has a share well below [0-5]%. Consequently, the Commission will futher analyse this market.

11

The overlaps in maintenance, repair, and overhaul services do not give rise to any horizontal or vertical affected

market. According to the Parties, their combined market shares remain indeed below 15% regardless of the precise

market segmentation.

12

COMP/M.5889 - United Air Lines/Coontinental Airlines, COMP/M.5440 - Lufthansa/Austrian Airlines;

COMP/M.5335 - Lufthansa/SN Airholding; COMP/M.5364 - Iberia/Vueling/Clickair; COMP/M.3280 - Air

France/KLM; COMP/M.3770 - Lufthansa/Swiss.

5

(19) The Commission has in the past taken into consideration the network competition

between airlines. This is particularly relevant on the supply-side, as network carriers

build their network and decide to fly almost exclusively on routes connecting to their

hubs.

13

In line with the Commission's notice on market definition and with the case

law, the Commission has given pre-eminence to demand-side substitution, whereby

it considered that customers still need transportation from one point to another and

that competition still takes place on an O&D city-pair basis.

14

(20) A large majority of respondents to the market investigation have confirmed this

approach in the present case, and confirmed that it was relevant for the purpose of

analysing the competitive effects on the overlap routes

15

.

(21) While in particular the Parties, some network carriers and some charter airlines tend

to believe competition between carriers wield network-based aspects, the O&D

approach best reflects the demand-side perspective according to which both the point

of origin and the point of destination should include all airports that are substitutable

in the eyes of passengers.

(22) In light of the above, the effects of the Transaction will be assessed on the basis of

the city-pair O&D approach, while all substitutable airports will be included in the

respective points of origin and destination provided that they are perceived as

substitutable by travellers. The question of airport substitutability will be examined

for those O&D routes in Section 4.1.4.

4.1.2. Premium vs. non premium passengers

(23) The Commission has traditionally found that a distinction may be drawn between

time sensitive/premium and non-time sensitive/non-premium passengers.

(24) Premium passengers tend to travel for business purposes, require significant

flexibility with their tickets (such as cost-free cancellation and modification of the

time of departure, etc.) and tend to pay higher prices for this flexibility. Non-

premium customers travel predominantly for leisure purposes or to visit friends and

relatives, book long time in advance, do not require flexibility with their booking and

are generally more price-sensitive.

16

(25) The Parties do not object with this distinction. They moreover adopt a distinction

between premium and non-premium based on restricted Economy fares falling into

the latter category and all other fares falling into the former for the purpose of the

market definition and the calculation of the market shares. The Parties claim that this

13

On the network approach, see CMP/M.6447 - IAG/bmi, COMP/M.5889 - United Air Lines/Continental Airlines,

COMP/M.5830 - Olympic/Aegan Airlines, COMP/M.5747 - Iberia/British Airways. The O&D approach was

confirmed by the General Court, most recently in Case T-342/07 Ryanair Holdings plc v European Commission

[2010 ECR], paragraph 53.

14

Commission's Notice on the definition of the relevant market, paragraph 13 (OJ C 372, 09.12.1997, p.5),

COMP/6447 IAG/bmi, recital 31 and following.

15

See responses to questions 5 and 6 of Q1 – Questionnaire to Competitors, responses to questions 4 and 5 of Q2 –

Questionnaire to Corporate Customers, responses to question 4 and 5 of Q3 – Questionnaire to Travel Agencies.

For the sake of the present decision, "Transatlantic routes" stands for the 12 routes to and from New York, Boston,

Washington, Chicago, Los Angeles, San Francisco, Cancun, Miami, Las Vegas, and Orlando, from and to London

and Manchester.

16

COMP/M.5889 - United Air Lines/Continental Airlines, COMP/M.5440 - Lufthansa/Austrian Airlines;

COMP/M.5335 - Lufthansa/SN Airholding; COMP/M.5364 - Iberia/Vueling/Clickair.

6

delineation is conservative. If the boundary between premium and non-premium had

been set up otherwise, the Parties' markets shares would indeed dilute.

(26) A large majority of respondents to the market investigation confirmed this approach,

acknowledging that the distinction between premium and non-premium passengers

was relevant for the assessment of the Transaction.

17

(27) Some respondents amongst the Parties' competitors nonetheless indicated that the

distinction between premium and non-premium passengers has become blurred, and

that there is a chain of substitution between these two broad categories rather than a

clear-cut distinction.

18

(28) However, for the assessment of the Transaction, the conclusion on whether premium

and non-premium passengers belong to the same market can be left open as no

competition concerns arise under any alternative market definition.

4.1.3. Non-stop (direct) vs. one-stop (indirect) flights

19

(29) The Commission has in its practice considered that with respect to long-haul routes

(more than 6 hours flight duration), one-stop flights constitute a competitive

alternative to non-stop services under certain conditions (for example if they are

marketed as connecting flights on the O&D pair in the computer reservation

system).

20

(30) The Parties claim that one-stop services can in certain circumstances present a

competitive alternative to non-stop services. According to the Parties, this

competitive constraint would be greater the shorter the additional duration is relative

to that of non-stop services.

(31) A large majority of respondents to the market investigation confirmed that one-stop

services could constitute competitive alternatives to non-stop services as identified

above. A majority of the respondents also confirmed that one-stop services with a

greater difference in duration constituted a smaller competitive constraint to non-stop

services than one-stop services with a shorter difference in duration.

21

Nevertheless,

a majority of the corporate customers stated that they would not buy one-stop tickets

for their employees, emphasizing the fact that the distinction is more relevant as far

as premium passengers are concerned.

22

17

See responses to question 7 of Q1 – Questionnaire to Competitors, responses to question 6 of Q3 – Questionnaire to

Travel Agencies.

18

See responses to question 7 of Q1 – Questionnaire to Competitors.

19

"Non-stop" flights are flights that take off at airport A and land at airport B, where they offload passengers, and that are

constantly in the air from their origin airport and to their final destination airport. By contrast, "direct" flights may entail

a refuelling stop and/or a disembarking/re-embarking stop, but are marketed under a single flight code and are flown

with a single aircraft. "One-stop" flights include direct flights that do not qualify as "non-stop", as well as indirect flights

which are journeys that require a change of aircraft or a change of flight code. Unless indicated otherwise, the terms

"non-stop/one-stop" and "direct/indirect" are used interchangeably in the present decision as this terminology does not

have an effect on the outcome of the competitive assessment in the present case.

20

COMP/M.5440 - Lufthansa/Austrian Airlines, COMP/M.2041 - United/US Airways, COMP/M.2672 -

SAS/Spanair.

21

See responses to question 11 to 16 of Q1 – Questionnaire to Competitors, question 11 of Q2 – Questionnaire to

Corporate Customers, question 8 to 11 of Q3 – Questionnaire to Travel Agencies, question 5 to 8 of Q4 –

Questionnaire to Consumer Associations.

