Colorado Local

Government Handbook

2023 | Research Publication No. 795

Legislative Council Sta

Nonpartisan Services for Colorado’s Legislature

This page intentionally left blank.

The following Legislative Council Sta

members contributed to this report:

April Bernard, Consitituent Services Manager

Anna Gerstle, Senior Fiscal Analyst

Shukria Maktabi, Fiscal Analyst

Katie Kolupke, Graphic Design &

Administrative Support Specialist

This page intentionally left blank.

Introduction

This handbook is intended to serve

as a resource guide on the role and

responsibilities of local governments,

including counties, municipalities,

special districts, and school districts. It

is divided into nine sections:

• Section 1 provides an overview of

the Colorado Department of Local

Aairs;

• Sections 2 through 4 describe

county governments, municipal

governments, and city and county

governments;

• Section 5 provides an overview

of local government land use and

planning powers;

• Sections 6 and 7 describe special

districts and public schools;

• Section 8 discusses the initiative

and referendum process for local

governments; and

• Section 9 describes the laws

concerning term limits and recall of

local elected ocials.

Denver City & County Building

This page intentionally left blank.

Local Government Handbook

Table of Contents

Introduction .................................................................................................................................... 5

Section I: Overview of Colorado Department of Local Aairs ................................................. 1

Section II: County Governments .................................................................................................. 4

Organization and Structure...................................................................................................................................4

County Elected Ocials .........................................................................................................................................5

Salaries of County Ocials ...................................................................................................................................7

Home Rule Counties ............................................................................................................................................. 12

County Powers and Responsibilities ............................................................................................................... 12

County Revenue Sources .................................................................................................................................... 12

Revenues and Expenditures ............................................................................................................................... 14

Section III: Municipal Governments ..........................................................................................15

Statutory Towns and Cities ................................................................................................................................. 15

Home Rule Municipalities ................................................................................................................................... 17

Annexation ............................................................................................................................................................... 20

Discontinuance of Incorporation ..................................................................................................................... 22

Abandoned Municipalities ................................................................................................................................. 22

Financial Powers of Municipalities .................................................................................................................. 23

Section IV: City and County Governments ................................................................................24

Revenues and Expenditures ............................................................................................................................... 24

Section V: Local Government Land Use and Planning Powers ................................................27

General Land Use and Planning Laws for Local Governments ............................................................. 27

Municipal Land Use and Planning Powers ................................................................................................... 28

County Land Use and Planning Powers ........................................................................................................ 28

Local Governments and the Power of Eminent Domain ........................................................................ 29

Local Government Handbook

Section VI: Special Districts .........................................................................................................30

Types of Special Districts .................................................................................................................................... 30

Special Districts Listings .............................................................................................................. 31

Organization and Oversight of Special Districts ........................................................................................ 34

Dissolution of Special Districts ......................................................................................................................... 36

Reporting Requirements ..................................................................................................................................... 37

Section VII: Public Schools .......................................................................................................... 39

School Districts ....................................................................................................................................................... 39

Types of Public Schools ....................................................................................................................................... 42

Section VIII: Initiative and Referendum Process for Local Governments ..............................44

Section IX: Term Limits and Recall of Local Elected Ocials ..................................................45

Term Limits ............................................................................................................................................................... 45

Recall ........................................................................................................................................................................... 45

1

Local Government Handbook

The Department of Local Aairs (DOLA)

supports Colorado’s local communities and

builds local government capacity through

training, technical, and nancial assistance.

The divisions of the department serve several

purposes for local entities, including disaster

recovery, provision of aordable housing,

property tax assessment and collection,

training for local government ocials, and

distribution of state and federal aid for

community projects. The department is

comprised of four divisions: the Executive

Director’s Oce, which includes the State

Demography Oce, the Division of Property

Taxation, the Division of Housing, and the

Division of Local Government, as well as a

quasi-judicial body, the Board of Assessment

Appeals. DOLA is appropriated $442.1 million

in total funding for FY 2022-23 with the

majority of funding consisting of cash fund

sources, as detailed in Figure 1.

Cash funds are separate funds received from

taxes, fees, and nes that are earmarked for

specic programs and typically related to the

identied revenue source. The largest cash

funds in the department’s budget come from

the Local Government Severance Tax Fund

($53.8 million), lottery proceeds credited to

the Conservation Trust Fund ($58 million),

Local Government Mineral Impact Fund

(44 million), Marijuana Tax Cash Fund ($3.8

million), and the Local Government Limited

Gaming Impact Fund ($5.2 million).

The following section describes the

functions of each division, and Figure 2

shows the FY 2022-23 appropriations to the

department’s divisions.

Executive Director’s Oce. The

Executive Director provides leadership and

administrative support to the department’s

division including accounting, budgeting,

and human resource responsibilities. Within

the division, the State Demography Oce is

Section I: Overview of Colorado Department of Local Aairs

Colorado Residential Neighborhood

2

Local Government Handbook

the primary state agency for population and

demographic information. The oce makes

the data it collects publicly available to assist

local governments, nonprots, and the public.

Division of Property Taxation. The Division

of Property Taxation has three primary

responsibilities. First, the division oversees

the administration of property tax laws,

including issuing appraisal standards and

training county assessors. The division also

grants tax exemptions for charities, religious

organizations, and other eligible entities.

Lastly, the division sets valuations for public

utility and rail transportation companies.

The division is managed by the Property Tax

Administrator who is appointed by the State

Board of Equalization. The division provides

funding for the State Board of Equalization,

which supervises the administration of

property tax laws by local county assessors.

Division of Local Government. Currently,

there are 4,626 local governments in

Colorado. The Division of Local Government

provides information and training for local

governments in budget development,

purchasing, demographics, land use

planning, community development, water

and wastewater management, and regulatory

issues. Lastly, the division distributes state and

federal moneys to assist local governments in

capital construction and community services,

including, but not limited to:

• Community Services Block Grants;

• Community Development Block Grants;

• Local Government Mineral and Energy

Impact Grants;

• Local Government Severance Tax Fund

distributions;

• Limited Gaming Impact Grants; and

• Conservation Trust Fund distributions.

Division of Housing. The Division of Housing

(DOH) works with local communities to assist

Coloradans in accessing aordable, safe, and

secure housing. DOH work includes:

