HARVARD UNIVERSITY FINANCIAL POLICY

Responsible Office: University Financial Services

Date First Effective: 7/1/2010

Revision Date: 12/1/2015

Tit

le: Travel Policy Page 1 of 8

Travel

Policy Statement

This policy establishes how Harvard University will reimburse individuals for travel expenses incurred conducting

University business. As a public charity that benefits from gifts by donors and sponsored awards, Harvard University has a

stewardship obligation to use its funds prudently; all Harvard University employees must use University resources wisely

and in the fullest support of Harvard’s mission of education and research. As such, travel expenses must be reasonable

and necessary, and travelers must always use the most cost-effective means of travel. All travel reimbursements must

meet the IRS accountable plan rules in order to be excluded from the traveler’s gross income. While no policy can address

every scenario, this document is intended to cover the most common travel-related situations; where unusual

circumstances arise, the spirit of this policy – along with good judgment – should prevail.

Reason for Policy

Harvard has an obligation to promptly and consistently reimburse people incurring appropriate expenses on its behalf.

Individuals should not benefit financially, nor incur financial losses, as a result of traveling on behalf of the University.

This policy protects the University’s assets, and the assets of those spending on its behalf, by clearly stating acceptable

expenses and reimbursement procedures.

Who Must Comply

All Harvard University schools, tubs, local units, Affiliate Institutions, Allied Institutions and University-wide Initiatives

must comply. All individuals incurring travel expenses on behalf of the University must comply. Due to differences in

travel activities across the University, some units may have stricter local policies to address their particular needs; check

with your local unit before traveling.

Procedures

1.

Select your means of travel. Strategic Procurement has formed key vendor partnerships with certain travel

agencies to secure favorable rates. Harvard strongly encourages travelers to book all travel arrangements

through these preferred agencies and to always choose the most cost-effective means of travel. See

the Harvard Travel Services

website for more information. General information on common methods of travel

follow; see Appendices A – D for detailed guidance for each type. Travel charged to federal awards must comply

with additional restrictions; see sections below marked with an asterisk (*) and refer to Appendix G for details.

A. Air travel*: travelers are expected to book the lowest and most reasonable nonstop airfare consistent

with their itinerary, the business purpose of their trip, and the requirements of the funding source. The

purchase of first class air travel is not allowed. Business class air travel is only allowed for certain flights

(local policies may be more restrictive). Complimentary no-cost upgrades are allowed. See Appendix A

for

detailed guidance. Travel charged to federal awards must follow the special federal requirements

listed in Appendix G.

B. Ground transportation*: travelers are expected to use the most economical mode of transportation

appropriate for their needs. See Appendix B for detailed guidance.

a. Public t

ransportation, shuttle services, taxis: Where available, public transportation and

shuttle services should be considered. Taxis may also be used where other methods of travel

are unavailable or impractical.

b. Business use of personal cars: Harvard reimburses mileage up to the federal rates for business

use of personal cars, gas expenses cannot be reimbursed. Travelers must ensure personal cars

used for business use have appropriate insurance.

c. Rental cars: travelers must only rent cars for business use when it is the most cost-effective or

practical means of travel. Travelers should rent cars through Harvard preferred vendors, which

include insurance coverage inside the continental U.S. for benefits-eligible employees;

otherwise, travelers must purchase appropriate insurance coverage. Fifteen passenger vans

*

See Appendix G for restrictions on travel expenses c

har

ged to federal awards

HARVARD UNIVERSITY FINANCIAL POLICY

Responsible Office: University Financial Services

Date First Effective: 7/1/2010

Revision Date: 12/1/2015

Titl

e: Travel Policy Page 2 of 8

are not permitted for safety concerns, and the University provides no insurance coverage for

such vehicles.

d. Car/sedan/limousine service: private sedan or car services should be used only when valid

business reasons preclude the use of more economical transportation. The use of private

sedan or car services to attend meetings on or around campus is prohibited. Harvard will NOT

reimburse for limousine expenses under any circumstances.

e. Bus and van rental: if chartering a bus is necessary, travelers are recommended to charter

such buses through Harvard Campus Services Transit & Fleet department, when possible.

Insurance restrictions apply when working with outside vendors.

f. Rail travel: expected to be at the lowest fare that offers reserved seating.

C. Lodging*: the University will reimburse travelers for lodging expenses while on official University

business further than 50 miles one way from the traveler’s place of work. If an employee is required to

stay on or near campus overnight, those expenses may be reimbursed if they are incurred for the

benefit of the University rather than for the convenience of the employee; allowing non-essential

employees to come to work on time or in inclement weather are not sufficient reasons. Travelers must

stay in standard, single-occupancy rooms where available. See Appendix C for detailed guidance.

D. Meals, entertainment and miscellaneous travel expenses*: see Appendix D for detailed guidance.

a. Indivi

dual meals: travelers will be reimbursed for reasonable individual meal expenses while on

University business. Per IRS regulations, the University does not reimburse individual meal

expenses for one-day travel except when the travel time is greater than 12 hours. Individual

entertainment expenses, such as in-room movies, are not reimbursable.

b. Business meals: all meal costs must be substantiated by a complete and explanatory business

purpose; if a traveler hosts others at a business meal, the traveler must document each

attendee’s name (if fewer than five guests; otherwise list total number of guests), connection

to Harvard and the business conducted during the meal.

E. Insurance

a. Business travel accident insurance/emergency assistance: the University maintains a

business travel accident insurance policy that provides worldwide coverage for accidental

death or dismemberment while employees and registered Harvard students are traveling on

official University business. Because this coverage has a maximum payout limit per

conveyance such as aircraft or car, travelers are encouraged to travel in groups of no more

than four when possible. Non-employees are not covered by University business travel

accident insurance; travel accident insurance for nonemployees is reimbursable at the

School/unit’s discretion if it is for a compelling business reason. The University maintains no

insurance for loss or damage to personal property. For more information on the University’s

business travel accident insurance policy, including information on what to do in the event

of a claim, see the Risk Management and Audit Services website. Zipcar users are generally

encouraged to purchase the full damage waiver; see Appendix B for

details.

b. Trip cancellation insurance*: trip cancellation insurance may be reimbursed on nonfederal

funds if it is approved in advance and is for a compelling business reason. Travelers are

cautioned that trip cancellation insurance does not necessarily provide coverage in all

situations; purchasing a refundable ticket may be more appropriate for certain scenarios.

c. Repat

riation insurance: some countries require travelers to show proof of repatriation

insurance when applying for a visa. While traveling on Harvard business you will typically be

covered by the University’s business travel accident insurance which includes the requisite

coverage. This insurance is a component of the Harvard Travel Assist

program administered by

Global Support Services. To request a letter certifying coverage please complete a request

form.

