2

June 1, 2019

FEMA | FIMA | NFIP

Claims Manual

Table of Contents

Table of Contents

Purpose ......................................................................................................................................................... 8

Introduction ................................................................................................................................................ 10

1 Message to National Flood Insurance Program Claims Professionals ............................................. 10

2 National Flood Insurance Program .................................................................................................. 11

3 Standard Flood Insurance Policy ..................................................................................................... 11

3.1 Dwelling Form ......................................................................................................................... 12

3.2 General Property Form ........................................................................................................... 12

3.3 Residential Condominium Building Association Policy Form .................................................. 12

4 Emergency and Regular Programs .................................................................................................. 12

4.1 Emergency Program ................................................................................................................ 12

4.2 Regular Program ..................................................................................................................... 12

5 Amounts of Insurance Available ..................................................................................................... 13

6 Deductibles ..................................................................................................................................... 13

7 Group Flood Insurance Policy ......................................................................................................... 14

8 Disaster Response ........................................................................................................................... 15

8.1 FEMA Joint Field Office ........................................................................................................... 16

8.2 Disaster Response NFIP Field Offices ...................................................................................... 16

8.3 Adjuster Briefings .................................................................................................................... 17

9 Claims Professionals Expectations .................................................................................................. 17

9.1 NFIP Core Values ..................................................................................................................... 17

9.2 Customer Service .................................................................................................................... 18

10 NFIP Adjuster Participation ......................................................................................................... 19

10.1 Adjuster Authority................................................................................................................... 20

10.2 NFIP Knowledge ...................................................................................................................... 20

10.3 Required NFIP Adjuster Authorization .................................................................................... 20

10.4 Adjuster Qualifications ............................................................................................................ 21

10.5 Adjuster Authorization Process............................................................................................... 21

10.6 NFIP Fee Schedule ................................................................................................................... 22

11 Examiner Participation in the NFIP ............................................................................................. 23

11.1 Authority ................................................................................................................................. 23

11.2 Responsibilities ....................................................................................................................... 24

3

June 1, 2019

FEMA | FIMA | NFIP

Claims Manual

Table of Contents

11.3 Knowledge of the NFIP ............................................................................................................ 25

12 Training for Claims Professionals ................................................................................................ 25

12.1 NFIP Sponsored Training ......................................................................................................... 25

12.2 Annual NFIP Claims Presentations .......................................................................................... 26

12.3 Other Training ......................................................................................................................... 26

Section 1: SFIP Forms .................................................................................................................................. 28

1 Overview ......................................................................................................................................... 28

2 Dwelling Form ................................................................................................................................. 29

3 General Property Form ................................................................................................................... 98

4. Residential Condominium Building Association Policy ................................................................. 157

Section 2: Claims Processes and Guidance ............................................................................................... 221

1 Adjuster Preliminary Damage Assessment ................................................................................... 221

2 Advance Payments ........................................................................................................................ 222

2.1 Advance Payment Opportunity One: Pre-Inspection ........................................................... 222

2.2 Advance Payment Opportunity Two: Post-Inspection .......................................................... 223

2.3 Procedures for Issuing Advance Payment............................................................................. 224

2.4 Advance Payments Exceeding the Covered Loss .................................................................. 225

3 Appraisal ....................................................................................................................................... 226

4 Cisterns.......................................................................................................................................... 227

5 Claims Adjustment ........................................................................................................................ 228

5.1 Building Scope and Estimate ................................................................................................. 228

5.2 Contents (Personal Property)................................................................................................ 230

5.3 Special Limits ......................................................................................................................... 230

5.4 Depreciation .......................................................................................................................... 230

5.5 Progress Notes in File ............................................................................................................ 231

6 Claim Closed Without Payment Reasons ...................................................................................... 232

7 Communications from Attorneys, Public Adjusters, and Other Policyholder Representatives ... 233

8 Condominium Claims Handling ..................................................................................................... 234

9 Contents Manipulation ................................................................................................................. 235

10 Cooperative Buildings ............................................................................................................... 236

11 Countertops .............................................................................................................................. 237

11.1 Common Countertop Types and their Repair or Replacement ............................................ 237

4

June 1, 2019

FEMA | FIMA | NFIP

Claims Manual

Table of Contents

11.2 Countertop Adjustment Concerns ........................................................................................ 238

12 Electronic Signatures................................................................................................................. 239

13 Expense Payments .................................................................................................................... 240

13.1 Adjuster Fees ......................................................................................................................... 240

14 Flood-In-Progress ...................................................................................................................... 240

15 GFIP Claims Handling ................................................................................................................ 241

16 Guidance on the Use of Outside Professional Services ............................................................ 242

16.1 When to request a Building Structural Evaluation ................................................................ 242

16.2 Outside Financial Accounting Professionals ......................................................................... 243

16.3 Insurers must comply with the following requirements regarding the use of outside

professional services ......................................................................................................................... 244

17 General Adjuster (GA) Re-inspection Request .......................................................................... 246

18 HVAC Equipment ....................................................................................................................... 246

19 Identification of Building Equipment, Appliances, Electronics, and Mechanicals .................... 247

19 Improvements and Betterments .............................................................................................. 248

19.1 Tenants’ Contents Only Policies ............................................................................................ 248

19.2 Building Owner and Tenant Named on Same Policy with Coverage A ................................. 249

19.3 Duplicate Policies with Coverage A Not Allowed .................................................................. 249

20 Increased Cost of Compliance ................................................................................................... 250

21 Inspection .................................................................................................................................. 250

22 Letter of Map Amendment/Letter of Map Revision ................................................................. 251

22.1 Letter of Map Amendment Definition .................................................................................. 251

22.2 Letter of Map Revision Definition ......................................................................................... 251

22.3 Obtaining a LOMA or LOMR .................................................................................................. 252

22.4 How a LOMA or LOMR Applies to Claims .............................................................................. 252

23 Lowest Elevated Floor Determination ...................................................................................... 252

24 Manufactured (Mobile) Home/Travel Trailer Worksheet ........................................................ 254

25 Non-Waiver Agreement ............................................................................................................ 254

26 Notice of Loss ............................................................................................................................ 255

27 Overhead and Profit .................................................................................................................. 255

28 Payment and Paying Undisputed Loss ...................................................................................... 256

29 Perimeter Wall Sheathing ......................................................................................................... 257

29.1 General Guidance on Perimeter Wall Sheathing .................................................................. 257

5

June 1, 2019

FEMA | FIMA | NFIP

Claims Manual

Table of Contents

29.2 Determining Coverage of Damage to Perimeter Wall Sheathing ......................................... 257

29.3 Determining Methods of Repair or Replacement of Damaged Sheathing ........................... 258

29.4 Adjuster Considerations ........................................................................................................ 259

30 Photographs .............................................................................................................................. 259

31 Pollutants .................................................................................................................................. 260

32 Porches ...................................................................................................................................... 260

33 Prior Loss Request ..................................................................................................................... 261

34 Prompt Communications .......................................................................................................... 262

35. Proof of Loss/Increase Cost of Compliance Waiver Request Process....................................... 263

36 Property Address Waiver .......................................................................................................... 267

37 Property Related to Controlled Substances .............................................................................. 268

38 Record Request from Special Investigator for Fraud Investigation .......................................... 269

39 Release of Claim File Information to Policyholders .................................................................. 269

39.1 Integrity of Claim Files........................................................................................................... 269

39.2 Disclosure of Claim Files ........................................................................................................ 270

39.3 Letters of Representation ..................................................................................................... 270

40 Remediation, Drying, and Emergency Service Contractors ...................................................... 271

41 Reporting................................................................................................................................... 272

41.1 Timely Reporting ................................................................................................................... 272

41.2 Preliminary Report ................................................................................................................ 273

41.3 Interim Report ....................................................................................................................... 275

41.4 Narrative Report ................................................................................................................... 275

41.5 NFIP Final Report................................................................................................................... 276

41.6 Proof of Loss .......................................................................................................................... 276

42 Requests for Additional Payment ............................................................................................. 277

43 Reservation of Rights ................................................................................................................ 278

44 Salvage ...................................................................................................................................... 278

45 SFHAs and Non-SFHAs ............................................................................................................... 280

45.1 Special Flood Hazard Areas (SFHAs) ...................................................................................... 280

45.2 Non-Special Flood Hazard Areas (Non-SFHAs) ...................................................................... 280

46 Special Allocated Loss Adjustment Expense (SALAE) Processes ............................................... 280

47 Statute of Limitations ................................................................................................................ 289

48 Subrogation ............................................................................................................................... 290

6

June 1, 2019

FEMA | FIMA | NFIP

Claims Manual

Table of Contents

49 Underwriting Referral ............................................................................................................... 291

50 Waiver of Elevated Building Coverage Limitation..................................................................... 292

51 Wildfires .................................................................................................................................... 293

51.1 Application of Post Wildfire Exception to 30-Day Waiting Period for New Policies ............. 293

51.2 Assistance with the Proper Application of Post Wildfire Exception ..................................... 294

52 Wind/Flood Loss ....................................................................................................................... 294

52.1 Wind/Water Investigative Tips ............................................................................................. 295

53 Withdrawal Letters and Denial Letters ..................................................................................... 297

54 Oversight ................................................................................................................................... 297

54.1 Claims Oversight ................................................................................................................... 297

54.2 Claims Operation Reviews Description of Findings .............................................................. 299

55 Claim Overpayment Recovery................................................................................................... 301

55.1 Claim Overpayment Recovery Process ................................................................................. 301

55.2 Methods of Claim Overpayment Reimbursement to the NFIP ............................................. 301

Section 3: Increased Cost of Compliance .................................................................................................. 304

1 Increased Cost of Compliance (ICC) .............................................................................................. 304

1.1 Required ICC Requirements For Advance or Partial Payment: ............................................. 306

1.2 Required ICC Claim File Documents and Requirements ....................................................... 307

1.3 What to Know Concerning Elevation, Demolition, Relocation, and Floodproofing of a Flood

Damaged Building: ............................................................................................................................ 309

1.4 Assignment of Coverage D, ICC Benefits ............................................................................... 315

1.5 Grants .................................................................................................................................... 316

1.6 Cost Share ............................................................................................................................. 317

1.7 Some ICC Issues ..................................................................................................................... 318

1.8 ICC U-CORT Waiver Process .................................................................................................. 319

Section 4: NFIP Claims Appeals ................................................................................................................. 322

1 NFIP Claims Appeals ...................................................................................................................... 322

1.1 Eligibility ................................................................................................................................ 322

1.2 Filing an Appeal ..................................................................................................................... 322

1.3 What to Expect ...................................................................................................................... 323

1.4 Insurer Responsibility ............................................................................................................ 324

Appendix ............................................................................................................................................... 327

Acronyms and Abbreviations ................................................................................................................ 329

7

June 1, 2019

This page was intentionally left blank.