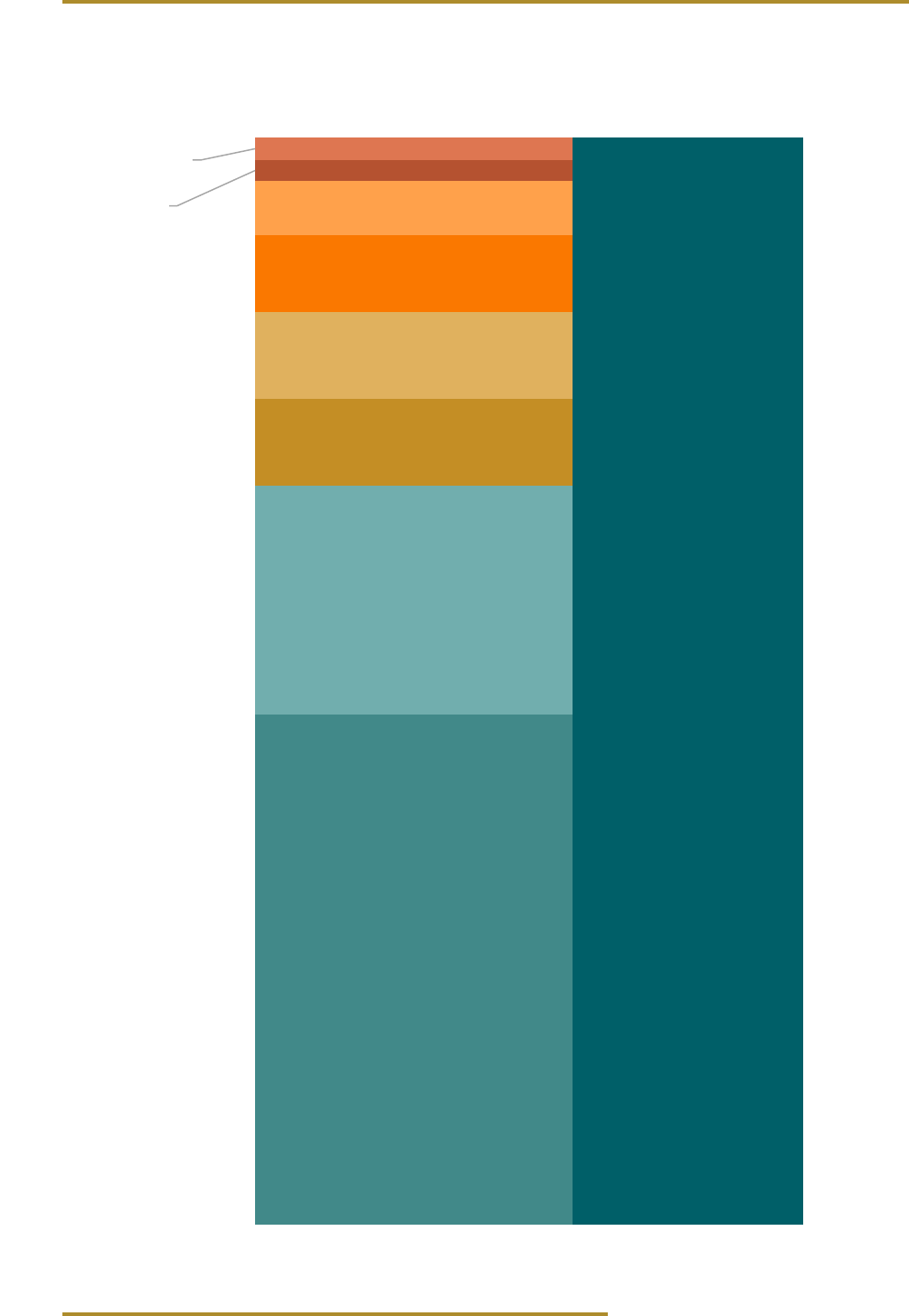

Figure 1

Department of Local Aairs FY 2022-23

Appropriation

(millions)

General Fund Cash Re-appropriated Funds Federal Funds Total Appropria�on

$55.30 $281.80 $22.40 $82.60 $442.10

12% 64% 5% 19% 100%

Re-appropriated Funds $22.40 5%

General Fund $55.30 12%

Federal Funds $82.60 19%

Cash Funds $281.80 64%

Total Appropria�on $442.10 100%

Re-appropriated Funds

$22.40

General Fund

$55.30

Federal Funds

$82.60

Cash Funds

$281.80

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

$442.10

Total

Appropriations

Source: Joint Budget Committee Sta

3

Local Government Handbook

• increasing and preserving Colorado’s

inventory of aordable housing;

• managing rental assistance vouchers;

• creating and supporting collaborative

approaches to end homelessness; and

• regulating the construction and

installation of factory-built structures.

Table 2

Divisions Within the Department of Local Affairs

FY 2022-23 Appropriation (millions)

Division

General

Fund

Cash

Fund

Re-

appropria

ted Funds

Federal

Funds

Director’s

Office

$3.60 $2.20 $5.00 $1.90 3.00%

Property

Taxation

$2.40 $1.30 $0.30 $0.00 1.00%

Housing $27.70 $88.20 $2.00 $68.80 42.00%

Local

Governme

nt

$21.60 $190.20 $15.10 $11.90 54.00%

$55.30 $281.90 $22.40 $82.60

Division

General

Fund

Cash

Fund

Re-

appropria

ted Funds

Federal

Funds

Total

Appropri

ation

$55.30 $281.80 $22.40 $82.60 100.00%

$442.10

Total Appropriation

Total Appropriation

$12.70

$4.00

$186.60

$238.80

$4

$2

$28

$22

$2

$1

$88

$190

$5

$0.3

$2

$15

$2

$69

$12

Director’s Office

Property Taxation

Housing

Local Government

General Fund

$55

Cash Fund

$282

Re-appropriated

Funds

$22

Federal Funds

$83

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

Table 2

Divisions Within the Department of Local Affairs

FY 2022-23 Appropriation (millions)

Division

General

Fund

Cash

Fund

Re-

appropria

ted Funds

Federal

Funds

Director’s

Office

$3.60 $2.20 $5.00 $1.90 3.00%

Property

Taxation

$2.40 $1.30 $0.30 $0.00 1.00%

Housing $27.70 $88.20 $2.00 $68.80 42.00%

Local

Governme

nt

$21.60 $190.20 $15.10 $11.90 54.00%

$55.30 $281.90 $22.40 $82.60

Division

General

Fund

Cash

Fund

Re-

appropria

ted Funds

Federal

Funds

Total

Appropri

ation

$55.30 $281.80 $22.40 $82.60 100.00%

$442.10

Total Appropriation

Total Appropriation

$12.70

$4.00

$186.60

$238.80

$4

$2

$28

$22

$2

$1

$88

$190

$5

$0.3

$2

$15

$2

$69

$12

Director’s Office

Property Taxation

Housing

Local Government

General Fund

$55

Cash Fund

$282

Re-appropriated

Funds

$22

Federal Funds

$83

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

Table 2

Divisions Within the Department of Local Affairs

FY 2022-23 Appropriation (millions)

Division

General

Fund

Cash

Fund

Re-

appropria

ted Funds

Federal

Funds

Director’s

Office

$3.60 $2.20 $5.00 $1.90 3.00%

Property

Taxation

$2.40 $1.30 $0.30 $0.00 1.00%

Housing $27.70 $88.20 $2.00 $68.80 42.00%

Local

Governme

nt

$21.60 $190.20 $15.10 $11.90 54.00%

$55.30 $281.90 $22.40 $82.60

Division

General

Fund

Cash

Fund

Re-

appropria

ted Funds

Federal

Funds

Total

Appropri

ation

$55.30 $281.80 $22.40 $82.60 100.00%

$442.10

Total Appropriation

Total Appropriation

$12.70

$4.00

$186.60

$238.80

$4

$2

$28

$22

$2

$1

$88

$190

$5

$0.3

$2

$15

$2

$69

$12

Director’s Office

Property Taxation

Housing

Local Government

General Fund

$55

Cash Fund

$282

Re-appropriated

Funds

$22

Federal Funds

$83

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

Figure 2

Divisons Within the Department of Local Aairs

FY 2022-23 Appropriation

(millions)

Source: Joint Budget Committee Sta

Board of Assessment Appeals. The Board of

Assessment Appeals (BAA) is a quasi-judicial

body with nine members that hears appeals

concerning the valuation of real and personal

property, property tax abatements, and

property tax exemptions. Board members are

appointed by the Governor and conrmed by

the Senate.

4

Local Government Handbook

provided under state law. The constitution

also provides for a county attorney who, by

statute, is appointed by and reports to the

county commissioners. The county ocers

are elected to four-year terms under the state

constitution. County ocers must be qualied

electors and have resided in the county for

at least one year preceding election. These

elected ocials have specic powers and

duties that are prescribed by law, and they

function independently from each other and

from the board of county commissioners.

All counties in Colorado are assigned to one

of six categories based on population and

other factors for the purposes of setting the

salaries of elected county ocials. Counties

Organization and Structure

Colorado is divided into 64 counties. Counties

are political subdivisions of state government,

and may only exercise those powers

specically provided in state law. Generally,

counties are responsible for law enforcement;

the provision of social services on behalf of

the state; the construction, maintenance,

and repair of roads and bridges; and general

control of land use in unincorporated areas.

County boundaries are established in

state law.

