Executive Summary 2Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin Comprehensive Housing Market Analysis as of June 1, 2019

Comprehensive Housing Market Analysis Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Executive Summary

Housing Market Area Description

Known as the “Twin Cities,” the Minneapolis-St. Paul-Bloomington,

MN-WI Housing Market Area (hereafter, the Minneapolis HMA)

is coterminous with the metropolitan statistical area of the same

name and includes 14 counties in Minnesota and 2 in Wisconsin.

The “twin cities” of Minneapolis and St. Paul are the largest cities

in the HMA and are the primary cities in Hennepin and Ramsey

Counties, respectively. For purposes of this analysis, the HMA is

divided into two submarkets: (1) the Central Counties submarket,

which includes Hennepin and Ramsey Counties, and (2) the

Suburban Counties submarket, which includes Anoka, Carver,

Chisago, Dakota, Isanti, Le Sueur, Mille Lacs, Scott, Sherburne,

Sibley, Washington, and Wright Counties in Minnesota, and Pierce

and St. Croix Counties in Wisconsin.

The current population of the HMA is estimated at 3.67 million.

Tools and Resources

Find interim updates for this metropolitan area, and select geographies nationally,

at PD&R’s Market-at-a-Glance tool.

Additional data for the HMA can be found in this report’s supplemental tables.

For information on HUD-supported activity in this area, see the Community Assessment Reporting Tool.

Executive Summary 3Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin Comprehensive Housing Market Analysis as of June 1, 2019

Comprehensive Housing Market Analysis Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Market Qualifiers

Notes: Total demand represents the estimated production necessary to achieve a balanced market at the end of the forecast period. Units are under

construction as of June 1, 2019. The forecast period is June 1, 2019, to June 1, 2022.

Source: Estimates by the analyst

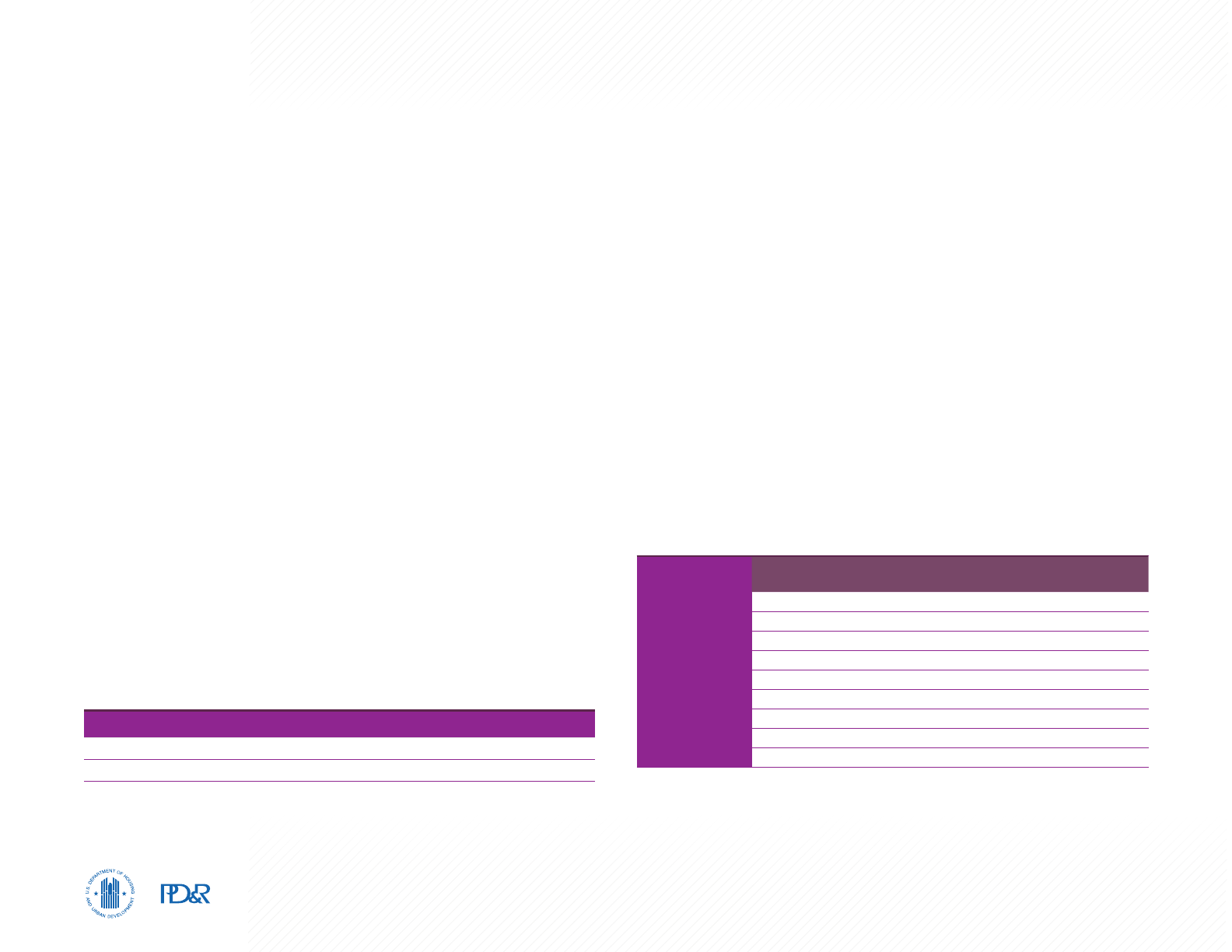

3-Year Housing Demand Forecast

Sales Units Rental Units

Central Counties Submarket

Total Demand 9,550 15,250

Under Construction 780 10,850

Suburban Counties Submarket

Total Demand 15,050 5,525

Under Construction 1,650 3,000

Minneapolis HMA

Total Demand 24,600 20,775

Under Construction 2,430 13,850

Nonfarm payrolls totaled 2.01 million during the

12 months ending May 2019, with growth of 9,300

jobs, or 0.5 percent, well below the 1.3-percent

growth rate, or 25,300 jobs, added during the

previous 12-month period. By contrast, from

2010 through 2017, payrolls grew by an average

of 34,500 jobs annually, an average annual

growth rate of 1.9 percent. The unemployment

rate averaged 2.8 percent during the 12 months

ending May 2019, down from 2.9 percent during

the previous 12-month period. During the 3-year

forecast period, nonfarm payroll growth is

expected to continue at an average annual

rate of 0.5 percent.

Sales housing market conditions in the Minneapolis

HMA are currently slightly tight, with an estimated

2.4-month supply of homes for sale. In the Central

Counties submarket, sales housing conditions

are slightly tight, and in the Suburban Counties

submarket, conditions are more balanced. During

the 12 months ending May 2019, 70,750 new

and existing homes were sold in the HMA, 950

sales above the 69,800 home sales recorded a

year earlier. At the same time, the average sales

price for all home sales was $298,300, nearly 5

percent higher than the average sales price a year

earlier. During the 3-year forecast period, demand

is estimated for 24,600 homes; the 2,430 homes

currently under construction will satisfy a portion

of that demand.

The overall rental housing market in the

Minneapolis HMA is slightly tight, with an estimated

vacancy rate of 4.7 percent, down from 7.6 percent

in April 2010. Similar conditions exist throughout

the HMA with current estimated vacancy rates of

5 percent or less in both submarkets. The apartment

market is tight, with a vacancy rate of 2.9 percent

as of the first quarter of 2019, up from 2.8 percent

a year earlier. The average apartment asking rent

was $1,305, nearly 5 percent above the average

asking rent a year earlier. During the 3-year forecast

period, demand is estimated for 20,775 new units;

the 13,850 units currently under construction will

satisfy a portion of that demand during the first

2 years of the forecast period.

Economy

Strong: Economic conditions remain

strong in the Minneapolis HMA,

although the rate of job growth

slowed considerably during the past year.

Rental Market

Slightly Tight: Despite record-high

levels of rental housing development

since 2010, rental housing market

Sales Market

Slightly Tight: Relatively low levels of

new single-family home construction

have not kept pace with demand since

TABLE OF CONTENTS

Economic Conditions 4

Population and Households 10

Home Sales Market Conditions 14

Rental Market Conditions 22

Terminology Definitions and Notes 29

the mid-2010s; particularly acute is the shortage

of houses for sale at entry-level price points.

conditions in the HMA have been slightly tight

as compared with balanced conditions during

2010, due to strong rental household growth.

