HOLDER REPORTING MANUAL

STATE OF VERMONT TREASURER OFFICE

Unclaimed Property Division

UNCLAIMED PROPERTY REPORTING STEPS,

REQUIREMENTS AND STATUTES

Revised 2021

Table of Contents

TABLE OF CONTENTS ____________________________________________________________________________ I

INTRODUCTION ________________________________________________________________________________ 1

AMOUNTS TO REPORT ___________________________________________________________________________ 2

THE ROLE OF HOLDERS ___________________________________________________________________________ 2

Holder Reporting Responsibilities __________________________________________________________________ 2

OVERVIEW ____________________________________________________________________________________ 3

Topics Covered _________________________________________________________________________________ 3

Online-Filing Options ____________________________________________________________________________ 4

Errors, Disk Problems __________________________________________________________________ 4

NAUPA File Encryption Utility ___________________________________________________________ 4

Frequently Asked Questions ______________________________________________________________________ 4

PROPERTY CODES & TYPES ______________________________________________________________________ 5

Vermont Statute: Definition of Unclaimed – Abandoned – Property ______________________________________ 5

Escheatment of Property: Jurisdiction to Escheat _____________________________________________________ 5

HOLDER TYPES ________________________________________________________________________________ 6

Who and/or What is a Holder? ____________________________________________________________________ 6

Holder Types ___________________________________________________________________________________ 7

REPORTING STEPS _____________________________________________________________________________ 8

REPORTING STEPS IN DETAIL _______________________________________________________________________ 9

THE LAW ____________________________________________________________________________________ 9

FINANCIAL BOOKS & RECORDS REVIEWS _______________________________________________________________ 9

LAST TRANSACTION/ACTIVITY DATE AND CUSTOMER CONTACT ________________________________________________ 9

DUE DILIGENCE ________________________________________________________________________________ 9

QUANTITY OF PROPERTIES ________________________________________________________________________ 10

REPORT FORMATS _____________________________________________________________________________ 14

DATA ENTRY _________________________________________________________________________________ 14

UPDATES ___________________________________________________________________________________ 14

FINALIZATION ________________________________________________________________________________ 14

REMITTANCE AND PAYMENT ______________________________________________________________________ 15

PROPERTY REMITTANCE AND DELIVERY ___________________________________________________________ 16

Physical Delivery _____________________________________________________________________ 16

Worthless or Non-Transferable Securities _________________________________________________ 17

Proceeds from Checking, Savings or Other Financial Institution Account ________________________ 17

Safe Deposit Boxes ___________________________________________________________________ 17

Other Tangible Property _______________________________________________________________ 18

REPORTING FORMS ___________________________________________________________________________ 19

NEGATIVE REPORTS ___________________________________________________________________________ 20

RECIPROCAL REPORTING _______________________________________________________________________ 21

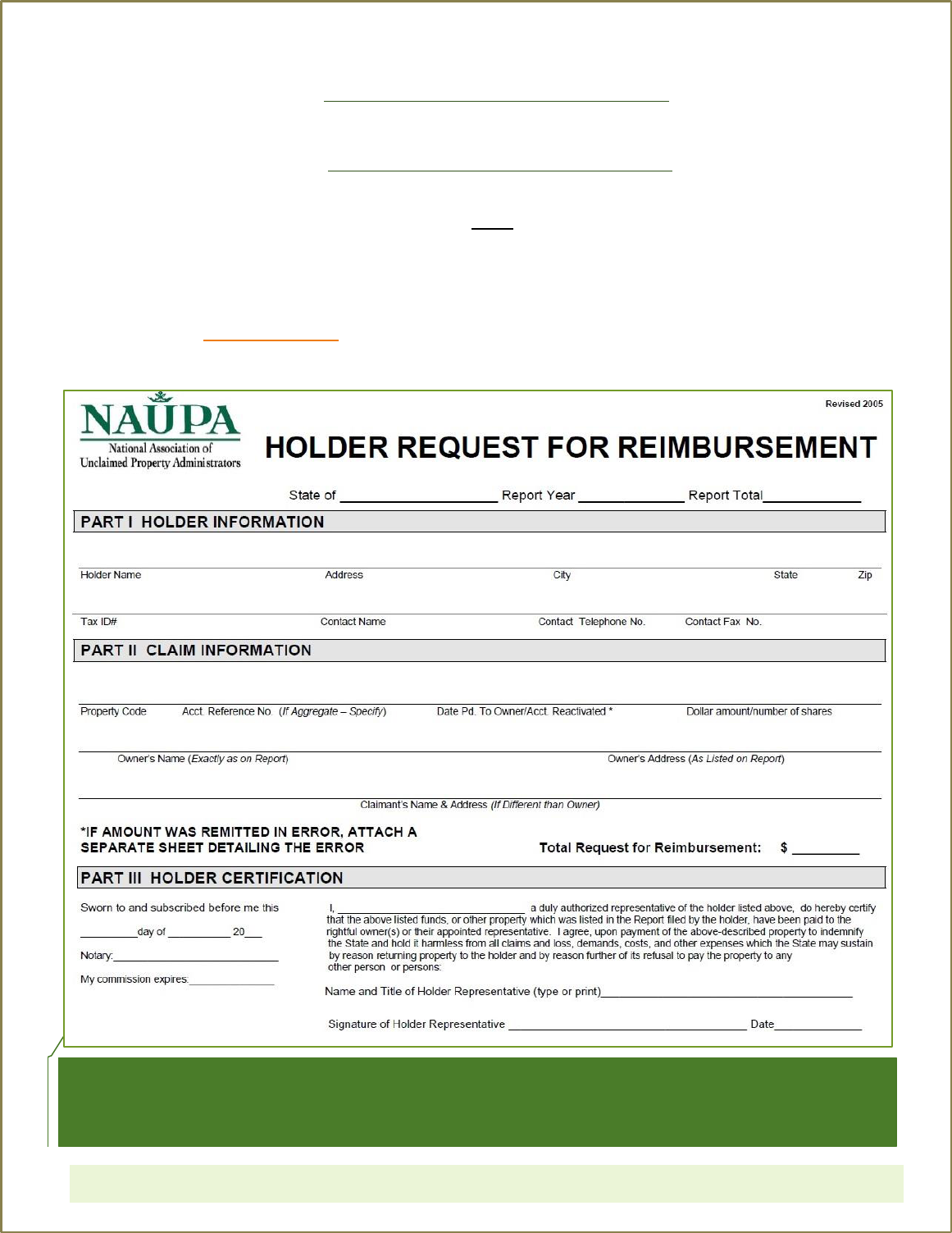

HOLDER REIMBURSEMENT _____________________________________________________________________ 22

VOLUNTARY COMPLIANCE PROGRAM ____________________________________________________________ 23

VCP Eligibility _________________________________________________________________________________ 23

VCP Look-Back Period __________________________________________________________________________ 23

Records Unavailable for the Look-back Period _____________________________________________ 23

Program Duration ______________________________________________________________________________ 24

Examination Provision __________________________________________________________________________ 24

VCP Participation ______________________________________________________________________________ 24

VCP Terms and Conditions _______________________________________________________________________ 24

Vermont Compliance Program Process _____________________________________________________________ 24

GLOSSARY __________________________________________________________________________________ 26

TABLES _____________________________________________________________________________________ 28

CONTACT INFORMATION _________________________________________________________________________ 33

IMPORTANT DATES ____________________________________________________________________________ 34

DORMANCY PERIODS ___________________________________________________________________________ 34

Vermont Unclaimed Property Reporting Manual

Holder Reporting Manual: Introduction February 2021 Page 1

INTRODUCTION

The Unclaimed Property Division of the State of Vermont Treasurer Office practices a

vital consumer-protection role as custodian of abandoned or lost assets.