22

See responses to question 10 of Q2 – Questionnaire to Corporate Customers.

7

(32) However, for the assessment of the Transaction, the conclusion on whether or not

non-stop/direct and one-stop/indirect flights belong to the same market can be left

open as no competition concerns arise under any alternative market definition.

4.1.4. Airport substitutability

(33) The Commission has found that flights from and to airports which have sufficiently

overlapping catchment areas can be considered as substitutes in the eyes of

passengers. Such airport substitution has often been found where several airports are

located in the same city. In order to correctly capture the competitive constraint that

flights from and to two different airports exert on each other, a detailed analysis

taking into consideration the specific characteristics of the case at hand is

necessary.

23

(34) In the present case, such airport substitutability is particularly relevant for London

and New York, as well as for Orlando, Washington, Chicago, and Miami.

4.1.4.1. London airports

(35) London has six airports, namely London Heathrow, London Gatwick, London City,

Stansted, Luton and Southend

24

.

(36) Table 1 summarises the following: (i) the distance from the London airports to

London city centre (in km and time):

Table 1: London airports

Airports Heathrow (LHR)

Gatwick (LGW)

London City (LCY)

Distance and travel

times to London city

centre

LHR – 28 km

LGW – 46 km

LCY – 14 km

Car: LHR – 65 mins; LGW – 85 mins; LCY – 20 mins.

Bus: LHR – 65 mins; LGW – 90 mins.

Rail: LHR – 55 mins; LGW – 60 mins; LCY – 22 mins.

Source: Form CO (paragraph 226 – Table 5)

(37) Previous Commission decisions determined that a certain degree of substitutability

exists between the London airports, at least for non-premium passengers.

25

Also, the

Commission found in the past that at least the airports of London Heathrow, London

Gatwick, and London City were considered substitutable for both premium and non-

premium passengers flying from London to Madrid and to Barcelona

26

and that the

23

COMP/M.5747 Iberia/British Airways; COMP/M.5440 Lufthansa/Austrian Airlines; COMP/M.5335 Lufthansa/SN

Airholding; COMP/M.3280 Air France/KLM.. See also judgment of the General Court of 6 July 2010 in case T-

342/07 Ryanair v Commission paras. 99 et seq.

24

According to the data collected during the market investigation, there are no flights to and from Stansted, Luton

and Southend relevant for the assessment of the Transaction.

25

COMP/M.4439 – Ryanair/Aer Lingus, paragraph 109 and following; COMP/M.5747 – Iberia/British Airways;

COMP/M.5889 – United Air Lines / Continental Airlines; COMP/M.6447 – IAG/bmi;

26

COMP/M.5747 – Iberia/British Airways, paragraph 30.

8

airports of London Heathrow and London Gatwick were considered substitutable for

both premium and non-premium passengers flying between London and Athens.

27

(38) In the recent IAG/Bmi case

28

, the Commission assessed each of the relevant routes on

the narrowest possible market, namely a market comprising flights to and from

London Heathrow only. In line with the approach adopted in the decision relating to

COMP/M.5747-Iberia/British Airways, the effects of the concentration were

examined on a wider “London(three)” market comprising flights to and from London

Heathrow, London Gatwick and London City and also on a wider “London(five)”

market comprising flights to and from London Heathrow, London Gatwick, London

City, Luton, and Stansted.

(39) The Parties contend that no competition concern will arise as a result of the

Transaction, regardless of the precise London airport market definition. However, the

Parties consider that there is support for the following possible London airport

market definitions: (i) London Heathrow only market

29

, (ii) London Heathrow and

London City market for premium passengers

30

, and (iii) a "London (three)" market

encompassing London Heathrow, London Gatwick and London City

31

.

(40) The results of the market investigation are blurred, both for premium and non-

premium passengers.

(41) Indeed, a large majority of respondents to the market investigation considers that a

significant proportion of premium passengers would not switch to another London

airport, should the prices of fares on the Transatlantic routes to and from London

Heathrow would increase by 5-10%. However, the Parties' main competitors on the

Transatlantic routes to and from London disagree and deem that premium passengers

would switch under some circumstances

32

.

(42) As concerns the non-premium passengers, market participants' opinions are rather

mixed. A majority of competitors

33

, including American Airlines, US Airways and

United, considers that in case of price increase by 5-10% of the Transatlantic flights

to and from London Heathrow, a significant proportion of non-premium passengers

would switch to either London Gatwick and/or London City. A contrario, a large

majority of corporate customers contends that non-premium passengers would

continue to fly from London Heathrow, in spite of such price increase

34

. As concerns

the travel agencies, a majority of respondents considers that passengers would switch

from London Heathrow. However, there is no clear trend as to whether passengers

would switch to either London Gatwick and/or London City or to any other London

airport. As explained by Thomas Cook: "Our non-premium paxs are very price

27

COMP/M.5830 – Olympic/Aegean Airlines, paragraph 1644.

28

COMP/M.6447 – IAG/bmi.

29

The Parties consider that London Heathrow is a critical airport for the provision of transatlantic services and that it

cannot be excluded from any possible London airport market definition.

30

The Parties argue that London City airport provides some competitive constraint on London Heathrow for premium

passengers. In particular, British Airways offers two daily direct Business class only services between London City

and New York (JFK airport). These services would be substitutable for services to and from London Heathrow for

premium passengers who value the direct access to the City of London which this service offers.

31

The Parties take account in this respect of the transatlantic services to and from Gatwick. Delta does not offer any

services to and from Gatwick.

32

Responses to question 19.1 of Q1 – Questionnaire to competitors.

33

Responses to question 20 of Q1 – Questionnaire to competitors.

34

Responses to question 17 of Q2 – Questionnaire to corporate customers.

9

sensitive and we do see them swapping to airports to get themselves a cheaper

deal"

35

.

(43) Therefore, the effects of the Transaction for the relevant routes to and from London

will be examined on a market comprising flights to and from Heathrow only, and on

a wider market comprising flights to and from Heathrow, Gatwick and London City.

4.1.4.2. New York airports

(44) New York has three airports, namely John F. Kennedy International Airport ("JFK"),

Newark Liberty International Airport ("Newark") and La Guardia

36

. JFK is located

31 kilometres i.e. 30 minutes by car, 52 minutes by bus and 75 minutes by rail away

from the New York City centre. Newark is located 21 kilometres i.e. 22 minutes by

car and 24 minutes by rail away from the New York City centre.

(45) The Parties consider that transatlantic services between JFK or Newark and London

should be considered to be part of the same market

37

. They submitted a quantitative

study to support this finding

38

. In that study, the Parties compared Virgin's London

Heathrow-JFK and London Heathrow-Newark fares and conducted both stationary

and correlation analyses. According to the Parties, those analyses follow the method

applied by the Commission itself in previous air transport cases. [Outcome of Virgin

Atlantic's fare analysis]. Besides, the Parties referred to previous decisions where the

Commission found that transatlantic services between London and JFK or Newark

were part of the same market

39

.