*

See Appendix G for restrictions on travel expenses charged to federal awards

HARVARD UNIVERSITY FINANCIAL POLICY

Responsible Office: University Financial Services

Date First Effective: 7/1/2010

Revision Date: 12/1/2015

Tit

le: Travel Policy Page 3 of 8

d. Baggage insurance is not a reimbursable expense; typically it is included when travel is

booked on the Harvard Corporate Card and is also provided by carriers.

e. Other insurance: any additional travel or other travel-related insurance purchased is

generally not a reimbursable expense, unless specifically required for certain international

trips and pre-arranged with Insurance or Global Support Services.

F.

Emergency Travel Assistance Program: Harvard

Travel Assist provides medical and security advice and

referrals and emergency evacuation services to eligible Harvard travelers abroad. To learn more about

the program prior to traveling and to register your trip in the Harvard Travel Registry, go

to the Global

Support Services website.

2. Pay for travel using an approved method.

A. Corporate Card: Harvard’s Corporate Card (also called the Travel and Entertainment Card) is the

preferred payment method for travel expenses for Harvard employee travelers and employees

arranging travel on behalf of others. Using the Harvard Travel & Entertainment Card eliminates the

need to calculate foreign currency conversions—charges made using the Card are automatically

converted to U.S. dollars on the billing statements, usually at favorable rates. Paid employees

who take at least three business trips per year and/or incur entertainment expenses of $5,000 or

more per year are strongly encouraged to apply for a Harvard Travel and Entertainment Card; visit

the Harvard Travel Services

website for additional information. Expenses charged to the

Corporate Card must be paid within 60 days to avoid late fees.

B. Direct Billing using Harvard General Ledger Coding: direct billing is only available for tickets

purchased through BCD Travel, a Harvard vendor partner. A Harvard employee traveler (or

employee arranging travel on behalf of others) may directly bill Harvard departmental general

ledger coding for approved airline and Amtrak tickets using Harvard’s Web Reimbursement

application. Restrictions apply to fellowship payments made to non-resident aliens. For more

information on direct billing, visit the Harvard Travel Services website

.

C. Personal Funds: travelers without access to a Travel and Entertainment Card (students, non-

employees, and employees who may travel too infrequently to apply for a Travel and Entertainment

Card) may use personal cash or a personal credit card to pay for travel expenses. The traveler can be

reimbursed for these expenses AFTER the trip has occurred and upon presentation of appropriate

documentation. Travelers should keep all required detailed receipts for reimbursement; alternately,

per diems may be allowed depending on local policy.

D. Cash Advances:

a. The University strongly discourages the use of cash advances due to financial risks and the

administrative burden associated with processing and reconciling advances. Cash advances

should be used infrequently and must be reasonable and dictated by circumstances, such as

for incidental, out-of-pocket expenses like tips, taxis, and meals that cannot be charged to

the Travel and Entertainment Card. Daily cash advances for domestic travel should not

exceed $50, and daily cash advances for international travel should not exceed $75. Cash

advances will be issued to University employees only.

b. Advances must be settled based on actual expenses. Cash advances should be settled

within fifteen (15) days of the completion of the trip. Cash advance amounts unreconciled

after 90 days will be added to the traveler’s gross income. “Reconciled” means all

documentation submitted by the traveler, reviewed, and approved by UFS BEFORE 90 days;

employees are encouraged to submit documentation well in advance of the 90 day

deadline to allow for transit and processing. Employees who fail to account for a cash

advance will NOT be eligible to obtain future cash advances.

3. Get reimbursed for your travel. Harvard follows the IRS accountable plan rules for business travel

reimbursements. In order to comply with IRS accountable plan regulations, travelers must provide the following

HARVARD UNIVERSITY FINANCIAL POLICY

Responsible Office: University Financial Services

Date First Effective: 7/1/2010

Revision Date: 12/1/2015

Titl

e: Travel Policy Page 4 of 8

information when submitting their travel expenses for reimbursement. Any expense that fails to meet IRS

accountable plan rules must be treated as income to the reimbursee. Special rules apply to non-resident aliens

and fellowship recipients; contact the Non-Resident Alien Tax Group at (617) 495-8500 for more information.

A. Business connection: travel expenses must be directly related to services provided on behalf of the

University, not personal activities.

a. Combining business with personal travel: generally, business trips should have more days

spent on business activities than personal activities. However, in certain circumstances, a

business-related primary motivation for the trip may be more determinative than the relative

number of days. See Appendix E for more information.

b. Spousal/family member travel: expenses related to an employee’s spouse or other family

members are not reimbursable unless there is a bona fide business purpose for their presence

on the trip. See Appendix F for more information.

B. Substantiation: each reimbursement request for travel expenses must be supported by a detailed

business purpose that includes the following information:

a. Who traveled or attended the event (e.g., all guests who attended a business-related meal)

b. What type of event or activity was attended or purchase made

c. When the event or activity took place

d. Where the event or activity took place

e. Why the expense was incurred

C. Receipts* (see Appendix G and the Sponsored Expenditure Guidelines for more information):

a. Reimbursement requests for individual expenses equal to or greater than $75 must be

accompanied by receipts.

b. All hotel receipts (usually called hotel folios) must be submitted regardless of amount.

c. Itemized receipts for all business meals that include alcohol regardless of amount are

encouraged. There are special rules around itemized receipts for business meals and federal

awards. In addition, Schools, particularly those with significant federal funding, may also

have special rules around itemized receipts and charging of alcohol to non-federal funds.

Contact your Tub Finance Office for more information.

d. Original receipts are strongly encouraged, but copies, scans or faxes are acceptable if

originals are not available. Reimbursees and approvers are jointly responsible for ensuring

duplicate receipts are not submitted for payment.

D. Missing Receipt Affidavits (MRAs): travelers who lose receipts required by this policy must submit

completed, signed Missing Receipt Affidavits and proof of payment with their reimbursement

requests. MRAs must be used as exceptions, not on a regular basis. Missing Receipt Affidavits lacking

required information or documentation itself will be returned to the authorized signer.

E. Reimbursee signature: the traveler/reimbursee must sign all his or her reimbursement receipt reports

or expense forms.

F. Timeliness of reporting requirements:

a. Standard (not extended) business trips: regardless of the method used to pay for travel, UFS

must receive completed employee receipt reports within 90 days of the end date of the trip

Receipt reports submitted after this date must be processed through Payroll as Additional

Pay.