Mining, Logging, & Construction 4%

Manufacturing 10%

Wholesale 5%

Retail 9%

Transportation & Utilities 4%

Information 2%

Financial Activities 7%

Professional & Business Services 16%

Health 15%

Education 2%

Leisure & Hospitality 9%

Other Services 4%

Federal 1%

State 3%

Local 8%

Government

12%

Education

& Health

Services

17%

Trade 14%

Total

2,010.1

Notes: Total nonfarm payroll is in thousands. Percentages may not add to 100 percent due to rounding. The

current date is June 1, 2019.

Source: U.S. Bureau of Labor Statistics

Figure 1. Current Nonfarm Payroll Jobs in the Minneapolis HMA, by Sector

Economic Conditions

4Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin Comprehensive Housing Market Analysis as of June 1, 2019

Comprehensive Housing Market Analysis Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Primary Local Economic Factors—

A Stable Base of Employers

The Minneapolis HMA is the largest metropolitan area in the state of Minnesota

and includes the state capital (in St. Paul). Because of these attributes, the

HMA relies on several industries and sectors that provide generally stable

employment, including (state) government, trade, and health care, which are

three of the four largest sectors or subsectors in the HMA (Figure 1). Included

in the government sector is the University of Minnesota, which is the third

largest employer in the HMA, with 26,450 direct jobs (Table 1). The University

of Minnesota, with five campuses statewide, including its largest campus in

Minneapolis, east of downtown and the Mississippi River, had an estimated

economic impact (statewide) of approximately $8.6 billion annually and

supported more than 77,000 jobs as of 2017 (University of Minnesota). State

government payrolls averaged 65,800 during the 12 months ending May 2019,

a gain of 500 jobs, or nearly 1 percent from a year earlier.

The wholesale and retail trade sector is currently the third largest employment

sector in the HMA. Opened in 1992, the Mall of America (MOA) is in suburban

Bloomington, Minnesota, south of Minneapolis in Hennepin County. The MOA

includes 5.6 million square feet of retail space and is the largest single retail and

entertainment destination in North America (Mall of America). The MOA includes

more than 520 retail stores, more than 60 dining options, an indoor theme park,

and a 1.3-million-gallon aquarium. The MOA generates more than $2 billion in

economic impact for the state of Minnesota annually and employs more than

Economic Conditions

Largest sector: Education and health services

During the 12 months ending May 2019, the rate of payroll job growth

in the Minneapolis HMA fell to the lowest annual rate since early 2011.

Table 1. Major Employers in the Minneapolis HMA

Name of Employer Nonfarm Payroll Sector Number of Employees

Allina Health System Education & Health Services 27,650

Target Corp. Wholesale & Retail Trade 26,700

University of Minnesota Government 26,450

HealthPartners Education & Health Services 22,500

Fairview Health Services

Education & Health Services 22,000

Wells Fargo & Co. Financial Activities 20,000

UnitedHealth Group Education & Health Services 15,750

CHS Inc. Manufacturing 12,150

U.S. Bancorp Financial Activities 12,000

Land O’Lakes, Inc. Manufacturing 10,000

Note: Excludes local school districts.

Source: Moody’s Analytics.

Economic Conditions 5Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin Comprehensive Housing Market Analysis as of June 1, 2019

Comprehensive Housing Market Analysis Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

11,000 workers year-round, increasing to 13,000 workers during peak seasons.

The MOA is located directly south of the Minneapolis International Airport and

is the southern terminus of the Metro Transit Blue Line light rail.

The education and health services sector is the largest nonfarm payroll sector

in the HMA and the only sector to have job growth every year since 2000.

Since 2000, jobs have increased an average of 3.1 percent annually, compared

with 0.6-percent average annual growth for total nonfarm payrolls. Steady

population growth in the HMA contributes to demand for jobs in this service-

providing sector, and major healthcare providers are 4 of the 10 largest

employers in the HMA.

The U.S. Bank Stadium contributes to jobs in the leisure and hospitality sector

by spurring tourism; recent examples include the National Collegiate Athletics

Association (NCAA) “Final Four” men’s basketball tournament playoffs in April

2019 and Super Bowl LII in February 2018. Super Bowl LII attracted 100,000

visitors to the HMA and included an economic impact estimated at $450 million.

Figures for the NCAA Final Four suggest more than 90,000 visitors and a $140

million economic impact. In addition, the stadium has spurred investments

estimated at $1.1 billion in the near-eastside area of downtown Minneapolis,

where the stadium is sited.

Current Conditions—Nonfarm Payrolls

Economic conditions in the Minneapolis HMA have been strong since 2010,

although the rate of job growth declined significantly during the past year.

During the 12 months ending May 2019, nonfarm payroll jobs increased

by 9,300, or 0.5 percent from a year earlier, to 2.01 million (Table 2). By

comparison, jobs grew 1.3 percent during the 12-month period ending May

2018. The primary reason for slowed job growth is a lack of qualified workers;

as of the fourth quarter of 2018, approximately 76,550 jobs were available,

more than 11 percent higher than available jobs a year earlier (Figure 2).

Significant job expansions have become less common in the HMA as

employers have been discouraged by a lack of qualified workers.

Table 2. 12-Month Average Nonfarm Payroll Jobs (1,000s)

in the Minneapolis HMA, by Sector

12 Months

Ending

May 2018

12 Months

Ending

May 2019

Absolute

Change

Percentage

Change

Total Nonfarm Payroll Jobs 2,000.7 2,010.1 9.3 0.5

Goods-Producing Sectors 277.7 282.5 4.8 1.7

Mining, Logging, & Construction 80.8 82.9 2.1 2.6

Manufacturing 196.8 199.6 2.8 1.4

Service-Providing Sectors 1,723.0 1,727.5 4.5 0.3

Wholesale & Retail Trade 284.9 286.7 1.7 0.6

Transportation & Utilities 75.3 75.4 0.1 0.1

Information 38.0 37.4 -0.6 -1.5

Financial Activities 148.5 150.2 1.7 1.2

Professional & Business Services 324.9 325.1 0.2 0.1

Education & Health Services 334.5 335.1 0.5 0.2

Leisure & Hospitality 188.9 190.0 1.1 0.6

Other Services 79.2 79.1 -0.1 -0.1

Government 248.9 248.6 -0.3 -0.1

Notes: Based on 12-month averages through May 2018 and May 2019. Numbers may not add to totals due to

rounding. Data are in thousands.

Source: U.S. Bureau of Labor Statistics

90,000

80,000

70,000

60,000

50,000

40,000

30,000

20,000

10,000

0

2Q 2008

4Q 2008

2Q 2009

4Q 2009

2Q 2010

4Q 2010

2Q 2011

4Q 2011

2Q 2012

4Q 2012

2Q 2013

4Q 2013

2Q 2014

4Q 2014

2Q 2015

4Q 2015

2Q 2016

4Q 2016

2Q 2017

4Q 2017

2Q 2018

4Q 2018

Available Jobs

Figure 2. Available Jobs in the Seven-County Twin Cities Region

2Q = second quarter. 4Q = fourth quarter.

Note: Data are for the seven-county Twin Cities region including Anoka, Carver, Dakota, Hennepin, Ramsey,

Scott, and Washington Counties.

Source: Minnesota Department of Employment and Economic Development, Job Vacancy Survey

Economic Conditions 6Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin Comprehensive Housing Market Analysis as of June 1, 2019

Comprehensive Housing Market Analysis Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Job growth in the goods-producing sectors significantly exceeded the service-

providing sectors during the most recent 12 months. The two fastest-growing

sectors were the mining, logging, and construction and the manufacturing

sectors, which increased 2.6 percent and 1.4 percent, with growth of 2,100

and 2,800 jobs, respectively. The mining, logging, and construction sector has

grown 4.9 percent annually, on average, since 2011, nearly three times as fast as

total nonfarm payrolls in the HMA (Figure 3). Modest increases in sales housing

construction since 2011 and significant increases in multifamily construction

have contributed to job growth in this sector. During 2018, residential building

permits for single-family and multifamily residences were at the highest levels

since 2006, contributing to increased jobs in the construction subsector. Growth

in the manufacturing sector included an expansion by Winnebago Industries,

which added approximately 75 manufacturing jobs at its Eden Prairie (Hennepin

County) site in late 2018. Minnetronix Medical Incorporated, a medical equipment

manufacturer located in St. Paul, added approximately 100 jobs during 2018

and expects to increase employment by 30 to 40 jobs annually during the

next 3 years. The Minneapolis HMA includes more than 40 medical device

manufacturers with more than 100 employees each (Minnesota Department of

Employment and Economic Development). Service-sector job growth was led by

the financial activities and the wholesale and retail trade sectors, which added

1,700 jobs each, or gains of 1.2 and 0.6 percent, respectively. The number of jobs

in the leisure and hospitality sector increased by 1,100, or 0.6 percent. Declining

sectors during the past year include the information sector, the government

sector, and the other services sector, which recorded job losses of 600, 300,

and 100 jobs each, or 1.5 percent, 0.1 percent, and 0.1 percent, respectively.