Designed to successfully reunite owners with lost or abandoned assets, unclaimed

property programs exist throughout the United States and in Puerto Rico, the U.S. Virgin

Islands as well as three Canadian Provinces: Quebec, British Columbia, and Alberta.

The concept stems from feudal England, where it pertained primarily to lands. Today it

excludes real estate and covers various types of monetary assets:

The Revised Uniform Unclaimed Property Act (RUUPA) is the latest revision to the Uniform

Unclaimed Property Act, first promulgated in 1954 and last updated in 1995. The act requires

holders of unclaimed property to turn it over to the state unclaimed property administrator after

a suitable dormancy period so the administrator can attempt to reunite the property with its

rightful owner. RUUPA updates numerous provisions and addresses, life insurance benefits,

securities, dormancy periods, and use of contract auditors.

Vermont Unclaimed Property Reporting Manual

Holder Reporting Manual: Introduction February 2021 Page 2

Vermont’s unclaimed property statutes require entities with abandoned assets on their

balance sheets to report such items to the Unclaimed Property Division of the State of

Vermont Treasurer Office. Use this manual as a guide for report preparations. The law

excludes land, real estate and – except for bank-held safe deposit box contents – other

tangible property.

Amounts to Report

No amount can be written off to income or surplus; there are no de minimis amounts.

ALL amounts must be reported, even a penny. In addition, the following scenarios do

not eliminate the requirement to report property to the State of Vermont:

• Internal activities: e.g., service charges, interest credits, dividends, automatic dividend

reinvestment and automatic withdrawals

• Automatic deposits: from one dormant account into another dormant account (e.g.,

transfer of interest from a time account to a dormant savings account)

• The “Void after XXX days” shown on the face of check: although the business considers a

check invalid after a specified time period, the underlying obligation remains and, those

funds, once having reached their dormancy thresholds, must be reported

The Role of Holders

Reporting owner details accurately in prescribed formats enables holders to play an

integral role in helping states reunite abandoned assets with their rightful owners.

Besides assisting states in maintaining the integrity of owner data, holders show a

commitment to Corporate Social Responsibility components.

The Unclaimed Property Division of the State of Vermont Treasurer Office reviews all

reports for accuracy before adding the items to the owner database used to process

and pay property claims. Your efforts in helping protect consumer property and comply

with Vermont State Unclaimed Property Statutes are appreciated.

Holder Reporting Responsibilities

▪ Maintain unclaimed items intact until remitted to Unclaimed Property Division.

▪ Make a diligent effort to locate owners.

▪ Report yearly and accurately.

▪ Retain records for 10 years after filing report.

▪ File safe box reports “separately” from yearly financial reports.

Vermont Unclaimed Property Reporting Manual

Holder Reporting Manual: Overview February 2021 Page 3

OVERVIEW

This Unclaimed Property Holder Reporting Manual provides basic requirements,

procedures and options for filing timely holder reports, which are due May 1 annually in

Vermont.

Topics Covered

▪ Unclaimed Property Law, Terminology

▪ Reporting Requirements

o Manual vs digital reporting

o Forms: cover sheet, schedules, report and affidavits

o Due diligence

▪ Property Types and Codes

▪ Dormancy Periods

▪ Reporting Process

o Preparation: pre-reporting and actual reporting

o Delivery and payment

o Holder Reimbursement

o Reciprocity

▪ Voluntary Compliance Program

▪ NAUPA Codes for Relationship, Owner, Property Types

▪ Contact Information and Important Dates

▪ Forms

On-line Filing Options

This manual also introduces third-party online applications; technical support for each is

provided by the application manufacturer.

Submit reports directly to the State of Vermont Unclaimed Property Division through

either the Vermont Holder Reporting Website (Preferred method),

https://vermontholder.unclaimedproperty.com/, UPExchange (if already a client) or

UPExpress (if you created your file using HRSPro or some other application). UPExpress is

free to use. *

HRS Pro

Free downloads of HRS Pro Standard Edition – created and supported by Wagers

and Associates - are available; however, prior to downloading the software,

review the HRS Pro User Guide and HRS Pro How-To section shown on that page.

UPExchange™ UPEnterprise UPExpress Vermont Holder Reporting Website

Vermont Unclaimed Property Reporting Manual

Holder Reporting Manual: Overview February 2021 Page 4

Vermont’s Holder Reporting Website is a Vermont dedicated website that is supported

by Avenu Insights & Analytics and is the State’s preferred method of reporting. A Holder

Website User’s Manual and a Holder Manual and Codes are tools to help holder

navigate the website to complete NAUPA reporting compliance. A hard copy of the

Report Cover Sheet is still required when submitted via the Vermont Holder Reporting

Website. You can reach our site here: https://vermontholder.unclaimedproperty.com/

UPExchange and UPEnterprise - created and supported by Eagle Technology

Management, Inc. - are web-based tools for managing and reporting

unclaimed property according to NAUPA standards. They can be accessed

online from anywhere and allow holders to grant access to other stakeholders for

efficient collaboration.

A User Guide, interactive tutorials, pre-recorded videos on the system

capabilities, a four-minute overview of its optional models, FAQs and training

webinars are available. ETM also offers complete, ongoing product support by e-

mail (uphelp@eagletm.com) and phone (319.739.3557).

*When submitting reports via UPExpress or UPExchange, hard copies of the report

are no longer required to be submitted; however, a hard copy of the affidavit

cover sheet must be sent with the remittance and/or confirmation page.

Errors, Disk Problems

Using an outdated version of HRS Pro causes problems: holders must use the most

recent version of the software. HRS Pro automatically transfers info from the outdated

system into the new version. Remember: make sure report totals from the outdated HRS

Pro software match those in the updated reporting software.

NAUPA File Encryption Utility

To create the HRS Pro Digital Envelope (HDE extension files) when using software other

than HRS Pro, use the NAUPA File Encryption Utility available from the Wagers Web site.

Frequently Asked Questions

Our FAQs provide answers to questions not found in this manual.

Vermont Unclaimed Property Reporting Manual

Holder Reporting Manual: Unclaimed Property Defined February 2021 Page 5

PROPERTY CODES & TYPES

Property is deemed unclaimed after being held for an extended period with no

documented owner contact and after making unsuccessful efforts to locate the

owner(s). Abandoned – or unclaimed – property typically is divided into two categories:

Vermont Statute: Definition of Unclaimed – Abandoned – Property

Unclaimed or abandoned property consists of intangible (e.g., accounts payable,

uncashed checks, etc.) and tangible (e.g., safe deposit box contents) personal assets

owed to an individual or business.

See Table 1 for a list of NAUPA property codes.

Escheatment of Property: Jurisdiction to Escheat

The primary right to escheat intangible personal property belongs to the state of the last

known address of owner contained in holder records.

When/if no last known address is shown in holder records, the property is escheatable

by the state of holder’s domicile.

NOTE: lack of an address does not relieve holder of the obligation to report and remit

unclaimed property.

Intangible

Wages Stocks

Account Credits Dividend Payments

Uncashed Checks Interest

Utility Deposits Bonds

Patient Refunds

Insurance Proceeds

Tangible

Jewelry

Coins

Personal Papers

Safe Deposit Box Contents

Vermont Unclaimed Property Reporting Manual

Holder Reporting Manual: Holder Types February 2021 Page 6

HOLDER TYPES

As stated: holders play an integral role in helping states return abandoned assets to

their rightful owners and demonstrate a commitment to CSR ethics.

Who and/or What is a Holder?