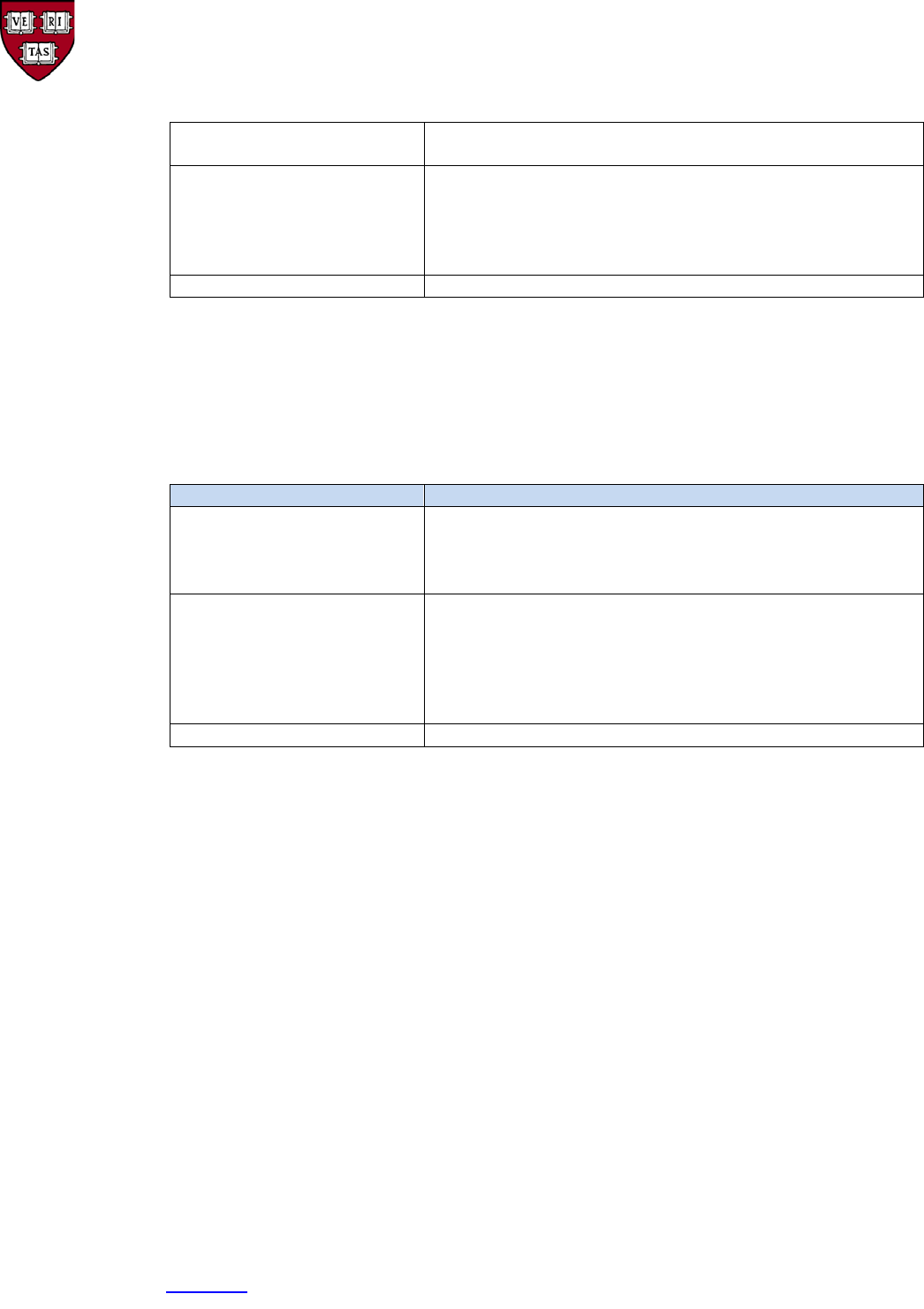

Receipt deadlines for standard (not extended) business trips:

If UFS receives receipt report in:

Result:

0-90 days after trip end date

(preferably within 60)

Reimbursement without tax implications to reimbursee

*

See Appendix G for restrictions on travel expenses charged t

o federal awards

HARVARD UNIVERSITY FINANCIAL POLICY

Responsible Office: University Financial Services

Date First Effective: 7/1/2010

Revision Date: 12/1/2015

Title:

Travel Policy Page 5 of 8

on the Corporate Card must be

paid by the statement due date)

91-182 days after trip end date

Reimbursement will be treated as income to the employee and

must be processed via Payroll. Reimbursement will be processed

as additional pay and taxes will be withheld; departments must

include an Additional Pay for with reimbursement request.

Payments may NOT be grossed up.

183+ days after trip end date

Expenses will NOT be reimbursed with University funds.

b. Extende

d business trips: travelers on trips lasting over 30 consecutive days (but less than

one year) have 120 days to submit receipt reports for nontaxable reimbursement; include

the term “Extended Business Trip” at the beginning of the business purpose. Other

deadlines are the same as for standard business trips:

