Page 1 GAO-24-107150 Federal Student Loans

441 G St. N.W.

Washington, DC 20548

Accessible Version

July 29, 2024

The Honorable Bill Cassidy, M.D.

Ranking Member

Committee on Health, Education, Labor and Pensions

United States Senate

The Honorable Virginia Foxx

Chairwoman

Committee on Education and the Workforce

House of Representatives

Federal Student Loans: Preliminary Observations on Borrower Repayment Practices

after the Payment Pause

Federal student loans are an important resource to help individuals access higher education. As

of January 2024, the Department of Education held $1.5 trillion in outstanding federal student

loan debt for nearly 43 million borrowers, according to Education.

1

Beginning in March 2020, in response to the COVID-19 pandemic, the CARES Act and related

administrative actions paused several aspects of student loan repayment, including payments

being due and interest accrual.

2

After several extensions, this payment pause ended on August

30, 2023, per the Fiscal Responsibility Act of 2023. Interest began accruing again in September

2023, and monthly payments resumed in October 2023, according to Education.

To assist borrowers who may struggle to make payments, Education introduced a new

repayment plan option and flexibilities. For example, it created the Saving on a Valuable

Education (SAVE) plan, an income-driven repayment (IDR) plan that bases monthly payments

on a borrower’s income and family size. Like other IDR plans, the SAVE plan offers forgiveness

of the borrower’s remaining loan balance at the end of the repayment period, and monthly

payments for some borrowers can be as low as $0 and still count toward forgiveness.

3

1

This includes outstanding William D. Ford Federal Direct Loans and Federal Family Education Loans held by

Education that were in an in-school status, the 6-month grace period before repayment begins, repayment,

forbearance, deferment, and default.

2

The CARES Act was enacted on March 27, 2020. See Pub. L. No. 116-136, § 3513, 134 Stat. 281, 404-05 (2020).

Education implemented this COVID-19 emergency relief for federal student loans retroactive to March 13, 2020, the

date COVID-19 was declared a national emergency.

3

Under the SAVE plan, the remaining unpaid loan balance is forgiven after up to 20 years for borrowers with only

undergraduate loans and up to 25 years for borrowers with any graduate loans.

Page 2 GAO-24-107150 Federal Student Loans

Education expects the SAVE plan to result in lower monthly payments for most borrowers

compared to other IDR plans.

4

On July 18, 2024, the U.S. Court of Appeals for the Eighth Circuit

granted an emergency motion for a stay temporarily prohibiting Education from implementing

the SAVE plan.

5

On July 19, 2024, Education announced that borrowers enrolled in the SAVE

plan would be placed in an interest-free forbearance while the litigation was ongoing.

6

Education also established temporary relief options for certain borrowers during the initial period

of resuming repayment. Education instituted a 12-month “on-ramp” to repayment, running from

October 1, 2023, to September 30, 2024, so that financially vulnerable borrowers who miss

monthly payments during this period are not reported as delinquent to credit bureaus, placed in

default, or referred to debt collection agencies. These protections are provided automatically to

borrowers who miss payments—there is no action needed from borrowers. Education also

implemented Fresh Start, a temporary program running through September 2024 that allows

borrowers with defaulted loans to restore them to good standing without the typical requirement

of loan consolidation or loan rehabilitation.

7

Borrowers who restore their loans to non-defaulted

status gain access to IDR plans and postponement options to help them manage repayment.

8

You asked us to provide information on the resumption of student loan repayment. This report

describes the extent to which

(1) borrowers were current on their student loan payments, and

(2) borrowers enrolled in the SAVE repayment plan.

On June 5, 2024, we briefed congressional staff on our preliminary observations. This report

transmits a final version of the briefing slides. We have updated the slides to include information

about relevant ongoing litigation and the status of the SAVE plan after the briefing (see

enclosure I). We have ongoing work examining other related topics, including Education’s

4

Lower monthly payments for borrowers enrolled in the SAVE plan are possible because Education set payment by a

smaller proportion of their income compared to other IDR plans. Monthly payments are set as a proportion of the

borrower’s discretionary income, which Education defines as adjusted gross income that exceeds 225 percent of the

applicable poverty guideline for the SAVE plan, 100 percent of the applicable guideline for the Income-Contingent

Repayment plan, and 150 percent of the applicable guideline for the Income-Based Repayment and Pay As You Earn

plans. Also, under the SAVE plan, if a borrower makes a full monthly payment, the borrower will not be charged any

remaining accrued interest that month. However, for some borrowers with higher income, the SAVE plan may result

in higher payments compared to repayment plans that cap monthly payment amounts at less than or equal to the

fixed monthly payment amount under the Standard 10-year repayment plan.