The Colorado Constitution establishes the

following county ocers: commissioners,

treasurers, assessors, coroners, clerk and

recorders, surveyors, and sheris, with duties

Section II: County Governments

Map 1

Colorado Counties

Source: Department of Local Aairs

CheyenneCheyenne

Kit Carson

Kit Carson

Yuma

Yuma

Washington

Washington

Phillips

Phillips

Sedgwick

Sedgwick

Logan

Logan

Morgan

Morgan

Weld

Weld

Broomfield

Broomfield

Adams

Adams

Denver

Denver

Glipin

Glipin

Boulder

Boulder

Larimer

Larimer

Jackson

Jackson

Grand

Grand

Routt

Routt

Moffat

Moffat

Arapahoe

Arapahoe

Elbert

Elbert

El Paso

El Paso

Teller

Teller

Park

Park

Chaffee

Chaffee

Lake

Lake

Pitkin

Pitkin

Delta

Delta

Mesa

Mesa

Garfield

Garfield

Rio Blanco

Rio Blanco

Eagle

Eagle

Summit

Summit

Jefferson

Jefferson

Clear Creek

Clear Creek

Fremont

Fremont

Custer

Custer

Saguache

Saguache

Ouray

Ouray

Gunnison

Gunnison

Douglas

Douglas

Lincoln

Lincoln

Kiowa

Kiowa

Prowers

Prowers

Bent

Bent

Otero

Otero

Crowley

Crowley

Pueblo

Pueblo

Huerfano

Huerfano

Baca

BacaLas AnimasLas Animas

Costilla

Costilla

Conejos

Conejos

Rio Grande

Rio Grande

Archuleta

Archuleta

La Plata

La Plata

Montezuma

Montezuma

Dolores

Dolores

San Miguel

San Miguel

Montrose

Montrose

Alamosa

Alamosa

Mineral

Mineral

San Juan

San Juan

Hinsdale

Hinsdale

5

Local Government Handbook

are also assigned a dierent class in state law

for the purpose of xing fees collected by the

county.

County Elected Ocials

County commissioners. The board of

county commissioners is the primary

policy-making body for the county and is

responsible for the county’s administrative

and budgetary functions. In fact, the county

commissioners approve the budgets for all

county departments. The board of county

commissioners has a duty to supervise the

conduct of general and special elections, and

is expected to consult and coordinate with

the clerk and recorder on rendering decisions

and interpreting state election codes. Most

counties have three commissioners who

represent separate districts, but are elected

by the voters of the entire county. Any county

with a population over 70,000 may expand its

board from three to ve commissioners by a

vote of county electors.

County clerk and recorder. As the primary

administrative ocer of the county, the

county clerk and recorder records deeds in

the county and serves as the clerk to the

board of county commissioners. The clerk

is also an agent of the state Department

of Revenue and is charged with the

administration of certain state laws relating

to motor vehicles, certication of automobile

titles, and motor vehicle registrations. The

clerk administers all primary, general, and

special elections held in the county, oversees

voter registration, publishes notices of

elections, appoints election judges, and

ensures the printing and distribution of

ballots. The clerk and recorder also issues

marriage licenses, maintains records and

books for the board of commissioners,

collects license fees and charges required

by the state, maintains property ownership

records, and provides deed abstracts upon

request.

County treasurer. The county treasurer is

responsible for the receipt, custody, and

disbursement of county funds. The treasurer

collects some state taxes and all property

taxes in the county, including those for other

units of local government such as cities and

school districts, minus a statutory collection

fee. The treasurer also conducts sales of

property for delinquent taxes.

County assessor. The county assessor is

responsible for discovering, listing, classifying,

and valuing all property in the county in

accordance with state laws. It is the assessor’s

duty to determine the actual and taxable

value of property. Most real property, such

as residential and commercial property, is

reassessed every odd-numbered year, and

personal property is reassessed every year.

The assessor is required to send out a notice

of valuation each year to property owners,

which reects the owner’s property value

and the amount of property taxes due to the

county treasurer.

County sheri. Counties are responsible for

law enforcement, which includes supporting

the court system and the district attorney

functions, as well as providing jail facilities

through the sheri. The county sheri is

the chief law enforcement ocer of the

unincorporated areas of a county and is

responsible for maintaining the peace and

enforcing the criminal laws of the state. The

sheri supports the county court system by

serving and executing processes, subpoenas,

writs, and orders as directed by the court.

The sheri oversees the operation of the

county jail. The sheri is also the re warden

for prairie or forest res in the county and

is responsible for county search and rescue

functions. County sheris can also provide law

enforcement for, or share jurisdiction with,

municipalities through contracts for services

or intergovernmental agreements (IGA). State

law species that any candidate for county

sheri must:

6

Local Government Handbook

• be a citizen of the United States;

• be a resident of the state of Colorado;

• be a resident of the county in which the

person will hold the oce;

• have a high school diploma or its

equivalent or a college degree;

• complete a criminal history record check;

and

• provide a complete set of ngerprints to a

qualied law enforcement agency.

Any person who has been convicted of;

pleaded guilty to; or entered a plea of nolo

contendere to any federal or state felony

charge is ineligible for the oce of sheri

unless the person has been pardoned.

County coroner. The county coroner is

responsible for investigating the cause and

manner of deaths, issuing death certicates,

and requesting autopsies. The coroner is the

only county ocial empowered to arrest the

county sheri, or to ll the position of interim

county sheri in the event of a vacancy or

when it is believed that the sheri cannot

or will not perform his or her duties. Similar

to the requirements for county sheri, state

law species that any candidate for county

coroner must:

• be a citizen of the United States;

• be a resident of the state of Colorado;

• be a resident of the county in which the

person will hold the oce;

• have a high school diploma or its

equivalent or a college degree;

• complete a criminal history record check;

and

• provide a complete set of ngerprints

to a qualied law enforcement agency

according to state law.

Additionally, any person who has been

convicted of; pleaded guilty to; or entered

a plea of nolo contendere to any federal or

state felony charge is ineligible for the oce

of county coroner unless he or she has been

pardoned.

A constitutional amendment, passed in 2002,

authorizes the General Assembly to require

that coroners receive minimum training

upon election to oce. State law requires

a training course of at least 40 hours using

the curriculum developed by the Colorado

Coroners Standards and Training (CCST)

board, which is overseen by the Department

of Public Health and Environment. Within

one year of taking oce for the rst time,

a coroner must obtain certication in basic

medical-legal death investigation from the

7

Local Government Handbook

Colorado Coroners Association or another

training provider approved by the CCST

board. Coroners must complete in-service

training provided by the Colorado Coroners

Association or another training provider

approved by the CCST board each year that

the coroner is in oce.

County surveyor. The county surveyor is

responsible for any surveying duties for the

county and for settling boundary disputes

when directed by a court or when requested

by interested parties. The county surveyor

establishes the boundaries of county property,

including road rightsof-way, and supervises

construction surveys that impact the county.

County surveyors also create survey markers

and monuments, and conduct surveys relating

to toll roads and reservoirs. State law requires

that county surveyors meet the qualications

of a professional land surveyor and le an

ocial bond of $1,000 with the county clerk

and recorder.

Salaries of County Ocials

The Colorado Constitution requires the

General Assembly to set the salary levels for

county commissioners, sheris, treasurers,

assessors, clerk and recorders, and coroners.

The General Assembly must consider specic

factors when xing the compensation of

county ocers and compensate ocers

based on variations in workloads and

responsibilities.

The state constitution also provides

that county ocers cannot have their

compensation changed during their terms of

oce. Further, any change may occur only

when the compensation of all county ocers

within the same county is adjusted, or when

the compensation for the same county oce

in all of the counties of the state is increased

or decreased.