(46) The market investigation has not yielded unequivocal results as to the extent to

which London-JFK and London-Newark services are regarded as substitutable by

passengers

40

, notably within the premium category

41

. In particular, many corporate

travelers (who often fall within the premium category) may be inclined to choose

between JFK and Newark on the basis of the location of their final place of

destination or place of origin in the New York area rather than on the basis of

developments in fares for services between London and each of those airports.

(47) In any event, since the Transaction does not raise serious doubts as to its

compatibility with the internal market with respect to the London-New York route

under any possible market definition, the question of whether London-JFK and

London-Newark services belong to the same market can be left open.

4.1.4.3. Orlando airports

(48) Orlando has two airports: (i) Orlando International (20 kilometres/24 minutes

42

away

from the city center) and (ii) Sanford International (37 kilometres/27 minutes

43

away

from the city center). Both Delta and Virgin operate from London and Manchester to

Orlando International, while Sanford International is mainly used by charter carriers.

35

Responses to question 15 of Q3 – Questionnaire to travel agencies.

36

There are no flights to and from La Guardia relevant for the assessment of the Transaction.

37

Form CO, paragraph 224 (b).

38

Form CO, Annex 76.

39

Case COMP/39.596 BA/AA/IB, paragraphs 29 and 30, Case COMP/M.3280 Air France / KLM, paragraph 34.

40

In the sense that an increase in fares of 5-10% for one of these two categories of services would entice a significant

number of passengers to switch to the other category.

41

See responses to questions 18 of Q3 – Travel Agents, responses to question 20 of Q2 – Corporate Customers,

responses to questions 23 of Q1 – Competitors, Air Transport of Passengers.

42

By car.

43

Ibid.

10

(49) The Parties submit that both airports are substitutable as (i) Orlando is a holiday

destination, where non-premium passengers make up the vast majority of the

passenger numbers

44

; (ii) Sanford International airport is 37 kilometres miles away

from Orlando city centre, and Orlando International airport is around 20 kilometres

away from Orlando city centre; and (iii) such non-premium leisure passengers are

unlikely to be concerned about whether the airport is 20 or 37 kilometres from the

Orlando city centre (or relevant tourist destination at which they are staying, e.g.

Disney World).

(50) On the London-Orlando route, a majority of competitors considers that should the

fares on the London-Orlando International route increase, premium customers would

not switch to Sanford International. As explained by Aer Lingus: "While we consider

these airports to be substitutable, Premium passengers are not so price sensitive.

Consequently, such a price increase would not result in switching from their

preferred airport"

45

. As regards non-premium passengers, a majority of competitors

and of travel agencies deems that non-premium passengers would switch to Sanford

International in such situation. For instance, Brussel Airlines' response reads as

follows: "Non-Premium passengers are looking at the price (in first instance)"

46

.

(51) On the Manchester-Orlando route, a large majority of competitors, corporate

customers and travel agencies as well as the manager of the Manchester airport

contend that premium passengers would not switch to Sanford International, should

fares on Manchester-Orlando International increase by 5-10%

47

. As stated by Carlson

Wagon lit: "Generally, Sanford International Airport is only serviced by charter

companies, offering only non-flexible, economy service. Business travellers

appreciate the flexibility of Orlando International, the distance to Orlando and its

facilities, and a 5-10% price increase will likely not be sufficient to make them switch

to a carrier serving Sanford International"

48

. Conversely, the same market players

consider that non-premium passengers would switch from Orlando International to

Sanford International, should the fares on the Manchester-Orlando International

route increase by 5-10%.

(52) As a consequence, for the purpose of the present case, the two Orlando airports

appear to be substitutable for non-premium passengers only.

4.1.4.4. Washington airports

(53) Washington DC has two airports, namely Dulles International Airport (42

kilometres/30 minutes

49

away from the city centre) and Ronald Reagan Washington

National Airport (7 kilometres/12 minutes

50

from the city centre).

51

According to the

44

According to a CAA survey data from 2012 put forward by the Parties, 95 per cent of passengers travelled for

leisure on the London-Orlando route.

45

Response to question 23.1 of Q1 – Questionnaire to competitors.

46

Response to question 23.2 of Q1 – Questionnaire to competitors.

47

Responses to question 18 of Q2 – Questionnaire to corporate customers.

48

Response to question 16.1 of Q3 – Questionnaire to travel agencies.

49

By car.

50

Ibid.

51

The Parties state that for the assessment of the impact of the Transaction on the London-Washington route, the

relevant airports are Dulles International Airport and Ronald Reagan Washington National Airport, although

Baltimore-Washington International Airport may be considered by some passengers to and from Washington DC as

a substitute for these two airports. Given that Virgin only connects to Dulles International Airport and Delta mainly

to Ronald Reagan Washington National Airport, including Baltimore-Washington International airport in the

competitive assessment will not alter the outcome of the assessment of the Transaction.

11

Parties no competition concerns will arise from the Transaction regardless the precise

Washington DC airport market definition.

(54) The market investigation revealed mixed results on the substitutability of the two

airports for premium and non-premium passengers. Subsequently, no firm

conclusions can be drawn on the substitutability of the two airports of Washington

DC.

(55) For the assessment of the Transaction, the conclusion on the substitutability of the

two Washington DC airports can be left open as no competition concerns arise under

any alternative market definition.

4.1.4.5. Chicago airports

(56) Chicago has two airports, namely O'Hare International Airport (29 kilometres/24

minutes

52

away from the city centre) and Midway International Airport (17

kilometres/18 minutes

53

away from the city centre). According to the Parties no

competition concerns will arise from the Transaction regardless the precise Chicago

airport market definition.

(57) The market investigation revealed mixed results on the substitutability of the two

airports for premium and non-premium passengers. Subsequently, no conclusions

can be drawn on the substitutability of the two airports of Chicago.

(58) For the assessment of the Transaction, the conclusion on the substitutability of the

two Chicago airports can be left open as no competition concerns arise under any

alternative market definition.

4.1.4.6. Miami airports

(59) Miami has two airports, namely Miami International (7 kilometres/11 minutes

54

away from the city centre) and Fort Lauderdale International (39 km kilometres/30

minutes

55

away from the city centre). According to the Parties no competition

concerns will arise from the Transaction regardless the precise Miami airport market

definition.

(60) The market investigation revealed mixed results on the substitutability of the two

airports for premium and non-premium passengers. Subsequently, no conclusions

can be drawn on the substitutability of the two airports of Miami.

(61) For the assessment of the Transaction, the conclusion on the substitutability of the

two Miami airports can be left open as no competition concerns arise under any

alternative market definition.

