© Copyright 2021. The Associated Press and NORC May 2021 |

1

LONG-TERM CARE IN AMERICA:

AMERICANS WANT TO AGE AT HOME

In the wake of a pandemic that was especially

devastating for nursing homes, the vast majority

of Americans want to age at home and want

government action to help them do so, according

to a new study from The Associated Press-NORC

Center for Public Affairs Research.

Even as concerns about the safety of nursing

homes decline as more and more COVID-19

vaccines are administered, 88% of Americans

would prefer to receive any ongoing living

assistance they need as they age at home or with

loved ones.

1

Just 12% want to receive care in a

senior community or nursing home. With that

objective of aging in place in mind, more than 6 in

10 support a variety of policies that would

facilitate aging at home including a government-

administered long-term care insurance program,

similar to Medicare.

Overall, the public believes Medicare, health

insurance companies, and Medicaid should bear

a large responsibility for the costs of long-term

care. And with the Medicare trust fund at risk of

insolvency in the coming years, 89% think

shoring up the trust fund should be an important

priority for Congress and the Biden

administration. This is a priority on which both

Democrats and Republicans agree.

1

76% would prefer to receive this care in their own home and 11% would prefer a friend or family member’s home. Adding these categories

together, this rounds to a total of 88% of Americans who prefer one of these two options.

© 202

1 AP Photo/ Kathy Willens

Issue Brief

Three Things You Should Know

About The Long Term Care Poll on Aging at Home

Among Americans Adults:

1)

88% would prefer to receive any ongoing

living assistance they need as they age at

home or in a loved one’s home

2) 51% think Medicare should have a large

responsibility for paying for ongoing living

assistance, and 49% expect to rely on it to pay

for care they need as they age.

3) 53% have already received health care at

home during the pandemic through telehealth

LONG-TERM CARE IN AMERICA: AMERICANS WANT TO AGE AT HOME

© Copyright 2021. The Associated Press and NORC May 2021 |

2

Despite the impact of COVID-19 on older adults, few Americans are prepared for their own aging and

potential care needs. Although Medicare only covers limited ongoing living assistance services, the

program is cited as a key component of the long-term care financing plan for many Americans – 49% of

those age 40 and older expect to rely on the program to pay for their long-term care needs. And a

majority of Americans age 40 and older have done little or no planning for their own care needs.

During the pandemic, many Americans have become accustomed to receiving health care at home:

53% say they have used live video, phone calls, text messages, or email to receive health care from a

doctor or other health care provider over the last year.

Thinking ahead to their personal situation as they age, many express concerns about being alone

without family and friends, having their social needs met, and health and safety issues at a retirement

community or nursing home. They also worry about a loved one needing care in a nursing home,

though those concerns have declined since last September.

The AP-NORC Center conducted this study with funding from The SCAN Foundation. The survey

includes 1,113 interviews with a nationally representative sample of Americans using the AmeriSpeak

Panel®, the probability-based panel of NORC at the University of Chicago. Interviews were conducted

between March 25-29, 2021 via web and phone in English. The margin of sampling error is +/- 3.7

percentage points.

Key findings from the study include:

■

Support is high for government action in helping Americans pay for long-term care: 60% favor a

government-administered long-term care insurance program similar to Medicare and 63% favor

government funding for program to allow people with low incomes to receive care at home.

■

Americans think health insurance companies (52%), Medicare (51%), and Medicaid (41%) should

have a large or very large responsibility to pay for ongoing living assistance. Just 35% think

individuals and 15% think families should be responsible.

■

51% think shoring up the Medicare trust fund should be a top priority for the Congress and the

Biden administration and another 38% think it is a lower but still important priority. Just 9% think

it is not an important priority or shouldn’t be done at all.

■

Reflecting their strong preference for receiving care in a home environment, common aging

concerns about aging include losing independence as they age (67%), being alone without family or

friends around them (60%), and having social needs met (57%). Many also worry about having to

leave their home and move into a nursing home (53%) and about experiencing health and safety

issues in a retirement community or nursing home (54%).

■

33% would be very or extremely concerned about a loved one needing a short-term stay in a

nursing home for rehabilitation, and 44% would be concerned about a long-term stay or permanent

residence in a nursing home. These concerns have declined since September 2020 (44% and 60%,

respectively).

■

Most Americans do not feel prepared for their own care needs: 69% say they have done little or no

planning and just 16% are confident they will have the financial resources they need to pay for

long-term care.

■

Few have discussed their preferences for ongoing living assistance with their doctor (11%) or family

and friends (31%). Even among those age 60 and older, rates are low (14% and 46% respectively).

LONG-TERM CARE IN AMERICA: AMERICANS WANT TO AGE AT HOME

© Copyright 2021. The Associated Press and NORC May 2021 |

3

AMERICANS STRONGLY PREFER TO AGE AT HOME.