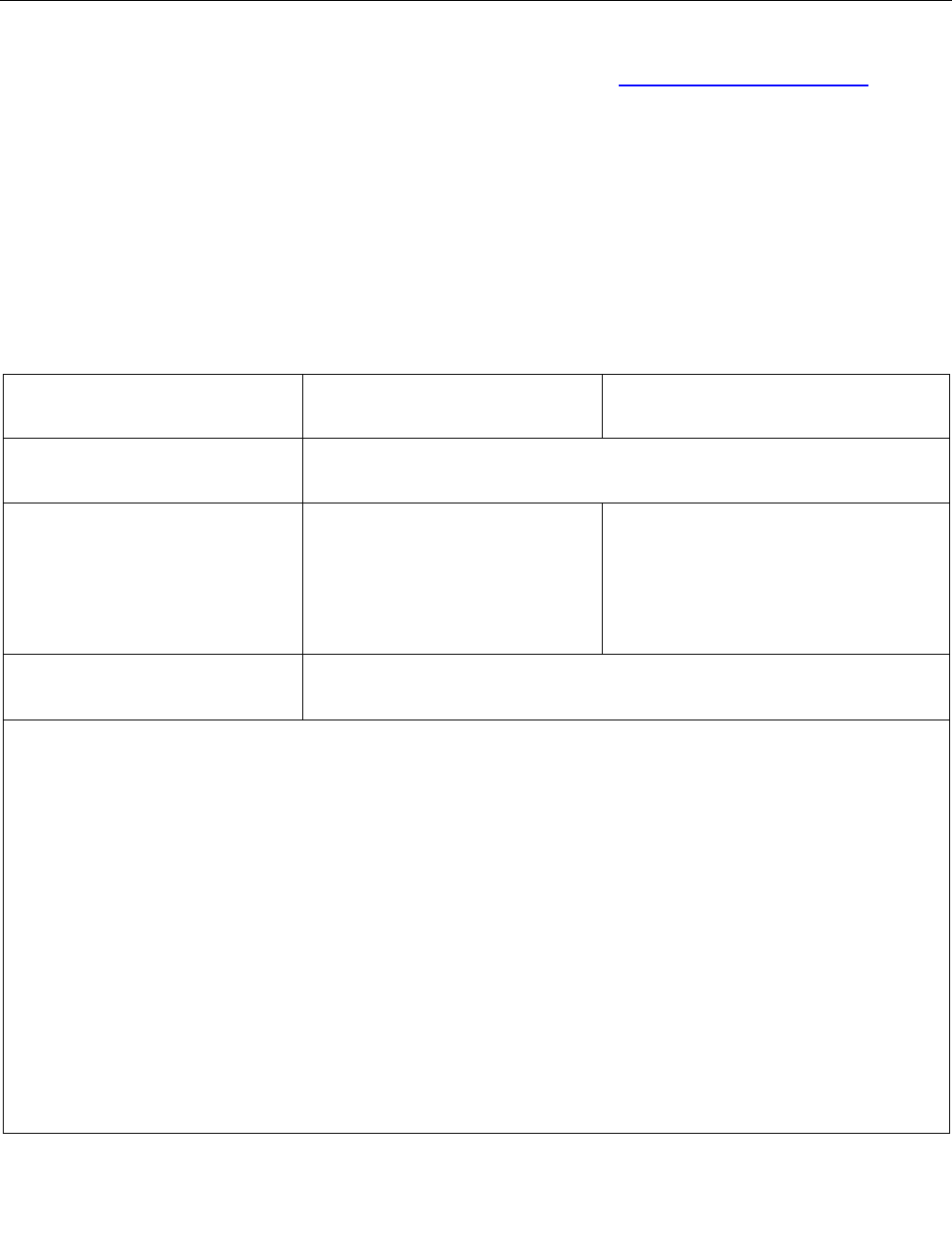

Receipt deadlines for extended business trips:

If UFS receives receipt report in:

Result:

0-120 days after trip end date

(preferably within 60 – expenses

on the Corporate Card must be

paid by the statement due date)

Reimbursement without tax implications to reimbursee

121-182 days after trip end date

Reimbursement will be treated as income to the employee

and must be processed via Payroll. Reimbursement will be

processed as additional pay and taxes will be withheld;

departments must include an Additional Pay for with

reimbursement request. Payments may NOT be grossed

up.

183+ days after trip end date

Expenses will NOT be reimbursed with University funds.

G. Forei

gn currencies: all reimbursement receipt reports must be submitted in U.S. dollars with an

explanation and translation of the foreign receipts and their conversions

a. Travelers and preparers must use the currency rates that were in effect when travel took

place (check with your school finance office for specifics); therefore, currency- exchange

receipts must be saved and used for converting foreign currencies back to U.S. dollars on the

reimbursement receipt report.

b. When more than one exchange of the same type of foreign currency is made during the

reporting period, use a weighted-average exchange rate (i.e., the total of U.S. dollars divided

by the total amount of foreign currency).

c. For current foreign currency conversion rates, visit the Harvard Travel Services website.

H. Use of per diems*: Individual schools/units have the discretion to allow or prohibit use of per

diems. However, travelers are encouraged to submit reimbursements for actual meal and lodging

expenses, particularly for long trips involving multiple stops in different cities. Harvard will reimburse

travelers up to the federal per diem rate; for a link to current government per diem rates, visit the

Harvard Travel Services website

. Per diems will not be paid in advance of a trip. On the first and

last travel days of a trip, travelers are only eligible for 75 percent of the total meals and incidental

expenses rate for their travel location.

I. Elective fees: some hotels, airlines and other vendors ask customers to pay for “elective fees” such as

carbon offset credits, donations to charities, etc. Harvard travelers may pay for these fees with

personal funds, but should not submit them for reimbursement with University funds. “Resort fees”

that are mandatory for all guests staying at a hotel are reimbursable.

*

See Appendix G for restrictions on travel expenses charged to federal awards

HARVARD UNIVERSITY FINANCIAL POLICY

Responsible Office: University Financial Services

Date First Effective: 7/1/2010

Revision Date: 12/1/2015

Titl

e: Travel Policy Page 6 of 8

J. Alcohol*: all purchases of alcohol at business meals – even if not charged to federal funds – should be

charged to object code 8450, Expenses Ineligible for Federal Reimbursement. For this reason,

itemized receipts for all business meals that include alcohol regardless of amount are encouraged.

Alcohol at business meals cannot be charged to federal funds (see Appendix G for detailed

instructions). Schools, particularly those with significant federal funding, may also have special rules

around itemized receipts and charging of alcohol to non-federal funds. Contact your Tub Finance

Office for more information.

4. Understand rules for special reimbursement situations.

A. Expenses payable by outside organizations: Tra

velers should not seek payment from Harvard for

business-related expenditures that will be reimbursed from another source. Where travel and other

expenses will ultimately be paid by a third party, travelers should seek reimbursement from the third

party directly. However, under extenuating circumstances, such as uncertainty regarding the outside

organization’s willingness to pay, or a multi-leg trip with expenses payable by Harvard and an outside

entity commingled, Harvard may reimburse an individual for some or all such expenses with Financial

Dean approval. Delay in the outside party’s payment to the traveler does not constitute an extenuating

circumstance. If Harvard does reimburse an individual for business expenses that are later reimbursed

by a third party, the individual must repay Harvard in full for any duplicate reimbursements. Under no

circumstances will Harvard provide up-front payment for expenses that are not related to University

business, even if the recipient intends to later reimburse Harvard.

B. Use of University tax exemption: note

that individuals who use a personal payment mechanism (for

example, their own cash or a personal credit card) to make a purchase on behalf of the University

CANNOT use the University’s sales or meals tax exemption. For Harvard’s sales tax exemption to be

valid, Harvard must make the entire purchase directly. Pursuant to local policies, Harvard may

reimburse individuals for sales or meals tax incurred on valid University purchases.

C. Employee recruitment*: Harvard can reimburse a prospective employee for his or her own authorized

travel expenses such as airfare, hotel, and meals incurred during the recruitment without tax

consequences. Once a candidate accepts an offer, additional travel or house-hunting expenses

incurred by the incoming employee and family are considered taxable (actual moving expenses may be

nontaxable, see below). See the Office of the Controller

website.

D. Moving expenses: reimbursement for the relocation of newly recruited personnel is authorized at

the department level, and should be approved by the department’s financial dean, vice president, or

department head. Under certain circumstances, an employee’s moving expenses may be nontaxable.

However, the University is required to report all moving reimbursements to the IRS; see the

Office of

the Controller website. Local HR offices can provide additional guidance.