8

June 1, 2019

FEMA | FIMA | NFIP

Claims Manual

Purpose

Purpose

The purpose of the NFIP Claims Manual is to improve clarity of claims guidance to WYOs,

vendors, adjusters, and examiners so that policyholders experience consistency and reliability of

service. The manual provides processes for handling claims from the notice of loss to final

payment.

All NFIP bulletins, other than those announcing Flood Insurance Claims Office numbers, Flood

Response Office locations, claims adjuster briefings, and current/future program changes, are

superseded by this manual and of no further effect.

Disclaimer: This document represents the current FEMA guidance on the covered topics and may

assist NFIP insurers, adjusters, vendors, and policyholders apply applicable statutory and

regulatory requirements, as well as the terms and conditions of the Standard Flood Insurance

Policy. This document is not a substitute for applicable legal requirements, nor is it itself a rule. It

is not intended to, nor does it impose, legally-binding requirements on any party, except where

parties have voluntarily entered into an agreement requiring compliance with FEMA guidance.

FEMA’s discussion of any brand, trademark, or registered mark is not an endorsement.

9

June 1, 2019

This page was intentionally left blank.

10

June 1, 2019

FEMA | FIMA | NFIP

Claims Manual

Introduction

Introduction

1 Message to National Flood Insurance Program Claims Professionals

Over the past several years, the Federal Emergency Management Agency

(FEMA) has highlighted our commitment to our policyholders. We are

transforming the ways we manage the National Flood Insurance Program

(NFIP). This transformation will enable our partners and stakeholders, Write

Your Own (WYO) insurance companies, insurance company vendors,

agents, adjusting firms, adjusters, and examiners as claims professionals, to

improve our policyholders’ experience when they have a flood claim.

We are getting policyholders on a road to recovery faster through a more

robust advance payment process. We are committed to making our

products and processes easier to understand from the policyholder’s point of view, that includes

rewriting of our claims and underwriting manuals in plain language so insurance professionals

understand the NFIP and can provide policyholders with consistency and reliability of service.

One of FEMA’s strategic goals is to build a culture of preparedness which promotes the idea that

everyone should be prepared when disaster strikes. One way an individual can be prepared is to

purchase proper insurance coverage. As representatives of FEMA and the NFIP, we will treat

each policyholder with empathy and respect, ensuring the NFIP adjusts each claim fairly and

without unnecessary delay, and handles each claim as if it were our home or business.

Policyholders’ positive word-of-mouth to family, friends, neighbors, and the wider community

regarding their claims experience can influence these individuals to purchase flood insurance.

All of you represent the NFIP and our improved customer experience. You will likely be the first

and may be the only NFIP representative the policyholder engages with after a flood event. FEMA

depends on your continued expertise and compassion to help our policyholders recover from

what may be a devastating experience for them.

As a claims professional, you are the one that will guide the policyholders through the entire

NFIP claims process – from the notice of loss to their final payment. With your knowledge of the

Standard Flood Insurance Policy, you can make the policyholder’s recovery smoother by

communicating what they should do to move their claim along the adjustment journey.

I would like to take a moment to recognize the hard work you do on our behalf.

During the past year, I have had the pleasure of observing quality adjusting by riding along on a

number of loss adjustments. I saw first-hand how much time, effort, and care claims adjusters

put into serving our policyholders. It is a tough job entering into dangerous spaces, dealing with

conditions such as mold and other hazards, and meeting the needs of NFIP policyholders still

processing the toll of a recent flood.

David Maurstad, Deputy

Associate Administrator for

Insurance and Mitigation

11

June 1, 2019

FEMA | FIMA | NFIP

Claims Manual

Introduction

I know first-hand how tough this is because my dad was an adjuster. In addition, during my 20+

years as an agent, I experienced the challenge of settling property losses many times. I

understand the dilemma claims professionals face trying to provide as much assistance to

someone in need within the constraints of the flood insurance contract.

We recognize your job is not easy. However, you have the opportunity to affect the claims

experience positively for NFIP policyholders. I appreciate that you go the extra mile to make sure

we are treating our policyholders with integrity and respect and getting every dollar allowed

them from the policy they purchased. Together we can help close the insurance gap and create

more resilient communities.

2 National Flood Insurance Program

The National Flood Insurance Act of 1968 (Title XII of the Housing and Urban Development Act of

1968, Public Law 90-448, codified as amended at 42 U.S.C § 4001 et seq.) created the National

Flood Insurance Program (NFIP). The NFIP is a cooperative venture involving the Federal

Government, state, and local governments, and the private insurance industry. The Federal

Government sets insurance rates, provides the necessary risk studies to communities, and

establishes floodplain management criteria guiding construction in the floodplain.

Communities must adopt and enforce minimum floodplain management standards for new,

substantially improved, and substantially damaged structures in order for the NFIP to provide

insurance within their boundaries. Private insurance companies, under an arrangement known

as the Write Your Own (WYO) program, sell and service federal flood insurance policies and

retain part of the premium for their efforts. FEMA also sells and services federal flood insurance

policies through the NFIP Direct Servicing Agent (NFIP Direct).

The Federal Insurance Directorate (FID) under the Federal Insurance and Mitigation

Administration (FIMA) is the component of FEMA charged with administering the NFIP.

3 Standard Flood Insurance Policy

The NFIP offers three Standard Flood Insurance Policy (SFIP) forms – Dwelling Form

1

, General

Property Form

2

, and the Residential Condominium Building Association Policy (RCBAP) Form

3

.

Each SFIP form has an insuring agreement between the policyholder and the insurer, which

details the terms and conditions explaining coverage and non-coverage provisions

4

.

1

44 C.F.R. pt. 61, App. A(1) (2018)

2

44 C.F.R. pt. 61, App. A(2) (2018)

3

44 C.F.R. pt. 61, App. A(3) (2018)

4

See 44 C.F.R. § 61.13 (2018); see also id. pt. 61, App. A(1), A(2), A(3)

12

June 1, 2019

FEMA | FIMA | NFIP

Claims Manual

Introduction

3.1 Dwelling Form

Insures a single-family dwelling, a two to four family dwelling, a residential renter, or a

residential condominium unit owner. See Section 1 for more information.

3.2 General Property Form

Insures a non-residential building or unit, a residential detached garage or outbuilding, a

non-residential leaseholder’s contents, a multi-family dwelling (other residential) such as

an apartment building, or a condominium association’s building, which has less than 75

percent of its square footage for residential use; and any other building that does not meet

the definition of a Dwelling or RCBAP. See Section 1 for more information.

3.3 Residential Condominium Building Association Policy Form

Insures a residential condominium building owned by a condominium association, which

has 75 percent or more of its square footage for residential use. See Section 1 for more

information.

4 Emergency and Regular Programs

NFIP only sells flood insurance in communities that participate in the NFIP. See the Community

Status Book for more information.

4.1 Emergency Program

A community may initially participate in the NFIP in the Emergency Program. The

Emergency Program is in place when FEMA has not made a Flood Insurance Rate Map

(FIRM). NFIP makes a limited amount of flood insurance coverage available for all residents

of the community. The community must adopt minimum floodplain management

standards to control future use of its floodplains.

5

4.2 Regular Program

The community joins the Regular Program of the NFIP after FEMA completes a detailed

engineering study for the community. The study allows FEMA to release the engineering

driven FIRM that provides flood data. The community must adopt or amend its floodplain

management regulations to incorporate the new flood data contained in the FIRM. FEMA

provides higher amounts of flood insurance coverage under the Regular Program than

under the Emergency Program and charges new construction actuarial rates to reflect the

risk of flooding.

6

5

See P.L. 90-448 § 1336, as added P.L. 91-152 § 91-152 § 408, 83 Stat. 396 (1969), 42 U.S.C. § 4056; 44 C.F.R. § 59.3 (2018)

6

See 44 C.F.R. § 59.2 (2018)