5

In addition, as of July 19, 2024, there was other litigation involving SAVE that was ongoing. Specifically, on June 24,

2024, the federal court for the District of Kansas issued a preliminary injunction enjoining Education from

implementing parts of the SAVE plan. On June 30, 2024, the U.S. Court of Appeals for the Tenth Circuit granted an

emergency motion for a stay of that preliminary injunction pending appeal.

6

Forbearance allows eligible borrowers to temporarily postpone making payments.

7

Loan consolidation and loan rehabilitation are two options that allow eligible borrowers to get their loans out of

default after they make a series of voluntary on-time monthly payments. For example, borrowers who make at least

three on-time monthly payments can pay off defaulted loans by consolidating one or more loans into a single loan

with a fixed interest rate. Borrowers who make nine on-time monthly payments within 10 months may be eligible for

loan rehabilitation, which entitles them to have the default removed from their credit report. However, borrowers may

rehabilitate a loan only once.

8

As part of the Fresh Start program, Education opted not to resume collections on defaulted loans, such as wage

garnishments and offsets on tax refunds or federal benefit payments.

Page 3 GAO-24-107150 Federal Student Loans

guidance and instructions to loan servicers regarding the resumption of federal student loan

payments.

To answer both objectives, we reviewed reports from Education that included summary data on

borrowers’ payment statuses, including current in repayment, past due, deferment, and

forbearance.

9

We focused our analysis on monthly summary data from October 2023 through

January 2024. To better understand changes in Education’s student loan portfolio since the start

of the payment pause, we reviewed selected data from January 2020. We also reviewed

summary data from January 2024 related to borrowers’ enrollment in IDR plans, including the

SAVE plan. We also reviewed relevant federal laws and regulations.

To ensure data reliability, we reviewed available technical documentation, solicited information

from Education, and conducted logic checks. We determined the data were sufficiently reliable

for our purpose of reporting on borrowers’ repayment statuses.

We conducted this performance audit from November 2023 to July 2024 in accordance with

generally accepted government auditing standards. Those standards require that we plan and

perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our

findings and conclusions based on our audit objectives. We believe that the evidence obtained

provides a reasonable basis for our findings and conclusions based on our audit objectives.

Borrowers’ Federal Student Loan Status

In summary, about half of borrowers in repayment (17.8 million) were current on their payments,

as of January 2024.

10

Nearly 30 percent of borrowers were past due on their payments, and the

remaining borrowers were not expected to make payments because their loans were in

deferment (10 percent) or forbearance (7 percent). Additional details on borrowers’ loan

statuses and values are depicted in figure 1 below. (For additional information, see enclosure

1).

9

Past due includes any loans borrowers have not paid on time. Past due begins at 1 day past due and includes

periods of delinquency, which is typically defined as more than 30 days past due. Deferment and forbearance allow

borrowers to temporarily postpone making loan payments. Borrowers are eligible for deferment if they are in active-

duty military service; reenrolled in school at least half-time after entering repayment; have income below a certain

level; qualify for federal means-tested benefits, such as Temporary Assistance for Needy Families; or are

unemployed. Borrowers qualify for mandatory forbearance if they meet certain requirements, such as if the total

payment they owe each month for all their federal student loans is 20 percent or more of their total monthly gross

income. Other borrowers experiencing financial difficulties may be eligible for general forbearance.

10

Loans in repayment include those current or past due on their payments as well as those in deferment and in

forbearance. They exclude loans with in-school or grace period status and those in default.

Page 4 GAO-24-107150 Federal Student Loans

Figure 1: Number of Borrowers and Dollar Value of Federal Student Loans in Repayment by Status, as of

January 31, 2024

Accessible Data for Figure 1: Number of Borrowers and Dollar Value of Federal Student Loans in Repayment by

Status, as of January 31, 2024

Borrowers (in millions), Total = 33.2 million duplicated borrowers

Percentage

Number in million

Forbearance

a

10%

2.5

Deferment

a

10%

3.3

Past due

b

29%

9.7

4.5 million current borrowers enrolled in

IDR plans were scheduled to pay $0

(14% of total or 25% of current)

25%

4.5

13.3 million current borrowers were

scheduled to pay more than $0 (40% of

total or 75% of current)