E. Fellowships (also called stipends or allowances): if student or non-employee travel is related to an

individual’s personal pursuit of study or research, that travel is not considered University business

and must be paid as a fellowship to the recipient. A fellowship is any amount paid or allowed to, or for

the benefit of, an individual in the pursuit of study or research. A fellowship may take the form of

payments to the recipient, such as stipend payments or reimbursements for supplies or non-University

travel expenses. These expenses must be processed via HCOM Payment Request through the

University’s Accounts Payable system, and not processed as a reimbursement. The recipients are not

employees performing services and therefore cannot satisfy the business-purpose requirement under

an accountable plan, as defined by the IRS. See the Fellowships policy

for additional information.

F. Non-resident aliens: The NRA Tax group must review all reimbursement requests payable to non-

resident aliens prior to payment, to ensure the expenses are reimbursable under IRS and Department

of Homeland Security regulations.

*

See Appendix G for restrictions on travel ex

p

enses charged to federal awards

HARVARD UNIVERSITY FINANCIAL POLICY

Responsible Office: University Financial Services

Date First Effective: 7/1/2010

Revision Date: 12/1/2015

Tit

le: Travel Policy Page 7 of 8

G. Lifetime professional or academic memberships: subject to local policy and budget, a department

may pay for lifetime membership to professional or academic organizations for tenured faculty only

and only if the economics of purchasing a lifetime membership are more cost-effective than

purchasing membership each year. Lifetime memberships for staff, junior faculty or other roles are

not a reimbursable expense and cannot be charged to sponsored awards.

Responsibilities and Contacts

Financial deans or equivalent tub financial officers ensure that local units, specifically travelers and approvers, abide by

this policy and the accompanying procedures. At their own discretion, tubs may impose stricter local policies.

Reimbursements and Card Services processes travel reimbursement requests, audits reimbursement requests to ensure

that t

hey are compliant with University policy and with IRS and other regulations, and records and reports any taxable

reimbursements. Contact: (617) 495-8500

Offic

e for Sponsored Programs (OSP) helps determine which travel expenditures are reimbursable under a particular

grant or contract, and is available to assist with any questions related to travel on sponsored funds. Contact: (617) 49

6-

4771 or http://osp.finance.harvard.edu/

Risk Man

agement and Audit Services (RMAS), within the Office of the Vice President for Finance, is responsible for

performing periodic, random departmental audits, which include reviews of travel and entertainment business expense

reimbursements. See the RMAS home page

.

Glo

bal Support Services:

provides operational guidance and resources to students, faculty, and staff traveling or

managing projects abroad, and manages Harvard Travel Assist program. Contact

: http://globalsupport.harvard.edu/

Str

ategic Procurement provides guidance and answers questions related to preferred vendors. Contact: (617) 495-9308

Definitions

Accountable plan: An IRS term for a plan under which an employer reimburses an employee for expenses and is not

required to report the reimbursement as taxable income to the employee. The employee must document business

purpose, substantiate expenses, and return any amount in excess of substantiated expenses to the employer.

Business meals: Meals taken with students, colleagues, or donors during which specific business discussions take place.

Employees will be reimbursed based on reasonable actual costs as determined by the authorized approver.

Entertainment expenses: Entertainment expenses include outings to theaters or other cultural events when a business

discussion takes place during, immediately before, or immediately after the event.

Hotel folio: A hotel industry term used describe a list of room charges for a guest (e.g., invoice or bill).

Incidentals: An IRS term for minor expenses included in the per diem rate for "meals and incidentals.” Incidental

expenses include tips, mailing expenses, etc.

Individual meals: Meal expenses of travelers on a business trip. Can be reimbursed according to actual and reasonable

costs, or on a per diem basis based on IRS rates.

Miscellaneous expenses: Expenses for ground transportation (e.g., taxis, airport shuttle services, public transportation),

tips, and other various non-personal expenses.

Official travel: Travel on official University business from one’s home or normal place of employment to another

destination, including University facilities outside the Boston metropolitan area. Per IRS rules, official travel does not

include commuting to and from work.

Per diem: Reimbursement rates established by the federal government for travel inside and outside the U.S.

HARVARD UNIVERSITY FINANCIAL POLICY

Responsible Office: University Financial Services

Date First Effective: 7/1/2010

Revision Date: 12/1/2015

Title: T

ravel Policy Page 8 of 8

Personal expenses: Expenses for personal items such as clothing, luggage, toiletries, newspapers, magazines, or movies.

Personal expenses are generally not reimbursable.

Related Resources

Job aid

on completing reimbursement forms:

http://eureka.harvard.edu/Eureka/jobaids.cfm?categoryID=503&y=0

Harvard Travel Services Website: http://travel.harvard.edu/

Global Support Services: http://traveltools.harvard.edu

Fly America Act and Open Skies Agreement: see the Harvard Travel Services International Travel page and click on

the “Fly America Act” section

Employee recruitment and moving expense information:

http://oc.finance.harvard.edu/how-to/tax-services/moving-

recruiting-and-related-expenses

Revision History

10/1/2015: Moved requirements for travel charged to federal funds to Appendix G; added additional guidance for airfare

based on clarified federal requirements; removed restriction on per diems for none

mployees; added guidance on local

lodging expenses, trip cancellation and repatriation insurance, travel accident insurance for non-benefits eligible

employees, rental cars for student groups, lifetime memberships, first and last day meals and incidental expense per

diems, and memberships for expedited security screening/customs processing; clarified responsibility for losses incurred

during business use of personal cars.

5/1/2015, 10/2/2014: Updated car rental insurance grid

11/15/2013: clarified that travelers should not seek payment from Harvard for business-related expenditures that will be

reimbursed from another source; allowed schools to define their own thresholds for airline seat upgrades; added

information to car rental insurance grid.

6/30/2013: updated format, increased reimbursable amount for airline seat upgrades to $100 per flight; added

information on the Open Skies Agreement; allowed copies/scans/faxes of receipts when originals are not available; added

insurance restrictions on rental of 15-passenger vans; added information about Harvard’s Commuter Choice Zipcar

program, added guidance on reimbursement of elective fees.

Appendices

Appendix A: Detailed Guidelines for Air Travel

Appendix B: Detailed Guidelines for Ground Transportation

Appendix C: Detailed Guidelines for Lodging

Appendix D: Detailed Guidelines for Meals, Entertainment and Miscellaneous Expenses

Appendix E: Guidance for Combined Business and Personal Travel

Appendix F: Guidance for Spousal/Family Member Travel

Appendix G: Requirements for Travel Charged to Federal Funds

*

See Appendix G for restrictions on travel expenses charged to federal awards

12/1/2015: Extended date of revised sponsored travel requirements to travel booked on or after 3/1/2016

, clarified

guidelines for reimbursement of ariline wifi on sponsored and non-sponsored funds

Travel Policy – Appendix A Page 1 of 2

Appendix A: Air Travel NOT CHARGED TO FEDERAL AWARDS

See Appendix G for federal guidelines

1. Preferred travel partners. Harvard strongly encourages travelers to book airline tickets through one of

Harvard’s preferred travel agencies and to use our preferred airlines where possible.