County categorization. All Colorado

counties are assigned a category — I through

VI — for the purpose of setting the salaries

of elected county ocials. In general, the

counties in categories I through III are

larger counties that are required to pay

higher salaries than counties in categories

IV through VI. The category assignments

are based on a number of factors, including

population, the number of persons residing

in the unincorporated areas of the county,

assessed valuation of properties in the county,

motor vehicle registrations, building permits,

military installations, and factors reecting

the workloads and responsibilities of county

ocers and tax resources of counties. These

categories are subject to change, based

on things like moving a county to another

category through legislation. The salary

schedule does not aect the city and county

governments of Broomeld and Denver, or

the home rule counties (Pitkin and Weld) that

are authorized to set their own compensation

rates.

In 2015, the General Assembly changed

the categorization of counties for the

purpose of setting salaries. Specically,

four subcategories were added to each

classication, for a total of 24 categories. All

changes to county salaries were eective

starting January 1, 2016, for all terms of oce

beginning after this date. Since 2015, several

changes have been made to the categories,

which are discussed later in this section.

County elected ocials’ salary commission.

In 2015, an independent commission made

recommendations to the General Assembly on

the equitable and proper salaries to be paid

to county elected ocials. The County Elected

Ocials’ Salary Commission was repealed by

the 2015 General Assembly, eective January

1, 2016.

Recent legislation. Senate Bill 15-288 created

24 categories — I-A through VI-D — for the

purposes of establishing the salaries of county

ocers whose terms begin on or after January

1, 2016. House Bill 16-1367 re-categorized

counties in regard to setting salaries for

county ocials. House Bill 18-1242 and House

Bill 20-1281 modied the categories for

8

Local Government Handbook

several counties, increasing and decreasing

the salaries in some counties. Government

ocials may not increase their salary for a

current term.

Table 1 summarizes the categorization of

counties. Several of these categories are not

currently applied to any counties and are

therefore not included in Table 6; however, a

county could be moved to another category

with future legislation.

Table 1

Categories of Counties to Set Salaries of

County Ocials Whose Terms Began On or After January 1, 2016

County

Category Counties

I-A

Adams, Arapahoe, Boulder, Douglas, Eagle, El Paso, Jeerson, Larimer, Pueblo, Routt,

Summit, and Weld*

I-D

Mesa

II-A

Gareld, Grand, and La Plata

II-B

Pitkin*

II-C

Fremont

III-A

Archuleta, Chaee, Clear Creek, Delta, Gunnison, Moat, Montezuma, Montrose, Morgan,

Ouray, Park, Rio Blanco, San Miguel, and Teller

III-B

Alamosa, Gilpin, and Logan

III-C

Otero, Las Animas

IV-A

Custer, Elbert, and Prowers

IV-B

Kit Carson, Lake, and Washington

IV-C

Huerfano, Rio Grande, and Yuma

V-A

Baca, Conejos, Costilla, Lincoln, Mineral, Phillips, Saguache, and San Juan

V-B

Crowley and Hinsdale

V-C

Bent and Dolores

V-D

Cheyenne

VI-C

Jackson and Sedgwick

VI-D

Kiowa

Source: Section 30-2-102 (1.5)(a), C. R. S.

* Home rule counties are authorized to set their own compensation rate (Pitkin and Weld Counties).

Prior to January 1, 2018 and every two

years thereafter, the director of research of

Legislative Council is required to adjust the

salaries of elected county ocials for ination

and post the adjusted salary amounts on the

General Assembly’s website. House Bill 22-

065 made changes to county coroner salaries

eective for terms beginning in 2023. These

are reected in recent salary calculations.

Current salaries may be found online.

