2007

SAMSUNG

ELECTRONICS

ANNUAL

REPORT

j^_da_d]WXekjoek

Yedj[dji

2007 financial highlights

01

performance summary by business

02

message from the CEO

04

message from the board

08

at-a-glance

10

j^_da_d]W^[WZe\oek

global performance

14

j^_da_d]^_]^[h\ehoek

brand marketing

22

sponsorship

24

R&D

26

product gallery

27

design

31

j^_da_d]icWhj[h\ehoek

digital media

34

telecommunication networks

38

digital appliance

42

semiconductor

46

LCD

50

j^_da_d]ceh[e\oek

corporate citizenship

56

co-prosperity

58

green management

60

financial statements

63

investor information

130

global network

131

01

I7CIKD=;B;9JHED?9I

7DDK7BH;FEHJ(&&-

SAMSUNG ELECTRONICS AND CONSOLIDATED SUBSIDIARIES

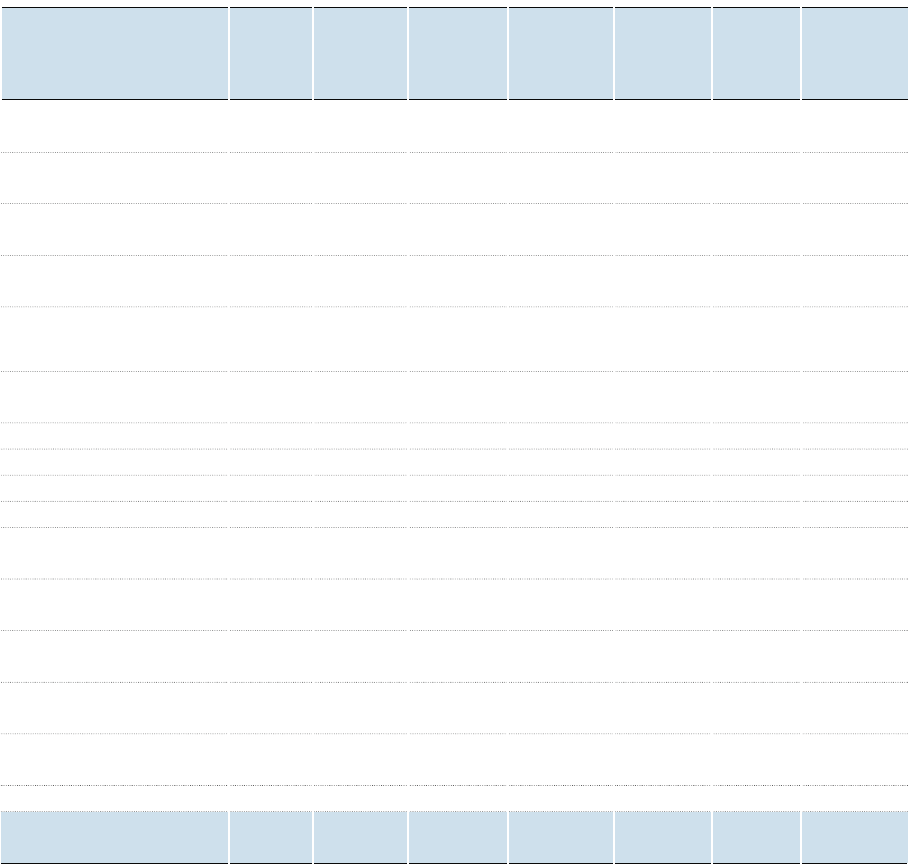

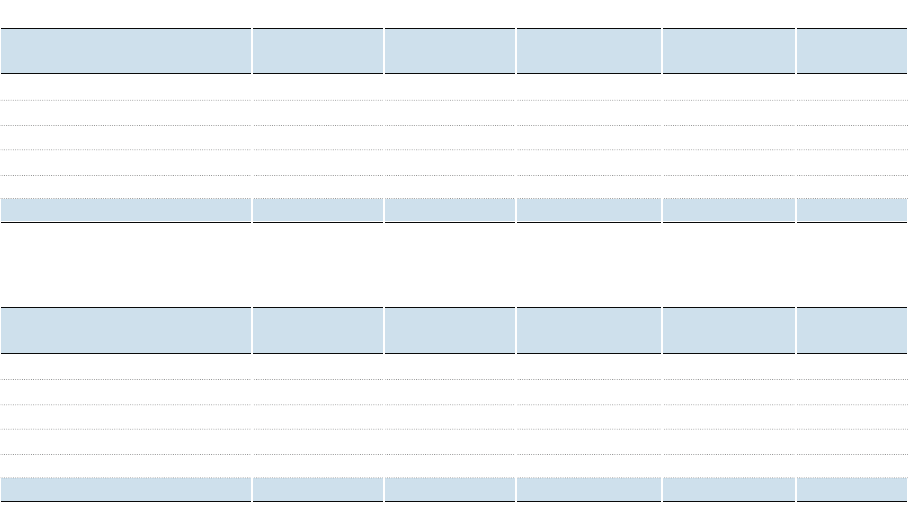

2007 FINANCIAL HIGHLIGHTS

Sales

Operating Profit

SALES AND OPERATING PROFIT

[

in trillions of KRW

]

80.6

7.6

2005

85.4

9.0

2006

98.5

9.0

2007 2005

13.3

-9.0

-11.1

15.1

2006

-12.0

14.8

2007

Cash Flow from Operating Activities

Cash Flow from Investing Activities

CASH FLOWS

[

in trillions of KRW

]

[

in billions of KRW

]

Income Statement

80,630 85,426 98,508

7,575 9,008 8,973

7,640 7,926 7,421

Balance Sheet

74,462 81,3 66 93,375

32,854 33,426 37,403

41,607 47,940 55,972

Cash Flows

13,329 15,081 14,791

(

9,046

)

(

11,0 98

)

(

12,002

)

(

3,266

)

(

3,889

)

(

1,600

)

2005 2006 2007

Please Read the Following Cautionary Statement Regarding Forward-looking Statements:

This annual report includes “forward-looking statements” which relate to future events, and can be generally identified by phrases containing words

such as “believes,” “expects,” “anticipates,” “foresees,” “forecasts,” “estimates,” or other words or phrases of similar meaning. These forward-

looking statements are not guarantees of future performance and may involve known and unknown risks, uncertainties and other factors that may

affect Samsung Electronics Co., Ltd.

(

SEC

)

’s actual results, performance, achievements or financial position, making them materially different

from the actual future results, performance, achievements or financial position expressed or implied by these forward-looking statements. Likewise,

statements relating to behavior of financial and consumer electronics markets, fluctuations in interest and exchange rates or commercial and

consumer credit environments, changes in regulation and regulatory and legal actions, future integration or acquisition of businesses are forward-

looking statements. Therefore, you should treat all future statements containing such aforementioned information as forward-looking statements.

Please understand that although SEC has been careful to ensure the accuracy of the contents of this annual report, the statements within are subject to a number of risks,

uncertainties, and assumptions, any of which could cause actual results to materially differ from the plans, objectives, expectations, estimates, and intentions expressed in this

annual report as described above. Therefore, SEC and any of its subsidiaries, affiliates, directors, officers, agents, or employees assume no liability caused by these forward-

looking statements, and shall not be liable to any third party, including investors, for any damages resulting from an investment or business decision based on the information

contained in forward-looking statements of this annual report. All risks in making an investment or business decision based on the information contained in the forward-looking

statements shall be entirely assumed by you.

All the financial data in this report comes from the consolidated financial statements.