Current Conditions—Unemployment

During the 12 months ending May 2019, the unemployment rate in the

Minneapolis HMA averaged 2.8 percent, down from 2.9 percent a year earlier,

and well below the 3.8-percent national rate (Figure 4). The unemployment

rate in the Minneapolis HMA peaked at 7.8 percent during the summer of 2010,

shortly after the end of the Great Recession, but has declined in all but 1 year

since. The rate has been below 5.0 percent since 2013 and is currently only

slightly higher than the recent low of 2.7 percent in 2000.

-10 -5 0 5 10 15 20 25 30 35 40 45 50 55

Change in Jobs (%)

Total Nonfarm Payroll Jobs

Goods-Producing Sectors

Mining, Logging, & Construction

Manufacturing

Service-Providing Sectors

Wholesale & Retail Trade

Transportation & Utilities

Information

Financial Activities

Professional & Business Services

Education & Health Services

Leisure & Hospitality

Other Services

Government

Figure 3. Sector Growth in the Minneapolis HMA,

2011 to Current

Note: The current date is June 1, 2019.

Source: U.S. Bureau of Labor Statistics

10.0

9.0

8.0

7.0

6.0

5.0

4.0

3.0

2.0

1.0

0.0

NationMinneapolis HMA

May-00

May-01

May-02

May-03

May-04

May-05

May-06

May-07

May-08

May-09

May-10

May-11

May-12

May-13

May-14

May-15

May-16

May-17

May-18

May-19

Unemployment Rate

(%)

9.7

7.8

Figure 4. 12-Month Average Unemployment Rate

in the Minneapolis HMA and the Nation

Note: 12-month moving average.

Source: U.S. Bureau of Labor Statistics

Economic Conditions 7Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin Comprehensive Housing Market Analysis as of June 1, 2019

Comprehensive Housing Market Analysis Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Historic Trends

2003 Through 2006

From 2003 through 2006, job growth averaged 1.0 percent, or 17,300 jobs

added annually. By comparison, national nonfarm payroll jobs grew an average

of 1.1 percent annually. Growth averaging 18,900 jobs annually in the service-

providing sectors offset an average decline of 1,700 jobs annually in the goods-

producing sectors because manufacturing jobs fell by 1,900, or 0.9 percent,

annually. Manufacturing sector layoffs were widespread in the HMA, and

impacted jobs in food, machinery, and medical equipment manufacturing. In the

service-providing sectors, the education and health services sector added an

average of 9,200 jobs annually, with growth averaging more than 4.0 percent.

The professional and business services sector added 5,200 jobs, or 1.9-percent

average annual growth, and the leisure and hospitality sector added 3,300 jobs

annually, or 2.1 percent. Figure 5 shows the 12-month average nonfarm payroll

count in the Minneapolis HMA from 2000 to the current date.

2007 Through 2010

This period encompassed the onset of the Great Recession, during which time

the national economy contracted and impacted economic conditions in the

Minneapolis HMA. Nonfarm payrolls in the HMA fell by an average of 22,300

annually or 1.2 percent; by contrast, nationally, payroll jobs declined an average of

1.1 percent. All sectors except the education and health services sector in the HMA

declined during this period with the most significant losses in the goods-producing

and trade sectors; these sectors declined by annual averages of 15,600 and

6,800 jobs, or 5.8 and 2.5 percent, respectively, during the period. In the goods-

producing sectors, the losses were nearly evenly split, averaging 7,700 annually

in the mining, logging, and construction sector, and averaging 7,900 annually

in the manufacturing sector, declines averaging 10.5 and 4.0 percent annually,

respectively. Residential building permitting had begun to fall sharply during 2005

and remained low during the period from 2007 through 2010. In the manufacturing

sector, job dislocations were varied and numerous during this period; during

2008, Graco closed a plant in Minneapolis that manufactured industrial valves,

eliminating 280 jobs. ADC, a manufacturer of telephone apparatuses, closed

plants in Eden Prairie (Hennepin County, Minnesota) and Shakopee (Scott County,

Minnesota), eliminating 200 total jobs. Food manufacturing jobs, medical device

manufacturing jobs, and others also declined. The education and health services

sector grew an average

of 7,900 jobs, or 3.1 percent, only slightly slower than

growth during the previous period.

2011 Through 2017

Nonfarm payrolls began to increase in the HMA in February 2011. Nonfarm

payrolls rose an average of 34,500 annually from 2011 through 2017, averaging

1.9 percent. Goods-producing jobs grew at a 2.5-percent annual rate, faster

than the 1.8-percent rate of growth for service-providing jobs; however,

service sector jobs increased an average of 28,100 annually, or 1.8 percent,

compared with 6,400 jobs added, or 2.5 percent, on average, in the goods-

producing sector. In the goods-producing sector, jobs in the mining, logging,

2,100

2,000

1,900

1,800

1,700

1,600

National Recession Nonfarm Payrolls

Nonfarm Payrolls (in Thousands)

May-00

May-01

May-02

May-03

May-04

May-05

May-06

May-07

May-08

May-09

May-10

May-11

May-12

May-13

May-14

May-15

May-16

May-17

May-18

May-19

Note: 12-month moving average.

Sources: U.S. Bureau of Labor Statistics; National Bureau of Economic Research

Figure 5. 12-Month Average Nonfarm Payrolls in the Minneapolis HMA

Economic Conditions 8Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin Comprehensive Housing Market Analysis as of June 1, 2019

Comprehensive Housing Market Analysis Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

and construction sector expanded by 3,600 annually, or 5.5 percent, primarily

in the construction subsector; net in-migration into the HMA rose strongly and

residential construction increased to meet the housing needs of new residents.

The construction of U.S. Bank Stadium, which opened in 2016, southeast of

downtown Minneapolis and adjacent to the combined portion of the Blue and

Green Metro Transit train lines, created an estimated 8,000 construction jobs

during its 2.5-year construction period.

The education and health services sector and the professional and business

services sector led gains in the service-providing sector. The two sectors

grew by averages of 8,300 and 7,000 jobs annually, or 2.8 and 2.4 percent,

respectively. Numerous expansions at hospitals and healthcare providers in

the HMA occurred, including Fairview Health Services in Princeton (Sherburne

County, Minnesota), and Fairview Southdale Hospital in Edina (Hennepin County,

Minnesota), as well as Allina Health System’s new “Mother-Baby Center” in St.

Paul. Additional growth occurred in the leisure and hospitality and the wholesale

and retail trade sectors, which grew by 4,300 jobs and 3,600 jobs annually,

average growth rates of 2.5 and 1.3 percent, respectively. The government

sector added an average of 600 jobs, or 0.2 percent, annually with job growth

for local governments averaging 1,300 jobs annually, more than offsetting

declines in federal and state government jobs. The information sector was the

only sector to lose jobs from 2011 through 2017, falling an average of 300 jobs

annually, or 0.8 percent.