9

Local Government Handbook

Map 2

County Category I

Map 3

County Category II

II-A

II-C

CheyenneCheyenne

Kit Carson

Kit Carson

Yuma

Yuma

Washington

Washington

Phillips

Phillips

Sedgwick

Sedgwick

Logan

Logan

Morgan

Morgan

Weld

Weld

Broomfield

Broomfield

Adams

Adams

Denver

Denver

Glipin

Glipin

Boulder

Boulder

Larimer

Larimer

Jackson

Jackson

Grand

Grand

Routt

Routt

Moffat

Moffat

Arapahoe

Arapahoe

Elbert

Elbert

El Paso

El Paso

Teller

Teller

Park

Park

Chaffee

Chaffee

Lake

Lake

Pitkin

Pitkin

Delta

Delta

Mesa

Mesa

Garfield

Garfield

Rio Blanco

Rio Blanco

Eagle

Eagle

Summit

Summit

Jefferson

Jefferson

Clear Creek

Clear Creek

Fremont

Fremont

Custer

Custer

Saguache

Saguache

Ouray

Ouray

Gunnison

Gunnison

Douglas

Douglas

Lincoln

Lincoln

Kiowa

Kiowa

Prowers

Prowers

Bent

Bent

Otero

Otero

Crowley

Crowley

Pueblo

Pueblo

Huerfano

Huerfano

Baca

BacaLas AnimasLas Animas

Costilla

Costilla

Conejos

Conejos

Rio Grande

Rio Grande

Archuleta

Archuleta

La Plata

La Plata

Montezuma

Montezuma

Dolores

Dolores

San Miguel

San Miguel

Montrose

Montrose

Alamosa

Alamosa

Mineral

Mineral

San Juan

San Juan

Hinsdale

Hinsdale

II-B

CheyenneCheyenne

Kit Carson

Kit Carson

Yuma

Yuma

Washington

Washington

Phillips

Phillips

Sedgwick

Sedgwick

Logan

Logan

Morgan

Morgan

Weld

Weld

Broomfield

Broomfield

Adams

Adams

Denver

Denver

Glipin

Glipin

Boulder

Boulder

Larimer

Larimer

Jackson

Jackson

Grand

Grand

Routt

Routt

Moffat

Moffat

Arapahoe

Arapahoe

Elbert

Elbert

El Paso

El Paso

Teller

Teller

Park

Park

Chaffee

Chaffee

Lake

Lake

Pitkin

Pitkin

Delta

Delta

Mesa

Mesa

Garfield

Garfield

Rio Blanco

Rio Blanco

Eagle

Eagle

Summit

Summit

Jefferson

Jefferson

Clear Creek

Clear Creek

Fremont

Fremont

Custer

Custer

Saguache

Saguache

Ouray

Ouray

Gunnison

Gunnison

Douglas

Douglas

Lincoln

Lincoln

Kiowa

Kiowa

Prowers

Prowers

Bent

Bent

Otero

Otero

Crowley

Crowley

Pueblo

Pueblo

Huerfano

Huerfano

Baca

BacaLas AnimasLas Animas

Costilla

Costilla

Conejos

Conejos

Rio Grande

Rio Grande

Archuleta

Archuleta

La Plata

La Plata

Montezuma

Montezuma

Dolores

Dolores

San Miguel

San Miguel

Montrose

Montrose

Alamosa

Alamosa

Mineral

Mineral

San Juan

San Juan

Hinsdale

Hinsdale

I-A I-D

10

Local Government Handbook

Map 4

County Category III

Map 5

County Category IV

III-A

III-B III-C

CheyenneCheyenne

Kit Carson

Kit Carson

Yuma

Yuma

Washington

Washington

Phillips

Phillips

Sedgwick

Sedgwick

Logan

Logan

Morgan

Morgan

Weld

Weld

Broomfield

Broomfield

Adams

Adams

Denver

Denver

Glipin

Glipin

Boulder

Boulder

Larimer

Larimer

Jackson

Jackson

Grand

Grand

Routt

Routt

Moffat

Moffat

Arapahoe

Arapahoe

Elbert

Elbert

El Paso

El Paso

Teller

Teller

Park

Park

Chaffee

Chaffee

Lake

Lake

Pitkin

Pitkin

Delta

Delta

Mesa

Mesa

Garfield

Garfield

Rio Blanco

Rio Blanco

Eagle

Eagle

Summit

Summit

Jefferson

Jefferson

Clear Creek

Clear Creek

Fremont

Fremont

Custer

Custer

Saguache

Saguache

Ouray

Ouray

Gunnison

Gunnison

Douglas

Douglas

Lincoln

Lincoln

Kiowa

Kiowa

Prowers

Prowers

Bent

Bent

Otero

Otero

Crowley

Crowley

Pueblo

Pueblo

Huerfano

Huerfano

Baca

BacaLas AnimasLas Animas

Costilla

Costilla

Conejos

Conejos

Rio Grande

Rio Grande

Archuleta

Archuleta

La Plata

La Plata

Montezuma

Montezuma

Dolores

Dolores

San Miguel

San Miguel

Montrose

Montrose

Alamosa

Alamosa

Mineral

Mineral

San Juan

San Juan

Hinsdale

Hinsdale

IV-A

IV-B IV-C

CheyenneCheyenne

Kit Carson

Kit Carson

Yuma

Yuma

Washington

Washington

Phillips

Phillips

Sedgwick

Sedgwick

Logan

Logan

Morgan

Morgan

Weld

Weld

Broomfield

Broomfield

Adams

Adams

Denver

Denver

Glipin

Glipin

Boulder

Boulder

LarimerLarimer

Jackson

Jackson

Grand

Grand

Routt

Routt

Moffat

Moffat

Arapahoe

Arapahoe

Elbert

Elbert

El Paso

El Paso

Teller

Teller

Park

Park

Chaffee

Chaffee

Lake

Lake

Pitkin

Pitkin

Delta

Delta

Mesa

Mesa

Garfield

Garfield

Rio Blanco

Rio Blanco

Eagle

Eagle

Summit

Summit

Jefferson

Jefferson

Clear Creek

Clear Creek

Fremont

Fremont

Custer

Custer

Saguache

Saguache

Ouray

Ouray

Gunnison

Gunnison

Douglas

Douglas

Lincoln

Lincoln

Kiowa

Kiowa

Prowers

Prowers

Bent

Bent

Otero

Otero

Crowley

Crowley

Pueblo

Pueblo

Huerfano

Huerfano

Baca

BacaLas AnimasLas Animas

Costilla

Costilla

Conejos

Conejos

Rio Grande

Rio Grande

Archuleta

Archuleta

La Plata

La Plata

Montezuma

Montezuma

Dolores

Dolores

San Miguel

San Miguel

Montrose

Montrose

Alamosa

Alamosa

Mineral

Mineral

San Juan

San Juan

Hinsdale

Hinsdale

11

Local Government Handbook

Map 6

County Category V

Map 7

County Category VI

V-A V-B V-C V-D

CheyenneCheyenne

Kit Carson

Kit Carson

Yuma

Yuma

Washington

Washington

Phillips

Phillips

Sedgwick

Sedgwick

Logan

Logan

Morgan

Morgan

Weld

Weld

Broomfield

Broomfield

Adams

Adams

Denver

Denver

Glipin

Glipin

Boulder

Boulder

Larimer

Larimer

Jackson

Jackson

Grand

Grand

Routt

Routt

Moffat

Moffat

Arapahoe

Arapahoe

Elbert

Elbert

El Paso

El Paso

Teller

Teller

Park

Park

Chaffee

Chaffee

Lake

Lake

Pitkin

Pitkin

Delta

Delta

Mesa

Mesa

Garfield

Garfield

Rio Blanco

Rio Blanco

Eagle

Eagle

Summit

Summit

Jefferson

Jefferson

Clear Creek

Clear Creek

Fremont

Fremont

Custer

Custer

Saguache

Saguache

Ouray

Ouray

GunnisonGunnison

Douglas

Douglas

Lincoln

Lincoln

Kiowa

Kiowa

Prowers

Prowers

Bent

Bent

Otero

Otero

Crowley

Crowley

Pueblo

Pueblo

Huerfano

Huerfano

Baca

BacaLas AnimasLas Animas

Costilla

Costilla

Conejos

Conejos

Rio Grande

Rio Grande

Archuleta

Archuleta

La Plata

La Plata

Montezuma

Montezuma

Dolores

Dolores

San Miguel

San Miguel

Montrose

Montrose

Alamosa

Alamosa

Mineral

Mineral

San Juan

San Juan

Hinsdale

Hinsdale

VI-C VI-D

CheyenneCheyenne

Kit Carson

Kit Carson

Yuma

Yuma

Washington

Washington

Phillips

Phillips

Sedgwick

Sedgwick

Logan

Logan

Morgan

Morgan

Weld

Weld

Broomfield

Broomfield

Adams

Adams

Denver

Denver

Glipin

Glipin

Boulder

Boulder

Larimer

Larimer

Jackson

Jackson

Grand

Grand

Routt

Routt

Moffat

Moffat

Arapahoe

Arapahoe

Elbert

Elbert

El Paso

El Paso

Teller

Teller

Park

Park

Chaffee

Chaffee

Lake

Lake

Pitkin

Pitkin

Delta

Delta

Mesa

Mesa

Garfield

Garfield

Rio Blanco

Rio Blanco

Eagle

Eagle

Summit

Summit

Jefferson

Jefferson

Clear Creek

Clear Creek

Fremont

Fremont

Custer

Custer

Saguache

Saguache

Ouray

Ouray

Gunnison

Gunnison

Douglas

Douglas

Lincoln

Lincoln

Kiowa

Kiowa

Prowers

Prowers

Bent

Bent

Otero

Otero

Crowley

Crowley

Pueblo

Pueblo

Huerfano

Huerfano

Baca

BacaLas AnimasLas Animas

Costilla

Costilla

Conejos

Conejos

Rio Grande

Rio Grande

Archuleta

Archuleta

La Plata

La Plata

Montezuma

Montezuma

Dolores

Dolores

San Miguel

San Miguel

Montrose

Montrose

Alamosa

Alamosa

Mineral

Mineral

San Juan

San Juan

Hinsdale

Hinsdale

12

Local Government Handbook

Home Rule Counties

The Colorado Constitution enables the

voters of a county to adopt a home rule

charter providing for the organization and

structure of their county. A county charter

may establish, either at the outset or by

subsequent amendment, its own structure of

county government. This includes the number,

terms, qualications, duties, compensation,

and method of selection of county ocials

and employees. A county home rule charter

does not provide the “functional” home rule

powers found in municipal charters, and, as

subdivisions of the state, a home rule county

must continue to provide the county services

required by law. Currently, there are two

home rule counties in Colorado: Pitkin and

Weld. Broomeld and Denver are also “home

rule,” but have unique dual city/county status

and specic constitutional provisions. City and

county governments are discussed further in

Section IV.

County Powers and Responsibilities

Mandatory services. Counties have the

powers, duties, and authorities that are

explicitly conferred upon them by state law.

Specic statutory responsibilities include

the provision of jails, weed control, and

establishment of a county or district public

health agency to provide, at minimum, health

and human services mandated by the state.

Discretionary powers. Counties also have

several discretionary powers to provide

certain services or control certain activities.

Listed below are other commonly used

powers or services that a board of county

commissioners is authorized to implement.

Under state law, counties have the authority

to:

• provide veteran services;

• operate emergency telephone services;

• provide ambulance services;

• conduct law enforcement;

• provide street lighting;

• operate mass transit systems;

• build and maintain roads and bridges;

• construct and maintain airports;

• lease or sell county-owned mineral and oil

and gas rights;

• provide water and sewer services;

• control wildre planning and response;

• promote agriculture research and protect

agricultural operations;

• administer pest control; and

• operate districts for irrigation,

cemeteries, libraries, recreation, solid

waste and disposal, and various types of

improvement districts.

Under state law, a board of county

commissioners is also authorized to control

specic activities through police powers or

through licensing requirements. Some of

the most common county powers are used

to regulate activities such as marijuana,

trash removal, animal control, disturbances

and riots, and the discharge of rearms in

unincorporated areas of urban counties. In

other areas, such as liquor licenses, landlls,

and pest control, counties and the state share

authority.