75%

13.3

Dollars (in billions), Total = $1,250 billion dollars

Percentage

Dollars in billions

Forbearance

a

10%

$127

Deferment

a

10%

$127

Past due

b

23%

$290

$494 billion were associated with

borrowers scheduled to pay more than

$0 (39% of total or 70% of current)

30%

$212

$212 billion were associated with

current borrowers enrolled in IDR plans

scheduled to pay $0 (17% of total or

30% of current)

70%

$494

Page 5 GAO-24-107150 Federal Student Loans

Source: GAO analysis of U.S. Department of Education data. I GAO-24-107150

a

Three million borrowers with loans totaling $112 billion had in-school deferment.

b

Past-due borrowers were 1 or more days late.

Note: Borrowers may have loans in more than one status. For example, a borrower may be current on one loan and have another

loan that is past due. As a result, the sum of borrowers in the different loan statuses (33.2 million) is slightly higher than the

unduplicated number of borrowers (32.2 million). Percentages do not add to 100 due to rounding. IDR plans are income-driven

repayment plans.

Current borrowers. About 40 percent of borrowers (13.3 million) were current in repayment

with scheduled payments of more than $0 as of January 31, 2024. In addition, about 14 percent

of borrowers (4.5 million) were current with scheduled payments of $0 on IDR plans.

Past-due borrowers. Nearly 10 million borrowers were considered past due on their loan

payments as of January 31, 2024. Six million, or 60 percent of them, were between 91 and 120

days late on their payments.

11

They account for most of the 6.7 million borrowers shielded from

negative credit reporting via Education’s "on ramp" program as of January 31, 2024.

Borrowers Enrolled in the SAVE IDR Plan

Nearly a quarter of borrowers in repayment were enrolled in SAVE as of January 31, 2024 (see

fig. 2).

12

Figure 2: Borrower Enrollment and Outstanding Loan Balances by Repayment Plan, as of January 31, 2024

11

As part of the on-ramp program, Education resets the clock on borrowers who reach 90 days past due, resetting

the number of days past due to zero to protect them from negative credit reporting. However, due to report timing,

these borrowers’ past-due status had not yet been reset to zero as of January 31, 2024, according to Education.

12

Loans in repayment include those current, past due, in deferment, and in forbearance.

Page 6 GAO-24-107150 Federal Student Loans

Accessible Data for Figure 2: Borrower Enrollment and Outstanding Loan Balances by Repayment Plan, as of

January 31, 2024

Borrowers (in

millions), Total =

32.8 million

duplciated

borrowers

Percentage

Dollars (in

billions), Total =

1,250 billion

dollars)

Percentage

Other IDR plans

5.5

17%

$304

24%

SAVE IDR plan

7.3

22%

$397

32%

Non-IDR plans

20

61%

$549

44%

Source: GAO analysis of U.S. Department of Education data. I GAO-24-107150

Note: These figures include loans that were current, past due, in deferment, and in forbearance. Borrowers may be enrolled in more

than one repayment plan. For example, borrowers may be enrolled in one repayment plan for loans they took out as a student and

another repayment plan for Parent PLUS loans borrowed for their child’s education. As a result, the sum of borrowers in the different

plan types (32.8 million) is slightly higher than the unduplicated number of borrowers (32.2 million). The Saving on a Valuable

Education (SAVE) plan is a type of income-driven repayment (IDR) plan. IDR plans generally offer lower monthly payment amounts

and extend repayment for up to 20 or 25 years of qualifying payments, after which borrowers become eligible for forgiveness of their

remaining loan balances without needing to apply. On July 18, 2024, the U.S. Court of Appeals for the Eighth Circuit granted an

emergency motion for a stay temporarily prohibiting Education from implementing the SAVE plan.