To learn more about

Harvard’s travel agency partners and exclusive travel discounts, see the Harvard Travel Services website.

2. Fare guidelines*

a. Travelers are expected to book the lowest and most reasonable nonstop airfare consistent with their

itinerary, the business purpose of their trip, and the requirements of the funding source. First class air

travel is not allowed. Business class is acceptable in limited circumstances, such as when a trip has an in-air

flight time over six hours. Under extenuating circumstances, such as documented medical reasons, the

purchase of business class or first class service may be reimbursable where it is normally prohibited,

provided the expense is approved by the traveler’s Financial Dean. The cost of a business class ticket, even

when allowed by Harvard policy, cannot be charged to a federal award unless it meets the criteria in

Appendix G.

Scheduled air time

(1)

of trip is six

(6) hours or less AND will not be

charged to a federal award

Scheduled air time

(1)

of trip is more than

six (6) hours AND will not be charged to a

federal award

Domestic Air Travel inside the

contiguous 48 United States

Lowest-priced non-stop economy class airfare only

Air Travel Involving

• Alaska

• Hawaii

• Canada

• Mexico

• U.S. Territories and

Possessions

(2)

Lowest-priced non-stop economy

class airfare only

Lowest -priced non-stop business class if

permitted by local policy and budget

Air Travel Involving an

international location OTHER

THAN Canada and Mexico

Lowest -priced non-stop business class if permitted by local policy and budget

(1)

Air time means the amount of time a traveler is in the air. The air time of connecting legs can be added together to

yield the total air time of a trip. Time spent on a stopover/layover does not count towards total air time

(2)

U.S. Territories and Possessions: Puerto Rico, American Samoa, Guam, the U.S. Virgin Islands and Baker, Howland,

Kingman Reef, Jarvis, Johnston, Midway, Palmyra, and Wake Islands

Examples:

1. A trip to San Francisco with in air time of 6 hours and 17 minutes must be booked in economy class because the flight

is within the contiguous 48 states.

2. A trip to Winnipeg, Canada that has a connection, Boston to Toronto with a scheduled air time of 1 hour 50 minutes,

and Toronto to Winnipeg with a scheduled on-board time of 2 hours, 40 minutes must be booked in economy class

because the total scheduled air time is under 6 hours.

3. A trip to Mazatlan, Mexico that has a scheduled air time of 8 hours 14 minutes can be booked in business class

because the scheduled in-air time is over 6 hours.

* See Appendix G for restrictions on travel expenses charged to federal awards

Travel Policy – Appendix A Page 2 of 2

b. Ticket upgrades*: Some airlines charge fees for preferred economy seating. Where permitted by local

policies and budget, reasonable costs for these items are reimbursable. Complementary no cost upgrades

are allowed.

c. Airline frequent flyer programs

i. Free tickets: Harvard CANNOT reimburse travelers for tickets purchased with frequent-flyer

miles. Monetary compensation provided to an employee in exchange for a free ticket is

considered additional income. Harvard will reimburse fees associated with issuing a frequent-

flyer ticket, such as taxes and agency or airlines services fees. Travelers must always select the

lowest-priced flight available regardless of personal frequent-flyer memberships.

ii. Upgrades: travelers may use personal, frequent-flyer-program miles to upgrade tickets provided

there is no additional cost to the University. Note all free upgrades on the expense-

reimbursement report to avoid confusion when auditing.

iii. Airline policies: Harvard travelers are expected to observe airline policies regarding booking of

flights, including restrictions on purchase of a roundtrip ticket for one-way travel.

3. Airline fees

a. Reimbursable:

i. Baggage check fees: Harvard will reimburse employees for reasonable and necessary fees for

checking baggage.

ii. Ticket cancellation fees and change fees: Harvard will reimburse any cancellation fees or

change fees provided there is a valid reason, such as a canceled conference or a medical

emergency, for the change or cancellation of the ticket. Authorized approvers must ensure any

change or cancellation fees charged to sponsored funds are allowable.

b. Not reimbursable:

i. Lost or damaged baggage: Harvard will not reimburse travelers for personal items lost or

damaged while traveling on business, nor will the University replace lost or damaged personal

items. The traveler must address any such claims to the responsible airline.

ii. Airport airline club membership fees: airline club membership dues and similar programs are

not reimbursable expenses.

iii. Memberships or fees for priority boarding, expedited security screening or customs processing

(Global Entry, PreCheck, Nexus, Sentri) are not reimbursable. At the tub’s discretion, the tub

can treat these fees as additional pay.

4. Airline incidentals*: some airlines charge fees for wifi, snacks, non-alcoholic drinks, pillows and blankets,

etc. Where permitted by local policies and budget, reasonable costs for these items are reimbursable.

5. Unused tickets*: when travel plans must be changed due to unforeseen circumstances, the traveler is

responsible for notifying Egencia, or the airline or travel agency that booked the ticket. Flights must be

cancelled prior to flight departure time. The traveler should request a refund (when a refundable ticket was

issued) or request that cost of the unused ticket be applied to a future ticket. Penalties for changes to an

airline ticket or similar charges for business reasons or circumstances beyond the traveler’s control will be

reimbursed. Unused tickets cannot be used for personal travel.

6. Non-commercial flights

a. Travel on charter aircraft: due to safety concerns, the University discourages use of chartered aircrafts.

Travelers considering a chartered flight must contact their local tub financial dean’s office before

booking. Additionally, proof of adequate liability insurance must be provided, in advance, by the aircraft

owners/operators. Minimum limits of $25 million for light turboprop aircraft, $50 million for light jet

aircraft, and a minimum of $3 million per seat for commercial airlines operated outside the US are

recommended.

b. Use of a private aircraft: a traveler may fly on private aircraft only under exceptional circumstances and

only with the prior approval of his or her financial dean (or designee), administrative dean (or designee),

or Vice President. Insurance recommendations are the same for private aircraft as for chartered aircraft;

see the Risk Management and Audit Services website, at http://rmas.fad.harvard.edu/

.

* See Appendix G for restrictions on travel expenses charged to federal awards

Travel – Appendix B Page 1 of 3

Appendix B - Ground Transportation: Rental Cars, Business Use of Personal Cars, and

Rail Travel

I. Public Transportation, Shuttle Services and Taxis. Travelers should consider public transportation and

shuttle services where they are available. Taxis may also be used where other methods of travel are unavailable or impractical.