13

June 1, 2019

FEMA | FIMA | NFIP

Claims Manual

Introduction

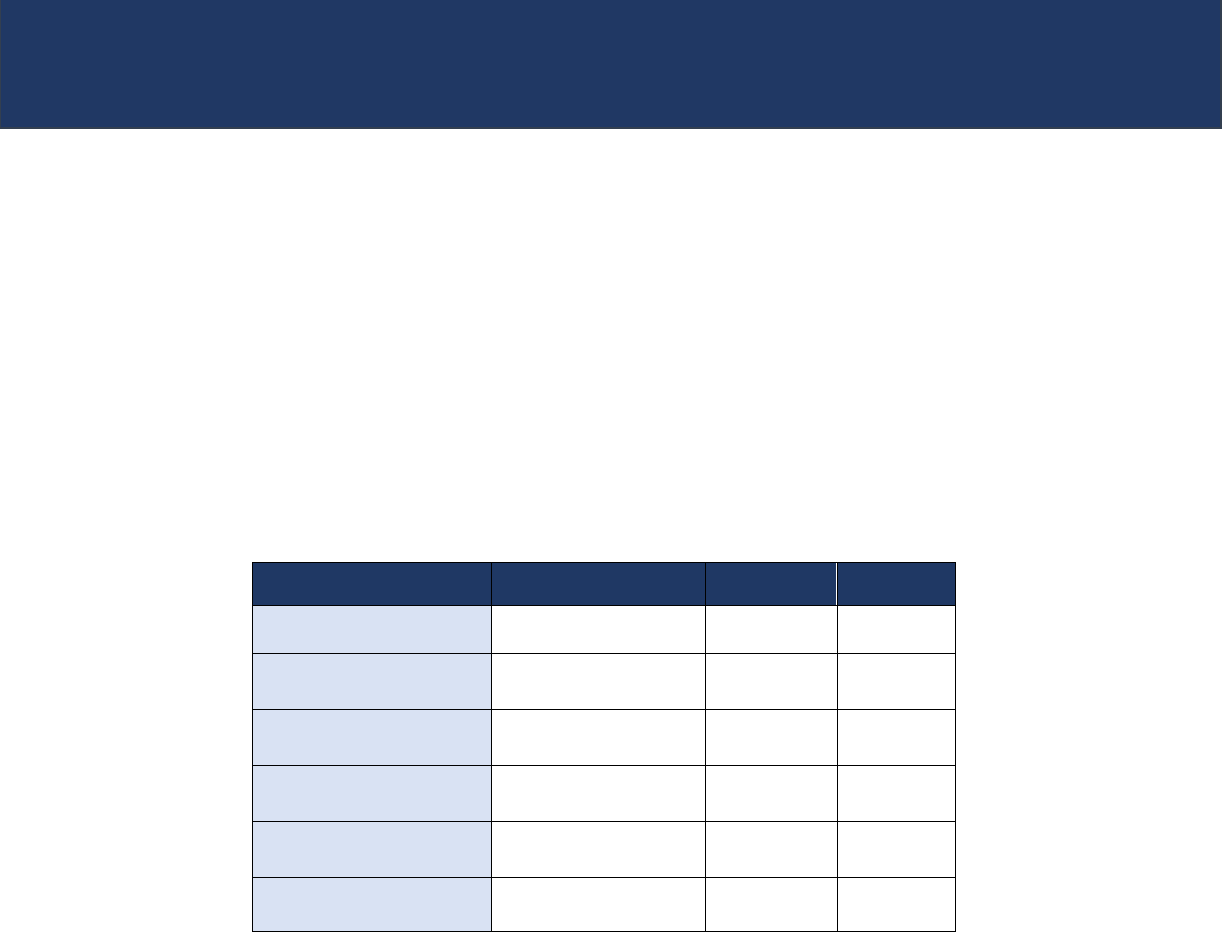

5 Amounts of Insurance Available

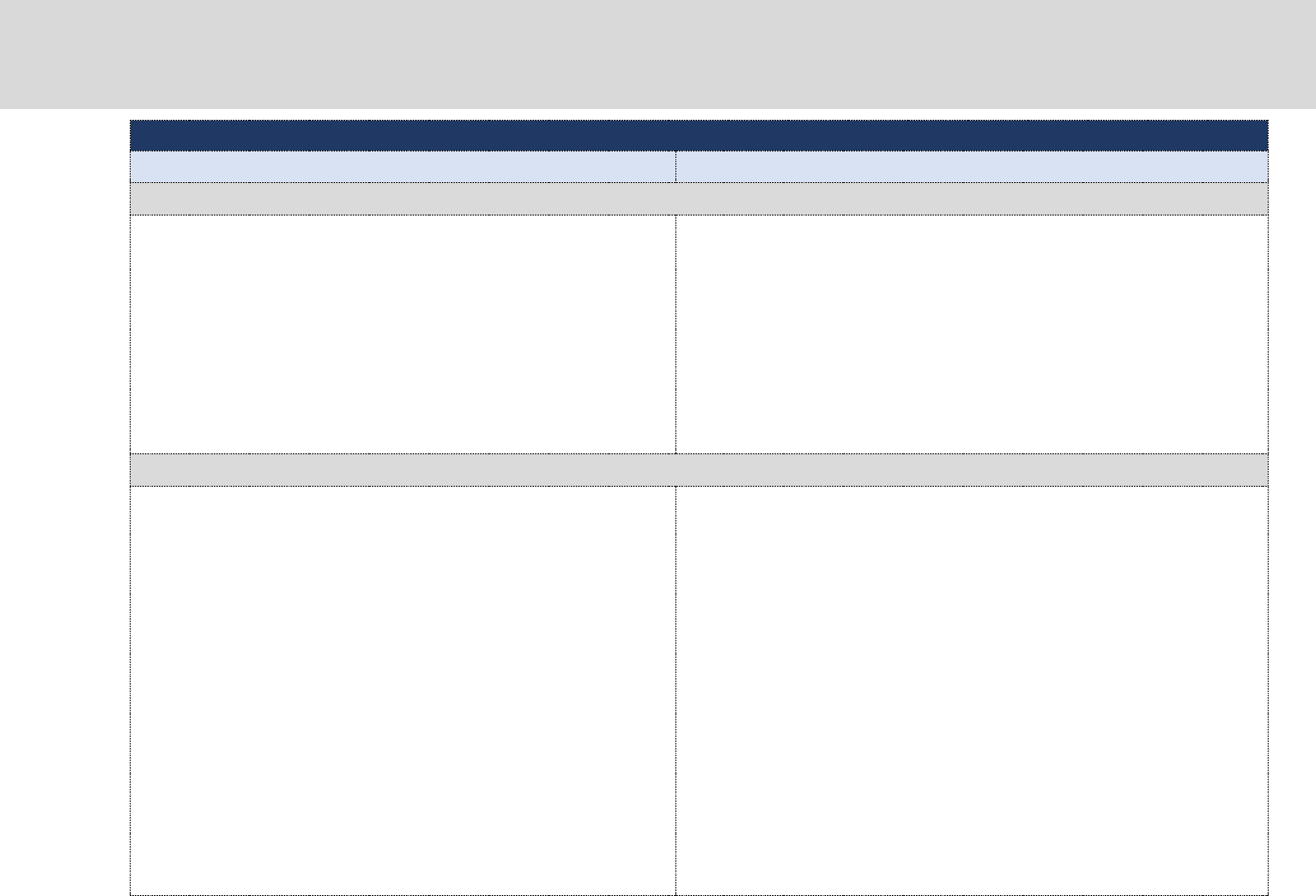

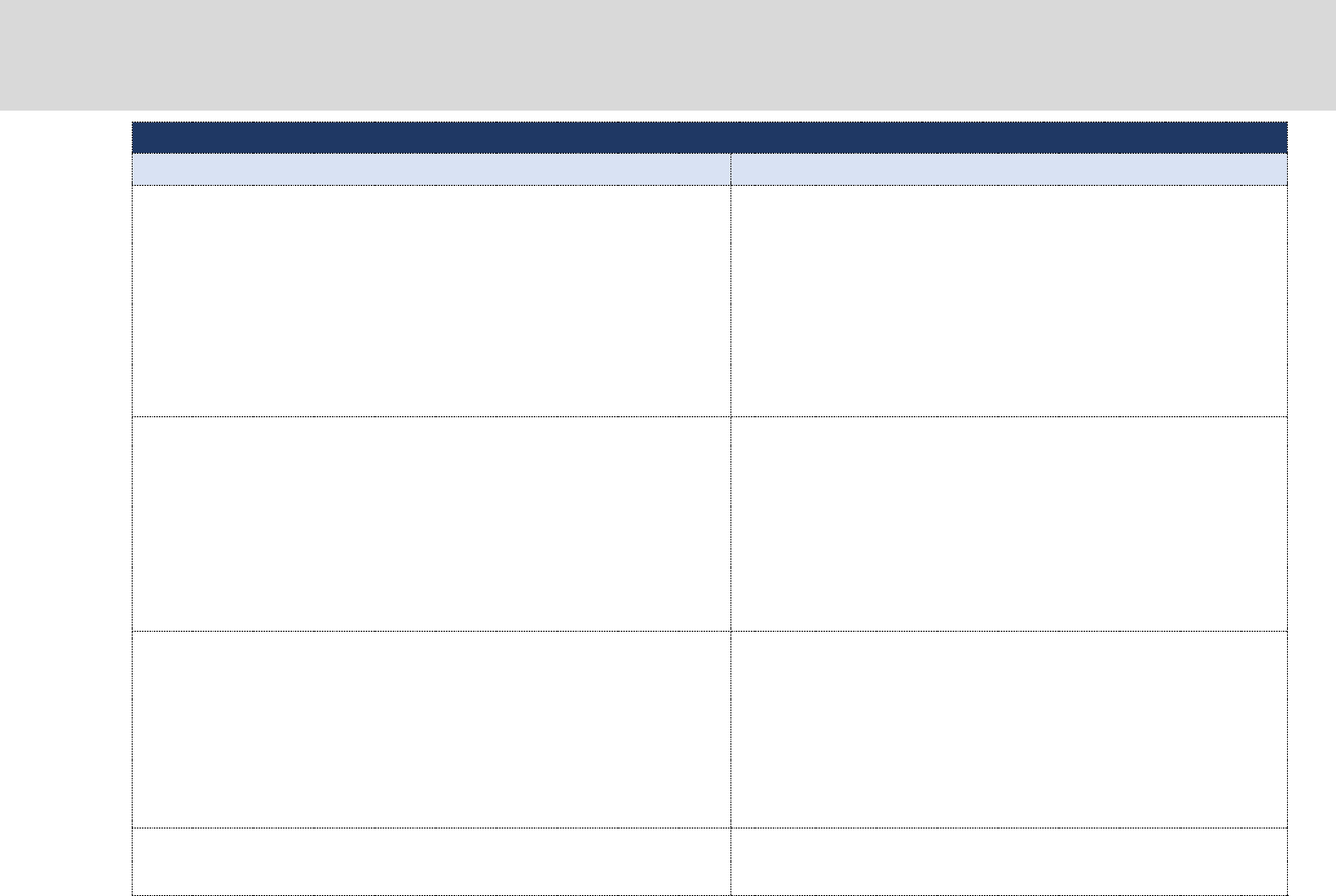

Table 1 shows the maximum amounts of insurance currently available under the SFIP for

building coverage and contents coverage, in both Emergency Program and Regular Program

communities. The aggregate limits for building coverage are the maximum coverage amounts

allowed by statute for each building included in the relevant occupancy category. These limits

apply to all single condominium units and all other buildings, not in a condominium form of

ownership, including cooperatives and timeshares

7

.

Table 1. Amounts of Insurance Available: Dwelling, General Property, and RCBAP Forms

Coverage

Type

Property Type

Emergency

Program

Regular Program

Building

Single – Family Dwelling

$35,000

1

$250,000

2 – 4 Family Building

$35,000

$250,000

Other Residential Building

$100,000

$500,000

Non-Residential Building (including Business Buildings

and Other Non-Residential Buildings)

$100,000

$500,000

Residential Condominium Building Association

N/A

$250,000 x number

of units or

replacement cost of

the building,

whichever is less.

Contents

Residential Property (Dwelling)

$10,000

$100,000

Non-Residential Business, Other Non-Residential

Property

$100,000

2

$500,000

Residential Property (RCBAP)

N/A

$100,000

1

In Alaska, Guam, Hawaii, and U.S. Virgin Islands, the amount of building coverage available in the Emergency

Program for a single-family dwelling and 2-4 family dwelling available is $50,000.

2

In Alaska, Guam, Hawaii, and U.S. Virgin Islands, the amount of building coverage available in the Emergency

Program for Other Residential and Non-Residential buildings is $150,000.