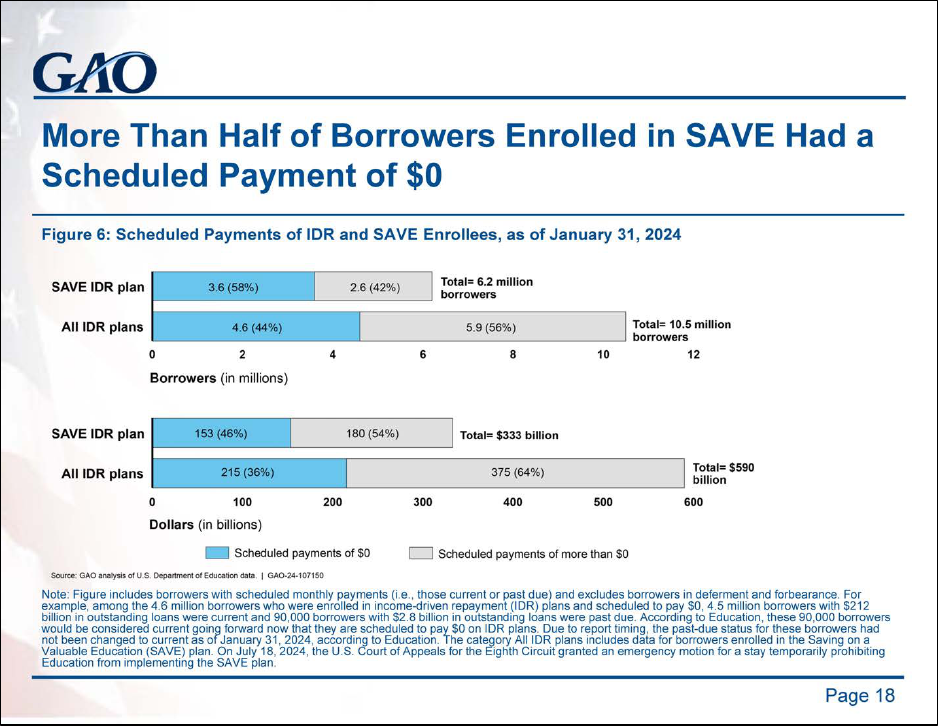

Among the 6.2 million borrowers who were enrolled in SAVE and had scheduled monthly

payments, nearly 60 percent (3.6 million) were scheduled to pay $0 as of January 31, 2024.

13

See enclosure 1 for more information.

Agency Comments

We provided a draft of this report to Education for review and comment. In its written comments,

reproduced in enclosure II, Education stated that it had anticipated significant challenges in

supporting about 28 million borrowers in returning to repayment—a fivefold increase compared

to the number of borrowers who enter repayment in a typical year—given the agency’s limited

resources and congressional mandates. In addition, Education noted that data typically show

higher risks of delinquency and default for borrowers after prolonged periods of forbearance.

Education provided context about efforts to support borrowers described in the report, including

implementing the SAVE plan and temporary relief options for borrowers who miss payments

(on-ramp) or have defaulted loans (Fresh Start). Education also described additional ongoing

efforts to support borrowers, including communicating with borrowers about repayment and

forgiveness options, launching a new loan servicing system, and providing eligible borrowers

with loan forgiveness. In addition, Education provided technical comments, which we

incorporated as appropriate.

As agreed with your offices, unless you publicly announce the contents of this report earlier, we

plan no further distribution until 30 days from the report date. At that time, we will send copies to

the appropriate congressional committees, the Secretary of Education, and other interested

parties. In addition, the report will be available at no charge on the GAO website

at https://www.gao.gov.

13

Borrowers who have scheduled monthly payments are a subset of borrowers in repayment; they include those

current or past due on their loans and exclude borrowers in deferment and forbearance because they do not have

scheduled monthly payments.

Page 7 GAO-24-107150 Federal Student Loans

If you or your staff have any questions about this report, please contact me at (617) 788-0534 or

[email protected]. Contact points for our Offices of Congressional Relations and Public

Affairs may be found on the last page of this report. GAO staff members who made key

contributions to this report are listed in enclosure III.

Melissa Emrey-Arras

Director, Education, Workforce, and Income Security

Enclosures – 3

Page 8 GAO-24-107150 Federal Student Loans

Enclosure I: Briefing Slides

Page 9 GAO-24-107150 Federal Student Loans

Page 10 GAO-24-107150 Federal Student Loans

Page 11 GAO-24-107150 Federal Student Loans

Page 12 GAO-24-107150 Federal Student Loans

Page 13 GAO-24-107150 Federal Student Loans

Page 14 GAO-24-107150 Federal Student Loans

Page 15 GAO-24-107150 Federal Student Loans

Page 16 GAO-24-107150 Federal Student Loans

Page 17 GAO-24-107150 Federal Student Loans

Page 18 GAO-24-107150 Federal Student Loans

Page 19 GAO-24-107150 Federal Student Loans

Page 20 GAO-24-107150 Federal Student Loans

Page 21 GAO-24-107150 Federal Student Loans

Page 22 GAO-24-107150 Federal Student Loans

Page 23 GAO-24-107150 Federal Student Loans

Page 24 GAO-24-107150 Federal Student Loans

Page 25 GAO-24-107150 Federal Student Loans

Page 26 GAO-24-107150 Federal Student Loans

Page 27 GAO-24-107150 Federal Student Loans

Page 28 GAO-24-107150 Federal Student Loans

Page 29 GAO-24-107150 Federal Student Loans

Page 30 GAO-24-107150 Federal Student Loans

Accessible Data for Enclosure I: Briefing Slides

Figure 1 (Enclosure I)