Vermont state statutes (Title 27-Property/Chapter 18: Unclaimed) define holder as:

The UPPO (Unclaimed Property Professionals Organization) defines a holder as:

“The business or other entity, which holds inactive property, that is payable or

distributable to another.”

And NAUPA (National

Association of Unclaimed

Property Administrators)

defines it as:

“An entity … in possession

of property belonging to

another, or … indebted to

another on an

obligation.”

Vermont Unclaimed Property Reporting Manual

Holder Reporting Manual: Holder Types February 2021 Page 7

Holder Types

Below are some categorized examples of holders:

Banking and Other Financial Organizations/Institutions

• State and federal banks

• Trust companies

• Savings banks

• S&L (savings and loan) associations and thrift institutions

• Credit unions

• Investment companies

Business Associations (wherever located, domiciled or incorporated)

• Corporations

• Joint stock companies

• Partnerships

• Business trusts

• Cooperatives

• Insurance companies

Utilities Owned or Operated for Public Use

• Communications (phone, internet, cable, cellular)

• Electricity

• Gas, petroleum, oil

• Steam

• Water

• Solid waste collection

Other Entities

• State, county and municipal governments

• Public corporations

• Nonprofit organizations, associations, groups

• Estates

• Trusts

• Employers – large and small

Vermont Unclaimed Property Reporting Manual

Holder Reporting Manual: Reporting Steps February 2021 Page 8

REPORTING STEPS

Follow these nine steps to complete a holder unclaimed property report:

1.

Review the Unclaimed Property Law.

Determine which sections apply to your organization and/or situation.

2.

Review Financial Books and Records.

Using Vermont state statutes, determine the property types to be examined and their

associated dormancy periods. Review books and records to locate properties subject to

reporting. NOTE: all amounts must be reported.

3.

Perform Due Diligence.

Due diligence must be completed – “not more than 120 days [and no less than] 60 days” -

prior to remitting any funds to the State of Vermont, except when the property value is less

than $50. Review the statutory requirements of the Unclaimed Property Law concerning due

diligence timing, account value and affidavit signing.

4.

Calculate Quantity of Items to be Reported.

Report format options correlate to the number of items reported. Important considerations in

determining this number are: multiple owner accounts, aggregation and account roll-up.

Each of these is described in detail in Report Detail Considerations.

5.

Select Report Format.

Based on the number of items and allowable parameters, choose a format for reporting to

the state. NOTE: an electronic NAUPA format is preferable whenever possible and is

mandatory when reporting more than 10 items.

6.

Enter Data.

Provide all owner and account information in manual or electronic format.

7.

Update Report as Required.

Routinely and continually update the report based on account activity – noting the specifics,

e.g., customer contact, re-activation – until it is finalized.

8.

Finalize Report.

After completing all account adjustments, recalculate the amount being remitted within

property type and in total.

9.

Remit Cash/Securities.

Arrange appropriate delivery (USPS, Express or Electronic mail) based on types of property

and remittances due.

Vermont Unclaimed Property Reporting Manual

Holder Reporting Manual: Reporting Steps February 2021 Page 9

Reporting Steps in Detail

The Law – Unclaimed Property law varies by state; §1247 Chapter18, V.S.A. Title 27 covers it in Vermont.

Financial Books & Records Reviews – Common types of unclaimed property include

uncashed payroll or dividend checks, which create a property right protected by state unclaimed

property laws. The Journal of Accountancy and other resources provide insights for identifying these

liabilities on company balance sheets.

Last Transaction/Activity Date and Customer Contact

Determine dormancy from the date of last account contact or activity, e.g., bank deposit by

customer. Customer contact restarts dormancy clock and can be an owner–generated activity

on a dormant account, e.g., written correspondence regarding the account from the customer.

Phone calls are considered customer contact. When speaking with a client, document the

following information:

A. Name of client and person taking the call.

B. Date and time of call.

C. Details of subject account.

The absence of customer contact is the criterion upon which property is designated unclaimed.

Customer response to due-diligence mailings eliminates the requirement to report their property –

at least for another one to three years (based on property type) from the date of their responses

(or the date of the last account activity).

The last activity date can be the date

▪ of the last account deposit or withdrawal by the owner.

▪ when dividends became payable.

▪ of issuance of the check or draft.

▪ when property became distributable to the owner.

▪ of mandatory withdrawal.

When the property in question is an instrument payable on demand, use the issuance date. The

check reissue date or date of a computer conversion cannot be considered the last activity date.

Reporting Requirements by Property Type

This document contains descriptions of reporting requirements by the property type.

Due Diligence – Due diligence is the responsibility of the holder. Holders must take reasonable

measures to locate owners of apparently abandoned property before filing a report.

State statute §1247 (e) Chapter18, Title 27 obligates holders to attempt communications with owners

before presuming property is abandoned when all the following apply:

Vermont Unclaimed Property Reporting Manual

Holder Reporting Manual: Reporting Steps February 2021 Page 10

▪ holder records contain an accurate address for the owner(s);

▪ the claim of the apparent owner is not barred by the statutes of limitation;

▪ property value is at least $50.

Holders must send written notification to owners advising them that their property will be escheated to

the Unclaimed Property Division of the State of Vermont Treasurer Office. This is to be done at no cost to

the owner – and no more than 180 days or less than 60 days – prior to filing a report.

Due Diligence Results

Affidavit of Due Diligence

Statute 27 §1247(h) stipulates the Affidavit of Due Diligence must be included for every report. Submit the

affidavit (if/when applicable) with signature authority as follows:

Public Corporation - a designated employee or representative from third-party preparer must sign

Privately Held Corporation or Association - an officer must sign

Partnership - a partner must sign

Holders must ensure:

• the affidavit section listed on the Annual

Compliance Report Cover Sheet is

completed and signed by the proper

person;

• the report cover sheet is signed by an officer

or a designated representative to protect

against liability on claims for reported

property.

Quantity of Properties – When reporting more than 10 items, holders must file reports in NAUPA

format on a compact disk, 3.5-inch diskette or thumb/flash drive included with a printout of the report.

Due diligence letter returned as undeliverable.

No response from the owner of the property.

Property Deemed Unclaimed or Abandoned.

Property NOT Deemed Unclaimed or Abandoned.

Owners send written reply indicating their intentions for the handling of their funds.

John Q. Public

194

An officer (or designated

staff) of the reporting entity

must:

▪ Complete the affidavit section

▪ Sign the Annual Compliance

Report Cover Sheet where

indicated

▪ Have his/her signature notarized

▪ Ensure Compliance Report

Cover Sheet is included with

reporting package

Vermont Unclaimed Property Reporting Manual

Holder Reporting Manual: Reporting Steps February 2021 Page 11

Encrypted files containing the report can be sent by E-mail along with a PDF or MSWord Document file

that contains the report details.

Online options available for reporting include Vermont Holder Reporting Website, HRS Pro by Wagers &

Associates and UPExchange™ and UPEnterprise by Eagle Technology Management, Inc.

When reporting 10 items or less, use manual or electronic reporting: for manual reports, use Schedule A

for all property types except stocks, bonds and other securities; use Schedule B for the latter types. Click

below link to access the two schedules:

Schedule A and Schedule B

Holders with no property to report can file a Negative Report; in Vermont, a negative report is not

mandatory but suggested.

AGGREGATE AMOUNTS

Vermont statute 27 §1247(b)(3) indicates owner and/or property information for items of $25 or

less may be omitted from the report. Instead, aggregate and identify items as shown below (see

page 13 for HRS Pro aggregate example).

• Total individual items of $25 or less into one aggregate

amount based on property type.

• Enter the total number of accounts comprising the

aggregate total in Section 3A of the Compliance Report

Cover Sheet.