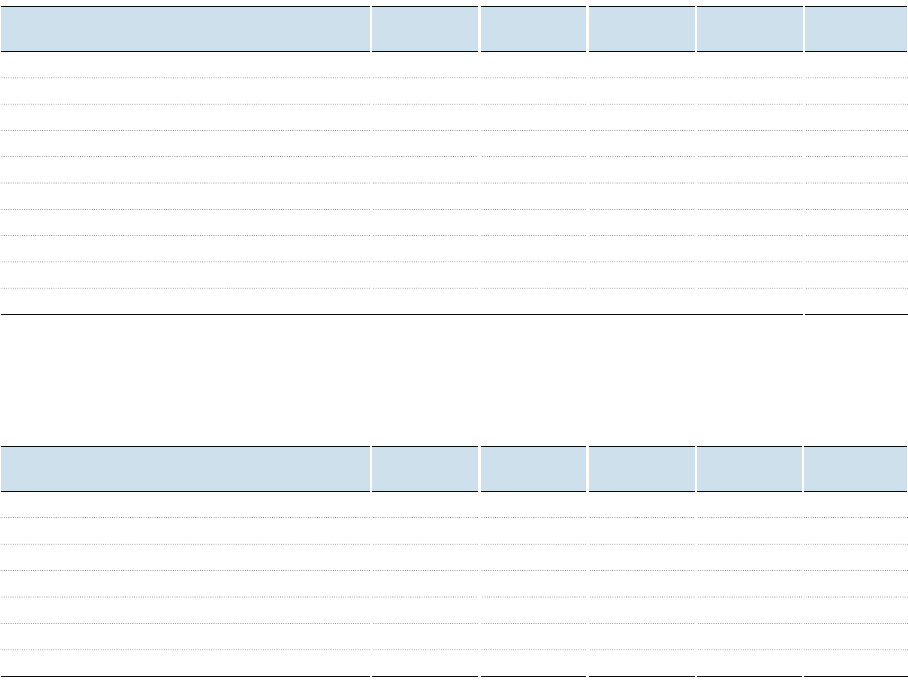

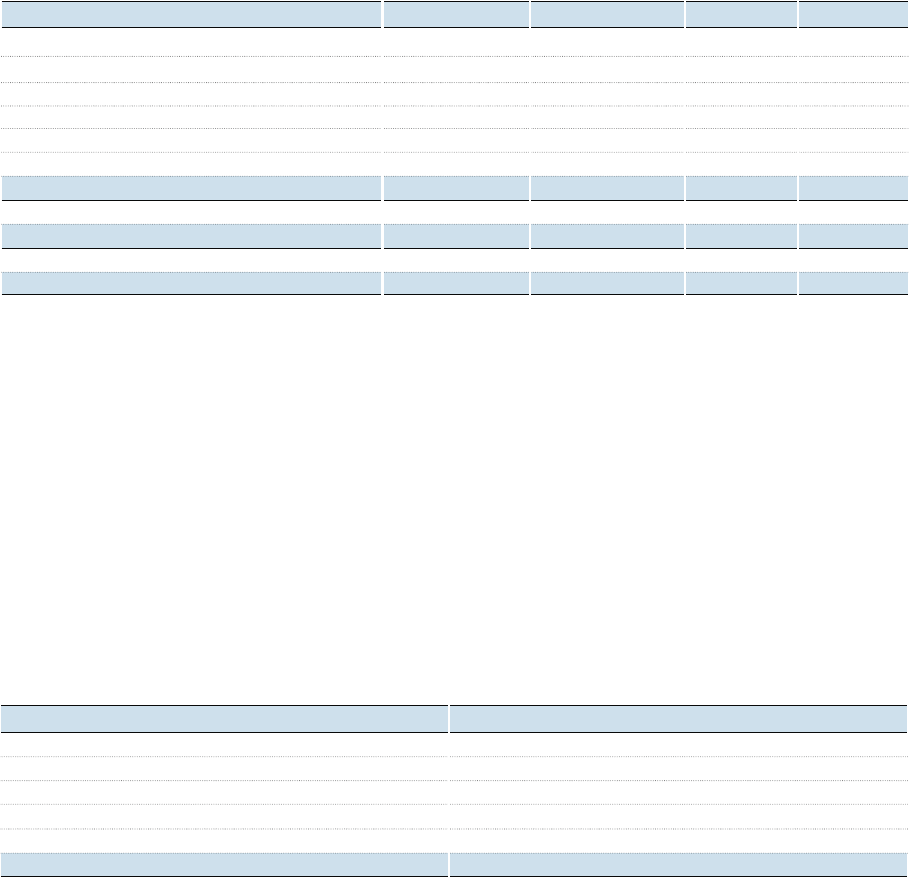

Net Sales and Operating Profit

Digital Media

2005 2006 2007

Net sales 17,656,558 20,774,962 26,513,285

Operating profit

(

loss

)

247,700 744,178 1,061,601

[

in millions of KRW

]

2005 2006 2007

Net sales 20,914,815 20,249,759 23,767,268

Operating profit

(

loss

)

2,480,001 1,937,747 2,756,586

[

in millions of KRW

]

2005 2006 2007

Net sales 5,617,708 5,538,837 6,854,578

Operating profit

(

loss

)

(

29,102

)

(

71,213

)

159,835

[

in millions of KRW

]

2005 2006 2007

Net sales 20,332,235 22,827,624 22,331,501

Operating profit

(

loss

)

5,410,677 5,129,845 2,347,239

[

in millions of KRW

]

2005 2006 2007

Net sales 8,715,225 13,912,968 17,062,523

Operating profit

(

loss

)

598,773 857,180 2,115,629

[

in millions of KRW

]

Telecommunication

Networks

Digital Appliance

Semiconductor

LCD

Net sales Operating profit

(

loss

)

PERFORMANCE SUMMARY BY BUSINESS

[

in trillions of KRW

]

0.2

17.7

2005

0.7

20.8

2006

26.5

1.06

2007

[

in trillions of KRW

]

2.5

20.9

2005

1.9

20.2

2006

23.8

2.76

2007

[

in trillions of KRW

]

-0.03

5.6

2005

-0.07

5.5

2006

6.9

0.15

2007

[

in trillions of KRW

]

5.4

20.3

2005

5.1

22.8

2006

22.3

2.35

2007

[

in trillions of KRW

]

0.6

8.7

2005

0.9

13.9

2006

17.0

2.11

2007

03

I7CIKD=;B;9JHED?9I

7DDK7BH;FEHJ(&&-

Our Digital Media business leads the world’s digital media market by producing

a wide range of products including digital TVs, monitors, audio-visual devices,

printers and PCs. We hold the largest market share in flat-panel TVs and PC

monitors. Our innovative product lineup includes ‘Touch of Color’ TVs, all-in-one

color laser printers including the world’s smallest, and a 4th-generation Blu-ray

disc player. In May 2008, we reorganized our Digital Media unit to produce

greater business synergy and enhance our overall performance. We integrated

our Digital Appliance unit into our Digital Media operations and transferred our

PC, MP3 player and set-top box businesses to our Telecommunications Net-

work business.

In 2007, we achieved record-breaking business performance, boosted by high

growth in the flat panel TV market and a steady increase in the sale of our core

products, such as LCD monitors, digital audio-visual products, laser printers

and notebook PCs. The strength of our market leadership position in TVs

helped us to maintain the No. 1 market share position across all TV market seg-

ments, from conventional TVs to flat panel and LCD TVs. We also ranked first in

market share for monitors in 2007, widening our lead over our competitors. Our

printer business also showed enhanced market leadership by holding the No. 1

position in all-in-one mono laser printers and the No. 2 position in color laser

printers.

Description of Business 2007 Highlights

Our Telecommunication Network business leads the world’s telecommunications

industry with the widest range of mobile phones on the market today, such as

3G and multimedia phones, in addition to telecommunication systems. A premium

brand image and distinctive product designs have elevated Samsung very high

among the leaders of the world market.

We have also led the standardization of next-generation mobile phone technolo-

gies such as Mobile WiMAX and HSDPA. Through a business reorganization

completed in May 2008, we integrated our PC and MP3 player businesses into

our Telecommunication Network business to enhance our competitive edge in

digital convergence solutions.

In 2007, we achieved record-breaking sales of 160 million mobile phone units,

securing the second largest share of the global market. This achievement can be

attributed to the continued success of our very popular Ultra Edition series

and our wide range of premium phones, as well as aggressive expansion into

emerging markets. Our operating profit also registered a steady performance

gain, showing a two-digit rate of revenue increase. In addition, Samsung’s

Mobile WiMAX technology for broadband mobile services was adopted as

the 3G global standard to pave the way for further market expansion worldwide.

Our Digital Appliance business creates premium home appliances that meet the

needs of consumers and help to make Samsung an undisputed market leader.

Building on distinctive designs and innovative technologies, we continue to

develop new types of added-value products to offer our customers. Our lineup

of world-leading premium products include refrigerators, air conditioners, wash-

ers, ovens, vacuum cleaners and other appliances that are ubiquitous in today’s

households. Under a company-wide reorganization plan implemented in May

2008, our Digital Appliance business was folded into our new Digital Media

business to leverage its competitive edge.

Building on the world’s most innovative technology and product designs, we

made significant progress at the high end of the appliance market in 2007. Our

product lines were enhanced through such innovative products as our drum

washing machine with Vibration Reduction Technology

™

, providing the lowest

noise and vibration levels in the industry, our highly efficient system air condi-

tioners and our side-by-side refrigerator with twin-cooling systems. Such inno-

vations helped us achieve a 24% increase in sales over 2006, and build a firmer

foundation from which to lead the world’s home appliance market.

Our LCD business produces panels for TVs, digital information displays, note-

book PCs and desktop monitors, as well as various display panels for mobile prod-

ucts. By investing in next-generation production facilities, we have remained the

world’s top LCD producer for the past six years. Our position is particularly

dominant in the segment of LCD TVs 40 inches and larger. We also are expand-

ing our premium product lineup for the multimedia and digital broadcasting

environments, while focusing on new businesses such as next-generation

displays and thin film solar cells.