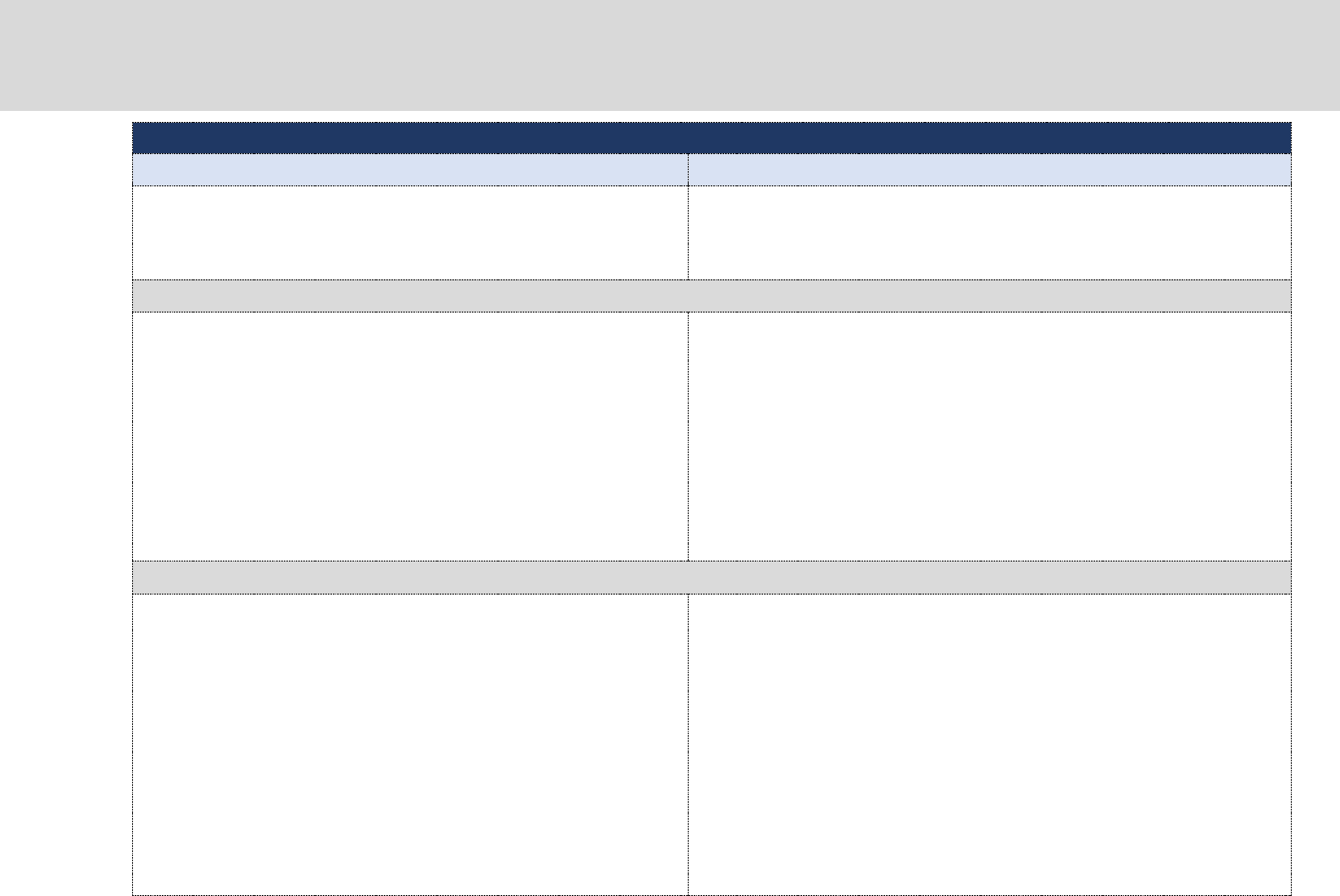

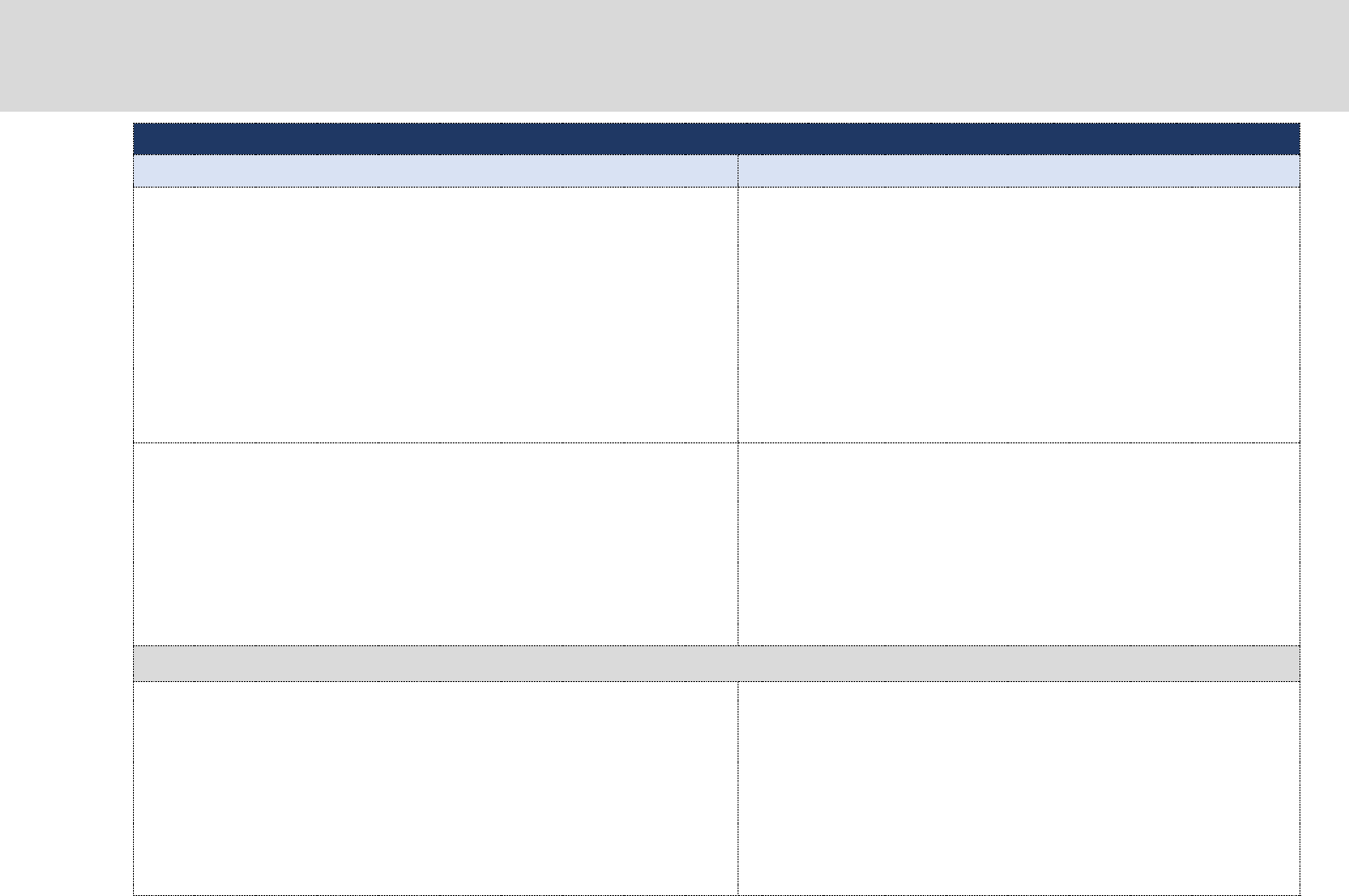

6 Deductibles

Table 2 shows the minimum deductibles available under the SFIP for building coverage and

contents coverage, in both Emergency Program and Regular Program communities.

7

See P.L 90-448 § 1306, 82 Stat. 575 (1968) (42 U.S.C. § 4013); 44 C.F.R. § 61.6 (2018)

14

June 1, 2019

FEMA | FIMA | NFIP

Claims Manual

Introduction

Table 2. Minimum Deductibles

1

Program

Type

Rating

Minimum

Deductible for

Coverage of

$100,000 or

Less

2

Minimum

Deductible for

Coverage Over

$100,000

Emergency

All

$1,500

$2,000

Regular

All pre-FIRM subsidized zones

3

: A, AE, A1-A30, AH, AO,

V, VE, and V1-V30, AR/AR Dual Zones without

Elevation Data

$1,000

$1,250

All Full-Risk

4

zones: A, AE, A1-A30, AH, AO, V, VE, and

V1-V30, AR/AR Dual Zones without Elevation Data and

B, C, X, A99, and D

Tentative and Provisional

1

The deductible for the PRP, MPPP and Newly Mapped policies will be $1,000 for both building and contents

if the building coverage is less than or equal to $100,000 and $1,250 if building coverage is over $100,000.

A contents-only policy will have a $1,000 deductible.

2

Use this column if building coverage is $100,000 or less, regardless of the contents coverage amount.

This includes policies issued with contents coverage only.

3

Pre-FIRM subsidized policies are those policies covering a pre-FIRM building that are rated in zones

unnumbered A, AE, A1–A30, AH, AO, VE, and V1–V30 without elevation data from an Elevation Certificate.

Also included among pre- FIRM subsidized policies are policies covering certain pre-FIRM buildings rated in

zones D and unnumbered V, for which the pre-FIRM subsidized rate remains more favorable than full-risk

rating in zone D or unnumbered V.

4

Full-Risk rates apply to all policies rated with elevation data from an Elevation Certificate in zones

unnumbered A, AE, A1–A30, AH, AO, VE, and V1–V30, regardless of whether the building is pre-FIRM or

post-FIRM. Post-FIRM buildings rated in zones D or unnumbered V, and pre-FIRM buildings in zones D or

unnumbered V using post-FIRM rate tables are considered Full-Risk. Full-Risk rates are also applied to all

policies rated in zones B, C, or X, regardless of product type or the building classification as pre-FIRM or

post-FIRM. Grandfathered standard-X zone policies and grandfathered policies using elevation data from

an Elevation Certificate are considered Full-Risk.

Refer to the Flood Insurance Manual for more information on deductibles, including maximum

and optional deductibles.

7 Group Flood Insurance Policy

A Group Flood Insurance Policy (GFIP) is an insurance certificate covering all individuals named

by a state as recipients under section 408 of the Robert T. Stafford Disaster Relief and

Emergency Assistance Act (P.L. 93-288 § 408, 42 U.S.C. § 5174) of an Individuals and Households

Program (IHP) award for flood damage because of a Presidential disaster declaration.

8

The NFIP

Direct handles all GFIPs. IHP funds the GFIP policy certificate, which is good for three years, from

the award to the recipient. Table 3 outlines the coverage details of the GFIP.