Commuting Patterns

The Central Counties submarket is the employment center in the HMA, accounting

for approximately 66 percent of all jobs in the HMA during 2018 (Table 3). That

figure is down slightly, from 68 percent during 2010 and 70 percent during 2001

as employers have become increasingly likely to relocate to less expensive parts

of the HMA. Approximately 87 percent of workers who live in the Central Counties

submarket work in either Hennepin or Ramsey County, 11 percent commute to

Employment Forecast

During the 3-year forecast period, nonfarm payrolls are expected to increase

at an average annual rate of 0.5 percent, with growth likely hindered by a lack

of qualified workers to fill jobs. Construction sector jobs will continue to grow

because of continued demand for housing going forward. Manufacturing sector

jobs are likely to remain stable despite TreeHouse Foods’ announcement in May

the Suburban Counties submarket, and 2 percent commute to areas outside the

16-county HMA. By comparison, 41 percent of workers who live in the Suburban

Counties submarket commute into the Central Counties submarket for work,

whereas 55 percent work in the Suburban Counties submarket, and 4 percent

commute to jobs outside of the HMA (U.S. Census Bureau, estimates as of July 1,

2015; Table 4). Anoka and Dakota Counties, which are directly to the north and

the south of the Central Counties submarket, respectively, combine to account for

approximately 48 percent of the jobs in the Suburban Counties submarket.

Central Counties Suburban Counties

66 34

Table 3. Estimated Percent Share of Covered Employment

by Submarket During 2018

Source: U.S. Bureau of Labor Statistics, with estimates by the analyst

Worker Residence

Central Counties

(%)

Suburban Counties

(%)

Location

of Primary

Job

Central Counties 87 41

Suburban Counties 11 55

Outside the HMA 2 4

Table 4. Jobs by Place of Worker Residence

Source: U.S. Census Bureau, 2015 Journey to Work

Economic Conditions 9Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin Comprehensive Housing Market Analysis as of June 1, 2019

Comprehensive Housing Market Analysis Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

2019 to close a plant in Minneapolis that manufactures snacks, thus eliminating

120 jobs. Job growth is expected to continue in the education and health services

sector, but at lower rates than recently. Jobs are expected to be added at the

University of Minnesota Health Center and Regions Hospital in St. Paul, which are

both undertaking expansions, although Blue Cross and Blue Shield of Minnesota

recently announced the elimination of approximately 60 jobs at its location

in Eagan (Dakota County). Some expansions are expected in the professional

and business services sector. Technology-consulting firm Wipro announced the

development of a new technology hub in Minneapolis that is expected to create

100 jobs by 2021. New York-based financial-technology startup company DailyPay,

Inc., selected Minneapolis as its second location, and plans to hire 100 workers by

2020. Offsetting these growth announcements, Thrivent Financial announced the

closure of its Brightpeak Financial division and is expected to eliminate 60 jobs in

Minneapolis. The continued decline in the number of unemployed residents is of

some concern as a shortage of available labor, for both skilled and unskilled jobs,

may dampen future economic growth.

Population and Households 10Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin Comprehensive Housing Market Analysis as of June 1, 2019

Comprehensive Housing Market Analysis Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Current population: 3.67 million

Population and Households

The rate of population growth in the Minneapolis HMA has been

consistent since 2000; however, the allocation of population growth

between the two submarkets has shifted significantly since 2010.

Population Trends

As of June 1, 2019, the population of the Minneapolis HMA was estimated at more

than 3.67 million. Population growth has averaged 1.0 percent annually since April

1, 2010, unchanged from the rate during the period from April 1, 2000, to April

1, 2010 (Table 5). Net in-migration has increased significantly as a share of total

population growth since 2010, while population growth has accelerated in the

Central Counties submarket and slowed in the Suburban Counties submarket.

2000 to 2010

From 2000 to 2006, the population in the HMA grew an average of 32,400

annually, or 1.0 percent, and net in-migration contributed 17 percent of this growth,

or 5,600 people, on average, each year. The remaining population growth, totaling

26,800 people on average each year, came from net natural change. From 2006 to

2010, encompassing declining economic conditions in the HMA resulting from the

Population

Quick Facts

2010 Current Forecast

Population

3,348,859 3,674,000 3,772,000

Average Annual Change

31,700 35,450 32,650

Percentage Change

1.0 1.0 0.9

Household

Quick Facts

2010 Current Forecast

Households

1,299,635 1,427,000 1,465,000

Average Annual Change

13,900 13,950 12,500

Percentage Change

1.1 1.0 0.9

Notes: Average annual changes and percentage changes are based on averages from 2000 to 2010, 2010 to

current, and current to forecast. The forecast period is from the current date (June 1, 2019), to June 1, 2022.

Sources: 2000 and 2010—2000 Census and 2010 Census; current and forecast—estimates by the analyst

Table 5. Minneapolis HMA Population and Household Quick Facts

Great Recession, population growth fell slightly, to an average of 30,550 annually,

or 0.9 percent, and net in-migration fell to an average of 2,750 people annually,

or only 9 percent of the increase in population.

2010 to Current

Starting in 2010, when the HMA began an ongoing, 9-year period of job growth,

net in-migration increased strongly, averaging 9,950 people annually from 2010

to 2014, and increasing to 14,350 people annually from 2014 to the current

date. Despite the increase in net in-migration, the rate of population growth has

remained stable, at 1 percent annually because net natural change has declined.

From 2010 to 2014, net in-migration contributed nearly 30 percent of total

population growth in the HMA—a rate that has risen to nearly 40 percent since

2014. Figure 6 shows components of population growth in the HMA since 2000.

Notably, from 2010 to 2018, net in-migration was primarily international migration,

which accounted for more than 90 percent of migrants into the Minneapolis HMA

45,000

40,000

35,000

30,000

25,000

20,000

15,000

10,000

5,000

0

-5,000

2000-2001

2001-2002

2002-2003

2003-2004

2004-2005

2005-2006

2006-2007

2007-2008

2008-2009

2009-2010

2010-2011

2011-2012

2012-2013

2013-2014

2014-2015

2015-2016

2016-2017

2017-2018

2018-Current

Current-Forecast

Net MigrationNet Natural Change

Population Growth

Figure 6. Components of Population Change in the Minneapolis HMA,

2000 Through the Forecast

Notes: Net natural change and net migration totals are average annual totals over the time period. The

forecast period is from the current date (June 1, 2019), to June 1, 2022.

Sources: U.S. Census Bureau; current to forecast—estimates by the analyst

Population and Households 11Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin Comprehensive Housing Market Analysis as of June 1, 2019

Comprehensive Housing Market Analysis Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

(U.S. Census Bureau, Population Estimates Program). Although immigrants from

Mexico are the largest contributor to the foreign-born population in the HMA,

immigrants from Asia including the Hmong and immigrants from Africa, notably

from Somalia and Ethiopia, are significantly represented in the HMA as well.

Age Cohort Trends

Local officials indicate a decline in the share of the population in the prime

working age, defined as persons age 18 through 64, is contributing to lower

economic growth in the HMA. The data supports this; Figure 7 shows the

proportion of the population in various age cohorts, estimated in 2010, 2014,

and 2017. The fastest growth is estimated to have occurred in the over age-

65 cohort; the population age 18 through 39 has declined modestly, and the

population age 40 through 64 has declined slightly faster. Combined, the prime

working age population in the HMA has declined from 64 percent to 62 percent

of the total population between 2010 and 2017.

Central Counties Submarket

The population of the Central Counties submarket is currently estimated at 1.84

million, or 50 percent of the population in the HMA (Figure 8). The population of

the submarket has risen an average of 19,300 annually since 2010, a growth rate

averaging 1.1 percent; this rise represents a sharp increase from the previous

decade, when the population increased an average of only 3,375 annually, or

0.2 percent. Average annual net natural change in the submarket has declined

since 2010, and net in-migration has accounted for all the increased population

growth. Since 2010, net in-migration to the submarket has averaged 7,350

people annually. By comparison, from 2000 to 2010, net out-migration from the

submarket averaged 9,125 people annually. Recent economic growth has had a

significant impact in the Central Counties submarket, and numerous development

initiatives focused in the downtowns of Minneapolis and St. Paul have made

the submarket more attractive to residents. In 2014, Metro Transit, the public

transportation system in the HMA, opened the Green Line, which runs parallel

35

30

25

20

15

10

5

0

2014 20172010

Under 18 18-39 Years 40-64 Years 65 Years and Over

Population

(%)

Source: 2010, 2014, and 2017 American Community Survey, 1-year data

Figure 7. Population by Age in the Minneapolis HMA

Suburban CountiesCentral Counties

50% 50%

Note: The current date is June 1, 2019.