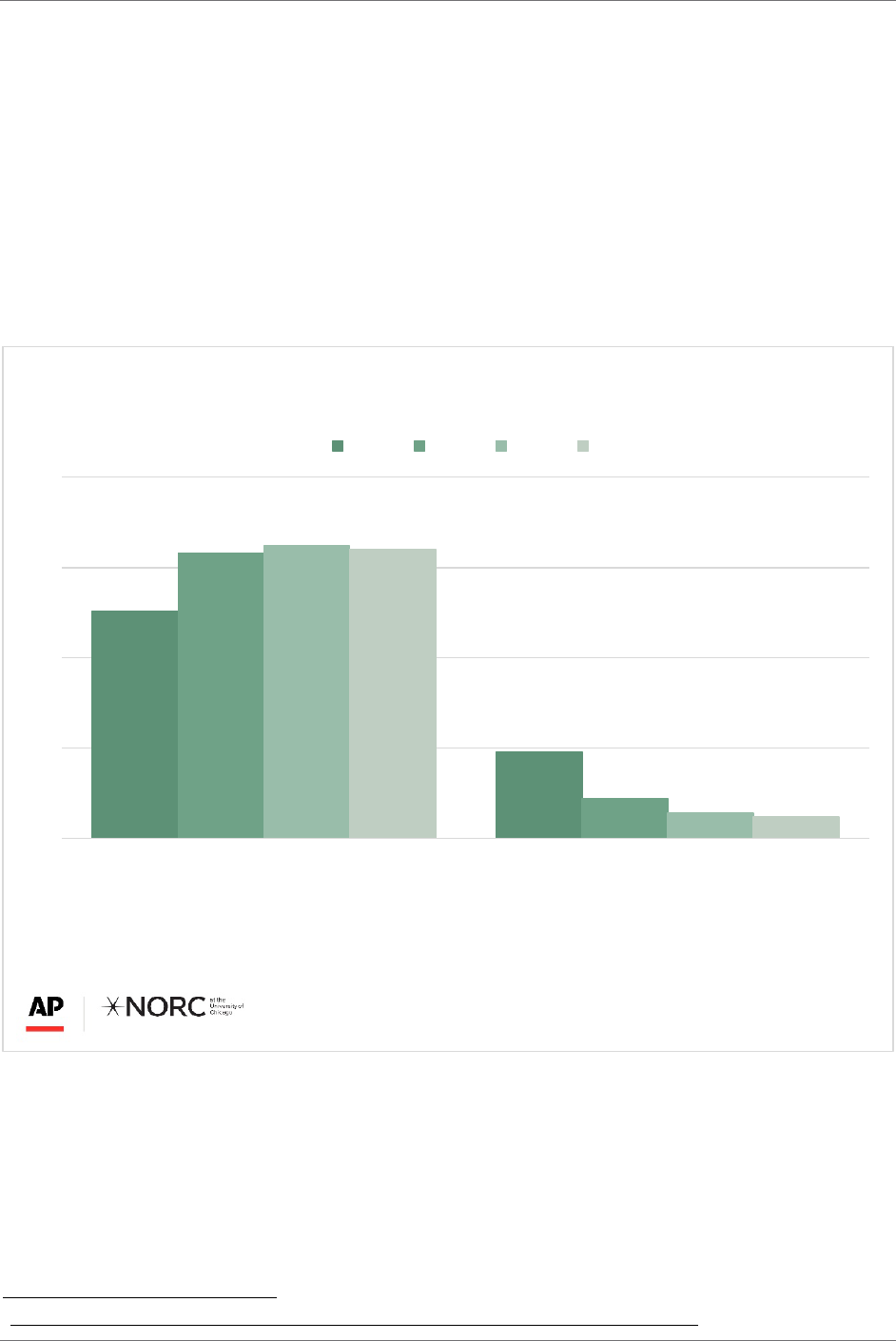

The vast majority of Americans (88%) want to stay in their own home or the home of a loved one in the

event they need ongoing living assistance as they age. Receiving care at their own home is the

preferred option for 76%, and 11% would prefer a friend or family member’s home. Just 10% would

prefer a senior community, and 2% a nursing home.

This remains essentially unchanged from previous years. In 2020, 89% preferred to receive care at

home or with friends or family. In a 2016 survey of Americans age 40 and older, 81% said the same.

2

In 2021, younger Americans are more likely than older Americans to prefer a friend or family member’s

home, while older Americans want to age in place. The desire to age in their own home is consistent

across race and ethnicity, as well as urban, suburban, and rural environments.

2

https://www.longtermcarepoll.org/wp-content/uploads/2017/11/AP-NORC-Long-term-Care-2016_Trend_Topline.pdf

63

24

79

11

81

7

80

6

0

25

50

75

100

Your own home Friend or family member's home

18-29 30-44 45-59 60+

Older Americans want to receive care at home if they need it.

Percent of adults

APNORC.org

Question: If you could choose, what would be your first choice as to where you would receive assistance right now? / In the

event that you need ongoing living assistance someday, if you could choose, what would be your first choice as to where you

would receive that assistance?

Source: The AP-NORC Long Term Care Poll conducted March 25 - 29, 2021, with 1,113 adults age 18 and older nationwide

%

LONG-TERM CARE IN AMERICA: AMERICANS WANT TO AGE AT HOME

© Copyright 2021. The Associated Press and NORC May 2021 |

4

In addition to their own future needs, Americans remain skeptical about nursing home facilities for

both long and short term stays for loved ones. A third would be very or extremely concerned about a

loved one receiving care in a nursing home for a short-term stay for rehabilitation, and 44% say the

same about a long term stay or permanent residence.