• Sum, prior to aggregating, multiple properties of the

same type (e.g., quarterly dividend checks) valued at

$25 or less – and payable in the same year – belonging

to the same owner.

✓ When the sum is $25 or less, include the multiple

amounts in one aggregate record.

✓ If the sum is greater than $25, exclude these from aggregate reporting.

▪ Report them as a single item.

▪ Use the property information from the most recent activity date.

▪ Record the sum as the escheated value.

DO NOT AGGREGATE RECORDS

CONTAINING UNCLAIMED

SECURITIES AND THOSE WITH

OWNERS’ ADDRESSES OUTSIDE THE

STATE OF VERMONT.

Vermont Unclaimed Property Reporting Manual

Holder Reporting Manual: Reporting Steps February 2021 Page 12

Enter total number of

accounts comprising

the aggregate in

Section 3A of the

Compliance Report

Cover Sheet.

28

Vermont Unclaimed Property Reporting Manual

Holder Reporting Manual: Reporting Steps February 2021 Page 13

Aggregate: HRS Pro Record Samples

ROLLING UP

Do not aggregate amounts more than $25.

Exception: combine amounts of $25.01 or more (payable to a single owner in a given year and

reportable under the same property type, e.g., quarterly dividend checks). When rolling up

dividends, use last check number and date as a property reference; indicate total number of

dividends in the “Comment” field.

Rolling Up:

HRS Pro

Record

Sample

Vermont Unclaimed Property Reporting Manual

Holder Reporting Manual: Reporting Steps February 2021 Page 14

Report Formats – All reports, whether created manually or electronically through HRS Pro or other

reporting software, must conform to NAUPA guidelines.

Data Entry – Method of data entry depends upon the reporting format – manual or electronic.

Regardless, to help ensure owners have the best chance of reclaiming their lost assets, be sure to enter:

▪ Full owner name, including any suffixes such as Jr., III, Sr., and middle names, initials

▪ Complete mailing address (even when the address on record is incorrect)

▪ Other identifying details, e.g., social security number, date of birth, account numbers

Updates – Some holders begin preparing reports long before the due date; in those instances, routine

updates are required, e.g., customer contact, re-activations, address corrections. Update reports

routinely until finalizing.

Finalization – After all updates and recalculations, review the report for any inaccuracies. Compile

the package and be sure to include the cover sheet.

All report packages must include:

1. Unclaimed Property Annual Compliance Report Cover Sheet and Verification Checklist

Be sure to:

• show the quantity of accounts under $25 being reported as aggregate in Section 3A

• ensure the “Affidavit of Due Diligence” on the Annual Compliance Report Coversheet

shows the number of due diligence letters mailed

• have the appropriate person sign the document in front of a notary

• indicate on the Checklist (back of Cover Sheet) the types of property being reported

2. NAUPA-formatted report in an encrypted HDE file on CD, diskette, thumb/flash drive (10 items or

less may be manually reported on a Schedule)

3. Printed version of the report (Coversheet, Summary & Detail sheets); if/when reporting securities,

include the transaction report with the report documents

4. Check payable to Vermont State Treasurer Office for the total shown in the “Total Financial

Property Remitted” section on the report; ACH and EFT payments can be used for payment

5. May 1 or earlier postmark; when May 1 occurs on Saturday, Sunday or a holiday, the due date is

the following workday

In accordance with V.S.A. 27, Chapter 18, verification and affidavit shall be executed by:

• Chief fiscal officer or his/her designee, in case of a public corporation

• Partner, in case of a partnership

• Officer, in case of unincorporated association or private corporation

Vermont Unclaimed Property Reporting Manual

Holder Reporting Manual: Reporting Steps February 2021 Page 15

Remittance and Payment – Report format and remittance depend on quantity and type of

property reported; regardless, all submissions must include:

• Unclaimed Property Annual Report Cover Sheet (includes the Affidavit of Due Diligence);

• Report detail in NAUPA format on a formatted CD-R or on a memory stick/thumb drive (10 items or

less may be reported manually on Schedules A or B);

• Hard copy (print out) of the report details;

• One check made payable to the State of Vermont Treasurer Office, in the amount shown on

report; if submitting securities, etc., make sure the appropriate preparations have been made,

then contact ACS Unclaimed Property Clearinghouse and include transaction confirmation.

Mail the entire report package to:

State of Vermont Treasurer Office

Unclaimed Property Division

109 State St., 4

th

Floor

Montpelier, VT 05609-6200

Vermont Unclaimed Property Reporting Manual

Holder Reporting Manual: Property Delivery February 2021 Page 16

PROPERTY REMITTANCE AND DELIVERY

INTANGIBLE

Mutual Funds, Stocks, Bonds and Other Securities

Submit confirmation document(s)- listing all owner

identification information - with the reports. Confirmation

documentation must show shares being sent electronically

through DTC (Depository Trust Corporation).

The confirmation/transaction documentation must include:

• fund name

• posted and trade dates

• transaction descriptions

• number and price of shares

• total number of shares remitted

The aggregate amount does not apply when securities and dividends are reported together.

Before Transferring Funds, Securities

Contact Conduent three to four (3-4)

business days prior to delivery/transfer.

Conduent provides account numbers

for all mutual funds transferred to the

state account.

NOTE: Holder remains the custodian of all mutual funds.

• All shares / securities transferred to the State of

Vermont must be registered in the name Mac & Co.

• Submit a confirmation report with owner

identification information.

• When owner reclaims funds, the State of Vermont

transfer agent - Conduent - sends to the holder the

paperwork required to transfer account(s) into the

name of claimant/owner.

Physical Delivery

Shares - must be registered to the State of Vermont Treasurer’s Office; documentation /

proof that shares have been remitted must be included with report. Deliver securities to

the state custodian: Unclaimed Property Clearinghouse UPCH.

Owner's Name

Last Known Address

Social Security or FEIN Number

Last Activity Date

Relationship Code

NAUPA Property Type

Security Name

CUSIP Number and/or Any

Other Identifying Number

Number of Shares

Owner ID and Property Info

DTC

#901

Account #822487

Account Name Mac & Co

Agent Bank #26500

DTC Account Delivery Details

Conduent State & Local Solutions, Inc

100 Hancock St., 10th Floor

Quincy, MA 02171

E-mail: [email protected]

Facsimile: 617.722.9660

For Stocks, Shares – Victoria Perkins, Account

Administrator

For Mutual Funds – Timothy Woodward

Vermont Unclaimed Property Reporting Manual

Holder Reporting Manual: Property Delivery February 2021 Page 17

Certificates - must be mailed with the report.

Mutual funds and Dividend Reinvestment Plans - must

be transferred into name of the State of Vermont

Treasurer and include the complete fund name and

CUSIP number.

Dividends & Securities - put both property types on

the same report and include the information shown in the “Listed Identification” box

shown on this page.

Worthless or Non-Transferable Securities - do not report non-transferable

positions/securities. Report and remit the shares if, and when, they become transferable

or gain value. Holder will not be penalized for late reporting.

Fractional Shares - liquidate and remit the cash proceeds; if they are mutual funds, then

escheat accordingly.

Proceeds from Checking, Savings or Other Financial Institution Account - report as cash

and use wire transfer or check to remit to the State of Vermont.

TANGIBLE

Safe Deposit Boxes

Deliver Safe Deposit Box contents after September 1. Due Diligence is not required prior to

reporting Safe Deposit Box contents. May 1 remains the due date for reporting them as

abandoned; however, delivery must be made no more than120 Days after that date.

• Before May 1, file the annual compliance report cover sheet showing the estimated

delivery date and number of safe deposit boxes to be delivered.