County Revenue Sources

Counties have the power to collect property

and sales and use taxes, as well as to incur

debt, enter into contracts, and receive grants

and gifts. While property taxes are the main

source of county revenue, counties may also

collect other sources of revenue at the local

level and receive state and federal dollars.

County property taxes. Under Colorado

law, property taxes, also called ad valorem

taxes, may only be assessed for local

government services. Property taxes are paid

on a proportion of a property’s value. This

assessed value of a property is determined by

multiplying the actual value by the assessment

rate, and the property tax is determined by

multiplying a property’s assessed value by a

mill levy. A mill is one-tenth of a cent; or $1

of taxes for each $1,000 of assessed value.

13

Local Government Handbook

County property tax levies are restricted by

the 5.5 percent limit on annual growth of

revenue in state law, and the mill levy rate

limit and the property tax revenue limit under

the Taxpayer’s Bill of Rights (TABOR).

Debt. Counties can incur either revenue debt,

based solely upon a specied revenue stream,

or general obligation debt, which constitutes

a general obligation of the local government

to repay the debt. Counties may also enter

into lease-purchase arrangements (as an

alternative to debt nancing) to build major

facilities such as justice centers.

Sales taxes. Sales taxes are levied in most

counties. The tax is collected at no charge

by the state Department of Revenue and

remitted monthly to the county.

Use taxes. Counties may also collect a use

tax. A use tax is levied on the retail price of

certain tangible personal property purchased

outside a taxing jurisdiction, but stored,

used, or consumed within that jurisdiction.

Counties are limited to collecting a use

tax on construction and building materials

and motor vehicles. The purpose of a use

tax is to equalize competition between in-

county and out-of-county vendors making

wholesale purchases. If a county has a use tax

on construction and building materials, for

example, a vendor is required to pay use tax

on the building materials purchased outside

of the county and used within the county.

When this circumstance occurs, the county

sales tax is not collected.

Figure 3

2020 Revenue Totals for Colorado County Governments

(billions)

(millions)

Left Column

Other Taxes $0.9 16%

Intergovernmental Revenue $1.9 33%

Local Taxes $2.9 51%

Local Taxes

Other Local Taxes $17 1%

Specific Ownership Tax $137 2%

Sales and Use Tax $898 16%

Property Tax $1,847 33%

Intergovernmental Revenue

Conservation Trust Fund $11 1%

Vehicle Registration Fees $17 1%

Highway Users Tax Fund $194 3%

Social Services $682 12%

Other Intergovernmental $988 18%

Other Taxes

Fines $4

Enterprise Transfers $6

Licenses & Permits $78

Miscellaneous $232

Service Charges $535

Other Taxes

$0.9

Intergovernmental

Revenue

$1.9

Local Taxes

$2.9

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

$17

$137

$898

$1,847

Property Tax

Sales and Use Tax

Specific Ownership Tax

Other Local Taxes

$11

$17

$194

$682

$998

Other Intergovernmental

Social Services

Highway Users Tax Fund

Vehicle Registration Fees

Conservation Trust Fund

$4

$6

$78

$232

$535

Service Charges

Miscellaneous

Licenses & Permits

Enterprise Transfers

Fines

Local Taxes

Intergovernmental Revenue

Other Taxes

14

Local Government Handbook

Leadville, CO

Figure 4

2020 Expenditure Totals for Colorado County Governments

Table 8

2020 Expenditure Totals for Colorado County Governments

0.000001

Local Expenditures Amount % of Total

Miscellaneous $124 2%

Judicial $134 2%

Culture and Recreation $256 5%

Health $315 6%

Public Works $621 11%

Social Services $849 16%

Public Safety $1,071 20%

General Government $1,213 23%

$4,583

Total Operating Expenditures $14,583 85%

Debt Service $0 3%

Transfer to Enterprises and Outside Entities $194 4%

Capital Outlay $444 8%

Total Other Expenditures $793 15%

Total Expenditures $5,376 100.00%

Total Operating Expenditures $4,583 85%

Total Other Expenditures $793 15%

Total Expenditures $5,376 100%

Operating Expenditures

Other Expenditures

$124

$134

$256

$315

$621

$849

$1,071

$1,213

General Government

Public Safety

Social Services

Public Works

Health

Culture and Recreation

Judicial

Miscellaneous

$156

$194

$444

Capital Outlay

Transfer to Enterprises

and Outside Entities

Debt Service

Total Operating

Expenditures

$4,583

Total Other

Expenditures

$793

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

0%

15%

70%

50%

20%

10%

30%

40%

60%

80%

90%

85%

Total Expenditures, $5,376

Table 8

2020 Expenditure Totals for Colorado County Governments

0.000001

Local Expenditures Amount % of Total

Miscellaneous $124 2%

Judicial $134 2%

Culture and Recreation $256 5%

Health $315 6%

Public Works $621 11%

Social Services $849 16%

Public Safety $1,071 20%

General Government $1,213 23%

$4,583

Total Operating Expenditures $14,583 85%

Debt Service $0 3%

Transfer to Enterprises and Outside Entities $194 4%

Capital Outlay $444 8%

Total Other Expenditures $793 15%

Total Expenditures $5,376 100.00%

Total Operating Expenditures $4,583 85%

Total Other Expenditures $793 15%

Total Expenditures $5,376 100%

Operating Expenditures

Other Expenditures

$124

$134

$256

$315

$621

$849

$1,071

$1,213

General Government

Public Safety

Social Services

Public Works

Health

Culture and Recreation

Judicial

Miscellaneous

$156

$194

$444

Capital Outlay

Transfer to Enterprises

and Outside Entities

Debt Service

Total Operating

Expenditures

$4,583

Total Other

Expenditures

$793

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

0%

15%

70%

50%

20%

10%

30%

40%

60%

80%

90%

85%

Total Expenditures, $5,376

Table 8

2020 Expenditure Totals for Colorado County Governments

0.000001

Local Expenditures Amount % of Total

Miscellaneous $124 2%

Judicial $134 2%

Culture and Recreation $256 5%

Health $315 6%

Public Works $621 11%

Social Services $849 16%

Public Safety $1,071 20%

General Government $1,213 23%

$4,583

Total Operating Expenditures $14,583 85%

Debt Service $0 3%

Transfer to Enterprises and Outside Entities $194 4%

Capital Outlay $444 8%

Total Other Expenditures $793 15%

Total Expenditures $5,376 100.00%

Total Operating Expenditures $4,583 85%

Total Other Expenditures $793 15%

Total Expenditures $5,376 100%

Operating Expenditures

Other Expenditures

$124

$134

$256

$315

$621

$849

$1,071

$1,213

General Government

Public Safety

Social Services

Public Works

Health

Culture and Recreation

Judicial

Miscellaneous

$156

$194

$444

Capital Outlay

Transfer to Enterprises

and Outside Entities

Debt Service

Total Operating

Expenditures

$4,583

Total Other

Expenditures

$793

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

0%

15%

70%

50%

20%

10%

30%

40%

60%

80%

90%

85%

Total Expenditures, $5,376

Revenues and Expenditures

Figure 3 shows the total amounts of revenue

received by Colorado counties in 2020,

of which 33 percent is from property tax

revenue, 16 percent is from sales and use

taxes, and 12 percent is from state and

federal sources for social services. Figure

8 shows the total amount of expenditures

spent by Colorado counties in 2020, including

20 percent on public safety, 16 percent on

social services, 11 percent on public works,

and 8 percent on capital outlay. 2020 is the

most recent available data due to lag time

between the end of the scal year and year-

end auditing and verication of revenue and

expenditures.