4.1.5. Inclusion of charter services

(62) Charter flights, as opposed to scheduled flights, are usually defined as air transport

services that take place outside normal schedules, normally through a hiring

arrangement with a particular customer (in particular a tour operator). Charter

companies often fly to destinations where no scheduled airline is active and usually

operate on a seasonal basis with a relatively low frequency of flights, in response to

52

By car.

53

Ibid.

54

By car.

55

Ibid.

12

the requirements of tour operators (for example, once a week on Saturday, only

during the summer or only during the ski season).

(63) Indeed, charter companies did not traditionally sell tickets directly to passengers.

They sold seats on their aircraft to tour operators which included the flight in a

holiday package. As such, the flight (air transport) is part of a package holiday, the

price of which includes flights, accommodation and other services. However, charter

companies now sell to some extent so-called "dry seats" directly to passengers (that

is to say seats only without other services), in addition to sales of seats to tour

operators for inclusion in package holidays.

(64) The Commission has previously held that most of the services offered by charter

companies (package holiday sales, seat sales to tour operators) are not in the same

market as scheduled point-to-point air transport services

56

. As concerns the sale of

"dry seats", the Commission recently left open whether they are part of the same

relevant market noticeably for long-haul flights

57

.

(65) The Parties consider that they face a meaningful competition from charter airlines on

five routes: (i) London-Orlando, (ii) Manchester-Orlando, (iii) London-Las Vegas,

(iv) Manchester-Las Vegas and (v) London-Cancun.

(66) Indeed, the Parties submit that leisure destinations, such as Orlando, Las Vegas and

Cancun, where the overwhelming majority of passengers even on scheduled airlines

are non-premium passengers travelling for leisure purposes, are the kind of

destinations where the scheduled airlines have regard to competition from charter

airlines.

(67) Respondents to the market investigation confirm the Commission's precedents. As

concerns the package holiday sales and seat sales to tour operators, the majority of

the respondents consider that they are not substitutable with scheduled passenger air

transport services in the eyes of customers on the overlap routes.

(68) As a consequence, for the assessment of the Transaction, the Commission concludes

that most of the services offered by charter companies (package holiday sales, seat

sales to tour operators) are not in the same market as scheduled air transport services.

(69) As concerns the competitive constraint exerted by charter carriers selling dry seats,

on the five routes referred to by the Parties, a large majority of respondents to the

market investigation do not see the charter airlines as credible alternatives to

scheduled airlines for premium services.

(70) However, for non-premium services, a majority of travel agencies deem that, facing

such fare increase, some of their customers would switch to buying dry seats from

charter carriers.

(71) Therefore, the relevance of dry seats offered by charter carriers to non-premium

passengers will be considered by the Commission in the competitive assessment in

the route- by-route analysis where relevant (Section 6.1).

56

COMP/M.4439 - Ryanair/Aer Lingus, COMP/M.5141 - KLM/Martinair, COMP/M.6663 – Ryanair/Aer Lingus III.

57

COMP/M.574 – Iberia/British Airways, paragraphs 34 and 35.

13

4.2. Air transport of cargo

4.2.1. Relevant product market

(72) In line with previous Commission decisions, the Parties submit that the O&D

approach to the market definition is inappropriate for the air transport of cargo, given

that cargo is generally less time sensitive than passengers and is usually transported

by trans-modal means of transport "behind" and "beyond" the points of origin and

destination.

58

Therefore, the relevant market should be defined more broadly.

(73) A majority of the respondents to the market investigation confirmed that a wider

market for air transport of cargo exists as, unlike passengers, cargo can be transported

with a higher number of stopovers and therefore any one-stop route is a substitute for

any non-stop route.

59

Besides, while some market players argued that that a separate

market could be identified including only non-stop flights used to transport specific

goods, such as livestock, perishable products, lifesaving drugs, etc., a large majority

of respondents indicated that such a distinction would not be material.

60

(74) Furthermore, the Parties submit that, as supported by previous Commission

decisions

61

, there is a single market for air transport of cargo and it is not appropriate

to sub-divide that market by type of air cargo carrier or by the nature of the goods

transported.

(75) The evidence collected through the market investigation indicates that there is no

reason to further sub-divide the market according to the type of provider. Even

though some market players argued that integrators

62

would have a specific market

segment as they focus on the express small packages market, a large majority of

respondents considered that all four types of air cargo carriers, namely (i) cargo

airlines with dedicated freighter airplanes; (ii) carriers with only belly space cargo

capacity on passenger flights; (iii) combination airlines (that is to say airlines with

both dedicated freighter airplanes and belly space cargo capacity); and (iv)

integrators, compete with each other for the same business in so far as they offer air

transport of cargo services.

63

(76) In previous decisions, the Commission considered a market for air transport of cargo

including all kinds of transported goods.

64

The market investigation in the present case

largely supports such approach. Whilst some respondents indicated that dangerous

goods require special handling for safety and security reasons, the large majority of

competitors indicated that they transport all kinds of goods in the same aircraft.

65

Likewise, the majority of respondents to the market investigation (competitors and

customers) confirmed that the market for air transport of cargo should not be further

58

COMP/M.5747 – Iberia/British Airways, recital 36; COMP/M.6447 – IAG/bmi, recital 87.

59

See responses to question 5 of Q8 – Questionnaire to Cargo Competitors and responses to question 6 of Q9 –

Questionnaire to Cargo Customers.

60

See responses to questions 6 and 6.1 of Q9 – Questionnaire to Cargo Customers.

61

COMP/M.5747 – Iberia/British Airways, recitals 38 and 40; COMP/M.6447 – IAG/bmi, recitals 89 and 91.

62

Integrators offer not only airport to airport services, but also handle cargo from the point of origin to the airport and

from the airport to the final destination, including legal formalities such as customs clearance. Examples of

integrators are DHL, UPS, FedEx and TNT.

63

See responses to questions 8 and 8.1 of Q8 – Questionnaire to Cargo Competitors and responses to questions 8 and

8.1 of Q9 – Questionnaire to Cargo Customers.

64

COMP/M.5747 – Iberia/British Airways, recital 40; COMP/M.6447 – IAG/bmi, recitals 91-92.

65

See responses to question 6 of Q8 – Questionnaire to Cargo Competitors.

14

sub-divided according to the nature of the transported items, mainly because

different kinds of cargo can be transported in the same aircraft. Some respondents

also pointed to the use of standardized forms of packaging and to the fact that no

different handling is required for loading and unloading the cargo.

66

(77) Finally, in line with previous Commission decisions, the Parties submit that the

markets for air transport of cargo are inherently unidirectional, due to differences in

demand at each end of the route, and must therefore be assessed on a unidirectional

basis.

67

The majority of respondents to the market investigation confirmed this

approach, mainly because of differences in terms of demand, products being shipped,

rate structure, customer base and deployed capacity.