II. Business Use of Personal Cars

1. Necessity. Travelers may use his or her personal car for University business travel if doing so is less expensive than

other means of transportation. Harvard reimburses travelers for the business use of a personal car up to the federal

government mileage rate. For a link to current government rates, visit the Harvard Travel Services website

. All

requests for mileage reimbursement must include the traveler’s itinerary, the dates the mileage expenses were

incurred, and the number of business-related miles driven. The University will NOT reimburse travelers for gas

expenses in lieu of miles. Commuting expenses, repairs, and ticket and traffic violations are not reimbursable.

2. Mileage reimbursements.

a. When traveling long distance to a business destination where flying would be an option, the mileage

reimbursement amount cannot exceed the lowest airfare. Travelers must submit documentation of the

lowest-cost airfare with the mileage reimbursement. If the driver requesting mileage reimbursement has

carried one or more other University employees involved in the business trip, this information should be

documented and submitted with the request.

b. When traveling from home to the airport on a business trip, a traveler may use a personal car and request

mileage reimbursement if the cost of taxi services exceeds the total cost of the mileage, tolls, and parking

combined.

c. When traveling to an off-campus temporary business destination, a traveler may use a personal car and

request mileage reimbursement if the traveler typically works at an on-campus location. In such cases,

travelers must be reimbursed from their actual starting point, i.e., from their home if traveling directly to the

temporary work location from home, or from their regular on-campus location to the temporary work

location.

3. Personal car insurance coverage. It is the responsibility of the traveler to carry adequate insurance

coverage for his or her own protection and for the protection of any passengers. Personal liability losses for

benefits-eligible employees are covered above $100,000 through the University’s self-insurance funds. Travelers will

not be reimbursed by the University for collision losses that occur during business usage of a personal car if that

car is not adequately insured for collision damage. For more information, visit Risk Management and Audit

Services Insurance Department website, at

http://rmas.fad.harvard.edu.

III. Rental Cars

1.

Necessity. A travel

er may rent a car if driving to a destination is more cost-effective or practical than flying or taking

a train, or if driving is necessary to transport large or bulky materials. Travelers arriving by other means may rent a

car at their destination if doing so is less expensive than other local transportation modes such as taxis or airport

shuttles.

2.

Preferred vendors. Employees who rent a car on Harvard business should where possible choose a University

preferred rental car provider. Travelers should make reservations directly with one of Harvard’s preferred rental car

agencies or through one of Harvard’s preferred travel agencies, using the appropriate Harvard corporate

account numbers to receive negotiated rates and insurance coverage. Harvard’s rental car corporate account

numbers and preferred agencies can be found on the Harvard Travel Services website, under “Exclusive Travel

Discounts – Preferred Rental Car,” at

http://travel.harvard.edu/traveling-ground

3. Restrictions on vehicle type. Travelers must rent the most economical vehicle consistent with business needs and

travel circumstances (usually a compact or mid-size), and must not exceed a full-size vehicle. Often Harvard’s preferred

rental car agencies will provide a free upgrade to travelers; travelers should note any free upgrades on their

reimbursement requests to assist auditors. Fifteen passenger vans (or larger) are prohibited.

Travel – Appendix B Page 2 of 3

4. Insurance coverage.

a.

Rental Car Insurance Coverage: Harvard drivers must get insurance for rental cars in accordance with the

attached Rental Car Insurance Quick Reference Guide prior to making a reservation. The University retains

losses below $250,000 per occurrence. Therefore, if a traveler does not purchase liability limits as specified in

the table below, the department is responsible for covering losses up to $250,000. Zipcar users are strongly

encouraged to purchase the full damage waiver. No insurance is provided for fifteen passenger vans or larger.

b. Insurance for Personal Use of a Rental Car. Personal use of a rental car during a business trip is NOT covered

under University insurance in most cases. Harvard provides (or reimburses for) insurance coverage for

travelers using a rental car the day before, the day after, and during the business trip. However, travelers who

choose to extend a business trip for personal reasons either before or after business is conducted must

purchase and pay for their own insurance coverage for those days. Harvard will NOT reimburse this coverage.

c. Accidents: should a rental car accident occur while on University business, the traveler must submit a

written accident report as soon as possible to the rental car company, to local authorities, as required, and to

the University Insurance Office at 496-8830. For more information, visit Risk Management and Audit Services

Insurance Department website, at

http://rmas.fad.harvard.edu.

5. Minimum driving age and cancellations.

a.

Minimum driving age: all drivers must meet the rental company’s minimum-age requirement (typically 21,

though sometimes older). Travelers must ensure that they meet age requirements when making

reservations.

b. Cancellati

ons: travelers are responsible for canceling rental-car reservations when necessary by contacting the

agency involved. When making cancellations, travelers must request and record a cancellation number in

case of any billing disputes.

6.

Rental Car Club Memberships.

a. Zipcar memberships may be arranged through Harvard’s Commuter Choice program;

see

http://www.campusservices.harvard.edu/commuterchoice. The preferred form of payment for Zip

Car rentals is the Corporate Card. If the Corporate cardholder is the renter, the coverage from the corporate

card will cover the zip car deductible as long as the renter does not accept any additional insurances from Zip

Car and reports the accident to Mastercard within 60 days. If the Corporate cardholder is

not the renter, or

the traveler is using another form of payment, there is a $750 deductible charged by Zip Car; in such cases,

travelers are strongly encouraged to purchase the full waiver from Zip Car which eliminates the deductible.

This is a reimbursable expense. Note that since Zipcar is an individual rental, the waiver would

not extend to

another driver for the same vehicle rental.

b. Harvard travelers can get free memberships with Hertz as a part of the University’s contract.

c. Membership fees for other rental car club programs are not reimbursable.

IV. Sedan Services. Private sedan or car services are normally more expensive than taxis and should be used only when

valid business reasons preclude the use of more economical transportation. The use of private sedan or car services to attend

meetings on or around campus is prohibited. Limousine expenses under any circumstances are not reimbursable. Visit the

Harvard Travel Services website, athttp://travel.harvard.edu/traveling-ground

for more information, including a list of preferred

sedan-services providers.

V. Rail Travel. All rail travel is expected to be at the lowest fare that offers reserved seating. For rail travel over six

hours, first-class seating is reimbursable. For most international rail travel, reserved seating is only available in first class.

VI. Bus Charters. For University groups chartering busses, we recommend travelers charter such vehicles from Campus

Services Transit & Fleet department, when possible. If chartering through an outside party, proof of adequate liability insurance

must be provided, in advance, by the charter owners/operators. Minimum limits of $1 million per seat are recommended.

Rental Car Insurance Quick Reference Guide

Travel – Appendix B, Rental Car Insurance Quick Reference Guide Page 1 of 1

The following matrix applies to benefits eligible Harvard employees, non-benefits eligible Harvard employees and non-employees traveling on Harvard

related business. This includes students performing official work for Harvard and student groups sponsored by the FAS’s Office of Student Life (and

equivalent offices at other Harvard schools) on official Harvard trips.