Source: Estimates by the analyst

Figure 8. Current Population by Submarket

Population and Households 12Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin Comprehensive Housing Market Analysis as of June 1, 2019

Comprehensive Housing Market Analysis Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

to Interstate 94 and University Avenue for much of its length and connects

downtown Minneapolis to downtown St. Paul. Between 2010 and 2017, the

population of the census tracts adjacent to the Green Line and the Blue Line,

which opened in 2004 and connects downtown Minneapolis to the Minneapolis

International Airport and the MOA, increased at an average annual rate of

2.3 percent, more than twice as fast as the HMA’s growth rate of 1.0 percent

(American Community Survey, 5-year data; Map 2).

Suburban Counties Submarket

The population of the Suburban Counties submarket is also currently estimated

at 1.84 million. Unlike in the Central Counties submarket, where the rate of

population growth has increased compared with the previous decade, the rate

of population growth has declined since 2010, although this decline has slowed

since 2015. Population growth in the submarket averaged 28,300 annually, or

1.9 percent from 2000 to 2010; since 2010, the average rate of growth declined

to 0.9 percent annually, or an average of only 16,200 people. From 2000 to 2006,

net in-migration to the submarket averaged 19,550 people annually, contributing

to average population growth of 34,100 people annually, or 2.3 percent. From

2006 through 2011, including the period of economic decline and the start of

the recovery in the HMA, net in-migration into the submarket fell dramatically,

averaging 2,900 people annually, and the rate of population growth more than

halved, falling to 1.0 percent, or growth averaging 17,100 people annually. As

economic conditions continued to improve, net in-migration into the Suburban

Counties submarket fell to an average of 2,850 people annually from 2011 to

2015, and population growth slowed to an average of only 0.8 percent annually,

or 14,300 people. Population growth has accelerated to an average of 1.1 percent

since 2015, however, as housing costs have risen in the areas closer to the

economic core of the HMA. Net in-migration to the submarket has increased

to an average of 8,750 people annually, since 2015.

Household Trends

The Minneapolis HMA contains an estimated 1.43 million households, with

slightly more than 52 percent residing in the Central Counties submarket, where

the average household size is relatively small; approximately 48 percent in the

Suburban Counties submarket, where families represent a larger share of the

Map 2. Average Annual Population Change by Census Tract

in the Minneapolis HMA, 2012–2017

Source: 2012–2017 American Community Survey, 5-year data

Population and Households 13Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin Comprehensive Housing Market Analysis as of June 1, 2019

Comprehensive Housing Market Analysis Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

total population. By tenure, an estimated 69.5 percent of households in the

HMA are homeowners, down from 71.6 percent in 2010 (Figure 9). The decline

in homeownership is largely a result of the housing crisis in the late 2000s,

with both new and existing households more likely to rent since 2010 than in

the previous decade. Since 2010, household growth has averaged 1.0 percent

annually in the HMA, or 13,950 new households annually, relatively unchanged

from 1.1 percent annual growth, or 13,900 households annually during the previous

decade. Since 2010, renter households in the HMA have increased 1.8 percent

annually, on average, compared with owner household growth averaging 0.7

percent annually. During the previous decade, renter households rose an average

of 1.5 percent annually, and owner households grew an average of 1.0 percent

annually. By submarket, households have increased an average of 1.0 percent

in each submarket since 2010, equal to 7,225 households added, on average,

in the Central Counties submarket, and 6,700 households added annually in the

Suburban Counties submarket.

RenterOwner

Current20102000

Homeownership Rate

72.6

Households

Homeownership Rate

(%)

73.0

72.5

72.0

71.5

71.0

70.5

70.0

69.5

69.0

1,600,000

1,400,000

1,200,000

1,000,000

800,000

600,000

400,000

200,000

0

71.6

69.5

Sources: 2000 and 2010–2000 Census and 2010 Census; current—estimates by the analyst

Figure 9. Households by Tenure and Homeownership Rate

in the Minneapolis HMA

Suburban CountiesCentral Counties

48% 52%

Note: The forecast period is from June 1, 2019, to June 1, 2022.

Source: Estimates by the analyst

Figure 10. Share of Forecast Population Growth by Submarket

Forecast

The anticipated slowdown in economic growth during the 3-year forecast period

is expected to result in slowed population growth. The population of the HMA is

expected to reach 3.77 million by June 1, 2022, growth of 0.9 percent, or 32,650

annually. By submarket, population growth rates are expected to average 0.9

percent annually in the Central Counties submarket and 0.8 percent annually

in the Suburban Counties submarket. Approximately 52 percent of the forecast

population growth is expected to occur in the Central Counties submarket

(Figure 10). Households are expected to expand by an average of 0.9 percent

annually in each submarket and the HMA, with annual increases of 6,650 in the

Central Counties submarket and 5,850 in the Suburban Counties submarket,

totaling 12,500 households added annually in the HMA.

Home Sales Market Conditions 14Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin Comprehensive Housing Market Analysis as of June 1, 2019

Comprehensive Housing Market Analysis Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Current Conditions

The home sales market in the Minneapolis HMA is currently slightly tight, with an

estimated 0.9-percent vacancy rate, down from 1.9 percent in April 2010, when

conditions were slightly soft (Table 6). During May 2019, there was a 2.5-months’

supply of single-family detached homes for sale and a 2.1-months’ supply of

condominium units for sale; a year earlier, the corresponding figures were

supplies of 2.4 months and 2.1 months (Minneapolis Area Realtors

®

[MAR]).

MAR further reports that home sales are hampered by a lack of supply,

particularly acute at the lower price levels. Current prices for both new and

existing home sales are at all-time highs, which would typically incentivize

Market Conditions: Slightly Tight

Sales housing market conditions in the HMA have tightened since

2010 because of stronger population growth and a shortage of

available inventory for sale.

Home Sales

Quick Facts

Minneapolis HMA Nation

Vacancy Rate 0.9% NA

Months of Inventory 2.4 3.3

Total Home Sales 70,750 6,003,000

1-Year Change 1.3% -1.8%

New Home Sales Price $433,500 $410,400

1-Year Change 2% 0%

Existing Home Sales Price $284,700 $310,200

1-Year Change 5% 2%

Mortgage Delinquency Rate 0.7% 1.4%

NA = data not available.

Notes: Vacancy rate is as of the current date, June 1, 2019. Home sales and prices are for the 12 months

ending May 2019. Months of inventory and mortgage delinquency data are as of May 2019.

Sources: Home sales and prices—Metrostudy, A Hanley Wood Company; delinquency rate—CoreLogic, Inc.

Table 6. Home Sales Quick Facts in the Minneapolis HMA

potential sellers to list their home, although many homeowners are concerned

they will not find another home to buy. Rising costs for land, materials, and labor

are identified as hindrances to increasing new home production in the HMA.

Home Sales

Home sales, including new and existing single-family homes, townhomes,

and condominiums, totaled 70,750 during the 12 months ending May 2019, an

increase of 930 sales or 1.3 percent above the sales total from a year earlier

(Metrostudy, A Hanley Wood Company). Figure 11 shows home sales by type in

the HMA. The increase in sales occurred despite a significant decline in real

estate owned (REO) sales, which fell by 1,075 sales, or more than 31 percent. Both

new home sales and regular (non-distressed) resales rose during the past year,

increasing 9 percent and 2 percent, to 6,300 and 62,100 sales, respectively.

90,000

80,000

70,000

60,000

50,000

40,000

30,000

20,000

10,000

0

May-06

May-07

May-08

May-09

May-10

May-11

May-12

May-13

May-14

May-15

May-16

May-17

May-18

May-19

Sales Totals

New Sales REO Sales

Regular Resale Sales

REO = real estate owned.

Source: CoreLogic, Inc., with adjustments by the analyst

Figure 11. 12-Month Sales Totals by Type in the Minneapolis HMA

Home Sale Prices

The average home sales price in the Minneapolis HMA during the 12 months

ending May 2019 was $298,300, approximately $14,050, or 5 percent, higher

than the average sales price a year earlier, and more than 9 percent above the

Home Sales Market Conditions

Sales Market—Minneapolis HMA

Home Sales Market Conditions 15Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin Comprehensive Housing Market Analysis as of June 1, 2019

Comprehensive Housing Market Analysis Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

prerecession high of $273,400 in 2006. By sales type, the average price of new

home sales was $433,500, and for regular resale homes, the average sales price

was $286,700, gains of 2 percent and 4 percent from a year earlier, respectively.