Borrowers (in millions), Total = 33.2 million duplicated borrowers

Percentage

Number in million

Forbearance

a

10%

2.5

Deferment

a

10%

3.3

Past due

b

29%

9.7

4.5 million current borrowers enrolled in

IDR plans were scheduled to pay $0

(14% of total or 25% of current)

25%

4.5

13.3 million current borrowers were

scheduled to pay more than $0 (40% of

total or 75% of current)

75%

13.3

Dollars (in billions), Total = $1,250 billion dollars

Percentage

Dollars in billions

Forbearance

a

10%

$127

Deferment

a

10%

$127

Past due

b

23%

$290

$494 billion were associated with

borrowers scheduled to pay more than

$0 (39% of total or 70% of current)

30%

$212

$212 billion were associated with

current borrowers enrolled in IDR plans

scheduled to pay $0 (17% of total or

30% of current)

70%

$494

Source: GAO analysis of U.S. Department of Education data. I GAO-24-107150

Figure 2 (Enclosure I)

Total = 10 million duplicated borrowers

Past due

Percentage of borrowers (borrower count in millions)

1-30 days

24% (2.4)

31-60 days

8% (0.8)

61-90 days

8% (0.8)

91-120 days

60% (6.0)

Source: GAO analysis of U.S. Department of Education data. I GAO-24-107150

Figure 3 (Enclosure I)

Borrowers (in millions)

Oct-23

2.3

Nov-23

4.6

Dec-23

4.6

Jan-24

2.5

Source: GAO analysis of U.S. Department of Education data. I GAO-24-107150

Page 31 GAO-24-107150 Federal Student Loans

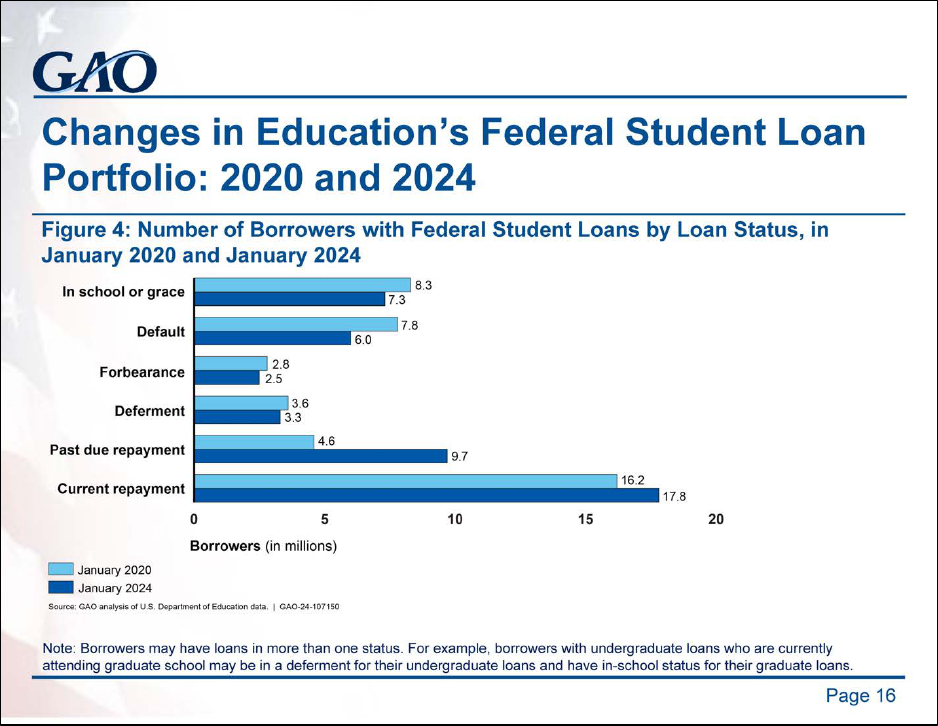

Figure 4 (Enclosure I)