68

(78) Therefore, the competitive assessment will be based on a broader market for air

transport of cargo encompassing all types of air cargo carriers and including all kinds

of transported goods on a unidirectional basis.

4.2.2. Relevant geographic market

(79) In line with previous Commission decisions, the Parties submit that for

intercontinental routes, catchment areas at each end of the route broadly correspond

to continents for those continents where local infrastructure is adequate to allow for

onward connections (for instance by road, train, or inland waterways, etc.), such as

Europe and North America. However, in respect of continents where local

infrastructure is less developed, the catchment area corresponds to the country of

destination.

69

(80) The evidence collected through market investigation confirms that in areas where

transport infrastructure allows for smooth onward connections the catchment area for

air transport of cargo can be broader than a country and can correspond to

continents.

70

This is particularly the case for Europe (encompassing the EEA area)

71

and North America (encompassing the United States and Canada)

72

. However, with

regard to Mexico, a large majority of respondents to the market investigation

indicated that transport infrastructure in this country is less developed and thus

insufficient to consider Mexico as part of a wider area.

73

Consequently, air transport

of cargo from Europe to Mexico (and vice versa) must then be assessed on a

continent (Europe) to country basis (and vice versa).

(81) Therefore, for the assessment of the Transaction, the relevant cargo markets are the

ones for air transport of overall cargo on a continent-to-continent (Europe - North

66

See responses to questions 7 and 7.1 of Q8 – Questionnaire to Cargo Competitors and responses to question 7 of Q9

– Questionnaire to Cargo Customers.

67

COMP/M.5747 – Iberia/British Airways, recital 39; COMP/M.6447 – IAG/bmi, recital 90.

68

See responses to questions 9 and 9.1 of Q8 – Questionnaire to Cargo Competitors and responses to questions 9 and

9.1 of Q9 – Questionnaire to Cargo Customers.

69

COMP/M.5440 – Lufthansa/Austrian Airlines, recital 30; COMP/M.5747 – Iberia/British Airways, recital 42;

COMP/M.6447 – IAG/bmi, recital 94.

70

See responses to question 10 of Q8 – Questionnaire to Cargo Competitors and responses to question 10 of Q9 –

Questionnaire to Cargo Customers.

71

See responses to question 13 of Q8 – Questionnaire to Cargo Competitors and responses to question 13 of Q9 –

Questionnaire to Cargo Customers.

72

See responses to question 11 of Q8 – Questionnaire to Cargo Competitors and responses to question 11 of Q9 –

Questionnaire to Cargo Customers.

73

See responses to questions 10 and 12 of Q8 – Questionnaire to Cargo Competitors and responses to questions 10

and 12 of Q9 – Questionnaire to Cargo Customers.

15

America and vice versa) and continent-to-country basis (Europe – Mexico and vice

versa) as the case may be.

5. CONCEPTUAL FRAMEWORK FOR THE ASSESSMENT OF THE PRESENT

TRANSACTION

(82) Prior to assessing the impact of the Transaction on the relevant markets, the

conceptual framework for the assessment of the Transaction must be determined. In

this respect, the Transaction raises one main conceptual issue: the treatment of

Delta's alliance and JV partners for the purposes of both the determination of affected

markets and the competitive assessment of the Transaction.

5.1. Alliances and profit-sharing joint ventures – passenger air transport services

(83) Delta is a founding member of the Skyteam alliance and participates in a profit-

sharing transatlantic joint venture with Air France/KLM and Alitalia (the "Air

France/KLM/Alitalia joint venture").

74

(84) In accordance with previous cases

75

, the assessment of the Transaction will be

carried out on the routes operated directly by Delta as well as by Delta's partners in

the Air France/KLM/Alitalia joint venture to the extent that they fall within the scope

of the JV agreement.

(85) [Information regarding the scope of Delta's joint venture with Air

France/KLM/Alitalia]

(86) [Scope of the JV arrangements between Delta and Virgin Atlantic]

(87) Similarly, there are two other revenue-sharing joint ventures covering air passenger

services on transatlantic routes, namely the oneworld Alliance Transatlantic Joint

Business of IAG (British Airways and Iberia) and American Airlines and the Star

Alliance A++ Joint Venture of United, Lufthansa and Air Canada. Their market

positions will be analysed as being a single one on all relevant routes.

5.2. Alliances and profit-sharing joint ventures – air transport of cargo

(88) Delta provides air transport of cargo services in the context of the Air

France/KLM/Alitalia joint venture and is a member of the SkyTeam Cargo alliance,

which provides for less integrated cooperation between SkyTeam members in

transporting cargo across the SkyTeam global network.

76

(89) For the purpose of the present case, the assessment will be carried out on the cargo

routes operated directly by Delta as well as by Delta's joint venture partners (Air

74

Delta's transatlantic joint venture with Air France/KLM/Alitalia covers routes between Europe and

North America (Canada, the US and Mexico) including points beyond Europe and beyond US entry

points into Delta's US domestic network. The Air France/KLM/Alitalia joint venture also covers

services between Amsterdam and India and between North America and Tahiti.

75

See for instance COMP/M. 5747 – Iberia/British Airways, 14 July 2010.

76

[Information regarding the scope of Delta's joint venture with Air France/KLM/Alitalia]. SkyTeam Cargo alliance

comprises Aeroflot, Aeromexico Cargo, Air France – KLM Cargo, Alitalia Cargo, China Airlines, China Southern

Cargo, Czech Airlines Cargo, Delta Cargo, Korean Air Cargo.

16

France/KLM/Alitalia) to the extent that they fall within the scope of the joint venture

revenue-sharing arrangements.

6. COMPETITIVE ASSESSMENT

6.1. Air transport of passengers

(90) The Transaction gives rise to horizontal overlaps on (i) two non-stop/non-stop routes:

London-New York and London-Boston, and (ii) ten non-stop/one-stop overlap

routes: London-Washington, London-Chicago, London-Los Angeles, London-San

Francisco, London-Cancun, London-Miami, London-Orlando, London-Las Vegas,

Manchester-Orlando and Manchester-Las Vegas.

77

These routes will be analysed in

turn below.

6.1.1. Methodology for calculating market shares

(91) The Commission regularly

78

endorses the use of Marketing Information Data Tapes

(MIDT) data as the best available proxy to estimate market shares. The Parties

therefore submitted data on market size and market share on the basis of MIDT data

for each relevant O&D route.

(92) MIDT data capture the booking of airline tickets made through Global Distribution

System (GDS); however MIDT data does not contain the bookings made directly via

the airline web-sites and charter sales.

(93) The Commission proceeded to a market reconstruction, asking the Parties and their

competitors to provide actual passenger numbers on each relevant O&D route. This

data encompasses the bookings through GDS as well as the bookings made directly

via the airline web-sites

79

.