With the help of price increases triggered by product shortages and our contin-

ued cost-reduction efforts, our LCD business showed outstanding results in

2007. Our sales and operating profits have increased dramatically, maintaining

the industry’s best profit rate. Successful commercialization of our 7th- and

8th-generation production lines also made us the unrivaled top producer of 46-

and 52-inch LCD TV panels, ensuring our leadership in the global LCD industry

for a sixth consecutive year. In ongoing efforts to enhance our leadership, we

also have begun mass producing the world’s first touch-screen-enabled LCD.

Our Semiconductor business consists of three major divisions: Memory, System

LSI and Storage. With the world’s most advanced technology, we are leading

the DRAM, SRAM, NAND Flash memory and MCP markets while pioneering

developments in next-generation Solid State Drives

(

SSDs

)

and fusion memories.

We also are building a strong base for our System LSI business to become one

of our next-generation growth engines and for the launch of several major new

products within our storage division.

Despite fierce competition and continued weakness in memory chip pricing,

Samsung’s Semiconductor Division continued to show steady growth and

increased profits, backed by strong customer relationships and successful

cost-reducing efforts. In 2007, Our performance remained solid with continued

market dominance in most areas of the memory business, including sales in

DRAM, SRAM, MCPs, flash memory and fusion memory devices. World-leading

introductions, such as 60 nanometer

(

nm

)

-class 2 Gigabit

(

Gb

)

DRAM, 30nm-

class 64Gb NAND Flash memory, 65nm digital TV receiver chips and the indus-

try’s fastest

(

6Gbps

)

512 Megabit

(

Mb

)

GDDR5 memory further enhanced our

leadership in core technologies.

By increasing management prowess

and embracing innovation at every opportunity,

Samsung Electronics will become one of the

most profitable and most revered global companies.

MESSAGE FROM THE CEO

05

I7CIKD=;B;9JHED?9I

7DDK7BH;FEHJ(&&-

We are determined to reach the highest echelon of global business leadership, even in the

face of today’s challenging global and domestic business conditions. Through our management’s

pursuit of innovative approaches, processes and product designs and accelerated

cost-reduction efforts, we achieved our highest-ever record for consolidated sales in 2007,

surpassing US$100 billion

(

KRW98 trillion

)

, and attaining a net profit of KRW7.4 trillion.

In 2008, we will continue to increase our competitiveness in key businesses, while

developing new markets and businesses and laying a firm foundation for sustainable growth

through the pursuit of greater operational efficiency. Moreover, by promoting innovative

management practices that optimize the speed, efficiency and creativity of our workforce,

we will generate additional value and establish ourselves as a true leader in the top tier

of the world’s electronics industry. In defining success, we are determined to transform ourselves

into one of the most respected, trusted and easily recognized global companies in the world.

Dear Customers, Business Partners and Shareholders:

I am extremely pleased to take this opportunity to discuss our 2007 achievements, as well as our future goals

and strategies. Samsung Electronics achieved its best ever business results in 2007, moving one step closer to

our dream of becoming one of only a handful of companies who are not only tremendously successful, but

also true global innovators. I would like to express my heartfelt gratitude to all of our customers, business

partners and shareholders who have supported us in accomplishing such excellent results.

2007 RESULTS AND ANALYSIS

We achieved our best-ever business results through a series of innovative management approaches

In 2007, at a time when the global economy was hampered by sharp increases in oil prices, as well as the

soaring cost of raw materials and unstable capital markets influenced by the U.S. subprime mortgage crisis.

Concurrently, the Korean economy continued to undergo difficulties caused by sluggish consumption, unstable

currency exchange rates and rising interest rates. Amidst these unfavorable business conditions, Samsung

Electronics achieved record-breaking consolidated sales of US$100 billion

(

KRW98 trillion

)

. We also achieved

solid earnings of KRW7.4 trillion in net profit thanks to an upward turn in profitability for our key strategic

businesses and steady progress in our efforts to diversify further.

Strengthening dominance in key strategic businesses

In 2007, our semiconductor business continued to yield substantial profits of over KRW2 trillion. This strong

showing was based on extensive cost reduction efforts, increased market differentiation in our areas of greatest

technological competence and concerted efforts to retain a stable customer base, despite aggravated conditions

in the memory market. Also, we maintained the highest profitability among LCD manufacturers around the

world by cutting production costs and improving production operations as favorable conditions continued to

support high LCD prices, further increasing our dominance in the large TV panel market. Meanwhile, in the

mobile phone segment, we launched a wide range of new products and have actively sought alternative markets,

thus achieving a sales increase of over 40 percent, compared to the previous year, allowing us to capture second

place in the global market. Our overall TV business has maintained its No. 1 position in global sales since

2006, widening the gap with our competition.

Reinforcing our core competence

Since 2004, when our company announced its vision of leaping into the top tier of global leadership, Samsung

Electronics has continued its unrelenting drive to differentiate the three main elements of our core competence:

human resources, technology and brand image. Last year, we focused on increasing our R&D workforce to

strengthen its future contribution to our company and, as a result, the number of R&D engineers reached 39,000.

Among them, 3200 hold PhDs, demonstrating that we have clearly elevated the degree of our R&D competence.

In addition, our brand value was said to have reached US$16.9 billion in the BusinessWeek/Interbrand survey

of “Best Global Brands,” as our aggressive marketing activities further enhanced the company’s brand.

2008 BUSINESS GOALS AND STRATEGIES

Maximizing business competitiveness and internalizing operational efficiency

This year, the instability of the global economy is expected to continue as financial markets absorb the impact of

the subprime mortgage crisis, oil prices rise further and the global economy slows down overall. The domestic

Korean market has been directly and indirectly influenced by these phenomena. Moreover, our business

environment has been beset with various new competitive challenges. Nevertheless, Samsung Electronics will

do its best to solidify its status as a top global company through its efforts to succeed in the face of adversity as

well as a seasoned understanding of the best ways to turn crisis into opportunity.

We will first increase our market dominance in such key businesses as memory chips, LCDs, mobile phones,

and flat panel TVs, building upon the unique design and operational efficiency of many leading-edge product

lines. We also will set the parameters for a successful incubation of promising growth engines that offer the

prospect of high added value in such segments as printers, System LSI, and Mobile WiMAX. To capitalize on

the rapid growth of emerging markets, we will develop locally customized products and implement a much

higher level of differentiated marketing. At the same time, we will generate more demand in new markets by

leveraging our competitive edge in digital electronics and by vigorously exploring new business areas that

enhance customer lifestyles. Furthermore, we will strengthen our means of collaboration with customers and

business partners and incorporate a more far-reaching managerial system that better address the needs and

demands of our customers, as well as the challenges of the overall marketplace.

REALIZING OUR VISION THROUGH INNOVATIVE MANAGEMENT TECHNIQUES

As part of our goal of becoming a true upper-echelon global leader, Samsung Electronics will concentrate on

further developing its innovative approaches to management with a focus on speed, efficiency and creativity,

and generating new values through the implementation of four key initiatives:

First, we will leverage the talents of our global workforce and revitalize our organizational culture

We will continue to secure and cultivate creative individuals throughout all fields of management so that their

ideas can positively influence change throughout our management structure.

07

I7CIKD=;B;9JHED?9I

7DDK7BH;FEHJ(&&-

Yoon-Woo Lee

Vice Chairman and Chief Executive Officer

Samsung Electronics Co., Ltd.

Second, we will explore new growth engines and reinforce our business structure

We will enhance our core businesses, which have been at the forefront of our determined move to achieve global

excellence, by upgrading our technologies and strengthening our market leadership, while concentrating a great

deal of attention on complimentary new businesses with high growth potential. In addition, we will continue to

explore, with a technologically skilled management team, new growth engines in other promising areas such as

advanced IT solutions and products, energy and the environment, and biotechnology and health.

Third, we will seize opportunities for future growth through a greater emphasis on market-focus from all

levels of management

We will strive to provide rewarding new experiences that enhance the lifestyles of our customers, while

leading markets in the developed world with the introduction of more innovative product offerings, greater

operational efficiencies and superior business models.

Lastly, we will continue our efforts to restructure a company respected and admired by people around the world

We will systematically implement our new management structure by emphasizing transparency, compliance

and greater sensitivity to customer needs, thereby fulfilling our social responsibilities as a company growing

hand-in-hand with shareholders, customers and business partners.

The ultimate goal of Samsung Electronics is to emerge as a global business leader of unparallel determination

and accomplishment, offering new values and a more prosperous future not only to our customers, shareholders

and regional communities, but also to humanity as a whole. All of us at Samsung Electronics stand together,

inseparably linked by a unified commitment to lead the growth of the global electronics industry as a truly

exemplary company, admired by customers worldwide. I would like to welcome the encouragement and

support of customers and shareholders alike in our tireless efforts to recreate ourselves into the most

promising model for becoming what I envision to be “the best of the best.”