8

See 44 C.F.R. § 61.17(a) (2018); see also id. 206.119(d) (explaining purchase of GFIP)

15

June 1, 2019

FEMA | FIMA | NFIP

Claims Manual

Introduction

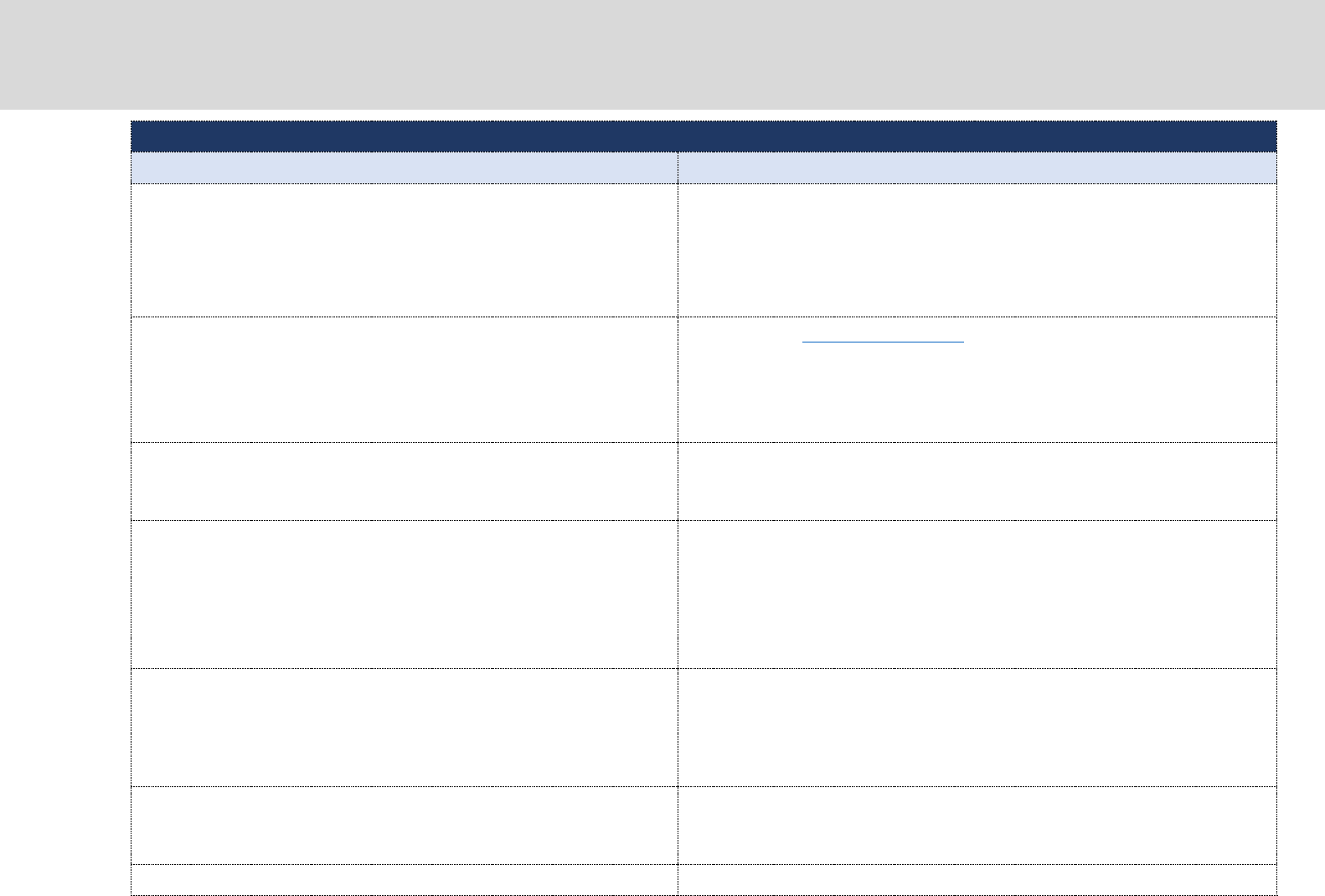

Table 3. GFIP Policy Details

Section

Details

Coverage

Amount

The amount of coverage is equivalent to the maximum grant amount established under

section 408 of the Stafford Act (42 U.S.C. § 5174) which FEMA determines annually.

9

See

the Federal Register

for the current grant amount.

Covered

Property

The GFIP covers the building and personal property of an owner. As of the publication

of this manual, the policyholder has the choice of whether to use the funds solely for

building damages, solely for contents damages, or for a combination of building and

contents. For renter policyholders, the GFIP is for damaged contents owned by the

policyholder. A renter cannot have building coverage under the GFIP.

There is no Increased Cost of Compliance (ICC) coverage under the GFIP.

Term

The term of the GFIP is for 36 months and begins 60 days after the date of the disaster

declaration. Coverage for individual grantees begins on the 30th day after NFIP Direct

receives the required data for the grantees and their premium payments. IHP will send

a Certificate of Flood Insurance to each individual under the GFIP.

10

Deductible

The GFIP is the SFIP Dwelling Form, except that Section VI. Deductibles does not apply.

FEMA applies separate deductibles of $200 each to any building loss and any contents

loss. This deductible applies to flood-damaged losses sustained to the insured property

during the term of the GFIP.

The deductible does not apply to the SFIP Section III.C.2. Loss Avoidance Measures, or

Section III. C.3. Condominium Loss Assessments Coverage.

The following sections of the SFIP do not apply to the GFIP:

• Section VII. General Conditions, E. Cancellation of Policy by You

• Section VII. General Conditions, H. Policy Renewal.

11

Cancellation

The policyholder cannot cancel a GFIP. However, the policyholder may purchase a

regular SFIP through the NFIP. Upon the purchase of an SFIP, the group flood certificate

becomes void and the NFIP does not refund the GFIP premium.

Renewal

NFIP Direct will send a notice to the GFIP certificate holders approximately 60 days

before the end of the 36-month term of the GFIP. The notice encourages the certificate

holder to contact an insurance agent or private insurance company selling NFIP policies

under the WYO program to purchase the amount of flood insurance coverage they

must have to maintain their eligibility for future disaster assistance.

12

8 Disaster Response

Every year disasters put millions of Americans in danger and cause billions of dollars of property

damage. FEMA is always ready, helping communities reduce their risk, helping emergency

9

See 44 C.F.R. § 61.17(c) (2018); 42 U.S.C. § 5174(h) (setting the limit at $25,000 with an annual adjustment)

10

See 44 C.F.R. § 61.17 (d)-(f)

11

See 44 C.F.R. § 61.17(g)

12

See 44 C.F.R. § 61.17(h)

16

June 1, 2019

FEMA | FIMA | NFIP

Claims Manual

Introduction

officials prepare for all hazards, and assisting our insured survivors on their road to recovery.

Following are disaster response efforts and offices established in support of disasters.

8.1 FEMA Joint Field Office

The FEMA Joint Field Office (JFO) is a temporary federal facility established close to a

disaster or a multi-state event. FEMA may establish JFOs that function as central points for

federal, state, local, and tribal executives with responsibility for incident oversight,

direction, or assistance to coordinate protection, prevention, preparedness, response, and

recovery actions.

Federal Insurance assists the JFO in several capacities pre- and post-disaster. It oversees

and coordinates response efforts between other divisions of FEMA and the NFIP to ensure

the execution of flood response activities.

8.2 Disaster Response NFIP Field Offices

A. Adjuster Control Office

NFIP Direct establishes the Adjuster Control Office (ACO) to control the assignment and

coordination of NFIP Direct claims including the GFIP, Repetitive Loss (RL), and Severe

Repetitive Loss (SRL) policies.

B. Integrated Flood Insurance Claims Office

NFIP Direct establishes an on-site Integrated Flood Insurance Claims Office (IFICO)

following a major flooding event to process NFIP Direct flood claim payments. Examiner

staff and general adjuster staff assist flood adjusters, agents, and policyholders in the

handling of NFIP Direct flood claims.

C. Flood Response Office

The NFIP directs its Bureau and Statistical Agent (NFIP BSA) to establish a Flood Response

Office (FRO) to provide a local NFIP presence and base of operations during a flood event.

The NFIP BSA General Adjusters (GAs), NFIP BSA Regional Support staff, and others may be

deployed to a FRO to conduct a variety of activities to support the NFIP stakeholders,

including policyholders, adjusters, local officials, agents, WYO Companies, the NFIP Direct,

and FEMA. FRO activities are conducted in cooperation with other Government operations,

including FEMA Disaster Field Offices (DFOs), FEMA Joint Field Offices (JFOs) and others.

At the FRO, the NFIP BSA:

• Coordinates with the insurers to provide guidance on the scope of coverage.

• Facilitates the adjustment of losses sustained by NFIP policyholders.

17

June 1, 2019

FEMA | FIMA | NFIP

Claims Manual

Introduction

• Educates and informs the insured public, agents, adjusters, and federal and state

officials in matters related to the NFIP's total catastrophic response procedures

through distribution of posters, notices, and NFIP material, and attendance and

support of FEMA at community meetings.

• Conducts special adjuster briefings, surveys flood disaster areas, assesses the extent of

damage, and advises FEMA of findings.

• Implements the re-inspection program and performs claims troubleshooting activities.

8.3 Adjuster Briefings

The NFIP BSA General Adjusters and FEMA conduct adjuster briefings immediately after

major storms. These briefings address regional problems, construction issues, adjuster

authorization, and community, and state ordinances, etc. FEMA posts the date, time, and

location of the briefings at www.nfipservices.floodsmart.gov. Independent adjusters,

adjusting firms, and WYO Company claims examiners and representatives should attend

these briefings.

9 Claims Professionals Expectations

FEMA expects all claims professionals to be committed to the following NFIP core values of

compassion, fairness, integrity, respect, and diversity. See Appendix L, NFIP Customer Service

Standards.

9.1 NFIP Core Values

A. Compassion

Be empathetic to the stressful circumstances the policyholder may be experiencing and

your crucial role in helping their recovery. Every interaction with the policyholder is an

opportunity to cultivate rather than harm a relationship.

B. Fairness

Strive to achieve principled, well-reasoned, and just outcomes in the execution of all claims

and adjust each claim fairly and without unnecessary delay, bias, or preference.

C. Integrity

Integrity is the foundation of all our actions and is central to our conduct. Maintain the

highest standards of integrity by creating a culture of honesty, consistency, and

predictability. Trust is the earned result of conducting our actions with integrity. Failure to

adhere to the highest standards reflects poorly on the NFIP.

18

June 1, 2019

FEMA | FIMA | NFIP

Claims Manual

Introduction

D. Respect

Treat all policyholders with dignity and respect. This is not only important, it is also their

right.

E. Diversity

Diversity is one of the defining strengths of our Nation. Our policyholders reflect the full

spectrum of cultures, beliefs, backgrounds, and commitments. The NFIP is committed to

serving the needs of every policyholder recognizing that diversity is central in our work

every day.

9.2 Customer Service

A. Be Professional

FEMA expects:

•

Claims professionals to respond promptly to telephone inquiries; be available

to answer questions, update the policyholder about the status of their claim,

and present clear and correct information about their claim.