(94) The market shares as calculated on the basis of the market reconstruction are within

similar ranges as the market shares calculated using MIDT data.

(95) The Commission uses data calculated through the market reconstruction for the

purpose of conducting the competitive assessment of the Transaction

80

.

(96) For the assessment of the Transaction, all one-stop flights are taken into acount

without applying a cut-off at a certain maximal duration of the connection time. The

Commission takes the view that the competitive analysis can include all booked one-

77

No competition concerns are deemed to arise on all affected non-stop/one-stop overlaps where throughout the last

four IATA seasons (for Delta this included Delta's integrated transatlantic joint venture partners Air France/KLM

and Alitatlia to the extent that the routes in question were within the scope of the joint venture): (i) the Parties'

combined market share was below 25%, or (ii) one of the Parties had a market share below 2%. There were no non-

stop/one-stop overlap routes for which at least one end of the city pair was outside the EU and on which the total

annual traffic was below 30,000 passengers. Similarly, no competition concerns are deemed to arise on all affected

one stop/one-stop overlaps where throughout the last four IATA seasons (i) the Parties’ combined market share was

below 25% or (ii) one of the Parties had a market share below 2% or (iii) where the total annual traffic was below

30,000 passengers.

78

Commission's Decisions of 30 March 2012 in Case No COMP/M.6447 – IAG/ BMI; 27 July 2010 in Case No

COMP/M.5889 – United Airlines/ Continental Airlines; 14 July 2010 in Case No COMP/M.5747 – Iberia/ British

Airways.

79

A limited number of minor market participants did not respond. However, they would likely represent a small

number of the passengers flying on the affected routes. In any event, their inclusion would have reduced the

Parties’ market shares.

80

However, the market reconstruction achieved in the present case confirms the possibility to rely on MIDT data for

similar cases.

17

stop tickets because the low popularity of very long one-stop flights will be reflected

in the booking data in that they will only account for a very small part of the relevant

market.

6.1.2. Congestion at relevant airports

6.1.2.1. UK airports

(a) London Heathrow

(97) Heathrow is a fully coordinated airport under the EU Slot Regulation (Level 3)

81

,

meaning that each business and general aviation movement requires the prior

allocation of a slot. At Heathrow there are constraints on airline access to slots across

the whole operating day on every day of the week across all months of the year. It is

therefore not currently possible for an airline to rely on the slot pool at Heathrow to

launch or extend services and each season there is either very limited availability or

no availability at all, as explained by the London Heathrow slot coordinator, ACL

82

.

(98) According to the Parties

83

, 56.6 % of all Heathrow slots are currently held by BA,

American Airlines, and Iberia, compared to 3.3% by Virgin

84

(and only 0.3% for

Delta (with 7% for all of the members of the SkyTeam alliance). The next largest slot

holders at Heathrow are Lufthansa with 5.6%, and Aer Lingus with 3.3%.

(b) London Gatwick

(99) Like Heathrow, Gatwick is designated as a fully coordinated airport under the EU

Slot Regulation (Level 3). Demand currently exceeds capacity throughout most or all

of the day at Gatwick

85

. According to ACL, the slot coordinator at Gatwick:

"Gatwick’s capacity limitations are runway movement and terminal passenger

throughput constraints. Runway capacity is the dominant constraint on airline access

to slots. Access to slots is limited by available capacity for much of the operating

day, particularly in the morning period and during summer seasons. London

Gatwick is also governed by environmental limits on the number of night movements

and night noise points permitted between 2300 – 0600 local time. Significant entry or

growth in the key morning and evening peak times of day is likely to be limited by

slot availability, although a secondary market for slots exists and slots at other times

(eg, afternoon/late evening) can be available from the pool"

86

.

(100) Virgin held 2% of the slots at Gatwick during the Winter 2012 IATA season

87

.

81

Council Regulation (EEC) No 95/93 of 18 January 1993 on common rules for the allocation of slots at Community

airports, OJ L 14, 22.1.1993, p. 1–6 and Regulation (EC) No 793/2004 of the European Parliament and of the

Council of 21 April 2004 amending Council Regulation (EEC) No 95/93 on common rules for the allocation of

slots at Community airports.

82

See ACL's response to Q5 – Questionnaire to slot coordinators.

83

Form CO, paragraph 373.

84

Virgin has recently obtained 9 slots pursuant to the remedies taken by the Parties in the IAG/bmi case. These 9

slots amount to 1.3% of the Heathrow slots.

85

Impact assessment of revisions to Regulation 95/93 Final report (Steer Davies Gleave, March 2011 available at:

http://ec.europa.eu/transport/air/studies/doc/airports/2011-03-impact-assessment-revisions-regulation-95-93.pdf

86

See ACL's response to question 6 of Q7 – Questionnaire to slot coordinators.

87

Delta does not operate ex Gatwick.

18

(c) Manchester airport

(101) Manchester is a level 3 coordinated airport. Manchester Airport is however broadly

not capacity or slot constrained, but is subject to a limited supply at the peaks.

6.1.2.2. North-American airports

(a) New York airports

(102) In the New York urban area, both JFK and Newark are subject to slot control. The

Parties indicated that for both airports, while availability of slots was limited in the

late afternoon and evening (from 1:00 pm to 9:59 pm), slots were generally available

in the morning and early afternoon (from 6:00 am to 1:00 pm)

88

.

(103) The United States' Federal Aviation Administration ("the FAA"), which acts as a slot

coordinator for these two airports, indicated that they both had slot constraints from

6:00 am to 10:59 pm daily and that the peak hours were generally from 7:00 am to

9:29 am and from 1:00 pm to 9:29 pm. The FAA also indicated that there had been

several instances during each of the last four IATA seasons where it was unable to

satisfy slot requests at each of those airports. In addition, the FAA does not expect

capacity to change at those airports in the next three to five years

89

.

(104) These elements point to a fairly high level of congestion at both airports during most

of the day, resulting in high barriers to entry and expansion on routes from or to these

airports, unless for carriers which already hold a substantial portfolio of slots at one

of them. Indeed, the more slots a carrier holds at a given congested airport, the easier

it is for that carrier to find a set of slots the use of which it can modify (in terms of

routes), so as to be in a position to add frequencies on certain routes.

(b) Other North American airports

(105) The information submitted by the Parties and collected during the market

investigation shows that no significant congestion would exist at other relevant US

airports and at Cancun airport.

6.1.3. Non-stop-non-stop long-haul overlaps: London-New York and London-Boston

(106) The Transaction gives rise to non-stop-non-stop overlaps on two routes, namely

London-New York and London-Boston.

6.1.3.1. General arguments put forward by the Parties

(107) The Parties put forward a number of arguments applying to both routes, as to why

they believe that the Transaction does not raise competition concerns

90

.