SALES REVENUE BY DIVISION

[

AS OF THE END OF 2007

]

Digital Media

Telecommunication Networks

Digital Appliance / Others

Semiconductor

LCD

25% 23%

15%

21%

16%

Samsung Electronics has enthusiastically established a global standard of corporate governance, operating

within a structure whose focal point is the Board of Directors. This enables transparent and sound manage-

ment practices while encouraging creative and progressive entrepreneurship from our top management, which

maximizes shareholder and overall corporate value. We are also sustaining shareholder focused management

to ensure that our profitable earnings and corporate values benefit our shareholders.

In 2007, a record-breaking year for business performance, we returned about 40% of our net profits to share-

holders, paying out a dividend of KRW8,000 a share and buying back about KRW2 trillion of company stock.

We also organized our third Analyst Day to help our investors and shareholders better understand the core

competencies of each business division, as well as our efforts to enhance our corporate value on a mid- and

long-term basis.

Our brand value has been marked at US$16.9 billion in the BusinessWeek/Interbrand survey of “Best Global

Brands,” ranked 21st in the world in 2007, to consolidate our enhanced position worldwide. In addition, leading

business journals such as Finance Asia and Asset have rated Samsung again among the very best in terms of

investor relations and corporate governance.

In 2008, we will overcome any challenge to our concerted efforts to reinvent ourselves as a world leader. By

achieving outstanding business performance, we will also enhance shareholder value. Looking ahead, we will

become an unparalled global electronics leader, actively practicing creative management with consistent inno-

vation in our management practices.

BOARD OF DIRECTORS

The Board oversees the performance of senior managers, sets corporate management policies and formulates strategic decisions on business

execution. These activities are performed in strict accordance with relevant laws and regulations, the Samsung Electronics Articles of Incorporation

and resolutions passed at the general shareholders’ meeting. There are nine members on the Board of Directors, of which two are Samsung executive

directors and seven are outside of the company. In 2007, the Board met seven times to discuss major corporate agendas. During that time, the Board

resolved 30 agenda items.

Committees have been established within the Board of Directors in accordance with the Board bylaws, and empowered with certain Board responsi-

bilities. This way, the directors can draw upon their experience and expertise in specific fields to enhance and accelerate the deliberation and

decision-making processes. The Board currently has four such bodies: the Management Committee, Audit Committee, Outside Director

Recommendation Committee and Internal Transaction Committee.

Management committee

The Board of Directors delegates the authority to discuss and decide specific agenda items to the Management Committee, thereby elevating its man-

agerial professionalism and effectiveness. The committee reports its decisions back to the Board. This committee convened 28 meetings during 2007.

Audit Committee

The Audit Committee supervises and supports management in order to maximize corporate value through a set of checks and balances. The

Committee is composed of three outside directors and held six meetings during 2007.

Outside Director Recommendation Committee

The Outside Director Recommendation Committee was formed to recruit and appoint outside directors fairly and independently. The Committee has

four members: two executive directors and two outside directors. The Committee met on three occasions during 2007.

Internal Transaction Committee

The Internal Transaction Committee was established to enhance corporate governance by ensuring fair business transactions. All three members are

outside directors. This Committee convened five times in 2007.

MESSAGE FROM THE BOARD

We seek to maximize corporate value

through transparent

and sound management.

09

I7CIKD=;B;9JHED?9I

7DDK7BH;FEHJ(&&-

Yoon-Woo Lee

UÊ

Vice Chairman & CEO, Samsung Electronics Co., Ltd.

[

Present

]

U

Vice Chairman, Corporate CTO & Global Collaboration, Samsung

Electronics Co., Ltd., Vice Chairman, Samsung Advanced Institute of

Technology

[

2005-May 2008

]

U

Vice Chairman, Global Collaboration, Samsung Electronics Co., Ltd

CEO, Samsung Advanced Institute of Technology

[

2004-2005

]

U

President & CEO, Semiconductor Business,

Samsung Electronics Co., Ltd.

[

1996-2004

]

U

Executive Vice President & CEO, Semiconductor Business,

Samsung Electronics Co., Ltd.

[

1994-1995

]

U

Executive Vice President, Semiconductor Business

(

Memory

)

,

Samsung Electronics Co., Ltd.

[

1992-1993

]

Gwi-Ho Chung

UÊ

Outside Director

[

2003-Present

]

U

Attorney at law

[

2006-Present

]

U

Advisor, the Constitutional Court

[

2001-Present

]

U

Attorney at law, Barun Law Office

[

1999-2006

]

U

Justice, Supreme Court

[

1993-1999

]

Kap-Hyun Lee

UÊ

Outside Director

[

2001-Present

]

U

Advisor, Boston Consulting Group

[

2001-Present

]

U

CEO & President, Korea Exchange Bank

[

1999-2000

]

U

Vice Chairman, Korea Chamber of Commerce & Industry

[

1999-2000

]

Chae-Woong Lee

U

Outside Director

[

2006-Present

]

U

Professor, Faculty of Economics, Sungkyunkwan University

[

1982-Present

]

U

President, Korean Economic Association

[

2005-2006

]

U

Vice Chancellor, Sungkyunkwan Universiry

[

1999-2003

]

UÊ

Member, Council for Financial Industry Development Review to the Ministry

of Finance

[

1994-1998

]

Oh-Soo Park

UÊ

Outside Director

[

2006-Present

]

U

Professor, College of Business Administration, Seoul National University

[

1988-Present

]

U

Chairman, Leadership Institute

[

2003-2004

]

U

Dean of College of Business Administration, Seoul National University

[

2003-2005

]

U

Chairman, Korean Human Resources Management Institute

[

2002-2003

]

Doh-Seok Choi

U

Executive President & CFO, Samsung Electronics Co., Ltd.

[

2003-Present

]

U

President & CFO, Samsung Electronics Co., Ltd.

[

2001-2003

]

U

Executive Vice President & CFO, Samsung Electronics Co., Ltd.

[

2000-2001

]

UÊ

Vice President, Corporate Executive Staff, Samsung Electronics Co., Ltd.

[

1999

]

Jae-Sung Hwang

U

Outside Director

[

2000-Present

]

U

Senior Advisor, Kim & Chang Law Office

[

1999-Present

]

U

Director, Seoul Regional Tax Office

[

1998-1999

]

U

Director, Kyeong-in Regional Tax Office

[

1996-1998

]

U

Head of the Research Bureau, National Tax Office

[

1995-1996

]

Dong-Min Yoon

UÊ

Outside Director

[

2006-Present

]

U

Attorney at law, Kim & Chang Law Office

[

1999-Present

]

U

Director, Social Protection and Rehabilitation Bureau at the Ministry of

Justice

[

1998-1999

]

U

Chief, Planning Management Dept. at the Ministry of Justice

[

1997-1998

]

Goran S. Malm

UÊ

Outside Director

[

2001-Present

]

U

Chairman & CEO, Boathouse Ltd.

[

2000-Present

]

U

President, Dell Computer Asia Pacific & Senior VP, Dell Computer

[

1999-2000

]

U

President, GE Asia-Pacific & Senior VP, GE

[

1997-1999

]

In 2007, Samsung Electronics established a solid foundation from which to grow into

a top-tier global company. We achieved record-breaking business performance

and continued to introduce new products built with the most advanced technology available.

With strong customer recognition of our products and technologies,

we are within reach of our vision to become a premier global company.

AT-A-GLANCE

JANUARY

U

Developed the world’s first truly double-sided LCD

U

Launched a home air conditioner that uses system

air conditioning technology

U

Demonstrated mobile WiMAX technology with

Sprint-Nextel

U

Exported Mobile WiMAX equipment to Middle

Eastern countries

U

Ranked No. 2 in 2006 for the number of U.S.

patents registered

U

Achieved No. 1 market share for the sale of

mobile phones in France for the second year in a row

U

Attained No. 1 worldwide market share position

for LCD for the sixth year in a row

FEBRUARY

U

Developed the first thermally-enhanced chip-on-film

(

TECOF

)

package for the display driver IC

(

DDI

)

, used

in high-resolution LCD TVs

U

Introduced the Ultra Smart F700, the next model of

multimedia phones

U

Demonstrated Mobile WiMAX Wave 2, the next

generation of Mobile WiMAX technology

U

Ultra Edition 12.9 won the Best GSM Mobile

Handset Award at 2007 3GSM

U

Produced 100 million OneNAND Flash fusion

memory units to date

MARCH

U

First in the world to begin mass producing DRAM

using 60nm-class technology

U

Mass produced a power-saving 256-channel

display driver for Plasma screens

U

Exported 3G CDMA system to Indonesia

U

Launched the innovative Cullinan refrigerator

U

Developed super-high-capacity 8GB MobiNAND

memory chip

U

Launched piano-finish black-panel Full HD LCD TV

U

First printer certified as Blue Angel

(

EU Eco-label

)

U

Developed the world’s first 3G fusion memory:

Flex-OneNAND

U

Launched three Mobile WiMAX devices

U

BlackJack bestowed the Best Smart Phone award

at CTIA in the U.S.

APRIL

U

Attained No. 1 market share position for

mobile phones in Russia for third year in a row

U

Sold a cumulative 1 million HSDPA music phones

in the U.S.