Although Americans still express reservations about nursing homes, these concerns have decreased

since September 2020.

60

44

44

33

27

32

37

39

19

22

19

27

0 25 50 75 100

Sept

2020

March

2021

Sept

2020

March

2021

Extremely/very concerned Moderately concerned Not at all/only a little concerned

Americans are less concerned about family or friends in nursing homes than they

were in September 2020.

Percent of adults

APNORC.org

Question: If [another] aging family member or friend were to need ongoing living assistance during the COVID-19 outbreak, how

concerned would you be about having them receive the following types of care in a nursing home?

Source: The AP-NORC Long Term Care Polls conducted March 25 - 29, 2021, with 1,113 adults age 18 and older nationwide, and

August 27- September 14, 2020, with 1,893 adults age 18 and older nationwide

%

Short-term stays for rehabilitation before moving home

Long term or permanent residence

LONG-TERM CARE IN AMERICA: AMERICANS WANT TO AGE AT HOME

© Copyright 2021. The Associated Press and NORC May 2021 |

5

Older Americans are more concerned than younger Americans about both short and long-term stays

in nursing homes for their loved ones. Women are also more concerned than men.

49

40

54

46

40

33

37

29

41

37

26

28

30

34

29

30

34

35

39

38

41

38

42

33

19

26

15

23

25

28

21

32

18

25

31

36

0 25 50 75 100

Women

Men

60+

45-59

30-44

18-29

Women

Men

60+

45-59

30-44

18-29

Extremely/very concerned Moderately concerned Not at all/only a little concerned

Older adults and women are more concerned about family or friends in nursing

homes.

Percent of adults

APNORC.org

Question: If [another] aging family member or friend were to need ongoing living assistance during the COVID-19 outbreak, how

concerned would you be about having them receive the following types of care in a nursing home?

Source: The AP-NORC Long Term Care Poll conducted March 25 - 29, 2021, with 1,113 adults age 18 and older nationwide

%

Short-term stays for rehabilitation before moving home

Long term or permanent residence

LONG-TERM CARE IN AMERICA: AMERICANS WANT TO AGE AT HOME

© Copyright 2021. The Associated Press and NORC May 2021 |

6

Reflecting their strong preference to age in a home setting, the top worry on Americans’ minds when

asked about potential concerns as they grow older is losing their independence. Many are also worried

about being alone without family or friends around them, having to leave their home, and being a

burden on family.

23

25

28

30

30

33

33

36

39

24

32

26

23

32

27

26

30

27

52

42

44

45

37

39

40

33

32

0 25 50 75 100

Leaving your home for a

family member’s home

Having your social needs met

Health and safety issues in a

senior community or home

Leaving your home for a

nursing home

Not planning enough for care

Being alone without family

or friends

Being a burden on your family

Being able to pay for care

Losing your independence

A great deal/quite a bit A moderate amount Only a little/none at all

Americans' top concern about growing older is losing their independence.

Percent of adults

APNORC.org

Question: Thinking about your own personal situation as you get older, does each of the following cause you a great deal of

concern, quite a bit of concern, a moderate amount, only a little, or none at all?

Source: The AP-NORC Long Term Care Poll conducted March 25 - 29, 2021, with 1,113 adults age 18 and older nationwide

%

LONG-TERM CARE IN AMERICA: AMERICANS WANT TO AGE AT HOME

© Copyright 2021. The Associated Press and NORC May 2021 |

7

Older and younger Americans have different concerns about aging. For example, 35% of those age 40

and older are very concerned about having to leave their home and move into a nursing home,

compared to 22% of those age 18-39. And 33% of those age 40 and older are very worried about health

and safety issues in a retirement community, compared to 20% of younger adults. Older Americans,

however, are less worried about being alone without friends and family than younger Americans.

Forty-three percent of those age 40 and older are only a little or not at all concerned about being alone,

while 32% of those under age 40 are not concerned.

Adults with lower incomes are generally more concerned than wealthier Americans, particularly

about needing to leave home for care.

22

18

28

27

34

32

21

17

22

30

30

34

29

30

33

38

41

47

0 25 50 75 100

Having your social needs met

Leaving your home for a

family member’s home

Health and safety issues in a

senior community or home

Being alone without family

or friends

Being able to pay for care

Losing your independence

Under $50k $50-$100k $100k +

Lower income adults are more worried about aging than wealthier Americans.

Percent of adults who say a great deal or quite a bit of concern

APNORC.org

Question: Thinking about your own personal situation as you get older, does each of the following cause you a great deal of

concern, quite a bit of concern, a moderate amount, only a little, or none at all?

Source: The AP-NORC Long Term Care Poll conducted March 25 - 29, 2021, with 1,113 adults age 18 and older nationwide

%

LONG-TERM CARE IN AMERICA: AMERICANS WANT TO AGE AT HOME

© Copyright 2021. The Associated Press and NORC May 2021 |

8

MANY ARE USING TELEHEALTH TO RECEIVE CARE AT HOME DURING

THE PANDEMIC, BUT FEW ARE DISCUSSING THEIR PREFERENCES FOR

CARE AS THEY AGE.