• At some point after Sept. 1, deliver safe deposit box contents to the state (when

shipment date differs from the estimated date shown on the annual compliance report

cover sheet, contact the Vermont Unclaimed Property Division and advise of the dates

change: by phone - 802.828.1490 or by email: tre.upcompliance@vermont.gov).

o complete Safe Deposit Box Cover Sheet

o be sure cover sheet affidavit is signed by authorized representative (and the

signature is notarized)

o attach Inventory Report page(s) to each safe deposit box contents package

o put all contents packages into shipping container

o pack Safe Deposit Box Cover Sheet with shipment

Issue name

Issue CUSIP number

Share amount per issue

Holder DTC number

Confirmation Must Include

Vermont Unclaimed Property Reporting Manual

Holder Reporting Manual: Property Delivery February 2021 Page 18

Steps:

1.

Enter number of boxes to be delivered and the estimated delivery date on the Unclaimed

Property Annual Compliance Report Cover Sheet.

2.

Inventory safe deposit box contents.

3.

Use the Unclaimed Safe Deposit Box Contents Inventory Report:

a. add holder name and safe deposit box charges, drill abandonment details

b. enter owner name and last known mailing address

c. use SD01 or another applicable property code to individually identify contents

d. indicate number of pages for each inventory

e. repeat these steps for each box to be shipped

Other Tangible Property

Other Tangible Property has a three-year dormancy period. If declared abandoned, follow all

steps for reporting and remitting safe deposit box contents.

Property used as loan collateral is considered unclaimed three years after:

▪ loan was paid in full or charged off and item is still being held by holder and cannot be

matched to an open account

▪ zero customer contact and “owner” whereabouts is unknown

Examples of tangible property include jewelry, stock certificates, furs, deeds.

REMITTANCE OPTIONS

Full payment of the amount shown on report must be included with the annual filing. Two

options available for remitting payment:

▪ enclose a check made payable to the Vermont State Treasurer with each report filing

▪ remit funds through Automated Clearing House (ACH) or Electronic Fund Transfer (EFT)

Obtain ACH and EFT wire transfer instructions by e-mailing the Unclaimed Property Division

(tre.upcomplian[email protected]) or calling (802.828.2407).

NOTE: the state provides this information only via facsimile. Wire transfer instruction requests must include:

• your name

• holder name and mailing address

• your phone number

• a fax number to where instructions should be sent

Vermont Unclaimed Property Reporting Manual

Holder Reporting Manual: Reporting Forms February 2021 Page 19

REPORTING FORMS

Click icons to access forms; all can be downloaded from the Unclaimed Property Division page

of the Office of the State Treasurer Web site in Microsoft Word and Adobe Acrobat files.

Document Title

PDF Files

Annual Compliance Report Cover Sheet

Compliance Report

Cover Sheet

Holder Reimbursement

Holder

Reimbursement Request

Safe Deposit Box Cover Sheet

Safe Deposit Box

Cover Sheet

Safe Deposit Box Inventory Report

Safe Deposit Box

Contents Inventory

Schedule A – General Property (10 and fewer)

Schedule A

Schedule B – Stocks, Bonds, Mutual Funds (10 and fewer items)

Schedule B

Vermont Unclaimed Property Reporting Manual

Holder Reporting Manual: Negative Reports February 2021 Page 20

NEGATIVE REPORTS

Vermont Unclaimed Property Statutes do not mandate the filing of negative reports; however,

the state encourages businesses and other entities to file this report with the State Office of the

Treasurer.

A “negative report” indicates to the state that a thorough review of the holder business books

and records has been completed and revealed no unclaimed properties. The Vermont Office

of the Treasurer suggests filing a negative report to show adherence to compliance laws and to

assist it in maintaining accurate internal files.

To File a Negative Report

Use the Unclaimed Property Annual

Compliance Report Cover Sheet.

• Enter zeros for all total lines in Section 3; be sure

to indicate zero in the Safe Deposit Box Details

area.

• Enter the name for the Due Diligence affidavit.

• Make sure an authorized agent of the

reporting organization signs the report in front

of a notary.

NOTE:

Submit negative reports separately from

yearly reportable financial property; do not

combine the reports.

Vermont Unclaimed Property Reporting Manual

Holder Reporting Manual: Reciprocal Reporting February 2021 Page 21

RECIPROCAL REPORTING

Reciprocity provides holders an opportunity to file unclaimed property reports for multiple

states through one agent state. “Agent State” is that of the holder place of business.

Except for safe deposit boxes, the State of Vermont accepts property for other states and

countries under the reciprocal agreements as an agent state. Safe deposit boxes must be

reported to the state in which they are located.

Reciprocal reporting is not a requirement. Each holder decides to which state it will report.

When/if taking advantage of reciprocal reporting:

▪ Report and remit in accordance with each state’s Unclaimed Property Law.

▪ Identify and subtotal all accounts – and aggregate accounts – by state.

▪ Do not aggregate out-of-state accounts with Vermont property.

▪ Identify “Negative Reports” by each state.

▪ Notify each reciprocal state of your intent to file an unclaimed property report through

the state where located.

Vermont Unclaimed Property Reporting Manual

Holder Reporting Manual: Holder Reimbursement February 2021 Page 22

HOLDER REIMBURSEMENT

When the holder directly repays the owner after submitting a report that included his/her

property – or when the holder uncovers items erroneously included within a report – the holder

can obtain repayment by submitting a completed Holder Request for Reimbursement form.

Holders can obtain this form directly from the Unclaimed Property Web site.

In addition to the notarized certification, holders must include supporting evidence

substantiating payment to owner: e.g., copy of canceled check(s) – front and back – or

proof of account reactivation, etc.

Vermont Unclaimed Property Reporting Manual

Holder Reporting Manual: Voluntary Compliance Program February 2021 Page 23

VOLUNTARY COMPLIANCE PROGRAM

Vermont requires every business entity to report unclaimed property annually to the state.

To encourage compliance with Vermont unclaimed property laws, the State Treasurer Office

implemented its Voluntary Compliance Program. Available to those holders unaware of their

legal obligation to report – or that have failed to comply with the Vermont Unclaimed Property

Law – the VCP enables them to report unclaimed property liabilities without assessment of any

penalties and interest.

VCP Eligibility

Holders who meet the above requirements are eligible to file a Voluntary Compliance

Agreement, except when the holder

▪ is currently under an Unclaimed Property examination;

▪ has been notified by the State Treasurer Office – or by a third party on behalf of the

State Treasurer Office – of the intent to conduct an unclaimed property audit (includes

all subsidiaries and related parties).

VCP Look-Back Period

Review books and records dating back 10 years; file a report encompassing those and all

subsequent report years. When/if records are unavailable for the full 10-year period, use an

extrapolation and statistical sampling methodology for the missing years. NOTE: Payment to the

State of Vermont for all unclaimed property due for those years must accompany holder

reports.

Records Unavailable for the Look-back Period

Lacking records does not relieve the obligation to report under VSA 27, Chapter 18. When

data are unavailable to complete the full look-back period, use extrapolation and statistical

sampling for those years. Provide the basis for the extrapolation as part of your report;

however, you may be required to submit additional details after a state review of the report.

Vermont statutes mandate no specific formula for calculating estimates and performing

extrapolations. One simple way to estimate – when the company or organization has

remained the same size for the past 10 years – is to average the amount of unclaimed

property for which records exist; apply that average to the years without records.

Contact your accountant for other extrapolation methods.

Vermont Unclaimed Property Reporting Manual

Holder Reporting Manual: Voluntary Compliance Program February 2021 Page 24

Program Duration

Under the VCP, holders are allowed six months to complete the book review, perform due

diligence and file the report. The six-month period starts from the date the state Division of

Unclaimed Property approves and signs the Voluntary Compliance Agreement.