(108) They first argue that their transatlantic services are predominantly complementary

and that this complementarity would allow them to build a more significant UK / US

network, in particular thanks to their respective domestic networks in the United

States and the United Kingdom. The Parties consider that such a stronger network

could help them act as a more effective competitive constraint on the Transatlantic

Joint Business of British Airways and American Airlines ("BA / AA"), […]. In this

88

Form CO, paragraph 382.

89

See FAA's responses to questions 7 to 9 of Q5 – Questionnaire to Slot Coordinators.

90

Form CO, paragraphs 350 to 451.

19

respect, the Parties stress the importance of connecting traffic to sustain operations

on transatlantic O&D routes. Indeed, by offering more connecting opportunities, a

carrier can attract further connecting passengers and increase its load factors on the

trunk routes. This, in turn, strengthens its performance on the route and enables it to

compete more aggressively on price for O&D passengers.

(109) The Parties also referred to London Heathrow, stressing its importance for UK / US

transatlantic routes, its very high level of congestion and the large share of slots held

at that airport by British Airways. […].

(110) Furthermore, the Parties stress that the ability to attract premium passengers is

critical to an airline's ability to compete effectively on transatlantic routes and argue

that the Transaction would reinforce this ability by providing them with a more

extensive network and the opportunity to offer more frequencies.

(111) [The Parties' views on relevant factors to compete effectively and closeness of

competition]

(112) [The Parties' views on relevant factors to compete effectively and closeness of

competition]

91

(113) [The Parties' views on the American Airlines/US Airways merger]

6.1.3.2. Closeness of competition between the Parties – general considerations

(114) The Parties have provided data on the share of passengers originating in Europe and

North America among their respective passengers on the London-New York and

London-Boston routes, distinguishing between premium and non-premium

passengers

92

. [The Parties' views on closeness of competition]

93

.

(115) [The Parties' views on closeness of competition]

94

95

96

(116) [The Parties views on closeness of competition]

97

(117) These various elements, whether taken individually or together, do not lead to firm

conclusions as regards closeness of competition between the Parties. However, they

constitute useful initial indications, hinting in general at a limited degree of

substitutability between Delta and Virgin on the London-New York and London-

Boston routes. These indications will be complemented below by the outcome of the

market investigation on a route-by-route basis.

6.1.3.3. London-New York

(118) According to the Parties, the London-New York route is the most-travelled

international long-haul service in the world. In the Winter 2011 IATA season, a total

of [500,000-1 million] passengers (among whom [300,000-400,000] premium

passengers) travelled on that route on a point-to-point basis. In the Summer 2012

IATA season, [1.5 million - 2 million] passengers (among whom [500,000 - 1

million] premium passengers) travelled on that route. For each of these seasons and

91

Form CO, Annex 74.

92

Form CO, paragraphs 429 and 438.

93

[The Parties' views on closeness of competition]

94

Form CO, Exhibits D, F and G, Parties' separate responses to request for information Q7 of 16 May 2013.

95

Form CO, Exhibit D Delta Benchmarking Strategy

96

Parties' separate responses to request for information Q7 of 16 May 2013.

97

Form CO, Exhibit I, page 2.

20

within each category of passengers (premium and non-premium), [90-100]% of these

passengers travelled non-stop

98

.

(119) Delta offers both non-stop and one-stop services on the London-New York route

while Virgin only offers non-stop services. Since the Parties' activities do not overlap

in the one-stop segment and since one-stop passengers account for a very minor

proportion of all passengers for all the relevant combinations of airports and both for

premium and non-premium passengers, the inclusion of one-stop services in the

analysis would not lead to alter the conclusions of the competitive assessment for the

London-New York route.

(120) In the Winter 2012 and in the Summer 2013 IATA seasons, Delta offered three daily

non-stop services between London Heathrow and JFK. Over the same period, Virgin

offered four daily non-stop services between London Heathrow and JFK and two

daily non-stop services between London Heathrow and Newark.

(121) Over the same period, BA / AA offered a total of 11-12 daily non-stop services

between London Heathrow and JFK (depending on the season). Moreover, they

offered three daily non-stop services between London Heathrow and Newark. In

addition, British Airways offered a Business class only service between JFK and

London City with 1-2 daily frequencies (depending on the season). This service is

non-stop in the US – UK direction and one-stop in the opposite direction. Since none

of the Parties offers non-stop services between London City and New York,

disregarding British Airways' services between London City and New York is a

conservative approach, which will be followed in the the remainder of this analysis.

(122) In the Winter 2012 and Summer 2013 IATA Seasons, United offered five daily non-

stop services between London Heathrow and Newark.

(123) Finally, Kuwait Airways offered three non-stop weekly frequencies between London

Heathrow and JFK over the same period.

(124) In view of these characteristics, and since the market definition has been left open

with respect to the substitutability of JFK and Newark, it is appropriate to assess the

effects of the Transaction on the following possible markets for non-stop services on

the London-New York route: London Heathrow-JFK and London Heathrow –New

York (including JFK and Newark). Moreover, for each of these possible markets,

sub-segmentations must be considered with respect to the type of passengers

(premium and non-premium).

(125) The market position of the Parties and their competitors on these markets is as

follows:

98

For the various routes under assessment, the numbers of passengers stem from the Commission's market

reconstruction. They correspond to one-way travels, meaning that a passenger who flies roundtrip is counted twice

as much as a passenger who flies inbound (or outbound) only.