Many Americans are already receiving some form of health care from home. Over the past year during

the pandemic, 53% of Americans received some form of virtual health care. Thirty-five percent spoke

on the phone with a health care provider, 33% communicated using live video, 18% used email, and 13%

used text messages. This has increased from 46% who already reported using telehealth for health

care in September 2020.

Although most Americans continue to access medical care during the pandemic, many report that the

health care system has not taken their preferences into consideration during the past year. Forty-five

percent feel that their preferences for care are only sometimes or never taken into account.

Thinking about their future needs for care, very few Americans have discussed their preferences

about ongoing living assistance. Thirty-one percent have done so with their friends and family, and

just 11% have with their doctor or other health care provider. Although older Americans are more likely

to have these conversations than young people, still just 46% of Americans age 60 and older have

expressed their aging preferences with family or friends and just 14% have done so with their health

care provider.

46

30

26

16

14

7

11

9

0 25 50 75 100

60+

45-59

30-44

18-29

Health care provider Friends and family

Older adults are more likely to have discussed care preferences.

Percent of adults who have discussed care preferences with:

APNORC.org

Question: Have you discussed your preferences for receiving ongoing living assistance with each of the following?

Source: The AP-NORC Long Term Care Poll conducted March 25 - 29, 2021, with 1,113 adults age 18 and older nationwide

%

LONG-TERM CARE IN AMERICA: AMERICANS WANT TO AGE AT HOME

© Copyright 2021. The Associated Press and NORC May 2021 |

9

RATES OF PLANNING FOR LONG-TERM CARE REMAIN LOW.

Twelve percent of Americans are providing ongoing living assistance to a friend or family member

right now, and 6% of Americans age 40 and older are currently receiving ongoing living assistance

themselves.

But few have done enough planning for their own care needs and many worry about their ability to

afford care in the future. And despite the impact of COVID-19 on older Americans, rates of planning

remain similar to 2020 and 2018.

12

10

14

23

18

17

64

72

69

0 25 50 75 100

2018

2020

2021

A great deal/quite a bit A moderate amount Only a little/none at all

Despite COVID-19 pandemic, few have planned for ongoing living assistance.

Percent of adults age 40+

APNORC.org

Questions: How much planning, if any, have you done for your own needs for ongoing living assistance?

Source: The AP-NORC Long Term Care Polls conducted March 25 - 29, 2021, with 1,113 adults age 18 and older nationwide,

August 27- September 14, 2020, with 1,893 adults age 18 and older nationwide, March 13 - April 5, 2018, with 1,945 adults age 18

and older nationwide

%

LONG-TERM CARE IN AMERICA: AMERICANS WANT TO AGE AT HOME

© Copyright 2021. The Associated Press and NORC May 2021 |

10

Since 2018, Americans have consistently felt unprepared financially for the costs of ongoing living

assistance. Only 16% are very or extremely confident they will have the financial resources they need

to pay for any care they need as they age, about the same level of confidence in 2020 (15%) and in 2018

(17%). Women are less likely than men to feel confident that they will have adequate financial

resources (12% vs. 20%).

Most Americans are at least moderately concerned about not having planned enough for care (62%) or

being unable to pay for needed care (66%). These rates are similar to 2020, when 64% reported concern

about not planning enough and 66% about being able to pay for it.

17

15

16

38

44

44

45

41

38

0 25 50 75 100

2018

2020

2021

Extremely/very confident Somewhat confident Not at all/not too confident

Most Americans lack confidence that they will have financial resources to pay for

care.

Percent of adults

APNORC.org

Questions: Thinking about your [current/possible] needs for ongoing living assistance, how confident are you that you will have

the financial resources to pay for any care you need as you get older?

Source: The AP-NORC Long Term Care Polls conducted March 25 - 29, 2021, with 1,113 adults age 18 and older nationwide,

August 27- September 14, 2020, with 1,893 adults age 18 and older nationwide, March 13 - April 5, 2018, with 1,945 adults age

18 and older nationwide

%

LONG-TERM CARE IN AMERICA: AMERICANS WANT TO AGE AT HOME

© Copyright 2021. The Associated Press and NORC May 2021 |

11

AMERICANS SUPPORT GOVERNMENT ACTION TO PAY FOR LONG-TERM

CARE INCLUDING WAYS TO HELP PEOPLE AGE AT HOME.

A majority of Americans support a number of government policies to help people prepare for the costs

of ongoing living assistance. Seventy percent favor the ability to get long term care coverage through

Medicare Advantage or a supplemental insurance plan. About 6 in 10 favor government funding for

programs to allow more people with low incomes to receive long term care at home; a government-

administered long-term care insurance program, similar to Medicare; or tax breaks for consumers who

purchase long-term care insurance.