U

Began IP Network business in Europe

U

Launched the first Ultra Edition II mobile phone

U

Launched the Q1 Ultra, a second-generation UMPC

U

Developed the world’s first all-DRAM stacked memory

package using “Through Silicon Via”

(

TSV

)

technology

U

Mass produced the world’s first 50nm-class

16Gb NAND Flash memory

U

Began LCD plant construction in Slovakia

MAY

U

Selected as the most favored mobile phone brand

in the U.S. for sixth year in a row

U

Developed the world’s first 65nm-class digital TV

receiver chip

U

Largest number of DDR3 memory components and

modules validated to work with Intel’s DDR3 chipsets

U

Launched the super-small, all-in-one, color laser printer,

nicknamed Lay

U

Developed the world’s largest-capacity memory card

for mobile phones

U

Partnered with IBM to co-develop 32nm node process

U

Launched home appliances designed by Jasper

Morrison in Europe

U

Introduced the world’s first 2.5-inch 250GB HDD

JUNE

U

Launched mobile phone designed by

Jasper Morrison

U

Printer rose to No. 2 position in the world market

U

Began TV plant construction in Russia

U

Launched the world’s largest (70-inch) Full HD LCD TV

U

Opened the largest 300mm NAND flash memory

wafer plant in Austin, Texas

U

Launched our innovative Vibration Reduction

Technology-enabled drum washing machine

U

Mass produced 1.8-inch, 64GB, MLC Solid

State Drive (SSD)

U

Developed the multi-standard, multiband mobile

TV chipset

U

Graphics DDR4 memory selected by AMD for its

next-generation graphic cards

No. 1 in the World, Six Years in a Row

Our LCD panel business posted record-breaking revenue of

US$17.06 billion in 2007, a 23% increase from the previous

year. We have continued our first-mover status in global

market share since we first achieved the world-leading sales

revenue mark in 2002.

The Best Smartphone of CTIA 2007

Samsung’s BlackJack II was honored as the “Best

Smartphone of the Year” in terms of design, menu, connec-

tivity, multimedia features and voice quality at CTIA 2007.

11

I7CIKD=;B;9JHED?9I

7DDK7BH;FEHJ(&&-

JULY

U

I ndustry first 50nm-class 1Gb DDR2 memory

validated by Intel

U

LCD monitor received an IDEA 2007 Gold Award

AUGUST

U

Four products received an EISA Award

U

Reached cumulative sales of 5 million LCD TVs

U

Launched 120Hz Full HD LCD TV

U

Hosted 4G Forum 2007

U

Launched three Bluetooth-enabled video MP3 players

U

First LCD panels shipped from the world largest

8th-generation line

U

Monitor selected the best brand in the U.S. for

the fifth year in a row

U

Developed the world’s smallest and slimmest

color laser printer and all-in-one printer

SEPTEMBER

U

Monitor ranked No. 1 in customer satisfaction index

in China for the eighth year in a row

U

Developed the world’s first 60nm-class

2Gb DDR2 memory

U

Sold the industry’s first aggregate 200 million

LCD panels for IT

U

Announced a strategic alliance with Armani

U

Launched Giorgio Armani Samsung mobile

OCTOBER

U

Introduced the Serenata, a premium music phone,

co-developed by Bang & Olufsen

U

Selected the board of directors’ committee for

discussing candidate 4G technology

U

Announced PVC-free LCD panel production

U

Received Lowe’s “Provider of the Year” award

U

Introduced 10mm-thin, 40-inch super-slim

LCD panel for TVs

U

Developed the world’s first 30nm-class

64Gb NAND Flash memory

NOVEMBER

U

Launched the industry’s first high-speed

SATA II 64GB SSD

U

Launched the High Efficiency Combination

air conditioner

U

Mass produced 16-million-color DDI for

AMOLED for the first time

U

32 products won CES Innovations 2008 Awards

U

Commercialized single-chip RFID reader for

mobile devices for the first time

U

Surpassed monthly US$2 billion LCD panel

sales total for the first time

DECEMBER

U

Developed the world’s fastest

(

GDDR5

)

memory

U

Agreed on cross-license OneNAND rights

with Toshiba

U

Launched video MP3 player “P2” in the U.S.

U

No. 1 worldwide market share position for TVs

achieved for the seventh quarter in a row

30nm-class 64Gb NAND Flash memory

In October 2007, Samsung announced that it had devel-

oped the world’s first 30nm-class 64Gb NAND flash memory

chip. This high-density chip represents the future of flash

storage solutions as the demand for greater memory

capacity increases exponentially every year.

World’s No. 1 Market Share

DisplaySearch, the worldwide authority in display market

research, identified Samsung as the leader in unit share and

revenue for the entire TV market during Q3 2007. The

results have solidified Samsung’s position as a key global

leader in the Flat Panel TV category.

j^_da_d]

Understanding the consumer is

paramount to achieving preeminent market leadership.

In today’s competitive world, if a company remains stagnant, it can quickly become obsolete.

Consumers have many choices, so it is a constant struggle to maintain relevancy in today’s market.

To stay relevant in this ever-changing world, we must keep one step ahead of our customers.

That’s why we have dedicated ourselves to exceed the needs of our customers through the production

and sale of world-class products and, most importantly, by anticipating their every need.

13

I7CIKD=;B;9JHED?9I

7DDK7BH;FEHJ(&&-

W^[WZe\oek

j^_da_d]

Sarah’s guitar is her most prized possession. Ever since she was

a little girl, Sarah’s dream was to be a world-famous rock star.

With Samsung’s LCD TV and Blu-ray DVD player, Sarah can

record and relive her performances. Plus, the P2 lets Sarah take

her music wherever she goes.

IWhW^J^ecWi

_ 15 years old _ High school student / Rock star

Dehj^7c[h_YW

_ Samsung Electronics’ premium prod-

ucts—all built with the latest in cutting-edge technology—

are loved by consumers across North America, especially in

the U.S. Our market-driven strategies contributed to the

development of popular products such as the digital TV,

smart phone, music phone, video MP3 player, side-by-side

refrigerator and drum washing machine. Supported by a

sound business plan, our innovative products have invariably

exceeded customer’s expectations. Now, we are intent upon

expanding our market presence in North America.

15

I7CIKD=;B;9JHED?9I

7DDK7BH;FEHJ(&&-

ceh[Xh_bb_Wdjbo

W

X

Y

W X Y

LCD TV

(

LN 52A750

)

Let the clear, crisp images of our LCD TV bring

you closer to the action—and closer to the

things you love.

MP3 Player

(

YP-P2

)

Sound should be lower-cased or better yet,

it could be all upper-cased–as in SOUND.

Good effect for what we’re trying to get across.

Blu-ray Player (BD-P1500)

Complement the high image quality of our LCD TV

with the latest Blu-ray player. And, watch your favorite

movies for the first time as a completely new,

high definition experience.

j^_da_d]

As an architect, Thierry has the curiosity of a scientist

and the sensibility of an artist. He relies on our products

to help him succeed in his business while allowing him

to explore his creative side.

J^_[hho8[WkY^Wcf

_ 26 years old _ Architect / Artist

;khef[

_ Satisfying our European customers’ sophisticated

sensibilities is a top priority. Our premium products include

the TOC monitor, Armani TV, J-Series refrigerator by Jasper

Morrison, and a five-megapixel camera phone. Building on

advanced technology with versatile features and stylish

design, our innovative premium products will increase

customer loyalty and pave the way to a greater leadership

position in the European market.

17

I7CIKD=;B;9JHED?9I

7DDK7BH;FEHJ(&&-

ceh[Yh[Wj_l[bo

W

X

Y

W

Color Laser Printer

(

CLX-3175

)

Our deluxe color laser printer is compact enough to

fit in any home office yet delivers outstanding

performance, allows for easy installation and

provides many convenient features.

X

Monitor

(

T260

)

Our beautifully designed monitors provide you with

the power and features to help drive your business

well into the future.

Y

BlackJack II

(

SGH-i617

)

Boost productivity whether you’re in the office

or on the road with the award-winning

BlackJack II.

j^_da_d]

Being a housewife is a full-time job. At Samsung, we

understand that and want to make everything as comfortable

as possible. Our products for the home are fully-equipped

with a long list of high-end features, providing the convenience

one would expect from a Samsung product.

P^Wd]B_

_ 30 years old _ Housewife / Home economics diva

;c[h]_d]CWha[ji

_ The dynamic growth in emerging

markets, including China, is a major opportunity for Samsung

Electronics. With aggressive marketing and locally custom-

ized products, including digital media, mobile phones and

home appliances, we are providing a more comfortable and

an enhanced lifestyle for customers within emerging markets.

We will continue to grow within these countries through

increased sales of creative, lifestyle-enhancing products.