Borrowers (in millions), January

2020

Borrowers (in millions), January

2024

In school or grace

8.3

7.3

Default

7.8

6.0

Forbearance

2.8

2.5

Deferment

3.6

3.3

Past due repayment

4.6

9.7

Current repayment

16.2

17.8

Source: GAO analysis of U.S. Department of Education data. I GAO-24-107150

Figure 5 (Enclosure I)

Borrowers (in

millions), Total =

32.8 million

duplicated

borrowers

Percentage

Dollars (in

billions), Total =

$1,250 billion

dollars

Percentage

Other IDR plans

5.5

17%

$304

24%

SAVE IDR plan

7.3

22%

$397

32%

Non-IDR plans

20

61%

$549

44%

Source: GAO analysis of U.S. Department of Education data. I GAO-24-107150

Figure 6 (Enclosure I)

Borrowers (in millions)

Scheduled payments

of $0

Scheduled payments

of more than $0

Totals

SAVE IDR plan

3.6 (58%)

2.6 (42%)

Total= 6.2 million borrowers

All IDR plans

4.6 (44%)

5.9 (56%)

Total= 10.5 million borrowers

Dollars (in billions)

Scheduled payments

of $0

Scheduled payments

of more than $0

Totals

SAVE IDR plan

$153 (46%)

$180 (54%)

Total= $333 billion

All IDR plans

$215 (36%)

$375 (64%)

Total= $590

Source: GAO analysis of U.S. Department of Education data. I GAO-24-107150

Page 32 GAO-24-107150 Federal Student Loans

Figure 7 (Enclosure I)

Consented to use

tax information

Did not consent

(provided

alternative

income

documentation)

Did not

consent

(self-

certified

income

greater

than zero

dollars)

Did not

consent (self-

certified no

income)

Totals

Borrowers (in

millions)

72% (2.6)

8% (0.3)

17% (0.6)

3% (0.1)

Total= 3.6

million

borrowers

Dollar Value

(in billions)

75% ($150)

9% ($18)

14% ($28)

2% ($5)

Total= $201

billion dollars

Source: GAO analysis of U.S. Department of Education data. I GAO-24-107150

Page 33 GAO-24-107150 Federal Student Loans

Enclosure II: Agency Comments

Page 34 GAO-24-107150 Federal Student Loans

Page 35 GAO-24-107150 Federal Student Loans

Page 36 GAO-24-107150 Federal Student Loans

Page 37 GAO-24-107150 Federal Student Loans

Page 38 GAO-24-107150 Federal Student Loans

441 G St. N.W.

Washington, DC 20548

Accessible Text for Enclosure II: Agency Comments

June 27, 2024

Melissa Emrey-Arras

Director, Education, Workforce, and Income Security

Government Accountability Office

441 G Street, N.W.

Washington, D.C. 20548

Dear Ms. Emrey-Arras:

I write on behalf of the U.S. Department of Education (Department), office of Federal Student

Aid (FSA) in response to the Government Accountability Office (GAO) draft report, Federal

Student Loans: Preliminary Observations on Borrower Repayment Practices after the Payment

Pause (GAO-24-107150). We appreciate the opportunity to review this draft report, which

contains no recommendations.

A record 16.04 million borrowers made payments on their student loans in January 2024, more

than in any previous month since these data began to be collected in 2018. To date, the share

of the federal portfolio that is making payments has returned to approximately the same level as

in January 2020 (prior to the pandemic and the payment pause).

For context, on March 20, 2020, due to the historic pandemic, for the first time ever, student

loan repayments were placed in a national pause, and interest rates were set at zero percent for

eligible federal student loans. This pause was critical for borrowers as the country reeled under

the financial upheaval and other circumstances due to the pandemic. This unprecedented

payment pause ended in August 2023 because of the Fiscal Responsibility Act of 2023. Interest

resumed accruing in September 2023, and payments were due in October 2023.

The Department anticipated significant challenges in supporting around 28 million borrowers in

returning to repayment, especially given limited resources and other congressional mandates;

this number was five times greater than the typical number of borrowers who had previously

entered repayment in any given year. Data typically show higher risks of delinquency and

default after borrowers experience prolonged forbearances as payment habits change and

become entrenched, while new borrowers develop no payment habits at all.

FSA supported borrowers during this time by processing targeted debt relief for as many as

possible; implementing the Saving on a Valuable Education (SAVE) Plan, which is the most

affordable repayment plan ever created; and creating a temporary on-ramp to protect borrowers

from the worst consequences of missed, late, or partial payments. FSA also executed a

communications plan to reach borrowers directly and hold loan servicers accountable for

informing borrowers of all available options and resources.