60

61

63

70

28

30

26

24

10

8

10

5

0 25 50 75 100

Government-

administered long-

term care insurance

program

Tax breaks for

purchasing long-

term care insurance

Government

programs for low

income people to

receive care in their

homes

The ability to get

long-term care

coverage through a

supplemental

insurance plan

Favor Neither favor nor oppose Oppose

Most favor government policies to help pay for ongoing living assistance.

Percent of adults

APNORC.org

Question: To help Americans prepare for the costs of ongoing living assistance, would you favor, oppose, or neither favor nor

oppose each of the following?

Source: The AP-NORC Long Term Care Poll conducted March 25 - 29, 2021, with 1,113 adults age 18 and older nationwide

%

LONG-TERM CARE IN AMERICA: AMERICANS WANT TO AGE AT HOME

© Copyright 2021. The Associated Press and NORC May 2021 |

12

In 2018, slightly more favored a government administered plan or tax breaks for purchasing long-term

care insurance when 66% and 70% supported each policy, respectively.

In the current survey, a majority of both Republicans and Democrats support tax breaks for

purchasing long-term care insurance and the ability to get long-term care coverage through a

supplemental insurance plan. But while a large majority of Democrats favor long-term care insurance

and programs for low income people, there is less Republican support for either government plan.

Adults age 40 and older are more supportive than younger adults of a government-administered long-

term care insurance program (65% vs. 53%), tax breaks for consumers who purchase long-term care

insurance (66% vs. 52%), and the ability to purchase long-term care coverage through a supplemental

insurance plan (77% vs. 58%).

58

49

65

42

58

60

63

56

64

76

77

78

0 25 50 75 100

Tax breaks for

purchasing long-

term care insurance

Government

programs for low

income people to

receive care in their

homes

The ability to get

long-term care

coverage through a

supplemental

insurance plan

Government-

administered long-

term care insurance

program

Democrats Independents Republicans

Majorities of both parties favor some government policies to help Americans pay

for ongoing living assistance.

Percent of adults who favor

APNORC.org

Question: To help Americans prepare for the costs of ongoing living assistance, would you favor, oppose, or neither favor nor

oppose each of the following?

Source: The AP-NORC Long Term Care Poll conducted March 25 - 29, 2021, with 1,113 adults age 18 and older nationwide

%

LONG-TERM CARE IN AMERICA: AMERICANS WANT TO AGE AT HOME

© Copyright 2021. The Associated Press and NORC May 2021 |

13

AMERICANS THINK GOVERNMENT PROGRAMS AND INSURANCE

COMPANIES SHOULD COVER THE COSTS OF LONG-TERM CARE.

Americans believe the responsibility for long-term care costs should fall primarily on health insurance

companies and Medicare rather than individuals or families.

15

35

41

51

52

32

35

37

36

38

51

28

20

12

10

0 25 50 75 100

Families

Individuals

Medicaid

Medicare

Health insurance

companies

Very large/large responsibility Moderate responsibility Small/no responsibility at all

Health insurance companies and Medicare should be responsible for ongoing care.

Percent of adults

APNORC.org

Question: How much responsibility should each of the following have for paying for the costs of ongoing living assistance?

Source: The AP-NORC Long Term Care Poll conducted March 25 - 29, 2021, with 1,113 adults age 18 and older nationwide