21

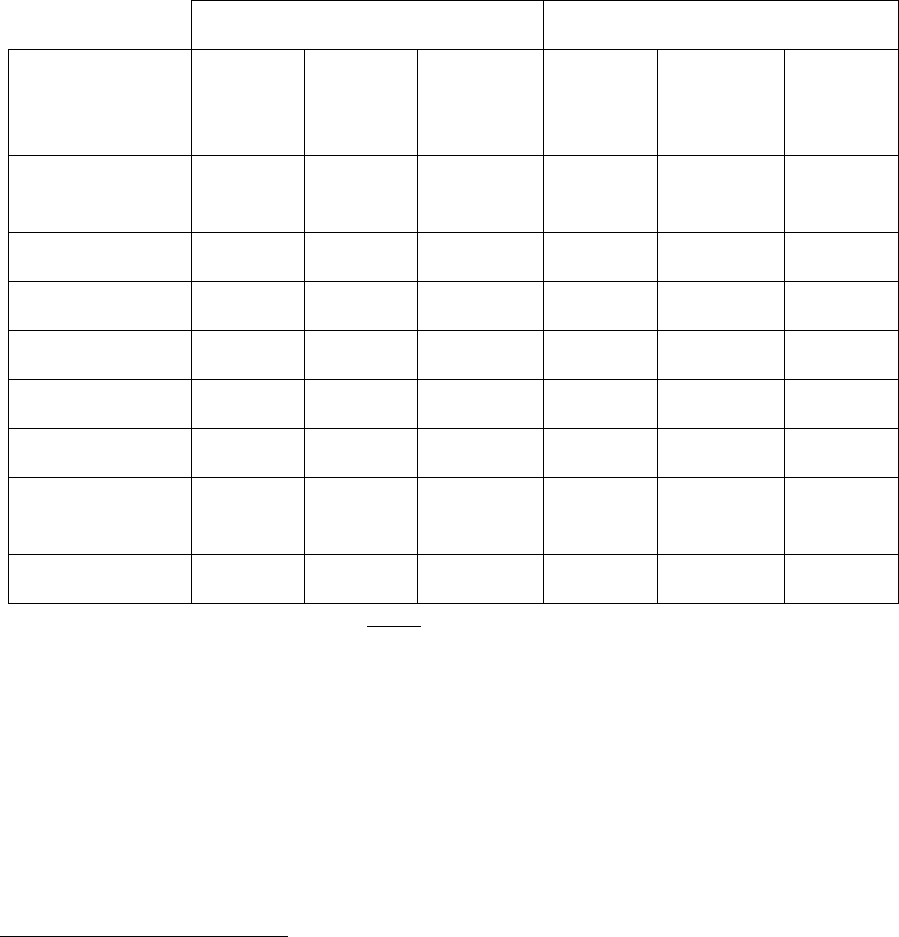

Table 2: Market shares on London-New York (non-stop services only)

London Heathrow- JFK

Carrier Winter 2011 Summer 2012

Premium Non-

premium

All

passengers

premium Non-

premium

All

passengers

Delta [5-10]% [20-30]% [10-20]% [5-10]% [10-20]% [10-20]%

Virgin [20-30]% [30-40]% [30-40]% [20-30]% [30-40]% [30-40]%

Delta +

Virgin

[30-40]% [50-60]% [40-50]% [30-40]% [50-60]% [40-50]%

BA / AA [60-70]% [40-50]% [50-60]% [60-70]% [40-50]% [50-60]%

Kuwait

Airways

[0-5]% [0-5]% [0-5]% [0-5]% [0-5]% [0-5]%

London Heathrow- New York (JKF + Newark)

Carrier Winter 2011 Summer 2012

Premium Non

premium

All

passengers

premium Non-

premium

All

passengers

Delta [0-5]% [10-20]% [10-20]% [5-10]% [10-20]% [10-20]%

Virgin [20-30]% [30-40]% [30-40]% [20-30]% [30-40]% [30-40]%

Delta +

Virgin

[30-40]% [50-60]% [40-50]% [30-40]% [50-60]% [40-50]%

BA / AA [50-60]% [30-40]% [40-50]% [50-60]% [30-40]% [40-50]%

United [5-10]% [10-20]% [10-20]% [5-10]% [10-20]% [10-20]%

Kuwait

Airways

[0-5]% [0-5]% [0-5]% [0-5]% [0-5]% [0-5]%

Source: Market reconstruction

22

(a) Parties' arguments

(126) In addition to the general arguments summarised in Section 6.1.3.1 above, the Parties

adduced route-specific justifications as to why the proposed Transaction does not

raise competition concerns. [Delta's plans regarding the London-New York route]

99

.

(127) Besides, the Parties argue that post-Transaction, the combined entity will be clearly

constrained by BA / AA and United. The Parties underline in particular the high

market shares of BA / AA, notably in the premium segment, and their significant

advantage in terms of number of frequencies, capacity and ability to increase both

capacity and frequencies due to British Airways' substantial slot portfolio at London

Heathrow. The Parties also claim that United and Kuwait Airways' non-stop services

as well as the various one-stop services offered on the route would constrain the

combined entity.

(b) Commission's assessment

(i) London Heathrow - JKF (non-stop services)

(128) BA / AA is likely to retain a very strong position in the premium segment post-

merger, with a market share currently higher than 60%. Moreover, BA / AA has a

significant frequency advantage with 11 daily frequencies in the Summer 2013 IATA

season, as opposed to seven for the combined entity. Premium passengers usually

attach value to high frequency services. In addition, in light of the general elements

mentioned in Section 6.1.3.2 and the outcome of the market investigation, the Parties

are rather distant competitors and BA / AA are closer to each of them than the other

Party. Indeed, a large majority of both travel agents and corporate customers took the

view that BA / AA was clearly a closer competitor to each Party than the other Party

with respect to premium passengers

100

. Respondents notably referred to reasons

relating to frequency and schedules, brand and frequent flyer programmes. Most

competitors took a similar view. This suggests that should the combined entity raise

prices, a large proportion of customers is likely to switch to BA / AA, which is the

closest competitor to each of the Parties.

(129) [Outcome of quantitative analysis]

(130) In view of the above and of the other available evidence, the proposed Transaction

does not raise serious doubts as to its compatibility with the internal market on the

market for air transport services for premium passengers on the London Heathrow-

JFK airport pair.

(131) On the non-premium segment, the Parties have higher combined market shares than

on the premium segment. However, BA / AA's will remain a strong competitor, with

market shares above 40%. Moreover, as regards closeness of competition between

the Parties on the non-premium segment, the same findings emerge from the market

investigation as on the premium segment: BA / AA is clearly a closer competitor to

99

Form CO, paragraph 540 and Confidential Annex 1.

100

See responses to questions 24 and 25 of Q3 – Travel Agents, responses to questions 27 and 28 of Q2 – Corporate

Customers, responses to questions 26 and 27 of Q1 – Competitors, Air Transport of Passengers.

23

each Party than the other Party

101

, which is also borne out by the elements mentioned

in Section 6.1.3.2. In particular, it should be noted that whilst Delta's brand appears

to be strong in the United States and less so in Europe and Virgin faces the opposite

situation, BA / AA benefits from the existence of strong brands both in the United

States and Europe. This is a further element suggesting that BA / AA is a closer

competitor to Virgin than Delta for passengers booking or originating in Europe and

a closer competitor to Delta than Virgin for passengers booking or originating in the

United States. It is also noted that there are potential one-stop alternatives on the

route. It is also noted that there are potential one-stop alternatives on the route: 15

daily one-stop services between London Heathrow and JFK are offered by various

carriers.

(132) In addition, as already pointed out with respect to premium passengers, BA / AA

have a significant frequency advantage over the combined entity. Even though such

advantage is not as crucial as for premium passengers, it is nevertheless an important

aspect also in the eyes of non-premium passengers which further contributes to

positioning BA / AA as a closer competitor to each Party than the other Party.

(133) Furthermore, while slot constraints at both London Heathrow and JFK constitute in

general high barriers to entry on the London Heathrow – JFK route, this does not

apply to British Airways and American Airlines. Indeed, within the IAG group,

British Airways and Iberia hold together more than 50% of all slots at London