19

I7CIKD=;B;9JHED?9I

7DDK7BH;FEHJ(&&-

19

9

I7C

7C

I

I

KD=

KD=

;B

;B

;9J

J

;

HED

HE

?

9

I

7

DD

K7B

K7B

H

;

FEH

FEH

J(

(

&&-

&&-

Y

X

W

ceh[Yec\ehjWXbo

W

Electric Range

(

FTQ386LWUX

)

Cook like a professional chef with our newest

line of electric ranges. With more even cooking

and easy-to-clean surfaces, you’ll find more

pleasure being in the kitchen.

X

Refrigerator

(

RSJ1KSSV

)

Let the modern look of our stainless steel refrigerator

add style to your kitchen design. Its sophisticated

features and increased space have put this

refrigerator in a class by itself.

Y

Drum Washing Machine

(

WF-448 & DV-448 VRT Steam: Stainless Platinum

)

Leading the newest trend in washing machines is

our silent, but powerful, drum washing machine.

From an attractive design to top-notch performance,

this washing machine has it all.

j^_da_d]

j^_da_d]

21

I7CIKD=;B;9JHED?9I

7DDK7BH;FEHJ(&&-

X[jj[hm_j^

oek

SCD5000 DuoCam

SEC develops the world’s first 70nm chip design

process. BusinessWeek ranks SEC the world’s

number one Info-Tech company in its annualInfo

Tech 100. the world’s number one Info-Tech

company in its annualInfo Tech 100.

SCD5000 DuoCam

SEC develops the world’s first 70nm chip design

process. BusinessWeek ranks SEC the world’s

number one Info-Tech company in its annualInfo

Tech 100. the world’s number one Info-Tech

company in its annualInfo Tech 100.

^_]^[h\ehoek

Becoming the most admired brand

in the world requires the unified vision

of an entire company.

Since day one, Samsung Electronics has committed itself to becoming a leader in every facet

of its market initiatives. The result is the growth of a brand that’s synonymous with impeccable standards,

high quality products and an unwavering dedication to the customer. Through continuous creativity

and the development of highly innovative products, Samsung has captured the hearts and

minds of customers worldwide, which will propel our company and our brand well into the future.

To become the brand most appreciated by people

all around the world, Samsung Electronics is carrying out consistent

and aggressive brand marketing. We will grow into a premium brand

that elicits exceptional pride from those who own our products,

through our commitment to innovative customer-focused marketing.

XhWdZcWha[j_d]

Growing Along with Global Enterprises in Electronics and IT

We have established solid partnerships and are

closely cooperating with major global leaders

in various industrial sectors, including Sony, IBM, Microsoft, EMC, Intel, TSMC and Time Warner.

In 2007, we partnered with Time Warner to provide bidirectional digital cable broadcasting

service in the U.S. We also aligned with major Internet portal sites such as Google and Yahoo

in launching phones that can utilize mobile Internet services through these portals. With IBM,

we began joint development of a 32-nm logic process. We also concluded a patent cross-

license agreement with Microsoft and agreed with EMC on establishing a global cooperative

system in the area of enterprise content management solutions. Looking ahead, we are con-

tinuing our efforts to create a solid foundation for future collaboration initiatives. In 2008, we

formed partnerships with Intel and TSMC to prepare a next-generation global standard for

semiconductor wafers. By establishing a consortium with LG Electronics, Hynix Semiconductor

and Sony-Ericsson, we will develop interface technology standards for mobile DRAM. Accord-

ingly, we will continue to strengthen partnerships with major global companies and improve our

brand position in the global market.

Enhancing Cooperation with Global Premium Brands

Our design and marketing alliances are another step toward becoming a premium brand. By

in

troducing unprecedented premium products and developing products with world-renowned

designers, we deliver new experiences to our customers—products they can be proud to own.

We collaborated with Giorgio Armani, one of the world’s top fashion designers, in launching

mobile phone and LCD TV lines, and worked with the world-famous industrial designer Jasper

Morrison in designing mobile phones, side-by-side refrigerators and electric ranges. In addition,

we jointly developed a premium music phone with Bang & Olufsen and launched a new concept

sports phone with Adidas. Our brand image was further upgraded thanks to our engagement in

cooperative marketing campaigns with a number of premium brands that promote quality living,

such as BMW and Cartier. We will continue to renew ourselves as a widely admired premium

brand by introducing innovative products and marketing activities through systematic coopera-

tion with leading global brands.

Strategic marketing and technology alliance with

Time Warner Samsung Electronics partnered with Time

Warner Cable, the second largest cable company in the

U.S., to sell its TVs and set-top box products with open-

cable-application platforms, allowing more customers to

use interactive broadcasting services.

_cW]_dWj_l[

US$16.9 Billion

BIGGEST GLOBAL

BRAND VALUE

BusinessWeek/Interbrand survey of “Best Global Brands”

21

st

23

I7CIKD=;B;9JHED?9I

7DDK7BH;FEHJ(&&-

j^_da_d]

Presenting Unique Experiences with Cutting-Edge Digital Products

We understand the importance of our customers’ experiences with our products. To increase

p

roduct visibility, we operate showrooms where our customers can see, touch and experience

the newest digital products firsthand in a number of countries, including the U.S., Russia, Brazil,

China and Chile. Samsung Experience, a digital showcase at the Time Warner Center in New

York City, has become a new digital attraction, visited by more than a million customers since it

opened in 2004. The successful operation of Samsung Experience was evaluated as an exem-

plary case of experience marketing by major newspapers such as The New York Times and

academic institutions such as Columbia University. Gallery Samsung, our digital showroom in

Moscow, also is rapidly growing in popularity by providing the best digital experience in

Russia, with over 500,000 people already having viewed it. We will further expand our trend-

setting showrooms to share new and fascinating digital experiences with our customers.

Providing a Wide Range of Benefits for Worldwide Tourists

Outstanding displays by Samsung Electronics are at

tracting the eyes of tourists traveling

around the world. For the convenience of global travelers, we have installed LCDs and PDPs

in major international airports, including Dallas-Fort Worth International Airport in the U.S.,

Comodoro Arturo Merino Benitez International Airport in Santiago, Chile, Hong Kong Interna-

tional Airport in China, Murtala Muhammed International Airport in Lagos, Nigeria, London

Heathrow Airport in the U.K., Amsterdam Airport Schiphol in the Netherlands, and Mexico City

International Airport in Mexico. We also installed mobile phone sculptures in more than 20

international airports such as Charles de Gaulle International Airport in France, Sheremetyevo

International Airport in Moscow, Russia, Cairo International Airport in Egypt, Ataturk International

Airport in Istanbul, Turkey, and Toronto Pearson International Airport in Canada. In addition,

Samsung Mobile Stations are set up at New York’s JFK International Airport and L.A. Interna-

tional Airport to enable tourists to recharge their digital devices, including mobile phones and

notebook PCs, free of charge, where electrical receptacles are lacking. Actively promoting our

on-site marketing initiatives, we maintain our brand leadership position by being the brand

our customers think of first.

SHALINI SINGH, MANAGER

CUSTOMER STRATEGY TEAM, GLOBAL MARKETING OFFICE

Strategic design alliance with Giorgio Armani

Through a groundbreaking alliance with Giorgio Armani,

Samsung’s portable and home consumer electronics will

include a signature line of Armani-designed products. The

alliance will combine Armani’s iconic design aesthetic with

Samsung’s advanced technology.

Samsung Experience at Time Warner Center in

New York City Located in New York City’s Time Warner

Center, Samsung Experience is the ultimate showroom

for Samsung’s digital products. It has attracted more

than 1 million visitors since it opened in September 2004.

Entrepreneurship for the growth of mankind.

A vision to become a renowned global leader. A commitment

to our customers. These are the pillars in which Samsung Electronics’ has

built its brand value. We are pushing our limits to become

the most beloved brand in the world.

ifediehi^_f

[nY_j_d]

As a global corporate citizen, Samsung Electronics contributes

to worldwide sports, culture and academic development through a robust range

of programs. We will continue to share the dynamic energy of sporting activities

and the emotional experiences of cultural events with our customers,

thereby enhancing global harmony and our customers’ quality of life.

An Official Partner for the Olympic Games

With consistent sponsorship for the Olympic Games, we contribute to humanity while

p

romoting major sporting events. Since signing The Olympic Partner

(

TOP

)

agreement with the

International Olympic Committee

(

IOC

)

in 1997, Samsung Electronics has sponsored the 1998

Nagano Winter Games, the 2000 Sydney Summer Games, the 2002 Salt Lake City Winter

Games, the 2004 Athens Summer Games and the 2006 Turin

(

Torino

)

Winter Games as a

Worldwide Partner in the Wireless Communications category. We are also participating as an

official partner in the Beijing Olympic Games and Paralympic Games to be held in 2008.