Total Operating Expenditures

Total Expenditures

Total Other Expenditures

(millions)

15

Local Government Handbook

EckleyEckley

Paoli

Paoli

Ovid

Ovid

Julesburg

Julesburg

Sedgwick

Sedgwick

Crook

Crook

Peetz

Peetz

Iliff

Iliff

Fleming

Fleming

Merino

Merino

Hillrose

Hillrose

Brush

Brush

Wiggins

Wiggins

Keenseburg

Keenseburg

Hudson

Hudson

Lochbuie

Lochbuie

Superior

Superior

Lakeside

Lakeside

Bennett

Bennett

Deer Trail

Deer Trail

FoxfieldFoxfield

Montezuma

Montezuma

Red Cliff

Red Cliff

Alma

Alma

Fairplay

Fairplay

Buena Vista

Buena Vista

Pitkin

Pitkin

Salida

Salida

Bonanza

Bonanza

Poncha

Springs

Poncha

Springs

Blue River

Blue River

Leadville

Leadville

Silver Plume

Silver Plume

Empire

Empire

Fraser

Fraser

Granby

Granby

Walden

Walden

Hot Sulphur

Springs

Hot Sulphur

Springs

Kremmling

Kremmling

Oak CreekOak Creek

Yampa

Yampa

Meeker

Meeker

Dinosaur

Dinosaur

Rangely

Rangely

Carbonate

Carbonate

De Beque

De Beque

Palisade

Palisade

Collbran

Collbran

MarbleMarble

Paonia

Paonia

Hotchkiss

Hotchkiss

Crawford

Crawford

Olathe

Olathe

Orchard City

Orchard City

Elizabeth

Elizabeth

Limon

Limon

Genoa

Genoa

Hugo

Hugo

Arriba

Arriba

Seibert

Seibert

Flagler

Flagler

Stratton

Stratton

Bethune

Bethune

Kit Carson

Kit Carson

Eads

Eads

Haswell

Haswell

Sheridan Lake

Sheridan Lake

Hartman

Hartman

Holly

Holly

Wiley

Wiley

Las Animas

Las Animas

Sugar City

Sugar City

Ordway

Ordway

Cheraw

Cheraw

Manzanola

Manzanola

Swink

Swink

Fowler

Fowler

Boone

Boone

Rye

Rye

Walsenburg

Walsenburg

La Veta

La Veta

Blanca

Blanca

La Jara

La Jara

Manassa

Manassa

Antonito

Antonito

Romeo

Romeo

San Luis

San Luis

Aguilar

Aguilar

Cokedale

Cokedale

Starkville

Starkville

Branson

Branson

Kim

Kim

Two Buttes

Two Buttes

Walsh

Walsh

Vilas

Vilas

Campo

Campo

Springfield

Springfield

Pritchett

Pritchett

Hooper

Hooper

Crestone

Crestone

Saguache

Saguache

Moffat

Moffat

Center

Center

Lake City

Lake City

Silverton

Silverton

Bayfield

Bayfield

Ignacio

Ignacio

Mancos

Mancos

Dolores

Dolores

Dove Creek

Dove Creek

Sawpit

Sawpit

Norwood

Norwood

Naturita

Naturita

Nucla

Nucla

Del Norte

Del Norte

South Fork

South Fork

City of

Creede

City of

Creede

Florence

Florence

Brookside

Brookside

Coal Creek

Coal Creek

Williamsburg

Williamsburg

Silver Cliff

Silver Cliff

Westcliffe

Westcliffe

Rockvale

Rockvale

Calhan

Calhan

Cripple Creek

Victor

Cripple Creek

Victor

Simla

Simla

Ramah

Ramah

Green

Mountain Falls

Green

Mountain Falls

Olney Springs

Olney Springs

Rocky Ford

Rocky Ford

Crowley

Crowley

Granada

Granada

Cheyenne

Wells

Cheyenne

Wells

Vona

Vona

Palmer Lake

Palmer Lake

Monument

Monument

Bow Mar

Bow Mar

ColumbineColumbine

Valley

Valley

Nederland

Nederland

Idaho

Spring

Idaho

Spring

Fort

Lupton

Fort

Lupton

Grover

Grover

Nunn

Nunn

Pierce

Pierce

Ault

Ault

Eaton

Eaton

Kersey

Kersey

LaSalle

LaSalle

Gilcrest

Gilcrest

Platteville

Platteville

MillikenMilliken

Severance

Severance

Wellington

Wellington

Garden City

Garden City

Estes Park

Estes Park

Berthoud

Berthoud

Mead

Mead

Firestone

Firestone

Frederick

Frederick

Erie

Erie

Lyons

Lyons

Grand Lake

Grand Lake

Jamestown

Jamestown

Raymer

Raymer

Log Lane

Village

Log Lane

Village

Haxtun

Haxtun

OtisOtis

Akron

Akron

Map 8

Colorado Statutory Cities

Overview. There are 272 municipalities

in Colorado, including 99 home rule

municipalities, 170 statutory municipalities, 2

consolidated city and county governments,

and 1 territorial charter municipality. A brief

description of each type of government

follows.

Statutory Towns and Cities

Formation. Residents of unincorporated areas

may form a municipal corporation under the

authority of state laws. Municipalities formed

under these laws, called statutory cities

and towns, are limited to exercising powers

specically granted to them by state law. In

general, ordinances of statutory towns and

cities that conict with state laws are invalid.

Residents in areas with 2,000 or fewer persons

may form a statutory town, and residents

in areas with more than 2,000 persons may

form a statutory city. There are 11 statutory

cities and 159 statutory towns in Colorado.

These statutory cities and towns are shown

in the map below, and a list can be found in

Appendix A. The small number of statutory

cities reects the preference of city residents

Section III: Municipal Governments

Source: Department of Local Aairs

16

Local Government Handbook

for constitutional home rule authority over

statutory powers.

To form a statutory town or city, residents

must rst le a petition for incorporation with

the district court of the county in which the

municipality is to be located. The petition

must be signed by at least 150 registered

electors who are landowners and residents of

the area to be incorporated. However, if the

area is located in a county with a population

of fewer than 25,000, 40 signatures are

required. The court reviews the petition to

determine whether the proposed municipality

satises statutory requirements. For example,

the law prohibits an incorporation election

if the proposed area includes, on average,

fewer than 50 persons per square mile. The

court will order an incorporation election

after it determines that the proposed area for

incorporation satises statutory requirements.

Incorporation occurs if a majority of the

registered electors vote to approve the

incorporation.

If the area of proposed incorporation includes

fewer than 500 registered electors, the board

of county commissioners may refuse to permit

an incorporation election if it determines

the proposal fails to satisfy certain statutory

requirements. For example, the board may

refuse to permit an incorporation election if

the proposed incorporation is inconsistent

with a county or regional comprehensive plan.

Municipal powers. State law provides

statutory cities and towns a broad range of

powers to address the needs of their denser

populations through self-government,

including administrative, police, and nancial

powers. Administrative powers enable

municipalities to ll vacancies in municipal

oces, appoint a board of health, and provide

ambulance, hospital, and other services.

Police powers enable municipalities to

enforce local laws, as well as enact measures

to preserve and protect the safety, health,

and welfare of the community. These powers

enable municipalities to prohibit oensive or

unwholesome businesses within municipal

limits or to compel such businesses to abate

their impacts. For example, Amendment

64, approved by the voters in 2012, allows

towns and cities to either regulate or prohibit

the sale of recreational marijuana within

their boundaries. State laws also grant

municipalities broad nancial powers to

nance municipal activities. This includes the

ability to levy taxes, impose fees, and issue

bonds and other types of debt to fund various

public projects such as infrastructure and

public building improvements. Municipalities

are also granted signicant authority to

manage land use and growth.

Town governments. The legislative and

corporate authority of statutory towns is

vested in a board of trustees that consists of

a mayor and up to six trustees. The mayor

and members of the board of trustees are

Administrative powers

enable municipalities to ll

vacancies in municipal oces,

appoint a board of health, and

provide ambulance, hospital,

and other services. Police

powers enable municipalities

to enforce local laws, as well as

enact measures to preserve and

protect the safety, health, and

welfare of the community.