Page 39 GAO-24-107150 Federal Student Loans

Restarting repayment is an unprecedented challenge that still requires the concerted efforts of

the Department, its contractors, its partners, and Congress. While most borrowers have already

begun making payments, others may need additional time to explore their options and

determine how best to resume payments. To this end, the Department continues to help

borrowers manage their student loans and to prevent defaults and delinquencies for millions of

Americans.

We are pleased that the GAO draft report highlights the Department’s efforts to support

borrowers as they returned to repayment, including important programs like the new SAVE plan

and temporary on-ramp program. A more detailed list of our efforts to support financially

vulnerable borrowers includes:

· Communicating directly to borrowers and ensuring loan servicers inform

borrowers of all available options and resources. Clear and actionable

communication to borrowers is a key factor in successfully resuming payments and

keeping borrowers out of default. We regularly communicate with borrowers, with a

particular focus on their unique situations, to help them smoothly return to repayment

and access resources, programs, and options that are best for them. FSA will

continue to work with its contractors and external partners to give borrowers clear

information as they navigate their repayment options, including considering applying

for loan forgiveness if they are eligible, enrolling in affordable repayment plans, and

enrolling in auto-debit payments if they are able to make regular payments without

experiencing financial difficulties. FSA continues to communicate with borrowers

through email, mail, text message, and over the phone.

· Ensuring that loan forgiveness programs provide borrowers the benefits to

which they are entitled. These efforts have already resulted in approving debt relief

for more than 4.75 million people, totaling more than $167 billion in loan discharges

to date. These loan discharges are part of the Department’s overall statutory

obligations to provide discharges to various groups, including borrowers with

disabilities and those who worked in public service, as well as discharges based on

institutional closure or misconduct that harmed borrowers.

· Implementing the SAVE Plan, the most affordable repayment plan yet. Most

borrowers are saving money under the new plan, which cuts monthly payments to $0

for millions of borrowers making $32,800 or less individually using 2023 Federal

Poverty Guidelines (the cutoff is $67,500 for a borrower with a family of four) and

saves other borrowers an average of $1,000 per year compared to other income-

driven repayment (IDR) plans. Additionally, borrowers on SAVE will not see their

balances grow from unpaid interest. We are encouraged by the rapid growth in sign-

up rates of borrowers into SAVE which, as of the end of May 2024, stands at 7.9

million borrowers, up from the 6.2 million borrowers in January 2024 (the number

reflected in the draft report).

· Developing a faster, more accurate IDR application that borrowers only need to

complete once. The new application is easier than ever, taking less than 10 minutes

for borrowers with an FSA ID to complete. The application benefits from consumer

research and testing to ensure it delivers the clearest, high-quality communications

to borrowers. Borrowers can also now provide approval for the Department to

automatically transfer their tax information from the Internal Revenue Service (IRS)

and consent to allow the Department to automatically recertify their IDR plan every

year using their tax information from the IRS. More than 70 percent of borrowers

Page 40 GAO-24-107150 Federal Student Loans

applying for an IDR plan are using this data exchange, as reflected in your report.

The benefits to borrowers and taxpayers of accurate income information will increase

as more borrowers apply or recertify their plans for the first time since the application

launched.

· Launching the SAVE on Student Debt campaign. This campaign, launched in fall

2023, aimed to help borrowers reduce their student loan payments by encouraging

them to enroll in the SAVE Plan. This campaign leverages the efforts of a diverse

coalition of hundreds of corporate, government, community-based, and national

organizations to reach millions of borrowers, particularly in communities where there

is a deficit of trust and populations that are historically harder to reach.

· Creating a temporary on-ramp to protect borrowers from the worst

consequences of missed, late, or partial payments. This 12-month on-ramp is not

a payment pause; payments are due, interest will accrue, and months without

payments will not count toward Public Service Loan Forgiveness (PSLF) or IDR

forgiveness. However, borrowers who miss monthly payments during this period are

protected from the worst consequences of missed, late, or partial payments,

including negative credit reporting for delinquent payments. FSA is using this time to

provide targeted help to these borrowers and for servicers to normalize operations.

As GAO notes, as of January, on-ramp has protected nearly 6.7 million past-due

borrowers from the level of delinquency that leads to negative credit reporting.