%

LONG-TERM CARE IN AMERICA: AMERICANS WANT TO AGE AT HOME

© Copyright 2021. The Associated Press and NORC May 2021 |

14

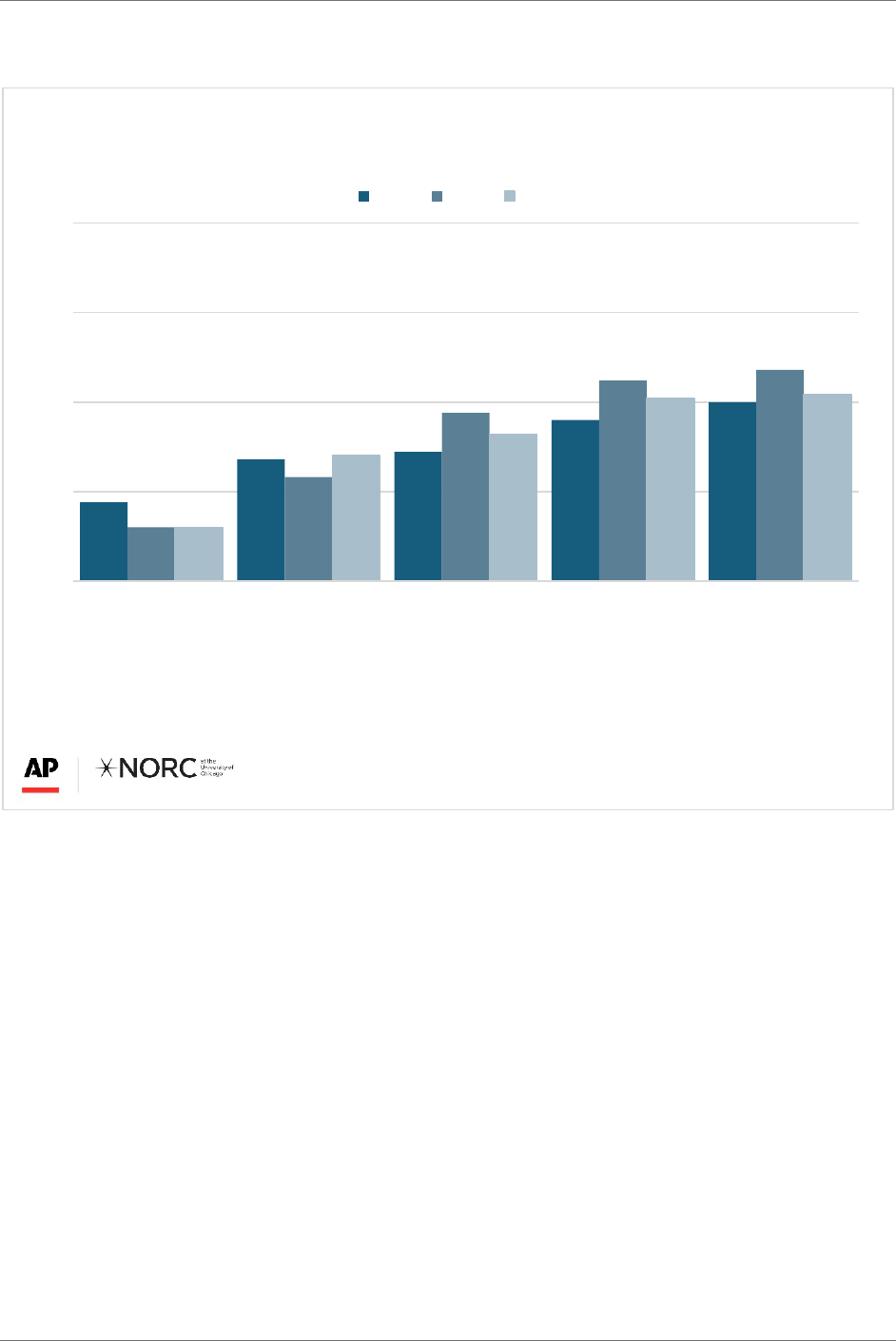

Although there has been some variation over time, Americans consistently put the responsibility on

Medicare and insurance companies relative to individuals and their families.

22

34

36

45

50

15

29

47

56

59

15

35

41

51

52

0

25

50

75

100

Families Individuals Medicaid Medicare Health insurance

companies

2018 2020 2021

Americans consistently want health insurers and Medicare to shoulder costs for

ongoing living assistance.

Percent of adults who say very large or large responsibility

APNORC.org

Question: How much responsibility should each of the following have for paying for the costs of ongoing living assistance?

Source: The AP-NORC Long Term Care Polls conducted March 25 - 29, 2021, with 1,113 adults age 18 and older nationwide,

August 27- September 14, 2020, with 1,893 adults age 18 and older nationwide, March 13 - April 5, 2018, with 1,945 adults age

18 and older nationwide

%

LONG-TERM CARE IN AMERICA: AMERICANS WANT TO AGE AT HOME

© Copyright 2021. The Associated Press and NORC May 2021 |

15

Younger Americans are more likely to say families, Medicaid and health insurance companies should

be responsible for paying for care.

21

46

57

11

38

48

0

25

50

75

100

Families Medicaid Health insurance companies

18-39 40+

Younger Americans are more likely to say families, Medicaid, and insurance should

be responsible for paying for long-term care.

Percent of adults who say very large or large responsibility

APNORC.org

Question: How much responsibility should each of the following have for paying for the costs of ongoing living assistance?

Source: The AP-NORC Long Term Care Polls conducted March 25 - 29, 2021, with 1,113 adults age 18 and older nationwide,

August 27- September 14, 2020, with 1,893 adults age 18 and older nationwide, March 13 - April 5, 2018, with 1,945 adults age

18 and older nationwide

%

LONG-TERM CARE IN AMERICA: AMERICANS WANT TO AGE AT HOME

© Copyright 2021. The Associated Press and NORC May 2021 |

16

Few Republicans and Democrats think that families (13% and 15%) and individuals (36% and 34%)

should be responsible for paying for ongoing living assistance. And about half of each party say

Medicare (47% and 56%) and health insurance companies (47% and 55%) should be responsible.

However, 47% of Democrats say that Medicaid should be responsible, compared to just 32% of

Republicans.

Although Medicare does not cover many costs of long-term care, 49% of those 40 and older expect to

rely on it if they need care. Since 2018, the number of Americans expecting to rely on personal savings

has increased, while the number of those expecting to rely on Medicare has decreased.

49

48

47

27

26

25

17

15

55

37

51

19

27

29

18

19

0 25 50 75 100

Medicare

Your personal savings or investments

Social Security

Sources of future income other than Social

Security, a pension, or personal savings

A pension

Medicaid

A family member's ability to

provide care at no cost

Long-term care insurance

2021 2018

Americans expect to rely on Medicare, savings, and Social Security to pay for care

Percent of adults age 40 and older who say they will rely on the following completely/quite a bit

Questions: Thinking about your [current/possible] needs for ongoing living assistance, how much do you think you will rely on

each of the following sources to support any care you need as you get older?