Both sales prices represent record highs for the HMA. Figure 12 shows average

home sales prices, by type of sale, in the Minneapolis HMA.

500,000

450,000

400,000

350,000

300,000

250,000

200,000

150,000

100,000

New Sales Regular Resale Sales REO Sales

Average Sales Price

($)

May-06

May-07

May-08

May-09

May-10

May-11

May-12

May-13

May-14

May-15

May-16

May-17

May-18

May-19

REO = real estate owned.

Source: CoreLogic, Inc., with adjustments by the analyst

Figure 12. 12-Month Average Sales Price by Type of Sale in the Minneapolis HMA

REO Sales and Delinquent Mortgages

During the 12 months ending May 2019, REO sales totaled 2,375, nearly one-

third fewer than the 3,450 REO sales a year earlier, and a fraction of the peak

of 19,350 in 2009 (CoreLogic, Inc., with adjustments by the analyst). As a

proportion of all resale sales, REO sales contributed 4 percent during the current

12-month period, down from 5 percent a year ago and well below the 41-percent

figure in 2009. As of May 2019, approximately 0.7 percent of all mortgages in

the HMA were seriously delinquent or transitioned into REO status, down from

0.9 percent a year earlier and well below the high of 6.3 percent in January

2010. (CoreLogic, Inc.). The current rate in the HMA is slightly lower than the

0.8-percent rate for the state of Minnesota and nearly one-half the national

rate of 1.4 percent.

Housing Affordability

Homeownership in the Minneapolis HMA is moderately affordable, although

affordability has generally trended downward since early 2013. Excess inventory,

present in the HMA during 2010 and 2011, has been mostly absorbed and

low levels of inventory have put upward pressure on purchase prices since

the mid-2010s. The National Association of Home Builders (NAHB) and Wells

Fargo Housing Opportunity Index (HOI) for the HMA, which represents the

share of homes sold that would have been affordable to a family earning the

local median income, was 78.6 during the first quarter of 2019, down slightly

from 78.9 percent a year earlier (Figure 13). During the most recent quarter,

84 metropolitan areas out of 239 metropolitan areas measured, or 35 percent

of the metropolitan areas in the nation, had greater housing affordability than

the HMA. From 2009 through 2012, the HOI for the Minneapolis HMA was

comparatively high, averaging 85.0 during the period, although affordability

has since declined with home sales prices rising faster than incomes despite

increased production of single-family homes, townhomes, and condominiums.

90

85

80

75

70

65

60

1Q 2008

1Q 2009

1Q 2010

1Q 2011

1Q 2012

1Q 2013

1Q 2014

1Q 2015

1Q 2016

1Q 2017

1Q 2018

1Q 2019

NAHB Opportunity Index

1Q = first quarter. NAHB = National Association of Home Builders.

Source: NAHB/Wells Fargo

Figure 13. Minneapolis HMA Housing Opportunity Index

Sales Market—Central Counties Submarket 16Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin Comprehensive Housing Market Analysis as of June 1, 2019

Comprehensive Housing Market Analysis Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

In December 2018, the city of Minneapolis adopted “Minneapolis 2040,” its most

recent comprehensive plan for housing and development. It includes 14 goals

and 100 policy proscriptions and was developed from a recognition that long-

term projections suggest the HMA will need to add approximately 14,000 new

housing units annually to keep up with expected population growth and housing

demand. The plan includes a proposal to eliminate single-family zoning entirely

in the city of Minneapolis, allowing duplex and triplex units to be built throughout

the city, as well as a proposal to allow three- to six-story buildings along certain

transit corridors. Both are designed to encourage additional sales housing

development, particularly of higher density projects. As of June 1, 2019, the plan

has been approved by the Minneapolis City Council, but has not been approved

by the Metropolitan Council, the local regional planning office that recently offered

amendments to the document.

Construction Activity

Construction of single-family homes and condominiums in the Minneapolis HMA,

as measured by units permitted, has increased modestly since recent low levels,

but remains low compared with levels of construction during the previous decade.

During the 12 months ending May 2019, approximately 8,825 single-family homes

and condominiums were permitted in the HMA, slightly above the 8,800 units

permitted a year earlier. During 2003 and 2004, the number of sales housing

units permitted averaged 26,150 annually, and fell sharply, declining 35 percent

annually, to 4,625 units permitted during 2008. From 2008 through 2011, the

number of sales housing units permitted remained low, averaging 4,325 annually,

before increasing modestly, averaging gains of 13 percent annually, to 9,250

homes permitted during 2017. Figure 14 shows sales housing permitting activity

in the Minneapolis HMA.

30,000

25,000

20,000

15,000

10,000

5,000

0

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

CondominiumsSingle-Family Homes/Townhomes

Notes: Includes single-family homes, townhomes, and condominiums. 2019 includes data through May 2019.

Sources: U.S. Census Bureau, Building Permits Survey; 2000 through 2017—final data and estimates by the

analyst; 2018 and 2019—preliminary data and estimates by the analyst

Figure 14. Average Annual Sales Housing Permitting Activity

in the Minneapolis HMA

Forecast

During the 3-year forecast period, demand is estimated for 24,600 new single-

family homes, townhomes, and condominiums in the HMA (Table 7). The 2,430

homes currently under construction will satisfy some of this demand. Demand is

expected to be strongest during the first year because of existing, unmet demand,

which is likely to carry over into the second and third year of the forecast period.

Table 7. Demand for New Sales Units in the Minneapolis HMA

During the Forecast Period

Sales Units

Demand 24,600 Units

Under Construction 2,430 Units

Note: The forecast period is June 1, 2019, to June 1, 2022.

Source: Estimates by the analyst

Current Conditions

The sales housing market in the Central Counties submarket is slightly tight, with

an estimated sales vacancy rate of 0.8 percent, down from 2.1 percent in April

2010 (Table 8). The current homeownership rate in the submarket is estimated

at 60.7 percent, down from 63.3 percent in 2010 because of strong renter

household growth. The foreclosure crisis shifted some owners into rental housing

Sales Market—Central Counties

Submarket

Sales Market—Central Counties Submarket 17Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin Comprehensive Housing Market Analysis as of June 1, 2019

Comprehensive Housing Market Analysis Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Home Sales

New home sales in the Central Counties Submarket totaled 1,625 sales during the

12 months ending May 2019, nearly 9 percent more than the 1,475 sales reported

a year earlier (Metrostudy, A Hanley Wood Company). New home sales fell by

an average of 25 percent annually from 2006 through 2011, when a recent low

level of 910 new sales occurred. Since 2011, new home sales have increased

modestly, with growth averaging 7 percent annually, to 1,400 sales during 2017

although new home sales activity remains well below the peak levels of the mid-

2000s. Regular (non-distressed) resale home sales have, by contrast, recovered

Home Sales

Quick Facts

Central Counties

Submarket

Minneapolis

HMA

Vacancy Rate 0.8% 0.9%

Months of Inventory 2.1 2.4

Total Home Sales 31,700 70,750

1-Year Change 0.3% 1.3%

New Home Sales Price $511,200 $433,500

1-Year Change -1% 2%

Existing Home Sales Price $308,000 $284,700

1-Year Change 4% 5%

Mortgage Delinquency Rate 0.7% 0.7%

Notes: Vacancy rate is as of the current date, June 1, 2019. Home sales and prices are for the 12 months

ending May 2019. Months of inventory and mortgage delinquency data are as of May 2019.

Sources: Home sales and prices—Metrostudy, A Hanley Wood Company; delinquency rate—CoreLogic, Inc.

Table 8. Home Sales Quick Facts in the Central Counties Submarket

35,000

30,000

25,000

20,000

15,000

10,000

5,000

0

Sales Totals

New Sales REO Sales

Regular Resale Sales

May-06

May-07

May-08

May-09

May-10

May-11

May-12

May-13

May-14

May-15

May-16

May-17

May-18

May-19

REO = real estate owned.

