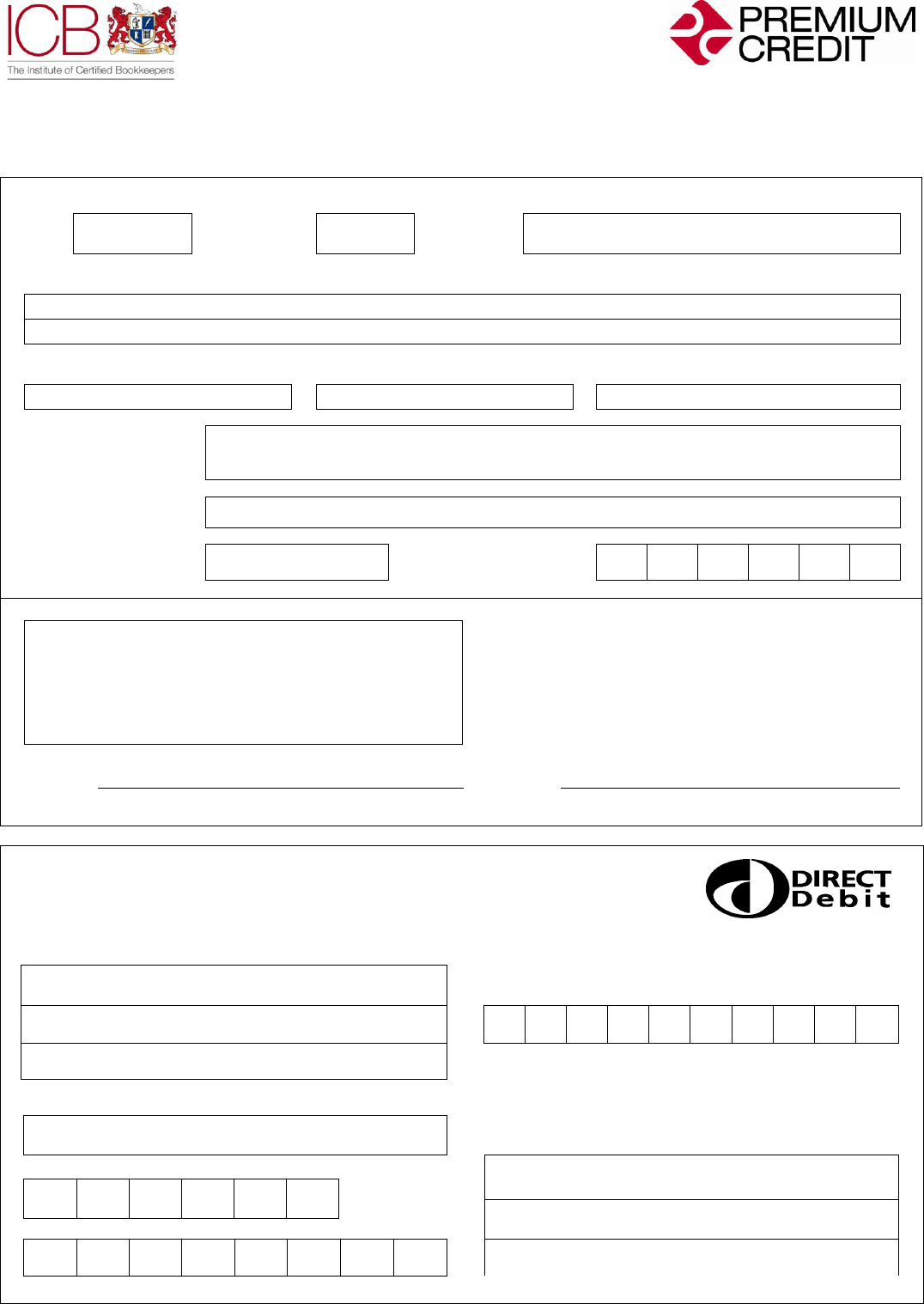

CREDIT APPLICATION FORM

PLEASE COMPLETE ALL THE FIELDS BELOW

Please return this form to Premium Credit at Ermyn House, Ermyn Way, Leatherhead, Surrey KT22 8UX.