•

Claims professionals to include all allowances payable in the policy in the

estimate. NFIP coverage differs from other insurance policies and claims

professionals may need to spend some extra time addressing the differences

with the policyholder.

•

Claims professionals to explain coverage early in the claim process in a clear

manner. For example, post-FIRM elevated building and basement coverage

can confuse the policyholder and require additional explanation.

•

Claims professionals to inform the policyholder of the exclusions in the SFIP

and the steps necessary to pay their claim promptly.

•

Claims professionals to be considerate of the policyholder’s time, keep

appointments, and honor their commitments.

•

NFIP adjusters to provide a copy of the estimate and assist policyholders with

the contents claim and proof of loss.

•

NFIP examiners to confirm that all payment recommendations made by the

adjuster are in line with the policy.

B. Be Prepared

FEMA expects:

•

Claims professionals to have their resources on hand; and to understand the

19

June 1, 2019

FEMA | FIMA | NFIP

Claims Manual

Introduction

policy including all three SFIP forms, Dwelling, General Property, and RCBAP,

and the GFIP. All claims professionals must have a good command of the SFIP

and its application of coverages so they can successfully support the

policyholder.

•

Claims professionals to ensure adjusting software is properly calibrated for the

geographic area where the loss occurred, and accounts for post-disaster, and

property-specific issues.

•

Claims professionals to offer an advance payment to the policyholder with an

eligible claim, and always check for new guidance on advance payments.

•

Claims professionals to know when to engage outside professional services on

adjustments and, when necessary, seek the appropriate authorization in a

timely manner.

C. Be Compassionate

FEMA expects:

•

Claims professionals to treat its policyholders with respect. The adjuster

should realize a policyholder and their family may have lost most of their

personal possessions, or worse, may no longer have a home to return to.

•

Claims professionals to be flexible based on the circumstances affecting the

policyholder. This may mean to make reasonable changes to accommodate

the needs of the policyholder when it comes to inspecting the loss, discussing

the claim, and returning phone calls.

•

Claims professionals to remember the flood loss may create a traumatic

experience and response by the policyholder. Claims professionals often work

with people under stress and should recognize this and create a positive

policyholder claims experience.

10 NFIP Adjuster Participation

FEMA’s goal is to ensure that claims professionals adjust each claim fairly and without

unnecessary delay. Adjusters should treat each policyholder with respect, fairness, and equity

during this stressful time in their lives.

Adjusters represent the NFIP and demonstrate its commitment to improved customer

experience. Adjusters will likely be the first and perhaps the only NFIP representative a

policyholder meets after a flood. The NFIP depends on the adjusters’ expertise and compassion

to help our policyholders recover from what may be a devastating experience for them.

20

June 1, 2019

FEMA | FIMA | NFIP

Claims Manual

Introduction

The adjuster works in concert with the claims examiner to guide a policyholder through the NFIP

claims process.

10.1 Adjuster Authority

FEMA expects every adjuster handling NFIP flood losses:

•

To understand and to communicate to the policyholders that the adjuster

does not have the authority to deny a claim.

•

To understand that the adjuster does not have the authority to commit the

NFIP insurer to pay a claim.

•

To understand that all adjustments are only recommendations and subject to

review by the NFIP insurer.

Important: Adjusters should follow the insurer’s guidelines. They should refer coverage

questions requiring clarification through their internal chain of command.

10.2 NFIP Knowledge

FEMA expects every adjuster handling NFIP flood losses:

•

To be thoroughly familiar with the provisions of the applicable form of the

SFIP and the GFIP.

•

To know the coverage interpretations issued by FEMA and explained at the

NFIP Claims Presentations.

•

To communicate the coverage and limitations to policyholders during the

inspection.

•

To adjust all claims in compliance with these provisions.

•

To help the policyholder to document their loss as complete and accurate as

reasonably possible.

10.3 Required NFIP Adjuster Authorization

Independent adjusters must register with the NFIP BSA to adjust flood losses for NFIP

insurers and possess an active Flood Control Number (FCN). Adjusters must have the

qualifications noted below and attend an annual NFIP Claims Presentation to become an

authorized adjuster or to maintain active status. The NFIP BSA verifies credentials before

an adjuster receives an FCN.

FEMA holds annual NFIP claims presentations to keep the adjusting community current on

claims procedures and guidance required to adjust losses under the three forms of the SFIP.

21

June 1, 2019

FEMA | FIMA | NFIP

Claims Manual

Introduction

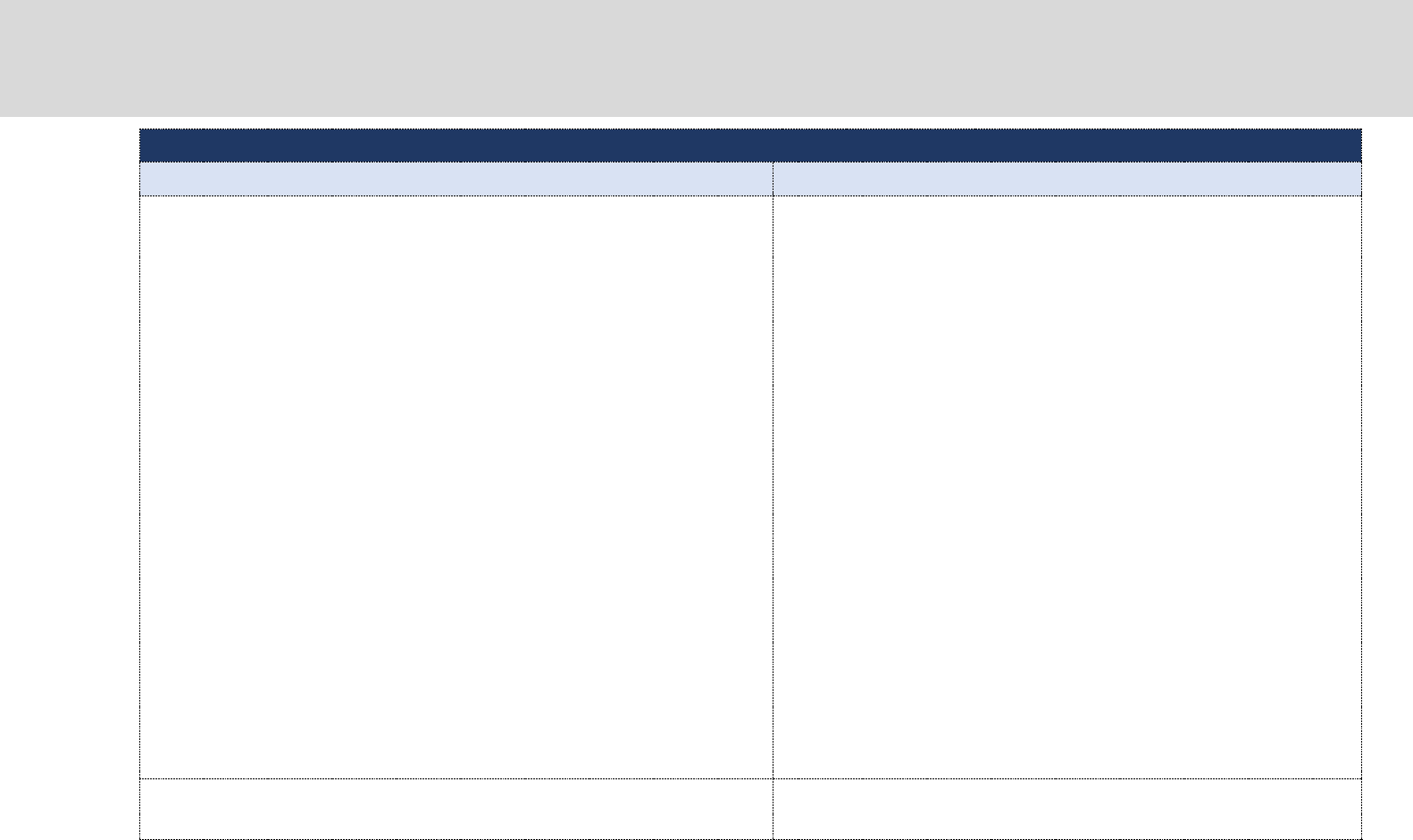

10.4 Adjuster Qualifications

The NFIP requires adjusters to have different levels of qualifications to adjust different

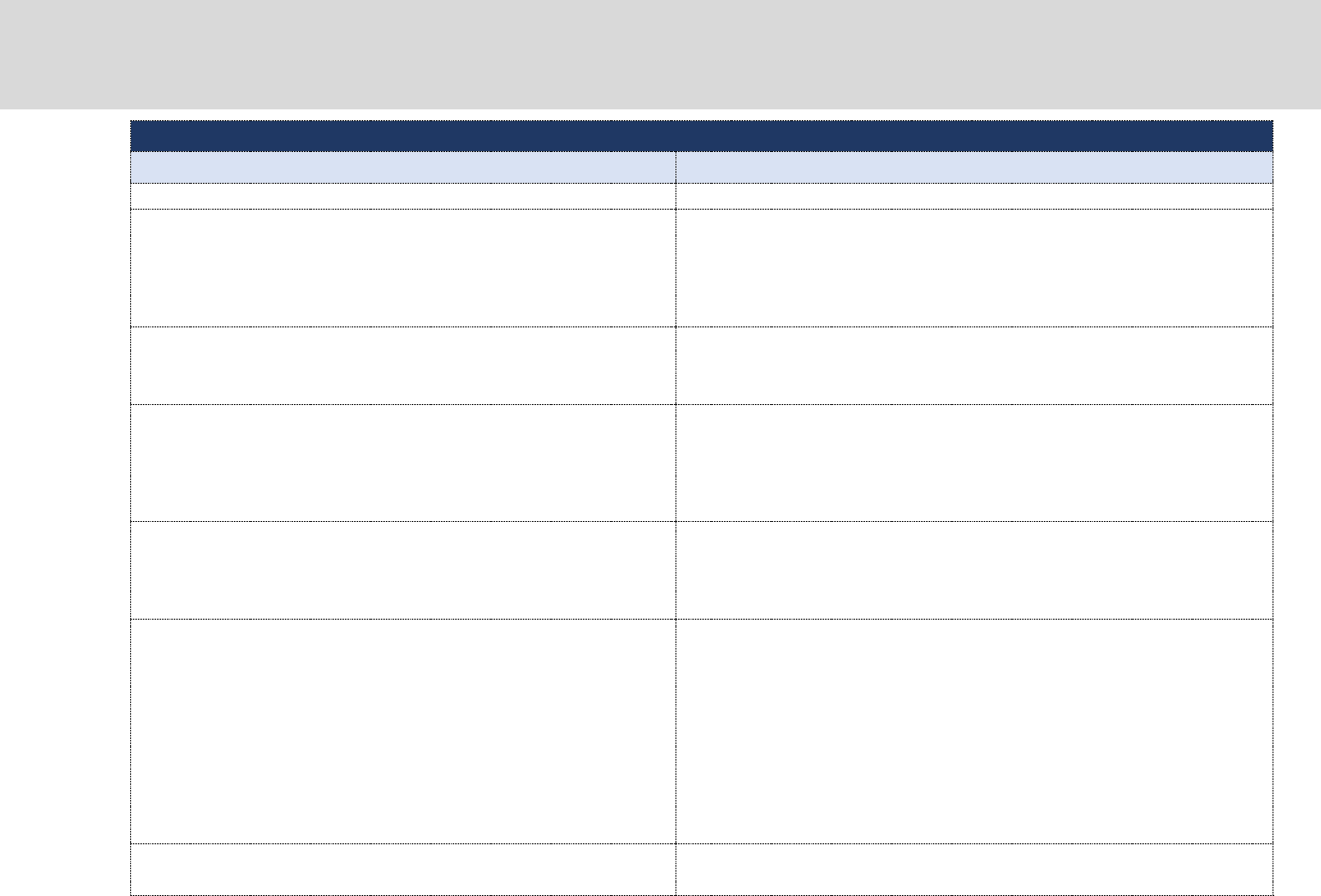

property types. Table 4 details what types of properties an adjuster can adjust for a given

level of training.