Source: CoreLogic, Inc., with adjustments by the analyst

Figure 15. 12-Month Sales Totals by Type in the Central Counties Submarket

in the late 2000s and early 2010s; the rate of seriously delinquent mortgages and

mortgages that transitioned into REO status peaked in the submarket in January

2010, at 5.8 percent of all outstanding mortgage loans. Despite strengthening

economic conditions, many new residents in the submarket continue to rent

rather than own due in part to the relatively high cost of sales housing and

scarcity of available sales housing units in the submarket. During the 12 months

ending May 2019, approximately 31,700 homes were sold, slightly more than the

31,600 home sales a year earlier; the average sales price was $318,500, nearly 4

percent more than the average sales price a year earlier.

to prerecession levels. During the 12 months ending May 2019, regular resales

totaled 28,900, nearly 2 percent more than the 28,400 sales recorded a year

earlier. Regular resales averaged 26,500 during 2005 and 2006 before falling

to a recent low of 12,350 sales during 2011. Since 2011, regular resales have

recovered and averaged 27,750 sales annually from 2015 through 2017. REO sales

totaled 1,200 during the 12 months ending May 2019, more than 30 percent fewer

than were reported a year earlier; REO sales at this time accounted for nearly

4 percent of all existing home sales. REO sales reached a recent peak of 9,900

sales during 2009, when they accounted for 41 percent of all existing home sales.

Figure 15 shows home sales by type in the Central Counties submarket.

Sales Prices

Although new home sales totals remain low compared with prerecession levels,

new home sales prices are much higher than prerecession levels. During the

12 months ending May 2019, the average new home sales price was $511,200,

approximately 1 percent below the $516,900 average sales price a year earlier,

but nearly 43 percent higher than the prerecession high of $358,600 in 2008.

New home sales prices reached their recent low average of $298,800 during

2010 but increased significantly beginning the following year with average gains

Sales Market—Central Counties Submarket 18Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin Comprehensive Housing Market Analysis as of June 1, 2019

Comprehensive Housing Market Analysis Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Condominium Sales Activity

Sales of condominium and other attached units are notably more prevalent

in the Central Counties submarket than in the Suburban Counties submarket.

Sales of new and existing condominium units averaged 8,975 during the 12

months ending May 2019, nearly 29 percent of all new and existing sales in the

submarket, and an increase of 2 percent from condominium sales totals a year

earlier. Also, during the 12 months ending May 2019, the average sales price

was $229,000, or 6 percent above the average sales price a year earlier. Total

550,000

500,000

450,000

400,000

350,000

300,000

250,000

200,000

150,000

100,000

New Sales Regular Resale Sales REO Sales

Average Sales Price

($)

May-06

May-07

May-08

May-09

May-10

May-11

May-12

May-13

May-14

May-15

May-16

May-17

May-18

May-19

REO = real estate owned.

Source: CoreLogic, Inc., with adjustments by the analyst

Figure 16. 12-Month Average Sales Price by Type of Sale

in the Central Counties Submarket

of 13 percent annually from 2011 through 2014, when the average new home

sales price was $493,600. Since 2014, new home sales prices have been stable,

averaging $509,300 annually during 2015, 2016, and 2017. Regular resale home

sales’ average prices have also surpassed prerecession levels, and averaged

$310,100 during the 12 months ending May 2019, more than 3 percent above the

average sales price a year earlier. Regular resale average prices reached a recent

low during 2009, when the average was $244,100. Prices for regular resale homes

remained modest during 2010, 2011, and 2012, averaging $253,100 during each of

those 3 years. After 2012, appreciation in regular resale prices occurred, averaging

slightly more than 3 percent annual growth, to $293,000 during 2017. Figure 16

shows average sales prices in the Central Counties submarket by sales type.

condominium sales remain below the levels in 2005 and 2006, when 9,850 and

9,075 sales occurred, which represented 30 and 29 percent of total sales in the

HMA, respectively. Current average condominium sales prices are also below

prerecession values, which averaged a relatively stable $241,900 annually during

2005, 2006, and 2007, before declining to a low level of $167,700 during 2011.

Construction Activity

Single-family home construction, as measured by the number of building permits

authorized, has trended upward since 2010, but is below prerecession highs.

Single-family homes permitted averaged 3,325 homes annually from 2001

through 2004, declined to an average of 2,800 homes annually during 2005 and

2006, and then fell sharply, with declines averaging 33 percent annually, to a

recent low level of 790 homes permitted during 2009. The subsequent recovery

in single-family permitting has been more modest than the decline, with gains

averaging 13 percent annually, to 2,150 homes permitted during 2017. During

the 12 months ending May 2019, approximately 2,100 single-family homes have

been permitted in the submarket, down slightly from 2,125 homes permitted a

year earlier (preliminary data; Figure 17). Permitting of condominium units also is

6,000

5,000

4,000

3,000

2,000

1,000

0

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

CondominiumsSingle-Family Homes/Townhomes

Notes: Includes single-family homes, townhomes, and condominiums. 2019 includes data through May 2019.

Sources: U.S. Census Bureau, Building Permits Survey; 2000 through 2017—final data and estimates by the

analyst; 2018 and 2019—preliminary data and estimates by the analyst

Figure 17. Average Annual Sales Housing Permitting Activity

in the Central Counties Submarket

Sales Market—Suburban Counties Submarket 19Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin Comprehensive Housing Market Analysis as of June 1, 2019

Comprehensive Housing Market Analysis Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Table 9. Demand for New Sales Units in the Central Counties Submarket

During the Forecast Period

Sales Units

Demand 9,550 Units

Under Construction 780 Units

Note: The forecast period is June 1, 2019, to June 1, 2022.

Source: Estimates by the analyst

Current Conditions

The sales housing market in the Suburban Counties submarket is balanced, with

a current vacancy rate estimated at 1.0 percent, down from 1.7 percent during

April 2010 (Table 10). Despite slowed population growth since 2010, significantly

lower sales housing construction has contributed to improving conditions in

the submarket, allowing the market to reach the current balanced state. The

homeownership rate in the submarket is estimated at 79.2 percent, down from

80.7 percent during 2010. Although some new households in the submarket have

chosen to rent rather than buy housing, foreclosure rates, which peaked at 6.7

percent during early 2010, were modestly higher in this submarket than in the

Central Counties submarket and have contributed to a decline in the homeownership

rate since 2010. During the 12 months ending May 2019, total home sales were

39,050, more than 2 percent above the 38,200 sales from a year earlier; at the same

time, the average sales price for all homes in the submarket was $281,900, or more

than 6 percent higher than the average sales price a year earlier.

Home Sales

Quick Facts

Suburban Counties

Submarket

Minneapolis

HMA

Vacancy Rate 1.0% 0.9%

Months of Inventory 2.7 2.4

Total Home Sales 39,050 70,750

1-Year Change 2.2% 1.3%

New Home Sales Price $406,500 $433,500

1-Year Change 4% 2%

Existing Home Sales Price $265,700 $284,700

1-Year Change 6% 5%

Mortgage Delinquency Rate 0.8% 0.7%

Notes: The vacancy rate is as of the current date, June 1, 2019. Home sales and prices are for the 12 months

ending May 2019. Months of inventory and mortgage delinquency data are as of May 2019.

Sources: Home sales and prices—Metrostudy, A Hanley Wood Company; delinquency rate—CoreLogic, Inc.

Table 10. Home Sales Quick Facts in the Suburban Counties Submarket

below prerecession highs, with most multifamily development in the submarket

being built for renter occupancy. Permitting for condominium units in the Central

Counties submarket fluctuated during the prerecession period, with a peak of

2,625 units permitted during 2005, after which condominium permitting fell,

reaching a recent low of 5 units permitted during 2010. Since 2010, permitting

for condominium units continues to fluctuate, but remains comparatively low.

Approximately 140 condominium units were permitted during the 12 months

ending May 2019, compared with 330 units permitted during the previous year.

Notable Recent Developments

New single-family home construction in this submarket tends to be outside

the cities of Minneapolis and St. Paul. Locations with significant homebuilding

include the southern suburban Hennepin County communities of Bloomington,

Edina, and Plymouth in western Hennepin County. In Plymouth, in suburban

Hennepin County, Camelot Nine includes six home designs on 80 lots; homes

start at $393,990 and offer three to six bedrooms and two and a half to five

bathrooms and start at 1,700 square feet. Currently, 72 of 80 home sites are

sold, built, and occupied. Eleven Condominiums in Minneapolis has recently

secured construction financing and is scheduled to break ground in late summer

2019. The 41-story tower will be east of downtown Minneapolis and include 118

units. Initial prices have yet to be released.

Forecast

During the 3-year forecast period, demand is estimated for 9,550 units, with an

estimated 780 units currently under construction (Table 9). Demand will likely

be strongest during the first year of the forecast period.