17

Local Government Handbook

elected from the town at large. The mayor

presides over board meetings and has the

same voting powers as other board members.

However, a town may adopt an ordinance that

limits mayors to voting only when there is a

tie vote of the board, provided the ordinance

also authorizes the mayor to veto spending

ordinances. This limit also provides that the

veto may be overruled by a two-thirds vote of

the board. The board of trustees is required to

appoint a clerk, treasurer, and town attorney,

or adopt an ordinance that provides for the

election of these oces. The clerk is the

custodian of municipal records. The board

may also appoint a town administrator to

oversee sta and the daily operations of the

town. Terms of the mayor and trustees are

two years, unless an ordinance is adopted to

extend the terms to four years. Because they

lack specic authority, statutory towns may

not adopt a city council-city manager form of

municipal government.

City governments. The legislative and

corporate authority of statutory cities are

vested in an elected mayor and city council.

The mayor presides over city council meetings

and has the same voting powers as other

board members. The mayor is responsible

for supervising the conduct of municipal

ocers and investigating complaints against

them. As with statutory towns, cities may

adopt an ordinance that limits mayors to

voting only when there is a tie vote of the

board. The ordinance must also authorize

the mayor to veto spending ordinances that

may be overruled by a two-thirds vote of

the board. Mayors are elected from the city

at large. Members of the council are elected

to represent a specic ward. The city clerk

and treasurer are elected from the city at

large. However, the city council may submit a

proposal to the registered electors to change

the city clerk and treasurer to appointive

oces. If approved by the voters, the

appointment of the city clerk and treasurer

would be made by the city council. The city

council may also submit a proposal to the

registered electors to return these oces to

elective oces.

City council-city manager governments.

Most Colorado municipalities with over 5,000

residents are organized as city council-city

manager municipalities. Under this form

of government, the mayor and the council

primarily address policy matters, and a

professional manager implements and

administers the council’s policies. At least 5

percent of a city’s registered electors must

sign a petition to cause an election to adopt

a city council-city manager form of municipal

government. This petition species whether

the mayor will be elected from among the

members of the city council or will be elected

from the city at large. If the voters approve

reorganizing as a city councilcity manager

form of municipal government, the council

appoints a city manager to supervise the

administration of the city and to ensure that

city ordinances are enforced. The council

must choose a manager based on his or her

executive and administrative qualications.

The city manager does not need be a resident

of the city or state at the time of appointment,

but may be required, by ordinance, to reside

in the city after appointment. The council

may not appoint a sitting council member as

city manager. The manager has the power

to appoint and remove all ocers and

employees in the administrative service of the

city. The council is prohibited from directing

the hiring or removal of administrative ocers

and employees.

Home Rule Municipalities

Overview. The Colorado Constitution allows

cities and towns to adopt a home rule charter.

Home rule charters have been adopted by

99 municipalities in Colorado. Home rule

municipalities can be seen in the maps 9 and

10 and are listed in Appendix A. A home rule

charter provides a city or town with greater

authority to regulate local and municipal

matters than is available to statutory

municipalities. Most home rule municipalities

have adopted the city council-city manager

form of municipal government.

18

Local Government Handbook

Map 10

Colorado Home Rule

Municipalities

Source: Department of Local Aairs

HolyokeHolyoke

Sterling

Sterling

Yuma

Yuma

Wray

Wray

Burlington

Burlington

Fort Morgan

Fort Morgan

Lamar

Lamar

La Junta

La Junta

Pueblo

PuebloPuebloPueblo

Frisco

Frisco

Dillon

Dillon

Silverthorne

Silverthorne

Vail

Vail

Avon

Avon

Minturn

Minturn

Eagle

Eagle

Gypsum

Gypsum

Glenwood

Springs

Glenwood

Springs

Cañon City

Cañon City

Aspen

Aspen

Basalt

Basalt

Carbondale

Carbondale

Parachute

Parachute

Fruita

Fruita

Snowmass Village

Snowmass Village

Fountain

Fountain

Woodland Park

Woodland Park

Gunnison

Gunnison

Montrose

Montrose

Ridgway

Ridgway

Ouray

Ouray

Ophir

Ophir

Telluride

Telluride

Crested

Butte

Crested

Butte

Cedaredge

Cedaredge

Delta

Delta

Colorado

Springs

Colorado

Springs

Manitou

Springs

Manitou

Springs

Mount

Crested

Butte

Mount

Crested

Butte

Pagosa

Springs

Pagosa

Springs

Mountain

Village

Mountain

Village

Castle

Silt

Castle

Silt

Grand

Junction

Grand

Junction

New

Rifle

New

Rifle

Trinidad

Trinidad

SanfordSanford

Alamosa

Alamosa

Monte Vista

Monte Vista

Rico

Rico

Cortez

Cortez

Durango

Durango

Breckenridge

Breckenridge

Winter Park

Winter Park

Map 9

Colorado Home Rule Municipalities

Front Range Zoom

KiowaKiowa

Morrison

Morrison

Lakewood

Lakewood

Glendale

Glendale

Aurora

Aurora

Dacono

Dacono

Johnstown

Johnstown

Evans

Evans

Greeley

Greeley

Windsor

Windsor

Loveland

Loveland

Fort Collins

Fort Collins

Timnath

Timnath

Arvada

Arvada

Westminster

Westminster

Louisville

Louisville

Lafayette

Lafayette

Boulder

Boulder

Ward

Ward

Longmont

Longmont

Federal

Heights

Federal

Heights

Thornton

Thornton

Brighton

Brighton

Northglenn

Northglenn

Commerce City

Commerce City

Mountain View

Mountain View

Edgewater

Edgewater

Wheat Ridge

Wheat Ridge

Golden

Golden

Central City

Central City

Black Hawk

Black Hawk

Winter Park

Winter Park

Parker

Parker

Lone Tree

Lone Tree

Centennial

Centennial

Littleton

Littleton

Sheridan

Sheridan

Englewood

Englewood

Greenwood

Village

Greenwood

Village

Cherry

Hills

Village

Cherry

Hills

Village

Larkspur

Larkspur

Castle Rock

Castle Rock

Castle Pines

Castle Pines

19

Local Government Handbook

Formation. The process for adopting,

amending, and repealing home rule charters

is specied in state law. Under state law, at

least 5 percent of the registered electors of a

municipality may petition the municipality’s

governing body to hold a charter commission

election. Alternatively, the governing body

may adopt an ordinance to cause a charter

commission election. If approved by the

voters, the charter commission has 120 days

to draft a home rule charter. The charter

identies the municipality’s powers, governing

structure, terms of elected oces, budget and

election procedures, procedures for initiative

and referendum of measures, and the process

for the recall of ocers.

Once approved by the commission, a charter

must be submitted to the voters for their

approval. If rejected by the voters, the

commission may draft another charter for

consideration at a future election. Rejection of

the second charter by the voters results in the

dissolution of the charter commission. Home

rule charters may be amended or repealed

through similar procedures as the creation of

a charter. State law also provides a process

for voters to adopt a home rule charter at the

time of incorporation.

Powers. A home rule charter provides a city

or town with the greatest authority to regulate

local and municipal matters. In general, a

home rule city’s ordinances pertaining to local

matters supersede conicting state laws. For

example, the courts have determined that

zoning is primarily a matter of local concern.

Consequently, a home rule municipality may

adopt its own procedures to rezone an area

instead of following the statutory requirement

pertaining to rezoning. State law also grants

home rule municipalities additional powers.

For example, the Local Government Land Use

Control Enabling Act allows home rule cities

and towns to regulate activities that impact

a community or surrounding area, to provide

planned and orderly use of land, and to

protect the environment.

Matters of local, state, and mixed concerns.

State laws may take precedence over

conicting home rule ordinances when such

issues are a matter of statewide concern.

For example, the Colorado Supreme Court

determined that a city ordinance requiring

a private use permit before occupying