· Providing a Fresh Start opportunity to about 7.5 million borrowers with

defaulted federal student loans to return to repayment, just like other borrowers,

so they can benefit from the new SAVE repayment plan and achieve repayment

success.

· Proactively engaging borrowers most at risk of delinquency and default with

high- quality communications from FSA and servicers explaining the steps for

returning to repayment and resources available to borrowers to ease the transition

back into repayment. FSA’s Targeted Early Delinquency Intervention (TEDI) initiative

provides additional direct outreach with enhanced communications specifically to

help borrowers who become delinquent after their payments resumed so they can

more easily find the most appropriate repayment plan for them and successfully stay

out of default. FSA will use evidence collected from A/B message testing (i.e.,

sending different versions of communications to similar borrowers) generated by this

initiative to learn what messages and supports are most effective in reaching these

borrowers and improve its messaging throughout this transition period.

· Modernizing the loan servicing experience to improve borrower outcomes and

increase servicer accountability. The Unified Servicing and Data Solution (USDS)

launched early this year has already begun to provide borrowers with a high-quality

experience and deliver support for at-risk borrowers so that all borrowers can find the

most affordable ways to repay their loans, avoid default, and obtain loan forgiveness

if they are eligible for it. Servicer accountability is a central goal of the new servicing

contracts, which provide financial incentives for better borrower outcomes and

impose consequences for failing to meet expectations.

· Strengthening servicer oversight. Before launching USDS, FSA leveraged new

accountability measures included in recent servicing contract extensions, including

overall borrower satisfaction with servicer interactions, quality of interaction during

borrower calls, ability to answer borrower calls, and accuracy of processing IDR

applications and other loan-related tasks.

Page 41 GAO-24-107150 Federal Student Loans

· Working with federal and state law enforcement to combat scams and fraud.

The Department regularly works with law enforcement partners and other federal

agencies to detect, investigate, and prosecute fraudsters, using advanced analytics

and fraud- prevention techniques. The Department has warned hundreds of

thousands of at-risk borrowers about fraudulent companies, thus saving them from

fraud. Additionally, the Department shares borrower complaints and other analyses

about suspected scams with federal and state regulators. The Department’s work

has also resulted in additional training for contractor staff and borrower-focused fraud

awareness campaigns.

Collectively, the Department’s actions, tools, and resources are supporting borrowers in making

the best repayment decisions for their financial situation and will ultimately increase the number

of borrowers who are able to make their required monthly payments for years to come. And

these efforts are working. Analysis by the Department shows in the first months of the return to

repayment:

1

· A record 16.04 million borrowers made payments on their student loans in January

2024, more than in any previous month since these data started being collected in

2018.

· The share of the federal portfolio making payments returned to approximately the

same level as in January prior to the pandemic.

· The average payment by borrowers making non-zero payments has nearly returned

to its pre-pandemic level.

FSA continues to adapt its communications and operations to respond to changes in borrower

repayment data, including when supports such as on-ramp and Fresh Start end later this year.

The Department continues to analyze its communications plan to inform borrowers of both their

financial responsibility and all available options. The Department will use this analysis to refine

and finalize its communications plan to help support the most vulnerable borrowers. Finally, the

Department continues to assess borrower behavior and the performance of repayment

programs to identify ways to evaluate overall repayment success.

Thank you again for the opportunity to review the draft report. Please find enclosed technical

comments.

We appreciate GAO’s examination of the student loan repayment process as we continue to

work to support borrowers and ensure and improve access to education for all.

Sincerely,

Richard Cordray

Chief Operating Officer

Federal Student Aid

1

Dr. Jordan Matsudaira and U.S. Undersecretary of Education James Kvaal, An Update on the First Months of the

Return to Repayment, U.S. Department of Education (Apr. 12, 2024), https://blog.ed.gov/2024/04/an-update-on-the-

first-months-of-the-return-to-repayment/.

Page 42 GAO-24-107150 Federal Student Loans

Enclosure

Page 43 GAO-24-107150 Federal Student Loans

441 G St. N.W.

Washington, DC 20548

Enclosure III: GAO Contact and Staff Acknowledgments

GAO Contact

Staff Acknowledgments

In addition to the contact named above, Debra Prescott (Assistant Director), Kathryn O’Dea

Lamas (Analyst in Charge), and Abby Marcus made key contributions to this report. Other

contributors to this report were Elizabeth Calderon, Marcia Carlsen, Linda A. Collins, Kirsten

Lauber, Mimi Nguyen, Jessica Orr, Almeta Spencer, and Adam Wendel.