Sales Market—Suburban Counties

Submarket

Sales Market—Suburban Counties Submarket 20Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin Comprehensive Housing Market Analysis as of June 1, 2019

Comprehensive Housing Market Analysis Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

50,000

45,000

40,000

35,000

30,000

25,000

20,000

15,000

10,000

5,000

0

Sales Totals

New Sales REO Sales

Regular Resale Sales

May-06

Jan-07

Sep-07

May-08

Jan-09

Sep-09

May-10

Jan-11

Sep-11

May-12

Jan-13

Sep-13

May-14

Jan-15

Sep-15

May-16

Jan-17

Sep-17

May-18

Jan-19

REO = real estate owned.

Source: CoreLogic, Inc., with adjustments by the analyst

Figure 18. 12-Month Sales Totals by Type in the Suburban Counties Submarket

450,000

400,000

350,000

300,000

250,000

200,000

150,000

100,000

50,000

0

Average Sales Price

($)

New Sales Regular Resale Sales REO Sales

May-06

May-07

May-08

May-09

May-10

May-11

May-12

May-13

May-14

May-15

May-16

May-17

May-18

May-19

REO = real estate owned.

Source: CoreLogic, Inc., with adjustments by the analyst

Figure 19. 12-Month Average Sales Price by Type of Sale

in the Suburban Counties Submarket

Home Sales

New home sales in the Suburban Counties submarket totaled 4,675 during the

12 months ending May 2019, an increase of nearly 9 percent from a year earlier.

This figure was less than one-half the prerecession high. From 12,100 new home

sales during 2005, sales activity subsequently dropped to a recent low level

of 2,025 sales during 2011, an average decline of nearly 26 percent annually.

Beginning in 2012, new home sales increased by an average annual rate of

15 percent to 3,050 sales during 2014. In the subsequent 3 years, new home

sales increased by an average of 11 percent annually to 4,175 new sales during

2017. By contrast, regular resales have surpassed prerecession levels. During

the 12 months ending May 2019, regular resale sales totaled 33,200, more than

3 percent above the total a year earlier, and 1 percent above the prerecession

high of 32,800 sales during 2005. Regular resale sales averaged 13,750

annually from 2008 through 2011, before increasing steadily by an average of

16 percent annually, to 32,600 sales during 2017. REO sales in the Suburban

Counties submarket totaled 1,175 during the 12 months ending May 2019, nearly

one-third fewer than the sales count a year earlier and only 3 percent of all

existing home sales, down from 5 percent a year ago. REO sales peaked at

10,150, or 43 percent of all existing home sales during 2011. Figure 18 provides

home sales counts by sales type in the Suburban Counties submarket.

Sales Prices

Average home sales prices, for all sales types, currently exceed prerecession

highs due in part to the relatively modest increases in new supply since 2010.

For new home sales during the 12 months ending May 2019, the average sales

price in the Suburban Counties submarket was $406,500, nearly 4 percent above

the average sales price a year earlier, and significantly above the prerecession

high of $302,100 averaged during 2006. From a low average sales price of

$261,300 during 2009, average new home sales prices have risen steadily,

averaging gains of 5 percent annually, to $386,900 during 2017. The average

sales price for regular resale homes during the 12 months ending May 2019 was

$266,400, nearly 6 percent above the average price a year earlier, and 9 percent

above the prerecession high average of $243,800 during 2006. Figure 19 provides

average home sales prices by sales type for the Suburban Counties submarket.

Construction Activity

Sales housing construction activity, as measured by the number of units

permitted, has been nearly all single-family homes in the submarket since the

mid-2000s. During 2003 and 2004, an average of 20,900 sales housing units

was permitted each year, 84 percent of which were for single-family homes;

Sales Market—Suburban Counties Submarket 21Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin Comprehensive Housing Market Analysis as of June 1, 2019

Comprehensive Housing Market Analysis Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

25,000

20,000

15,000

10,000

5,000

0

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

CondominiumsSingle-Family Homes/Townhomes

Notes: Includes single-family homes, townhomes, and condominiums. 2019 includes data through May 2019.

Sources: U.S. Census Bureau, Building Permits Survey; 2000 through 2017—final data and estimates by the

analyst; 2018 and 2019—preliminary data and estimates by the analyst

Figure 20. Average Annual Sales Housing Permitting Activity

in the Suburban Counties Submarket

Recently Completed Developments

More development in the submarket is occurring in counties closer to the

economic core of the HMA, including Dakota, Scott, Carver, and Washington

Counties, all in Minnesota. Located in Victoria (Carver County), where the

population grew an estimated 3.2 percent annually from 2010 to 2017 (ACS

5-year), Whispering Hills Townhomes includes 144 newly constructed townhome

units, with nearly 60 units sold. Homes range in size from 1,750 to 2,377 square

feet; include three or four bedrooms and two or three bathrooms, with two-car

garages; and start at $279,990. In Prior Lake (Scott County) Haven Ridge includes

162 home sites, with 25 closed and occupied and 20 more under contract.

Single-family homes with two to four bedrooms and two to three bathrooms,

including two- and three-car garages, start at $365,990.

Forecast

During the 3-year forecast period, demand is estimated for 15,050 new sales

units (Table 11). The 1,650 units under construction will satisfy a portion of this

demand. Given some current unfilled sales demand, it is likely to be stronger

in the first year of the forecast period and diminish during years 2 and 3.

Table 11. Demand for New Sales Units in the Suburban Counties Submarket

During the Forecast Period

Sales Units

Demand 15,050 Units

Under Construction 1,650 Units

Note: The forecast period is from June 1, 2019, to June 1, 2022.

Source: Estimates by the analyst

since 2005, construction of condominium units has declined somewhat, and

approximately 94 percent of all sales housing units permitted have been for

single-family homes. Beginning in 2005, sales housing permitting fell rapidly,

with declines averaging 37 percent annually, to 3,175 units permitted during 2008.

From 2009 through 2011, units permitted averaged only 3,050 annually, the

lowest recent levels. Since 2012, permitting has increased modestly, but remained

relatively low, compared with permitting levels during the previous decade. From

2012 through 2017, the number of sales housing units permitted averaged 5,525

annually. During the 12 months ending May 2019, approximately 6,700 sales

housing units have been permitted in the submarket, slightly fewer than the 6,675

sales housing units permitted a year earlier (preliminary data). Figure 20 shows

sales housing permitting in the Suburban Counties submarket since 2000.

Rental Market Conditions 22Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin Comprehensive Housing Market Analysis as of June 1, 2019

Comprehensive Housing Market Analysis Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Rental Market Conditions

Market Conditions: Slightly Tight

The rental housing market has been balanced to tight since the early

2010s, and the apartment vacancy rate has been at or below 5 percent

every quarter since 2012.

Current Conditions and Recent Trends

Rental housing market conditions in the Minneapolis HMA are currently slightly

tight, with an overall estimated vacancy rate of 4.7 percent, down from 7.6 percent

in April 2010 (Table 12). Despite relatively high levels of multifamily construction,

as measured by the number of multifamily units permitted, strong net in-migration

and increased renter household growth spurred by the housing crisis have kept

vacancy levels low and rents steadily rising (Figure 21). Twenty-five percent of all

renter households in the HMA live in single-family homes, modestly higher than

the 23-percent rate in 2010, and 63 percent of all renter households live in larger

apartment buildings with five or more units, like the rate in 2010, according to

Rental Construction Activity

Since 2012, rental permitting in the HMA has been at the highest levels since the

mid-1980s with the 12,950 units permitted during 2018 representing the highest

annual figure on record. From 2005 through 2010, including the Great Recession

that impacted the national and local economies, multifamily permitting averaged

1,875 units permitted annually. As population growth accelerated, multifamily

permitting rose to 3,000 units in 2011 before increasing sharply to an average of

7,075 units from 2012 through 2017, as apartment vacancy rates remained low and

rents rose. During the 12 months ending May 2019, approximately 11,250 rental

Rental Market—Minneapolis HMA

Rental Market

Quick Facts

2010

(%)

Current

(%)

Rental Vacancy Rate

7.6 4.7

Occupied Rental Units by Structure

Single-Family Attached & Detached

23 25

Multifamily (2–4 Units)

12 11

Multifamily (5+ Units)

64 63

Other (Including Mobile Homes)

1 1