Table 4. Adjuster Qualifications

Property

Type

Authorization Requirements

Residential,

Manufactured

Home, Travel

Trailer, and

Commercial

Losses

• Have at least four consecutive years of full-time property loss adjusting

• experience.

• Be capable of preparing an accurate scope of damage and dollar estimate to

• $50,000 for manufactured homes and travel trailers, $250,000 for residential

• losses, and up to $500,000 for commercial losses.

• Have attended an NFIP Claims Presentation, once a year.

• Demonstrate knowledge of the SFIP and of NFIP adjustment criteria for all policy

forms.

• Be familiar with manufactured home and travel trailer and Increased Cost of

Compliance coverages and criteria.

• NFIP encourages adjusters to have Errors and Omissions (E & O) Insurance

coverage. Some WYO Companies require adjusters assigned to their claims to

have E & O coverage.

Large

Commercial

and RCBAP

Losses

• Have at least five consecutive years of full-time large-loss property adjusting

experience.

• For large commercial losses, be capable of preparing an accurate scope of

damage and dollar estimate of $500,000 or more.

• For RCBAP, be capable of preparing an accurate scope of damage and dollar

estimate of $1,000,000 or more.

• Have attended an NFIP Claims Presentation.

• Provide written recommendations from three insurance company supervisors or

claims management personnel. The recommendations must reflect his/her

adjusting experience only.

• NFIP encourages adjusters to have Errors and Omissions (E & O) Insurance

coverage. Some WYO Companies require adjusters assigned to their claims to

have E & O coverage.

10.5 Adjuster Authorization Process

NFIP recognizes that specialized knowledge is required for an adjuster to adjust NFIP

losses. Adjusters must know the differences between the SFIP forms and differences with

private industry property insurance forms. They must know interpretations of coverage

made by FEMA and the unique reporting requirements of the NFIP.

A. NFIP BSA

The NFIP, through its NFIP BSA, issues FCNs and maintains a database of active authorized

independent flood adjusters and inactive flood adjusters. The NFIP BSA also maintains

records of the date and location of adjusters’ attendance at an annual NFIP Claims

22

June 1, 2019

FEMA | FIMA | NFIP

Claims Manual

Introduction

Presentation, or attendance at a FEMA-approved claims presentation conducted by

independent adjusting firms or WYO Companies.

B. WYO Staff Adjusters

WYO Companies can use staff adjusters to adjust their flood losses. Though not required,

FEMA encourages WYO staff adjusters handling flood claims on behalf of their employing

WYO Company to have an FCN.

C. Adjuster Registration

The Adjuster Registration Application contains five registration categories. Adjusters can

register for any or all categories if they meet adjuster qualification requirements. The

categories are:

•

Residential

•

Manufactured (Mobile) Home/Travel Trailer

•

Small Commercial (<$100,000)

•

Large Commercial ($100,001 - $500,000)

•

Condominium (RCBAP)

New applicants and adjusters seeking upgrades to their existing registration must submit a

completed Adjuster Registration Application to the NFIP BSA via any of the following

methods:

E-mail: NFIPCl[email protected]

Mail: NFIP BSA, PO Box 310, Lanham, MD 20703-0310

Adjusters seeking to maintain their active registered status do not need to submit an

application. The NFIP BSA will automatically renew previously registered adjusters when

they attend an annual NFIP Claims Presentation for the current calendar year.

The NFIP BSA will email new adjusters and adjusters who request an upgrade to their

classification of the approval or denial of their application. All approved adjusters who

attend the annual NFIP Claims Presentation receive an emailed FCN card confirming their

registration to handle NFIP flood claims.

Important: Adjusters who do not attend an annual NFIP Claims Presentation become

inactive and cannot adjust flood claims until they attend an approved NFIP Claims

Presentation and are reactivated.

10.6 NFIP Fee Schedule

Adjusters may bill based on the current NFIP Adjuster Fee Schedule:

23

June 1, 2019

FEMA | FIMA | NFIP

Claims Manual

Introduction

•

Current Adjuster Fee Schedule effective August 24, 2017 (See Appendix A)

•

For ICC claims, use the ICC fee schedule effective September 1, 2004 (See

Appendix B)

A. Gross Loss

The Adjuster Fee Schedule sets compensation amounts based on the claim’s gross loss.

Gross loss is the agreed cost to repair or replace before application of depreciation,

applicable deductible(s), and salvage buy-back. Gross loss shall not exceed any or all of the

following policy limitations: Building and personal property policy limits stated in the

Declarations Page; Program Limits building and/or personal property; damage values no

greater than 10% for a detached garage (Dwelling Form); Special Limits ($2,500); Loss

Avoidance Measures for Sandbags, Supplies, and Labor ($1,000); Property Removed to

Safety ($1,000); Pollution Damage - General Property form ($10,000); Policy Exclusions.

B. Increased Cost of Compliance (ICC) Claims

For Increased Cost of Compliance claims, use the ICC Fee Schedule whether the claim is

paid or closed without payment.

11 Examiner Participation in the NFIP

FEMA’s goal is to ensure that claims professionals handle each claim quickly and fairly and to see

that everyone involved in the flood claim process treats each policyholder with respect and

empathy.

NFIP insurers have the authority to act on behalf of the NFIP to examine claims, make coverage

decisions, and communicate the NFIP’s position to policyholders. How the examiner handles

their oversight of flood claims can positively influence the customer experience. The examiner

must be knowledgeable of the NFIP, stay up to date on program guidance, and be

compassionate about the situations that policyholders are facing. The examiner can help NFIP

policyholders recover from what may be a devastating experience for them by being responsive

to policyholder inquiries, proactively examining reports, timely issuing payments, and providing

appropriate and professional communications.

Examiners work in concert with the adjuster to guide policyholders through the entire NFIP

claims process – from the Notice of Loss to their final payment. Their knowledge of the SFIP can

make the policyholder’s recovery smoother by communicating what they should do to move

their claim along the claims journey.

11.1 Authority

Examiners are the claims administrators of the NFIP insurers and have the authority

through their management, to pay claims, make and confirm coverage determinations, and

24

June 1, 2019

FEMA | FIMA | NFIP

Claims Manual

Introduction

to deny coverage when appropriate. Examiners should provide adjusters guidance as

needed.

FEMA expects every examiner handling NFIP flood losses to:

•

Understand their first obligation to a policyholder is to identify coverage

under the SFIP.

•

Understand they should not take their authority lightly to determine

coverage under the SFIP and be aware that their decisions have a direct

impact on policyholders.

•

Understand their payment decisions must be in accordance with the SFIP.

Important: Examiners should follow their insurers’ internal settlement authority guidelines.

Examiners should also refer coverage questions that require clarification through their

internal chain of command.

11.2 Responsibilities

Claims examiner responsibilities include:

•

Assigning an adjuster within 24 hours of receipt of claim or document why

they did not make the assignment in the time frame required.

•

Managing the claim file including:

−

Issuing advances.

−

Resolving rating issues.

−

Overseeing adjusters for timely reporting settlement

recommendation.

−

Using experts.

−

Issuing proper payment.

•

Claims reporting and forms management including:

−

Transaction Record Reporting Process (TRRP) reporting.

−

Proper expense payments.

•

Communicating with policyholders, including information on reservation

of rights, non-waiver agreements, partial and full denial letters, and other

communications as necessary.

•

Handling of Increased Cost of Compliance (ICC) claims.

25

June 1, 2019

FEMA | FIMA | NFIP

Claims Manual

Introduction

11.3 Knowledge of the NFIP

FEMA expects every examiner handling NFIP flood losses:

•

To be thoroughly familiar with the provisions of the three forms of the

SFIP and the GFIP.

•

To know the coverage interpretations issues by FEMA and as explained at

the NFIP Claims Presentations.

•

To communicate the coverage and limitations to policyholders.

•

To oversee all flood claims in compliance with these provisions.

12 Training for Claims Professionals

12.1 NFIP Sponsored Training

A. Emergency Management Institute

FEMA’s Emergency Management Institute (EMI) offers independent study courses for

claims professionals that reinforce information offered at the NFIP Adjuster Claims

Presentations. EMI Independent Study courses are free and available to anyone. All

students must have a FEMA Student Identification (SID) number to take a course and can

register for a SID at https://cdp.dhs.gov/FEMASID.

Find out more about EMI Independent Study Courses and NFIP Perspectives informational

videos at https://nfipservices.floodsmart.gov/home/training/emi.

The Independent Study catalog is available at https://training.fema.gov/is/crslist.aspx.

Below is a list of relevant courses.

B. Adjuster Courses

−

Claims Review for Adjusters (IS-1104)

−

Adjuster Customer Service (IS-1107)

−

Introduction to Flood Claims (IS-1112)

−

Understanding Basement Coverage (IS-1109)

−

Introduction to Commercial Claims (IS-1111)

C. All Audiences

−

Increased Cost of Compliance (IS-1100)

−

EC Made Easy: Elevation Certificate Overview (IS-1105)

26

June 1, 2019

FEMA | FIMA | NFIP

Claims Manual

Introduction

12.2 Annual NFIP Claims Presentations

NFIP Claims Presentations keep the insurer examiners and the adjusting community

current on claims procedures and guidance required to adjust or oversee losses under the

three forms of the SFIP. FEMA does not charge a fee to attend the presentations, but you

must register. Click here to sign up for NFIP Adjuster Training emails.