Examination Provision

The State of Vermont reserves the right to audit a Holder issued a Voluntary Compliance

Agreement. When the determination has been made that the property reported under a VCA

is materially under-reported, interest and penalties on all unclaimed property due for all

reporting years may be assessed pursuant to V.S.A. Chapter 18 of the Vermont Unclaimed

Property Law.

VCP Participation

To participate in the Voluntary Compliance Program, interested holders must request the

Voluntary Compliance Agreement by postal mail, fax or email.

Vermont State Office of the Treasurer

Unclaimed Property Division

109 State Street, 4

th

Floor

Montpelier, VT 05609-6200

Fax: 802-828-2884

E-mail: tre.upcompliance@vermont.gov

VCP Terms and Conditions

1. The Voluntary Compliance Agreement may not be altered without written consent of

the State.

2. The “Original” completed and executed Voluntary Compliance Agreement must be

returned with the completed business questionnaire to the Vermont Unclaimed Property

Division.

3. The State of Vermont reserves the right to audit a holder of a Voluntary Compliance

Agreement after the holder has filed their report and paid over property under the

Voluntary Compliance Agreement.

4. The State of Vermont reserves the right to deny or void the Voluntary Compliance

Agreement if a holder does not adhere to the Program policies and procedures.

Vermont Compliance Program Process

1.

A “holder” (company, business, government agency or an association, organization,

etc.) submits a request to participate in the Vermont Voluntary Compliance Program

either through US Postal Service or e-mail (tre.upcompliance@vermont.gov) to the State

of Vermont Office of the Treasurer, Unclaimed Property Division.

Vermont Unclaimed Property Reporting Manual

Holder Reporting Manual: Voluntary Compliance Program February 2021 Page 25

The request must contain the following:

• Business Name

o Type of business

o Primary location address

• Mailing Address

• List of All Subsidiaries (and all related entities) also to be Considered for the VCP

• Federal Employer Identification Number for Each Entity Requesting Participation in the VCP

• VCP Business Contact

o Name

o Title

o Phone number

o E-mail

2.

The Unclaimed Property Division reviews the request.

3.

The UPD confirms eligibility for holder participation in the Voluntary Compliance

Program and sends the Voluntary Compliance Agreement and General Business

Questionnaire to the designated authorized contact. (If eligibility is denied, a letter

advising of such is mailed to the contact.)

4.

The contact ensures the agreement and questionnaire are completed then signed by

an authorized officer, partner or another designated representative.

5.

Holder returns completed Agreement and General Business Questionnaire to the UPD.

6.

The UPD examines the agreement and business questionnaire.

a. If approved, the agreement is signed by an authorized representative of UPD.

b. UPD sends the special VCA Unclaimed Property Annual Compliance Report

Coversheet and Verification Checklist containing the report due date at the top.

7.

The holder completes the requisite review of books, due diligence mailings and the

unclaimed property report.

8.

Holder returns the report with the completed VCA Unclaimed Property Annual

Compliance Report Cover Sheet and Verification Checklist by the indicated due date

to avoid assessment of any penalties and interest.

Vital VCP Points

• Never alter the Voluntary Compliance Agreement without written consent of the State.

• Return the original Voluntary Compliance Agreement signed by an agent along with

the completed business questionnaire to the Vermont UPD.

• Note that the State of Vermont reserves the right to:

o assess interest on any liability reported under the Voluntary Compliance

Agreement when the Agreement has not been received – or an extension has

not been requested and granted – within the allotted six-month period.

o audit a VCP holder after receiving its report and remittance for property covered

under the Voluntary Compliance Agreement.

o deny or void the Voluntary Compliance Agreement should a holder fail to

adhere to the VCP policies and procedures.

Vermont Unclaimed Property Reporting Manual

Holder Reporting Manual: Glossary February 2021 Page 26

Glossary

Below are some frequently used words and terms relative to unclaimed property.

TERM

DEFINITION

ACTIVITY

action taken on property by the owner, e.g., deposits, withdrawals, and

correspondence to the holder; excludes automatic transfers, payments or charges

AGGREGATE

a group of related property types reported as a single line item; owner name and

address are not required when and if the property is valued at $25 or less and

reported as an aggregate

CLAIMANT

a person who believes he/she is legally entitled to unclaimed property; a claimant is

not necessarily the original property owner and can be an heir or someone with a

legal right to claim the property on behalf of the owner(s)

CUSTODIAN

an individual or entity holding property for the benefit and care of the rightful owner

until it is returned to him/her; the Vermont State Treasurer acts as custodian for all

unclaimed property reported to the state

CUT-OFF DATE

date defined by Unclaimed Property Law for determining when property dormancy

thresholds are reached

DOMICILE

the state of incorporation of a business/organization; the state of the principal

place of business of an unincorporated person

DORMANCY PERIOD

time period in which a property owner takes no action on his or her property

DUE DILIGENCE

effort undertaken by a holder to find the rightful owner of unclaimed property

before reporting property to the state

ESCHEAT

a transfer of property to the state for custodial purposes on behalf of rightful

owner(s) – in perpetuity in Vermont

HOLDER

a person obligated to hold for the account of, or deliver or pay to, the owner

property that is the subject of VSA 27 Chapter 18

INCIDENTAL PROPERTY

10 or fewer properties totaling $1,000 or less

INDEMNIFICATION

an agreement that protects a party from loss by transferring responsibility to a third

party

INTANGIBLE PROPERTY

property that represents or is negotiable to cash, e.g., a stock certificate

representing ownership interest in a company or a savings bond with an obligation

to pay a certain amount; both are convertible to cash and represent cash values

LAST ACTIVITY DATE

date of last owner-generated activity or of last documented contact with property

owner; e.g., check issuance date or date of last bank account deposit/withdrawal

LAST KNOWN ADDRESS

location of property owner sufficient for delivery of USPS and other mail

LAWFUL CHARGES

charges specifically authorized either by statute – other than state unclaimed

property laws – or by a valid, enforceable contract and imposed by a holder

against property in its possession

Vermont Unclaimed Property Reporting Manual

Holder Reporting Manual: Glossary February 2021 Page 27

TERM

DEFINITION

NAUPA

National Association of Unclaimed Property Administrators, the official

representative of the state unclaimed property programs, NAUPA is recognized as

the foremost authority on unclaimed property and the affirmed leader of the

coalition of states, administrators and holders working together to reunite rightful

owners with lost or abandoned assets. Members represent all states, the District of

Columbia, the Commonwealth of Puerto Rico, U.S. Virgin Islands, several Canadian

provinces, and Kenya. NAUPA is a network of the National Association of State

Treasurers (NAST)

OWNER

the person having legal or equitable claim to unclaimed property (see “person”)

PERSON

individual or business association, governmental or other public agency,

corporation or authority, estate, trust, two or more persons having a joint or

common interest; any other legal or commercial entity

RECIPROCITY

an agreement of understanding between states whereby each agrees to

exchange information and collect unclaimed property for the other state

REPORT

forms and/or all related documents filed by the holder and listing items of

escheated property and applicable owner information as required by state

Unclaimed Property Statutes

TANGIBLE PERSONAL

PROPERTY

personal property presented by itself, e.g., contents of a safety deposit box such as

coins, jewelry, personal papers

UNCLAIMED PROPERTY

tangible or intangible property unpaid or undelivered to the rightful owner during

the legally specified time period

UNDERLYING SHARES

duplicate shares of stock issued by a business association, banking, or financial

organization: original certificate of these shares is in possession of shareholders who

have failed either to cash the dividends checks or to correspond with issuing

corporation

Vermont Unclaimed Property Reporting Manual

Holder Reporting Manual: Reference Tables February 2021 Page 28

Tables

The following tables contain NAUPA codes property types, owner relationships and safe

deposit box contents.