As an official partner for the Olympic Games in the Wireless Communications category, we

supplied cutting-edge mobile devices, starting with the 2004 Athens Summer Games, to assist

successful management of the event. During the event, we provided our unique Wireless Olym-

pic Works

(

WOW

)

service, a communications system designed to bring the power of mobile

wireless technologies to the Games. The system enabled officials and staff to access critical

data and to transmit results and special information about the Olympic Games. We have also

set up Olympic Rendezvous @ Samsung

(

OR@S

)

since the 2000 Sydney Summer Games and

provided a resting space where athletes and fans can experience state-of-the-art wireless

telecommunications technologies. In addition, we have been an official partner for the Olympic

Torch Relay since the 2004 Athens Summer Games and have promoted the excitement of the

Olympic Games throughout the world. We concluded a long-term sponsorship agreement with

IOC in April 2007, to maintain our support for the event through the 2016 Summer Games.

Active Sponsorship for Local Sports

We have sponsored a wide range of sports reflecting regional characteristics and sentiments

a

round the world. Since 1998, we have been an official sponsor for the Asian Games, a sports

festival for all Asians. Recently, we participated in the 2006 Doha Asian Games and will main-

tain our official sponsorship for the 2010 Guangzhou Asian Games. In 2007, we provided our

first official sponsorship for the Pan American Games, in which 42 countries from the American

continents participated, and for the accompanying torch rally held throughout Brazil.

Chelsea FC, 2nd Place in 2008 UEFA Champions

League As the official club sponsor of the Chelsea

Football Club, Samsung Electronics will play a key part in

its global development. Both brands share the same

passion for success, as seen by Chelsea’s second place

showing in the 2008 UEFA Champions League.

39th WorldSkills Competition As part of our com-

mitment to social responsibility, we have supported the

biennial International Apprentices

(

“WorldSkills”

)

Competition since 2007. Worldskills is a not-for-profit

membership association that promotes vocational edu-

cation and training.

25

I7CIKD=;B;9JHED?9I

7DDK7BH;FEHJ(&&-

j^_da_d]

JUNGHOON KANG, MANAGER

GLOBAL COMMUNICATIONS GROUP, CORPORATE COMMUNICATIONS TEAM

Our wide range of sponsorships around the world is our way

of showing our gratitude for our customers in a meaningful way.

Through these sponsorships, we’re able to support local communities

on a global scale, while sharing in the spectacle of sport.

In 2008, as an official worldwide sponsor of the Beijing Summer Games,

we will continue to share our passion with the world and contribute

to the betterment of society.

Soccer, the favorite sport in most countries of the world, is one of our main sponsored sports.

We supported major soccer championship games in each continent and acted as a sponsor for

some highly renowned soccer clubs. Since 2000, we have been the title sponsor for K-League,

held by the Korean Professional Football Association, and have supported the world-famous

Chelsea Football Club of the English Premier League since 2005. In 2008, the African Nations

Cup and various games of the Asian Football Confederation became Samsung sponsored

events. Chivas Football Team in Mexico registered as one of our sponsored teams as well.

Other noteworthy sports organizations and events include the International Hockey Federa-

tion

(

FIH

)

and the World Taekwondo Federation

(

WTF

)

, in addition to World Cup Short Track of

the International Skating Union

(

ISU

)

, and the Cycling Center of the Union Cycliste Internationale

(

UCI

)

. Each year, we also serve as the Worldwide Sponsor of the World Cyber Games

(

WCG

)

,

the world’s largest online gaming sport tournament, which was initiated in 2000. To promote

e-sports, we operate Samsung Khan, a professional online game team.

Nurturing Culture and Education

Sponsoring a wide range of cultural and academic activities represents our contribution in

n

urturing culture and science along with our global neighbors. In this relation, we have been

supporting the biennial International Apprentices

(

“WorldSkills”

)

Competition since 2007, and

recently agreed to sponsor the Nobel Museum’s Global Exhibition of the Nobel Foundation from

2008 through 2010. In March 2008, we also supported the Crufts Dog Show, the world’s most

prestigious dog show, held in the U.K. By participating as a sponsor for numerous cultural events,

we share an emotionally-charged passion for popular competitive events around the globe.

2008 Beijing Olympic Sponsorship Event Samsung

Electronics has been a proud sponsor of the Olympic

Games since 1998, and is pleased to continue that tradi-

tion at Beijing. Our passion for the Olympics is evidenced

through the diverse range of events, like the “Dreams of

Dragon” at the China Millennium Movement, to encour-

age a friendly, festive atmosphere.

Possessing an innovative R&D capability is critical for Samsung Electronics’

continued march toward becoming a leading global company.

Through strategic investments in R&D and a strong commitment to creative talent

development, we will continue to deliver cutting-edge technologies and

solutions that will advance us well into the future.

H:

Ongoing R&D Investment for Technology Leadership

By focusing our R&D efforts on our core businesses and future technology development, we

h

ope to deliver diverse and outstanding achievements, including: the world’s first 50nm-class-

1Gb DDR2 memory; first 30nm-class 64Gb NAND Flash; the world’s smallest and lightest all-

in-one color laser printer; a drum washing machine boasting the world’s lowest noise and vibration

levels; commercialization of the world’s largest (14.3-inch) color e-paper, the world’s largest

LCD panel (70-inch) for Full-HD TV; and selection of our Mobile WiMAX as the IMT-2000 stan-

dard along with WCDMA and CDMA-2000.

Special efforts have been made to manage intellectual property rights, which include our pat-

ents. In the U.S., our aggregate patent portfolio totaled approximately 20,600 by the end of 2007.

In 2007, we registered 2725 patents in the U.S. alone, which was the second most of any company.

Systematic R&D Structure for the Next Generation

In May 2008, Samsung Electronics revamped its R&D organization to focus on greater effi-

ciency and future technology development. The new organization is systematically structured in

three layers. The Corporate Technology Office

(

CTO

)

, the synergistic creator of technology,

leverages proprietary technology to drive innovation across current business units and enhance

core technologies for new business opportunities. The R&D centers of each business focus on

the development technology that is expected to deliver the most promising long-term results. In

the meantime, the development teams within each product division are responsible for com-

mercializing products scheduled to hit the market within one or two years.

Samsung Electronics operates six R&D centers in Korea and a total of 16 centers in eight

countries, including the U.S., the U.K., Russia, Israel, India, Japan and China. These centers are

tasked with developing best-in-class products and proprietary technology. We have also built a

global R&D network encompassing the world’s leading companies, research centers and

universities. These research facilities are closely linked, and develop strategic technologies for

the future as well as unique technologies that will establish new market trends.

Our greatest asset is the extensive pool of talented people who develop value-added, market-

leading products that are enhancing the lives of our customers. At the end of 2007, 39,000

people were involved in the development of Samsung products for tomorrow. There are now

3200 PhDs in our talent pool. Through solid alliances with global R&D networks and an efficient

support system for our R&D workforces, we will continue to lead the company into the future

with many of the world’s most innovative products and technologies.

Leading Future Technology Initiatives

Our goal is to be the clear leader in future technology development, rising above any challenges

in the business environment. We will enhance our technology and market leadership in our

current core businesses, while taking aim at future-oriented fields, such as the solutions busi-

ness, new IT devices, energy resources, the environment, bio-technology and health. Our R&D

investment will be further increased to strengthen our proprietary technology leadership in

nurturing future growth engines.

R&D INVESTMENT

[

in trillions of KRW

]

5.3492

2005

5.9047

2007

5.5851

2006

R&D HUMAN RESOURCE

[

Unit: employee

] [

Including employees overseas

]

32,000

2005

39,300

2007

36,000

2006

_ddelWj_l[

Our researchers are working very

closely with R&D, proud to be a part of

creating the future. Combining our ability

with unbridled passion, we will enhance

the lives of our customers through

the development of the newest,

groundbreaking technology.

JAEKWAN PARK, SENIOR RESEARCHER

NEXT-GENERATION RESEARCH TEAM 2 MEMORY

[

SEMICONDUCTOR BUSINESS

]

27

I7CIKD=;B;9JHED?9I

7DDK7BH;FEHJ(&&-

W

X

Y

8.4 Megapixel CMOS Image Sensor At 8.4

megapixels, the latest CMOS Image Sensor from

Samsung is the world’s smallest in terms of pixel

size. Its high resolution was achieved by imple-

menting advanced light-sensing features and mini-

mized noise levels.

W

14.3-inch e-paper

Samsung Electronics devel-

oped a 14.3-inch

(

A4-sized

)

, color “electronic”

paper

(

e-paper

)

, delivering undistorted images even

when the surface is bent. This flexible display does

not require any electricity.

Y

Flex-OneNAND™ For the first time, this new

fusion semiconductor enables the use of two types

of NAND flash memory in a single device, allowing

for greater flexibility and signifying the increasing

importance of semiconductors in the design of dig-

ital devices.

X

j^_da_d]

W

X

29

I7CIKD=;B;9JHED?9I

7DDK7BH;FEHJ(&&-

Y

Series 7 750 LCD HDTV The ultra-advanced

Series 7 is a major achievement in both technology

and design. Its Crystal Rose exterior houses some

of the world’s more advanced features, such as

InfoLink, WiseLink and a built-in Content Library.