Source: The AP-NORC Long Term Care Polls conducted March 25 - 29, 2021, with 1,113 adults age 18 and older nationwide,

March 13 - April 5, 2018, with 1,945 adults age 18 and older nationwide

APNORC.or

%

LONG-TERM CARE IN AMERICA: AMERICANS WANT TO AGE AT HOME

© Copyright 2021. The Associated Press and NORC May 2021 |

17

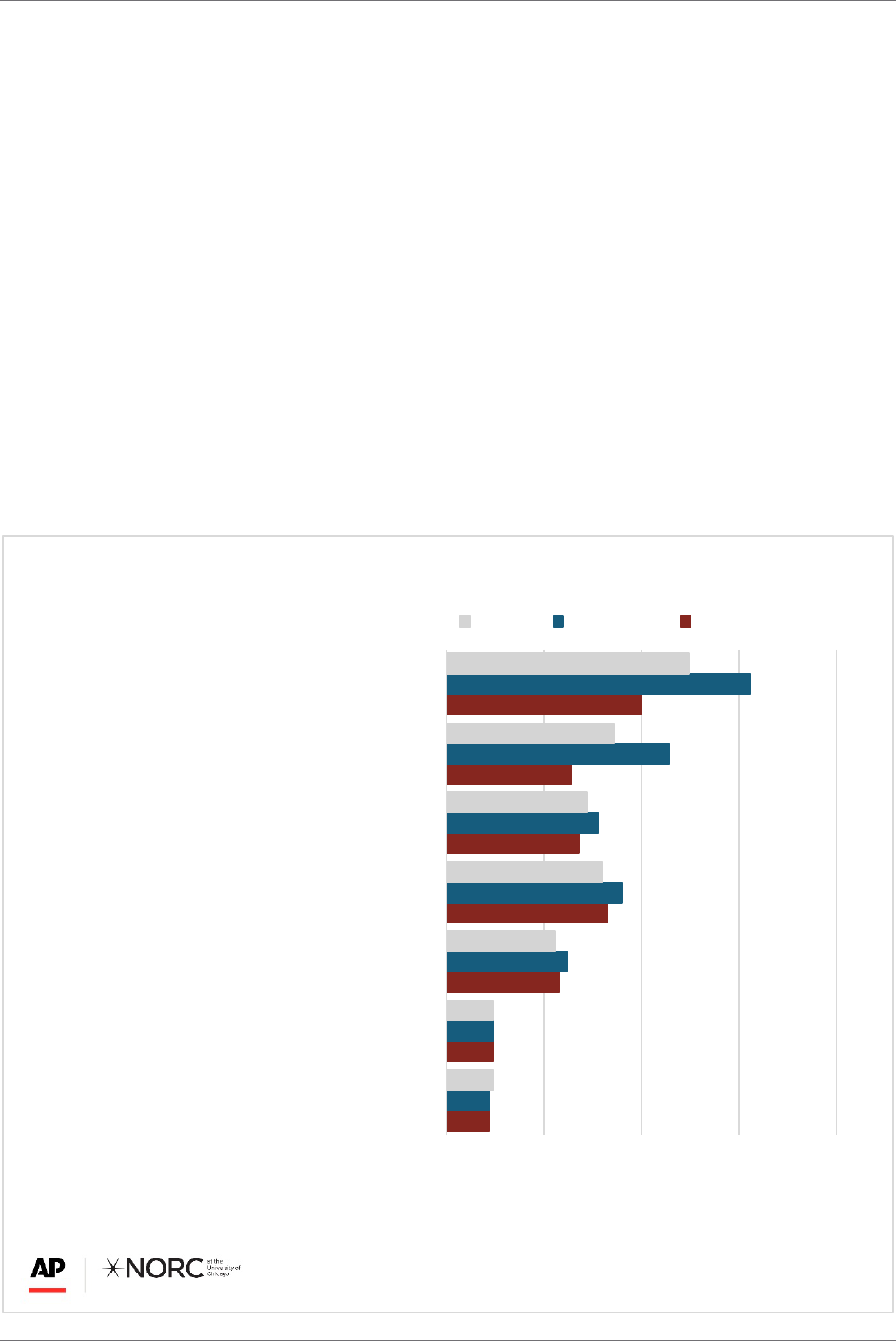

AMERICANS WANT THE GOVERNMENT TO SHORE UP THE MEDICARE

TRUST FUND.

With many Americans expecting to rely on Medicare to cover long-term care costs, 51% think shoring

up the Medicare trust fund should be a top priority for Congress and the Biden administration, and

another 38% say it is important but at lower priority. Both Democrats and Republicans strongly

support securing the Medicare trust fund, with about 9 in 10 saying it is an important priority.

Support for securing the Medicare trust fund varies by age though, with older Americans more likely

to view it as a priority. The most popular way to address shortfalls in the Medicare trust fund is tax

increases for wealthy individuals, followed by increasing the payroll tax and cuts in how much

Medicare pays pharmaceutical or insurance companies. Few support cutting benefits to current or

future Medicare beneficiaries or cutting payments to hospitals, doctors, and other services.