Table #1 – NAUPA Property Types and Codes

NOTE: Report property held by a court, government or governmental subdivision, agency

or instrumentality under the applicable property type using one-year dormancy. For

instance: report vendor checks from a municipality as CK13.

NAUPA PROPERTY TYPES WITH DORMANCY PERIODS

PROPERTY

CATEGORIES

CODE

DORMANCY

PERIOD

PROPERTY TYPE

Account Balances Due

AC01

3

Checking Accounts

AC02

3

Savings Accounts

AC03

3

Matured Certificates of Deposit or Savings Certificates

AC04

3

Christmas Club Accounts

AC05

3

Money on Deposit to Secure Funds

AC06

3

Security Deposits

AC07

3

Unidentified Deposits

AC08

3

Suspense Accounts

AC09

3

401 Accounts

AC99

3

Aggregate Account Balances Due

Court Deposits

CT01

1

Escrow Funds

CT02

1

Condemnation Awards

CT03

1

Missing Heirs' Funds

CT04

1

Suspense Accounts

CT05

1

Bail or Deposits Made with a Court or Public Authority

CT06

3

Victim’s Restitution

CT99

1

Aggregate Court Deposits

Educational

Savings

Accounts

CS01

3

Cash

CS02

3

Mutual Funds

CS03

3

Securities

CS04

3

Miscellaneous

Vermont Unclaimed Property Reporting Manual

Holder Reporting Manual: Reference Tables February 2021 Page 29

NAUPA PROPERTY TYPES WITH DORMANCY PERIODS

PROPERTY

CATEGORIES

CODE

DORMANCY

PERIOD

PROPERTY TYPE

Heal

th

Savings

Plans

HS01

3

Health Savings Account

HS02

3

Health Savings Account Investment

Insurance

* Person Outlives Policy Term

IN01

3

Individual Policy Benefits or Claim Payments

IN02

3

Group Policy Benefits or Claim Payments

IN03

3

Death Benefits Due Beneficiaries

IN04

3

Proceeds from Matured Policies / Endowments / Annuities

/ Limited Age *

IN05

3

Premium Refunds on Individual Policies

IN06

3

Unidentified Remittances

IN07

3

Other Amounts Due Under Policy Terms

IN08

3

Agent Credit Balances

IN10

2

Demutualization Funds

IN99

3

Aggregate Insurance Property

IRAS

Traditional IRA

, SEP IRA,

SARSEP IRA & Simple IRA

IR01

3

Cash

IR02

3

Mutual Funds

IR03

3

Securities

IR04

3

Miscellaneous

ROTH IRA

IR05

3

Cash

IR06

3

Mutual Funds

IR07

3

Securities

IR08

3

Miscellaneous

Mineral

Proceeds

MI01

3

Net Revenue Interests

MI02

3

Royalties

MI03

3

Overriding Royalties

MI04

3

Production Payments

MI05

3

Working Interests

MI06

3

Bonuses

MI07

3

Delay Rentals

MI08

3

Shut-in Royalties

MI09

3

Minimum Royalties

Vermont Unclaimed Property Reporting Manual

Holder Reporting Manual: Reference Tables February 2021 Page 30

NAUPA PROPERTY TYPES WITH DORMANCY PERIODS

PROPERTY

CATEGORIES

CODE

DORMANCY

PERIOD

PROPERTY TYPE

Miscellaneous Intangible Property

MS01

1

Wages, Payroll, Salary or other compensation for personal

services, including Commissions

MS02

3

Commissions, other than for personal services

MS03

3

Worker's Compensation Benefits

MS04

3

Payment for Goods and Services

MS05

3

Customer Overpayments

MS06

3

Unidentified Remittances

MS07

3

Un-refunded Overcharge

MS08

3

Accounts Payable

MS09

3

Credit Balances/Accounts Receivable

MS10

3

Discounts Due

MS11

3

Refunds Due

MS12

3

Unredeemed Gift Certificates (Prior to 7/1/2006)

MS13

3

Unclaimed Loan Collateral – Paid in Full/Charge-off

MS14

3

Sums Payable under Pension/Profit Sharing Plans

MS15

1

Property Distributable as Result of Dissolution

MS16

3

Miscellaneous Outstanding Checks

MS17

3

Miscellaneous Intangible Personal Property

MS18

3

Suspense Liabilities

MS99

3

Aggregate Miscellaneous Property

Other

VT01

3

Cash Assets

VT02

3

Miscellaneous

VT03

3

Revenue

Securities

SC01

3

Dividends

SC02

3

Interest Payable on Registered Bonds

SC03

3

Principle Bond Payments

SC04

3

Equity Payments

SC05

3

Profits

SC06

3

Funds Paid Toward Purchase Shares/Interest in Financial

SC07

3

Bearer Bond Interest and Matured Principal

SC08

3

Shares of Stock (Returned by Post Office)

SC09

3

Cash for Fractional Shares

SC10

3

Un-exchanged Stock of Successor Corporation

SC11

3

Any Other Certificates of Ownership

SC12

3

Underlying Shares/Outstanding Certificates of Owners

SC13

3

Liquidated/Redemption, Un-surrendered Stocks/Bonds

SC14

3

Debentures

SC15

3

U.S. Government Securities

SC16

3

Mutual Funds

SC17

3

Warrants

SC18

3

Matured Principal on Registered Bonds

SC19

3

Dividend Reinvestment Plans

SC20

3

Credit Balances – Security Notes

SC21

3

Cash in Lieu of Stock

Vermont Unclaimed Property Reporting Manual

Holder Reporting Manual: Reference Tables February 2021 Page 31

NAUPA PROPERTY TYPES WITH DORMANCY PERIODS

PROPERTY

CATEGORIES

CODE

DORMANCY

PERIOD

PROPERTY TYPE

SC22

3

Stock Split

SC50

3

Bonds

SC99

3

Aggregate Securities - Related Cash

Tangible

Property

SD01

5

Safe Deposit Box Contents

SD02

5

Other Safekeeping Items

SD03

3

Other Tangible Property

Trust,

Investment

&

Escrow Accounts

TR01

3

Paying Agent Accounts

TR02

3

Undelivered Dividends or Uncashed Dividends

TR03

3

Funds Held in a Fiduciary Capacity

TR04

3

Escrow Accounts

TR05

3

Trust Vouchers

TR99

3

Aggregate Trust Property

Uncashed Checks

CK01

3

Cashier's Checks

CK02

3

Certified Checks

CK03

3

Registered Checks

CK04

3

Treasurer's Check

CK05

3

Drafts

CK06

3

Warrants

CK07

7

Money Orders

CK08

15

Traveler's Checks

CK09

3

Foreign Exchange Checks

CK10

3

Expense Checks

CK11

3

Pension Checks

CK12

3

Credit Checks or Memos

CK13

3

Vendor Checks

CK14

3

Any Checks Written Off to Income/Surplus

CK15

3

Outstanding Official Checks or Exchange Items

CK16

3

CD Interest Checks

CK17

3

Bank Money Orders

CK99

3

Aggregate Uncashed Checks

Utilities

UT01

3

Utility Deposits

UT02

3

Membership Fees

UT03

3

Rebates

UT04

3

Capital Credit Distributions

UT99

3

Aggregate Utility Property

Vermont Unclaimed Property Reporting Manual

Holder Reporting Manual: Reference Tables February 2021 Page 32

Table #2 – NAUPA Owner Relationship Codes Table #3 – NAUPA Owner Type Codes

Table #4 –Tangible Property Codes

Table #5 – Deductions/Withholdings

CODE

OWNER TYPE

AG

Aggregate

BU

Business/Corporation

FD

Federal, US Government

IN

Individual

NP

Not Published

UN

Unknown

VT

Vermont Agency

CODE

OWNER RELATIONSHIP

AD

Administrator

AF

Attorney For

AG

Agent For

AN

And

AO

And/Or

AS

As Trustee For

BF

Beneficiary

CC

Co-Conservator

CF

Custodian For

CN

Conservator

ES

Estate Of

EX

Executor or Executrix

FB

For Benefit Of

GR

Guardian For

HR

Heirs

IN

Insured

IT

In Trust For

JC

Joint Tenants (In Common)