W

CDMA UbiCell™ The CMDA UbiCell is the

world’s first ultra-small CDMA base station. The

device attaches to a mobile network connection and

is designed to enhance coverage for the home.

Y

YP-S5 MP3 Player At only 14.9mm thick, the

YP-S5 is an extremely portable multimedia device.

Its full color screen makes watching videos a plea-

sure while its fold-out speakers are powered by

Samsung’s DNSe technology to produce rich sound.

It’s also Bluetooth enabled.

X

Y

X

W

SGH-F490

Samsung’s SGH-F490 is the phone

for people who want to use the Internet whenever,

wherever. This powerful multimedia device comes

fully equipped with a five megapixel camera and a

3.2-inch, 16:9 wide touch screen. Plus, it is built with

Samsung’s award-winning Croix user interface,

enabling greater convenience and ease of use.

W

TOUCHWIZ SGH-F480 The pocket-friendly SGH-

F480 from Samsung boasts a 2.8-inch touch screen

and its new TOUCHWIZ user interface allows for a

more rewarding and enjoyable experience through a

“drag and drop” widget system. Built with a strong

and versatile set of multimedia features, the SGH-

F480 also has a five megapixel camera and MPEG4

video recording and editing functions.

Y

Ultra Edition 10.9, SGH-U600 The highly effi-

cient Ultra Edition mobile phone has a 2.2-inch

screen display and is a mere 10.9mm thick. Housed

in a sleek, modern casing, the Ultra Edition boasts

advanced features such as a 3.2-megapixel camera,

video recorder, MP3 player and Bluetooth.

X

ijob_i^ j^_da_d]

Our approach to design begins with

the customer and ends with

the customer. With their total

experience in mind, we try to create

a design that’s both beautiful and

convenient, providing a sense of

comfort, fun, pleasure and interactivity.

31

I7CIKD=;B;9JHED?9I

7DDK7BH;FEHJ(&&-

3

3

3

3

3

3

31

3

3

3

3

3

3

3

3

3

3

3

3

3

3

3

3

3

31

3

3

3

3

3

3

3

3

3

31

3

3

3

3

3

3

3

3

3

3

3

31

1

1

3

3

3

1

1

3

3

3

1

1

1

I

7

CI

K

D=

;B

B

B

;

;

;

;9

;9J

;

;

;

;

;

;

;

;

;

HED

HED

D

D

D

D

D

D

D

D

D

D

D

D

D

D

D

D

D

D

D

D

D

D

D

D

D

D

D

D

D

D

D

D

?

9

I

I

I

I

I

I

I

I

I

I

I

I

I

I

7

DD

K7

B

H;

H;

;

;

;

;

;

;

;

;

F

FEH

F

F

F

F

F

F

F

F

F

F

F

F

FEH

F

F

F

F

F

F

F

J(

J(

(

(

(

(

(

(

(

(

(

(

(

(

(

&&-

&&-

&&-

&&-

-

&&-

&

&

-

&

&

&&-

&

&&

-

-

&

&

&

&

&&

&

&

&

&-

-

-

&

&&

&

&&

&&

&

&-

-

-

&&-

&&-

&&

&

Building upon our unique customer-focused design philosophy,

Samsung Electronics has continued to push the limits of excellence in

becoming a globally acclaimed design powerhouse. Our innovative designs

focus on the integration of sophisticated style, versatile convenience and

emotional reactions from our customers to create

a more enjoyable and fulfilling user experience.

Z[i_]d

Customer-Focused Design

Focusing on designs that satisfy both the experiential and emotional needs of the user, we

ha

ve taken a more intuitive, holistic approach to product development. Since 1996, we have

concentrated on enhancing our product images, particularly the element of uniqueness. In

2007, we launched a holistic design initiative: “Create an Emotional Journey.” We are designing

products that are highly attractive and undeniably stylish, products that have an intuitive user

interface and distinctively enhance the sensory experience, clearly distinguishing our products

in the era of digital convergence.

Global Design Network to Satisfy Every Customer

Samsung Electronics operates seven design centers

: the Corporate Design Center in Seoul

along with centers in London, Milan, Los Angeles, Shanghai, Tokyo and Delhi. Our experts at

the six geographically dispersed locations analyze local culture, lifestyles and industry trends,

providing input critical to the Corporate Design Center, which conducts global research projects

that results in the creation of products that satisfy every consumer and business need. As

design becomes a crucial component in driving the profitability and popularity of consumer

electronics, we encourage our designers to push the limits of their creativity in order to continue

delivering some of the world’s most innovative design solutions.

Effective Programs that Nurture Design Expertise

We offer a broad range of design-related training programs in order to cultivate a greater

number

of world-class designers, while improving our overall design competitiveness. The

Samsung Design Membership

(

SDM

)

program nurtures student designers and promotes the

exchange of creative ideas around the world. Our SDM program attracts students around the

world who major in design, cultivates their skills and encourages interaction through the

exchange of ideas and a great deal of creative brainstorming. At the same time, we operate the

Samsung Art & Design Institute

(

SADI

)

, which is changing the global design education paradigm

with one of the world’s most advanced curricula including a special emphasis on practical

applications.

Excellent Design Acclaimed by Numerous Awards

Admired by customers around the world, our outstanding design capabilities have received

incr

easingly frequent validation in several of the industry’s prestigious design awards every year.

In 2007, the iF Product Design Awards from International Forum Design Hanover honored 26

Samsung products, including LCD TVs, mobile phones, note PCs, and laser printers. We also

received 27 prizes at Japan’s Good Design Awards, including the Gold Prize for our side-by-

side refrigerator.

Samsung’s Ultra Edition II mobile phone and portable DMB TV received Best of the Best

awards in 2007 along with 21 other awards at the Red Dot Design awards. Our triple-hinge

design of the Mobius LCD monitor also won the Industrial Design Excellence Award

(

IDEA

)

last

year from the Industrial Designers Society of America.

31

I7CIKD=;B;9JHED?9I

7DDK7BH;FEHJ(&&-

MIA OH, SENIOR DESIGNER

UX PART

[

WIRELESS UNIT

]

, CORPORATE DESIGN CENTER

j^_da_d]

Satisfaction should not be a guarantee.

It should be a given.

Like modern-day pioneers, Samsung Electronics has opened doors to new worlds through

our innovative products and our dedication to customer satisfaction. In strengthening our R&D,

fostering more strategic alliances, and delivering an unrivaled customer experience, Samsung has

catapulted itself to the forefront of efforts to enhance consumer lifestyles, worldwide.

Remaining at the forefront will require a steadfast dedication to keeping customer satisfaction as our top priority.

33

I7CIKD=;B;9JHED?9I

7DDK7BH;FEHJ(&&-

icWhj[h\ehoek

Z_]_jWbc[Z_W

35

I7CIKD=;B;9JHED?9I

7DDK7BH;FEHJ(&&-

Global Leader in TVs and the IT Industry

In 2007, we achieved record-breaking business results, boosted by strong growth

w

ithin the flat panel TV market and a steady increase in sales of our core products,

such as LCD monitors, digital audio-visual products, laser printers and notebook PCs.

Sales increased to KRW26.51 trillion, a 26% jump from 2006, while operating profits

soared to KRW1.06 billion, a 43% increase year-to-year.

Our dominance of the flat panel TV market helped us to maintain No. 1 market share

in both sales revenue and units sold for two consecutive years and seven consecutive

quarters, respectively, including the No. 1 position in the sale of TVs overall, as well as

in the flat panel TV and LCD TV categories. We also ranked first in the monitor market

for five quarters straight, widening our lead over our competitors in 2007. Our color

laser printer solidified its market share position–No. 2 in the world–as well. In our PC

business, we achieved our best sales ever by increasing exports of Samsung-brand

products. Meanwhile, our digital AV products, including MP3 players, received positive

feedback from the world market for their enhanced quality and design.

Overall, Samsung’s Digital Media products were highly recognized for their innova-

tive technology and attractive designs. Our LCD TV and home theater system won

three EISA Awards while eight products, including an MP3 player, received Innovation

Awards at CES 2007. Last year, we were also honored with an iF Design Award for the

quality of a wide range of our digital media products.

MAY 18

Launched world’s smallest color laser

printer

The new 3-in-1 Samsung CLX-2161K printer,

nicknamed Lay, is 20% smaller than our previously small-

est model. At 41.3

×

35.3

×

33.3cm, Lay is able to fit into the

tightest spaces. The printer boasts the use of Samsung’s

proprietary technology: Non Orbiting Noiseless Optic

Imaging System

(

NO-NOIS

)

to deliver low-noise printing.

Other keys features include an ID Card Copy and a USB

Direct port.

JUNE 11

Began construction of a TV production

facility in Russia

To meet the fast-growing demand for

digital TVs in Russia and CIS countries, Samsung