12.3 Other Training

A. Associate in National Flood Insurance (ANFI)

Claims professionals may obtain the designation through the American Institute for

Chartered Property Casualty Underwriters, The Institutes, Risk & Insurance Knowledge

Group. There may be a cost associated with the ANFI designation that is not borne by the

NFIP. An ANFI designation is not required by FEMA to handle NFIP claims, and we do not

endorse or control the course content.

27

June 1, 2019

This page was intentionally left blank.

28

June 1, 2019

FEMA | FIMA | NFIP

Claims Manual

Section 1: SFIP Forms

Section 1: SFIP Forms

1 Overview

The SFIP specifies the terms and conditions of the insuring agreement between either FEMA, as

insurer for policies issued by the NFIP Direct, or the WYO Company as insurer for policies issued

through the WYO Program.

There are three policy forms:

1. Dwelling Form

2. General Property (GP) Form

3. Residential Condominium Building Association Policy (RCBAP) Form

Each form insures a different type of property; however, many coverage terms and conditions

are the same. This manual will detail coverages for each of the three forms. The following tables

include the actual policy language in the left columns, with commentary in the right columns.

29

June 1, 2019

FEMA | FIMA | NFIP

Claims Manual

Section 1: SFIP Forms – Dwelling Form

2 Dwelling Form

PLEASE READ THE POLICY CAREFULLY. THE FLOOD INSURANCE PROVIDED IS SUBJECT TO LIMITATIONS, RESTRICTIONS, AND

EXCLUSIONS. THIS POLICY COVERS ONLY:

1. A NON-CONDOMINIUM RESIDENTIAL BUILDING DESIGNED FOR PRINCIPAL USE AS A DWELLING PLACE OF ONE TO FOUR

FAMILIES, OR

2. 2. A SINGLE FAMILY DWELLING UNIT IN A CONDOMINIUM BUILDING.

I. Agreement

Policy Language Additional Explanation

The Federal Emergency Management Agency (FEMA) provides

flood insurance under the terms of the National Flood Insurance

Act of 1968 and its Amendments, and Title 44 of the Code of

Federal Regulations.

We will pay you for direct physical loss by or from flood to your

insured property if you:

1. Have paid the correct premium;

2. Comply with all terms and conditions of this policy;

and

3. Have furnished accurate information and statements.

We have the right to review the information you give us at any

time and to revise your policy based on our review.

This policy is under Federal law, unlike other property lines. Relevant definition at II.B.12 (direct

physical loss). Policyholder responsibilities appear at Section VII.J, K. post-loss underwriting at

Section VII.G.

30

June 1, 2019

FEMA | FIMA | NFIP

Claims Manual

Section 1: SFIP Forms – Dwelling Form

II. Definitions

Policy Language Additional Explanation

A.

In this policy, “you” and “your” refer to the insured(s) shown on the Declarations Page of this policy and your spouse, if a resident of the same household.

Insured(s) includes: Any mortgagee and loss payee named in the Application and Declarations Page, as well as any other mortgagee or loss payee determined

to exist at the time of loss in the order of precedence. “We,” “us,” and “our” refer to the insurer.

Some definitions are complex because they are provided as they appear in the law or regulations or result from court cases. The precise definitions are intended

to protect you.

Flood, as used in this flood insurance policy, means:

1. A general and temporary condition of partial or complete inundation of

two or more acres of normally dry land area or of two or more

properties (one of which is your property) from:

a. Overflow of inland or tidal waters,

b. Unusual and rapid accumulation or runoff of surface waters from any

source,

c. Mudflow.

For a general condition of flood to exist, the inundation must cover two or more

acres of normally dry land or two or more parcels of land, one of which can be

public property (such as a roadway).

The reference to “partial or complete inundation of two or more acres of normally

dry land area or of two or more properties” requires that the two or more acres must

be continuous acres, and that the two or more inundated parcels of land must touch.

For mudflow definition, see SFIP Section II.B.19.

2. Collapse or subsidence of land along the shore of a lake or similar body

of water as a result of erosion or undermining caused by waves or

currents of water exceeding anticipated cyclical levels that result in a

flood as defined in A.1.a. above.

The SFIP also defines a flood as the collapse or subsidence of land along the shore of

a lake or similar body of water from erosion or undermining caused by waves or

currents of water (velocity flow) exceeding anticipated cyclical levels during a flood

from the overflow of inland or tidal waters.

The SFIP does not cover damage from any other cause, form, or type of

earth movement. It also does not cover gradual erosion.

See Exclusions at SFIP Section V.C.

B.

The following are the other key definitions we use in this policy:

1. Act

The National Flood Insurance Act of 1968 and any amendments to it.

Refer to policy language.

2. Actual Cash Value

The cost to replace an insured item of property at the time of loss, less the

value of its physical depreciation.

Actual cash value (ACV) is the cost to replace a building, a building item, or a

personal property item, that includes all charges related to material, labor, and

equipment. The unit price may include charges such as delivery, assembly, sales

tax, and any applicable overhead and profit, and the like, less applicable

depreciation on all components of such price.

31

June 1, 2019

FEMA | FIMA | NFIP

Claims Manual

Section 1: SFIP Forms – Dwelling Form

II. Definitions

Policy Language Additional Explanation

3. Application

The statement made and signed by you or your agent in applying for this

policy. The application gives information we use to determine the eligibility of

the risk, the kind of policy to be issued, and the correct premium payment. The

application is part of this flood insurance policy. For us to issue you a policy,

the correct premium payment must accompany the application.

The statement made and signed by the prospective policyholder or the agent when

applying for a policy. The application contains information including the property

description, information to determine eligibility, the policy form selected, the

selected coverage and limits, deductible, and the premium amount.

4. Base Flood

A flood having a one percent chance of being equaled or exceeded in any

given year.

Refer to policy language.

5. Basement

Any area of the building, including any sunken room or sunken portion of a

room, having its floor below ground level (subgrade) on all sides.

The SFIP definition for a basement means the floor level of a room, or any area of a

floor level in a building is below the ground level on all sides. This definition may

differ from what policyholders consider as their “basement.” The SFIP considers a

sunken room or sunken portion of a room to be a basement if the floor level is below

the ground level on all sides. The entire below-ground-floor-level area, including

walls and the ceiling that may extend above grade, is subject to basement coverage

limitations.

32

June 1, 2019

FEMA | FIMA | NFIP

Claims Manual

Section 1: SFIP Forms – Dwelling Form

II. Definitions

Policy Language Additional Explanation

Figure 2. Sunken Room

Photograph credit Amber Flooring

Ground level is the surface of the ground immediately along the perimeter of the

building. If an exterior area of egress into the building is below the ground level on all

sides, installed over a subgrade, the area of egress is below ground level.

Figure 3. Ground Level vs. Below Ground Level

33

June 1, 2019

FEMA | FIMA | NFIP

Claims Manual

Section 1: SFIP Forms – Dwelling Form

II. Definitions

Policy Language Additional Explanation

Figure 4. Egress

A subgrade is a surface of earth leveled off to receive a foundation such as a concrete

slab of a building.

The insurer may need to engage a qualified, licensed professional (e.g., surveyor) to

measure the floor level in question. See Section 2

of this manual.

Sump wells and elevator pits are not basements because they are not a floor level.

6. Building

a. A structure with two or more outside rigid walls and a fully secured

roof, that is affixed to a permanent site;

b. A manufactured home (a “manufactured home,” also known as a

mobile home, is a structure: built on a permanent chassis,

transported to its site in one or more sections, and affixed to a

permanent foundation); or

c. A travel trailer without wheels, built on a chassis and affixed to a

permanent foundation, that is regulated under the community’s

floodplain management and building ordinances or laws.

Building does not mean a gas or liquid storage tank or a recreational

• The SFIP covers a building, manufactured home (mobile home), or travel

trailer, if located at the described location as shown on the Declaration

Page. The policy insures only one building.

• The SFIP requires a building to be affixed to a permanent site, whereas it

requires a manufactured home and a travel trailer to be affixed to a

permanent foundation.

• A travel trailer (recreational vehicle) with attached wheels is not a

building.

• Apply the same rules to determine building and contents coverage with a

storage or shipping container, if it is used as a shed, storage building or

residence, as you would a manufactured home or travel trailer.

34

June 1, 2019

FEMA | FIMA | NFIP

Claims Manual

Section 1: SFIP Forms – Dwelling Form

II. Definitions

Policy Language Additional Explanation

vehicle, park trailer or other similar vehicle, except as described in

B.6.c. above.

7. Cancellation

The ending of the insurance coverage provided by this policy before the

expiration date.

• The NFIP Flood Insurance Manual

provides a list for all valid policy

cancellation reasons.

• The expiration date is the ending of the policy term, the period of

coverage provided by the insurance policy.

• The policy term for the SFIP is one year, after any applicable waiting period.

8. Condominium

That form of ownership of real property in which each unit owner has an

undivided interest in common elements.

Refer to policy language.

9. Condominium Association

The entity made up of the unit owners responsible for the maintenance and

operation of:

a. Common elements owned in undivided shares by unit owners; and

b. Other real property in which the unit owners have use rights; where

membership in the entity is a required condition of unit ownership.

A unit must be part of a condominium governed by a condominium association

for a unit owner to have coverage eligibility under the Dwelling Form.

Homeowners’ associations, townhome associations, and cooperatives, and the like

are not condominium associations.

10. Declarations Page

A computer-generated summary of information you provided in the

application for insurance. The Declarations Page also describes the term of the

policy, limits of coverage, and displays the premium and our name. The

Declarations Page is a part of this flood insurance policy.

Refer to policy language.

11. Described Location

The location where the insured building(s) or personal property are found. The

described location is shown on the Declarations Page.

Each SFIP insures only one building. Under the Dwelling Form, an eligible detached

garage can be covered along with the dwelling at the option of the policyholder. Part

of this eligibility requires the detached garage to be located at the described location

stated on the Declarations Page. Personal property is covered within any building, but

only at the described location.

12. Direct Physical Loss By or From Flood

Loss or damage to insured property, directly caused by a flood. There must be

evidence of physical changes to the property.

The SFIP only pays for damage caused by direct physical loss by or from flood, as

defined by the SFIP. Direct physical loss means flood must physically contact the

insured property and there must be evidence of physical change by or from flooding

to

35

June 1, 2019

FEMA | FIMA | NFIP

Claims Manual

Section 1: SFIP Forms – Dwelling Form

II. Definitions

Policy Language Additional Explanation

the insured building or to insured personal property.

Several SFIP provisions, each with its own criteria, address specific situations where

the condition of direct physical loss by or from flood occurs despite an exclusion that