Title Forename Surname /or Company Name (if different from borrower)

Address

Postcode

Date of Birth Email address Mobile Number

Name and address of

Service Provider

The Institute of Certified Bookkeepers

122-126 Tooley Street, Ground Floor, london, S

E1 2TU

Producer Code KKX

Reference number

Amount of Fees

£

Start date

D

D

M

M

Y

Y

4 monthly payments

2.3% transaction fee

(subject to a minimum service charge of £15)

4.3% APR

Signed:

Dated:

Instruction to your bank or

building society to pay by Direct Debit

Please fill in the form and send to:

Premium Credit Ltd, Ermyn House, Ermyn Way, Leatherhead,

Surrey, KT22 8UX

Name and full postal address of your bank or building society

Service user number:

942461

To The Manager Bank/building society

Reference

Address

Postcode

Instruction to your bank or building society

Please pay Premium Credit Ltd Direct Debits from the account

detailed in this instruction subject to the safeguards assured by the

Direct Debit Guarantee. I understand that this instruction may

remain with Premium Credit Limited and, if so, details will be

passed electronically to my bank/building society.

Name(s) of account holder(s)

Branch sort code

Signature(s)

Bank/building society account number

Date

Banks and building societies may not accept Direct Debit Instructions for some types of account DDI5

Generic application form (non-promoted) v3 January 2017

You can apply for a credit facility allowing you to spread payment of your fees (and other services) over monthly payments. If

you wish to apply please complete the form overleaf. To apply you must be aged 18 years or over, have a UK residential or

BFPO address and hold a bank or building society account which supports Direct Debit payments. Credit is available

subject to status and provided by Premium Credit Limited, Ermyn House, Ermyn Way, Leatherhead, Surrey, RH22 8UX.

Tel: 0344 736 9818.

In assessing your application for credit we may search the public information that a credit reference agency holds about

you. The credit reference agency will add details of the search and your application to their record about you whether or not

your application for credit proceeds. This and other information about you may be used to make credit decisions about you and

undertake checks for the prevention and detection of money laundering. When you sign this form you are giving your consent

for such a search to be carried out and for us to contact you by email or text and send Word or PDF documents. If your application is

accepted, we will send you a welcome pack detailing our full terms and conditions and commence collection of your

payments. A credit agreement will be provided for you to sign either online or return by post and you should read this

together with the pre-contract information carefully. You’ll be charged £10 if we have to write to remind you to return a signed

credit agreement. We may begin collecting your Direct Debits before we have your signed credit agreement to pay for

any services you are receiving.

Authorised and regulated by the Financial Conduct Authority.

Representative Example

Cash price £1000.00

Transaction fee (6.5% of the cash price) £65.00 (subject to a minimum transaction fee of £15)

Representative 12.4% APR variable

This example is based on a credit limit of £1,200 and repayment by equal monthly instalments over 12

months.

Under this example, if you did not add any further transactions you would repay a total of £1065.00 (including

the transaction fee) by 12 monthly instalments of £88.75.

The Direct Debit Guarantee

This Guarantee is offered by all banks and building societies that accept instructions to pay Direct Debits

If there are any changes to the amount, date or frequency of your Direct Debit, Premium Credit Ltd will notify you

five working days in advance of your account being debited or as otherwise agreed. If you request Premium Credit

Ltd to collect a payment, confirmation of the amount and date will be given to you at the time of the request

If an error is made in the payment of your Direct Debit by Premium Credit Ltd or your bank or building society, you

are entitled to a full and immediate refund of the amount paid from your bank or building society

- If you receive a refund you are not entitled to, you must pay it back when Premium Credit Ltd asks you to

You can cancel a Direct Debit at any time by simply contacting your bank or building society. Written confirmation

may be required. Please also notify Premium Credit.