Although Democrats and Republicans are unified in their support for securing the Medicare trust fund,

they differ on which measures should be taken to stabilize it. Support for tax increases on the wealthy

is high for both parties, but Democrats are more supportive. Democrats are also more supportive of

increasing the payroll tax. Cuts to how much Medicare pays insurance companies, pharmaceutical

companies, and doctors have modest support from both parties, while few from either party support

cuts to current or future Medicare beneficiaries.

11

12

29

41

34

32

50

11

12

31

45

39

57

78

12

12

28

40

36

43

62

0 25 50 75 100

Cuts to benefits provided to current

Medicare beneficiaries

Cuts to benefits that would be provided to

future Medicare beneficiaries

Cuts in how much Medicare pays to hospitals, doctors,

and other services providers

Cuts in how much Medicare pays to pharmaceutical

companies for prescription drugs

Cuts in how much Medicare pays to

insurance companies

An increase in the Medicare payroll tax that is paid

by both employees and employers

A tax increase for wealthy individuals

making over $250,000 per year

Overall Democrats Republicans

Most Americans support tax increases to secure Medicare trust fund

Percent of adults who say they favor each measure

Questions: To stabilize the Medicare trust fund, would you favor, oppose, or neither favor nor oppose each of the following?

Source: The AP-NORC Long Term Care Poll conducted March 25 - 29, 2021, with 1,113 adults age 18 and older nationwide

APNORC.org

%

LONG-TERM CARE IN AMERICA: AMERICANS WANT TO AGE AT HOME

© Copyright 2021. The Associated Press and NORC May 2021 |

18

STUDY METHODOLOGY

This study, funded by The SCAN Foundation, was conducted by The Associated Press-NORC Center

for Public Affairs Research. Data were collected using the AmeriSpeak Omnibus®, a monthly multi-

client survey using NORC’s probability-based panel designed to be representative of the U.S.

household population. The survey was part of a larger study that included questions about other

topics not included in this report.

During the initial recruitment phase of the panel, randomly selected U.S. households were sampled

with a known, non-zero probability of selection from the NORC National Sample Frame and then

contacted by U.S. mail, email, telephone, and field interviewers (face to face). The panel provides

sample coverage of approximately 97% of the U.S. household population. Those excluded from the

sample include people with P.O. Box only addresses, some addresses not listed in the USPS Delivery

Sequence File, and some newly constructed dwellings. Of note for this study, the panel would also

exclude recipients of long-term care who live in some institutional types of settings, such as skilled

nursing facilities or nursing homes, depending on how addresses are listed for the facility. Staff from

NORC at the University of Chicago, The Associated Press, and The SCAN Foundation collaborated on

all aspects of the study.

Interviews for this survey were conducted between March 25 and March 29, 2021, with adults age 18

and older representing the 50 states and the District of Columbia. Panel members were randomly

drawn from AmeriSpeak, and 1,113 completed the survey—1,040 via the web and 73 via telephone.

Interviews were conducted in English. Respondents were offered a small monetary incentive ($3) for

completing the survey.

The final stage completion rate is 22.5 percent, the weighted household panel response rate is 19.5

percent, and the weighted household panel retention rate is 75.0 percent, for a cumulative response

rate of 3.3 percent. The overall margin of sampling error is +/- 3.7 percentage points at the 95 percent

confidence level including the design effect.

Once the sample has been selected and fielded, and all the study data have been collected and made

final, a poststratification process is used to adjust for any survey nonresponse as well as any non-

coverage or under and oversampling resulting from the study specific sample design.

Poststratification variables included age, gender, census division, race/ethnicity, and education.

Weighting variables were obtained from the 2020 Current Population Survey. The weighted data

reflect the U.S. population of adults age 18 and over.

Topline data and reports for all previous years, including full methodology statements, are available at

www.longtermcarepoll.org. For more information, email info@apnorc.org.

LONG-TERM CARE IN AMERICA: AMERICANS WANT TO AGE AT HOME

© Copyright 2021. The Associated Press and NORC May 2021 |

19

CONTRIBUTING RESEARCHERS

From NORC at the University of Chicago

Dan Malato

Semilla Stripp

Claire Inciong Krummenacher

Jennifer Benz

From The Associated Press

Emily Swanson

Hannah Fingerhut

ABOUT THE ASSOCIATED PRESS-NORC CENTER FOR PUBLIC AFFAIRS

RESEARCH

The AP-NORC Center for Public Affairs Research taps into the power of social science research and the

highest-quality journalism to bring key information to people across the nation and throughout the

world.

■

The Associated Press (AP) is an independent global news organization dedicated to factual reporting.

Founded in 1846, AP today remains the most trusted source of fast, accurate, unbiased news in all

formats and the essential provider of the technology and services vital to the news business. More

than half the world’s population sees AP journalism every day. www.ap.org

■

NORC at the University of Chicago is one of the oldest objective and non-partisan research

institutions in the world. www.norc.org

The two organizations have established The AP-NORC Center for Public Affairs Research to conduct,

analyze, and distribute social science research in the public interest on newsworthy topics, and to use

the power of journalism to tell the stories that research reveals.

Learn more at www.apnorc.org