JT

Joint Tenants (Survivorship)

OR

Or

PA

Payee

PO

Power of Attorney

PR

Personal Representative

RE

Remitter

SO

Sole Owner

TE

As Trustee For

UG

Uniform Gift Minors Act

UN

Unknown

CODE

SAFE DEPOSIT BOX

BOND

Savings Bonds & Others

CNS

Coins

CURR

Currency

DOC

Paper Documents

JEWL

Jewelry

MISC

Miscellaneous Other

Tangible Property

STMP

Stamps

WEAP

Weapons (various)

WILL

Signed Wills

CODE

DEDUCTION/WITHHOLDING

DW

Dividends Withheld or

Discontinued

IW

Interest Withheld or

Discontinued

MC

Mailing Cost

SW

Service Charge

TW

Income Tax Withheld

ZZ

Deduction Code Not

Identified Above

Vermont Unclaimed Property Reporting Manual

Holder Reporting Manual: Contact Information February 2021 Page 33

Contact Information

Web Site:

Office of the Treasurer of the State of Vermont – www.vermonttreasurer.gov

Unclaimed Property Division – www.vermonttreasurer.gov/unclaimed-property

Vermont Holder Reporting Website – https://vermontholder.unclaimedproperty.com/

E-mail:

Office of the State Treasurer – treasurers.office@vermont.gov

Unclaimed Property – unclaimed.property@vermont.gov (public)

Unclaimed Property – tre.upcompliance@vermont.gov (holders)

Phone & Fax:

Office of the State Treasurer – 802/828-2301

Unclaimed Property Division – 802/828-2047 (or toll-free in Vermont only - 800/642-3191)

Unclaimed Property Division Fax – 802/828-2884

Location and Mailing Address:

State of Vermont Office of the Treasurer

Unclaimed Property Division

109 State Street, Fourth Floor

Montpelier, Vermont 05609-6200

Vermont Unclaimed Property Reporting Manual

Holder Reporting Manual: Reporting Dates & Periods February 2021 Page 34

Important Dates

May 1 – Date Vermont Unclaimed Property Holder Reports and Remittances are due – or

postmarked by – for the previous calendar year*

See Table 1 - NAUPA Property Types and Codes for dormancy periods by property reported.

* When May 1 occurs on a weekend or holiday, reports are due the first following workday.

HOLDER TYPE

PROPERTY TYPE

DORMANCY

PERIOD

LAST ACTIVITY

DATE

REPORTING

PERIOD

REPORT &

REMIT DUE

All Holders

Wages

1 year

01/01/19 -

12/31/19

01/01/20 –

12/31/20

05/01/2021

Courts,

Governments,

Governmental

subdivisions

Any amounts

payable or

distributable

1 year

01/01/19 -

12/31/19

Corporations

Stocks, Dividends,

Vendor Checks,

Credit Memos,

Pensions, etc.

3 years

01/01/17 –

12/31/17

Banks &

Financial

Institutions

Dormant Accounts,

Uncashed

Checks

3 years

01/01/17 –

12/31/17

Banks

Safe Deposit Boxes

5 years

01/01/15 –

12/31/15

All Holders

Money Orders

7 years

01/01/13 –

12/31/13

Traveler’s Check

15 years

01/01/05 –

12/31/05

Dormancy Periods

Dormancy refers to the period during which the owner of the property takes no action on his/her

property. Property types may be grouped by dormancy periods into the following categories:

1 YEAR

Wages/Payroll; Properties Reported by Court or Governmental Entities; Property Distributable

in Dissolution

2 YEARS

Demutualization Proceeds

3 YEARS

All Other Property Types (includes Bank Money Orders)

5 YEARS

Safe Deposit Box Contents

7 YEARS

Money Orders

15 YEARS

Traveler’s Checks

Vermont Unclaimed Property Reporting Manual

Holder Reporting Manual: Reporting Dates & Periods February 2021 Page 35

PROPERTY SUBJECT TO REPORTING (VCA 10 YEAR PERIOD)

ITEMS THAT WERE ISSUED OR HAD A LAST ACTIVITY DATE DURING

1/1/2001 thru 12/31/2010 May 1, 2011

1/1/2002 thru 12/31/2011 May 1, 2012

1/1/2003 thru 12/31/2012 May 1, 2013

1/1/2004 thru 12/31/2013 May 1, 2014

1/1/2005 thru 12/31/2014 May 1, 2015

1/1/2006 thru 12/31/2015 May 1, 2016

1/1/2007 thru 12/31/2016 May 1, 2017

1/1/2008 thru 12/31/2017 May 1, 2018

1/1/2009 thru 12/31/2018 May 1, 2019

1/1/2010 thru 12/31/2019 May 1, 2020

1/1/2011 thru 12/31/2020 May 1, 2021

1/1/2012 thru 12/31/2021 May 1, 2022

1/1/2013 thru 12/31/2022 May 1, 2023

1/1/2014 thru 12/31/2023 May 1, 2024

WAGES - ONE YEAR DORMANCY PERIOD

ITEMS THAT WERE ISSUED OR HAD A LAST ACTIVITY DATE DURING

1/1/2001 thru 12/31/2010 May 1, 2012

1/1/2002 thru 12/31/2011 May 1, 2013

1/1/2003 thru 12/31/2012 May 1, 2014

1/1/2005 thru 12/31/2014 May 1, 2015

1/1/2005 thru 12/31/2014 May 1, 2016

1/1/2006 thru 12/31/2015 May 1, 2017

1/1/2007 thru 12/31/2016 May 1, 2018

1/1/2008 thru 12/31/2017 May 1, 2019

1/1/2009 thru 12/31/2018 May 1, 2020

1/1/2011 thru 12/31/2020 May 1, 2021

1/1/2011 thru 12/31/2020 May 1, 2022

1/1/2012 thru 12/31/2021 May 1, 2023

1/1/2013 thru 12/31/2022 May 1, 2024

MOST PROPERTY - 3 YEAR DORMANCY PERIOD

ITEMS THAT WERE ISSUED OR HAD A LAST ACTIVITY DATE DURING

1/1/2001 thru 12/31/2010 May 1, 2014

1/1/2005 thru 12/31/2014 May 1, 2015

1/1/2003 thru 12/31/2012 May 1, 2016

1/1/2004 thru 12/31/2013 May 1, 2017

1/1/2005 thru 12/31/2014 May 1, 2018

1/1/2006 thru 12/31/2015 May 1, 2019

1/1/2007 thru 12/31/2016 May 1, 2020

1/1/2011 thru 12/31/2020 May 1, 2021

1/1/2009 thru 12/31/2018 May 1, 2022

1/1/2010 thru 12/31/2019 May 1, 2023

1/1/2011 thru 12/31/2020 May 1, 2024

UNCLAIMED PROPERTY REPORTING SCHEDULE

REPORT BY

REPORT BY

REPORT BY

Current Yr Reporting

Current Yr Reporting

Current Yr Reporting