Travelers must purchase all of the insurance indicated below even if paying for the

rental with a Harvard corporate card.

Insurance Type and What It Covers

Within All 50 U.S. States and Within Puerto Rico

Outside All 50 U.S. States and Outside Puerto Rico

Supplemental Liability

Insurance (SLI)

Protects authorized drivers

against bodily injury

• Enterprise, National, or Hertz* - DECLINE

MUST use Harvard’s account numbers:

o Hertz = CDP 31570

o Enterprise/National = XZHARVB

• All other vendors - PURCHASE SLI of $250K per

person/$250K per occurrence

• All vendors - PURCHASE SLI of $250K per

person/$250K per occurrence

Loss Damage Waiver/Collision

Damage Waiver (LDW/CDW)

Covers damage to your rental

car

• Enterprise, National, or Hertz* - DECLINE

MUST use Harvard’s account numbers:

o Hertz = CDP 31570

o Enterprise/National = XZHARVB

• All other vendors - PURCHASE LDW/CDW

• All vendors - PURCHASE LDW/CDW

• In some countries there is a deductible that

applies even if you purchased the LDW/CDW

coverage. This is a reimbursable

expense. Departments can recover this

amount by filing a claim with the Insurance

Office (617-495-7971)

Personal Accident Insurance

(PAI)

Covers medical expenses, loss

of or damage to property, and

accidental death

•

PAI is not a reimbursable expense

• Drivers may purchase PAI at their own expense

•

PAI is not a reimbursable expense

• Drivers may purchase PAI at their own

expense

Revised 11/13/2015

*There are a handful of small, remote Hertz locations (“licensee” locations) that do not honor the Harvard corporate rates or include the required insurance; if renting from

one of these locations, travelers must purchase SLI of $250K per person, per occurrence and LDW/CDW insurance. When renting with Hertz, be sure to verify that Harvard’s

corporate rates and required insurance are provided at that location. See the Travel Policy page “Related Resources” sidebar for a list of Hertz licensee locations.

Travel Policy – Appendix C Page 1 of 1

Appendix C: Lodging

1. Necessity: the University will reimburse travelers for lodging expenses while on official University business

further than 50 miles one way from the traveler’s place of work.

2. Preferred travel partners: Harvard strongly encourages travelers to book lodging through one of

Harvard’s preferred hotels or travel agencies. To learn more about Harvard’s travel agency partners and

exclusive travel discounts, visit the Harvard Travel Services website, at http://www.travel.harvard.edu/cgi-

bin/travel/booking/hotels.php.

3. Hotels:

a. Rooms: travelers are expected to stay in standard, single-occupancy rooms where available; room-

upgrade fees are not reimbursable. Travelers are responsible for canceling room reservations

when necessary; Harvard will not reimburse travelers for cancelation or “no-show” charges.

Reimbursement requests for lodging expenses must be supported by a hotel folio, regardless of the

expense amount. Proof of payment is required.

b. Internet connection fees: Harvard will reimburse for reasonable internet connectivity fees.

c. In-room movies and similar charges: the University will not reimburse travelers for personal

expenses, such as, but not limited to, in-room video rentals, in-room alcoholic beverages, and

recreational charges (such as golf fees or exercise- room/health-club fees).

d. Hotel frequent guest programs: Harvard CANNOT reimburse travelers for rooms purchased with

frequent-guest-program credits. Monetary compensation provided to an employee in exchange for

free lodging is considered additional income. However, travelers may use personal, hotel-frequent-

guest-program credits to upgrade a room provided there is no additional cost to the University. All

free upgrades must be noted on the expense reimbursement report to avoid confusion when

auditing. Hotel frequent-guest program fees are not reimbursable.

4. Ren

tal accommodations: travelers may stay in rental accommodations only if the total cost of the rental

is less expensive than the total cost of the required hotel stay in a standard, single-occupancy room. For

example, if University business requires a traveler to stay in a hotel for four nights, the traveler could rent a

house for a week only if the weekly rental fee is less than the cost of a four-night hotel stay in a standard,

single occupancy room. Travelers must provide documentation of the rental accommodation’s lower cost.

Rental accommodations must be approved in advance by the traveler’s department or tub financial dean’s

office. Travelers must pay the landlord of the rental accommodation through HCOM Payment Request or

Harvard University Corporate Card to enable proper tax reporting; other payment methods are prohibited.

5. Private residences*: travelers who stay in a private residence with relatives or friends while traveling on

business may be reimbursed for one appreciation gift per visit, under $75 (including tax or any other

charges).

6. Sabb

atical lodging: sabbatical lodging expenses are reimbursed only if the faculty member incurs two

sets of living expenses simultaneously. A faculty member may be reimbursed for additional lodging

expenses incurred at the sabbatical location, less any income received by the faculty member for renting out

his or her primary residence, provided there is a stated business purpose for the additional lodging

expenses. The tax rules surrounding sabbatical expenses are complex; contact your local finance office.

*

See Appendix G for restrictions on travel expenses charged to federal awards

Travel Policy – Appendix D Page 1 of 1

Appendix D – Meals, Entertainment and Miscellaneous Expenses While Traveling

Generally Reimbursable

Inoculations

Expenses related to inoculations required for business travel are reimbursable

Passports and Visas

Expenses related to visas and/or passports required for University business travel are reimbursable.

Hotel Internet

Connections

Travelers will be reimbursed hotel internet-connection charges that are reasonable and necessary for conducting University business.

Reimbursable with Restrictions

Laundry

Laundry expenses for business trips of four (4) days or less are not reimbursable. Reasonable laundry expenses for business trips of five (5) days or more are

reimbursable, provided the reimbursement request has a proper detailed business purpose noting the duration of the trip.

Telephone Calls

Travelers will be reimbursed for phone calls that are reasonable and necessary for conducting University business, and that result in incremental out of pocket cost

to the traveler. Travelers are expected to use the most economical means of making phone calls while traveling on business. Reimbursement requests with

telephone-call expenses must be accompanied by a hotel or phone bill showing itemized call information. Expenses for calls made from airplane phones

(“airphones”) are not reimbursable except in emergencies or extenuating circumstances.

Cell phone/smartphone use when traveling abroad can become cost prohibitive if you are not equipped with the correct plans and tips for minimizing cost. HUIT

Telecom Operations has developed mobility guides with essential step by step instructions to ensure that you minimize cell phone costs for both voice and data

while traveling abroad. For more information, see the Cell Phone Travel Checklist to make sure you are ready to take your cell phone/smartphone abroad.

Entertainment

expenses*

Individual entertainment expenses while traveling (in-room movies, etc.) are not reimbursable. However, business entertainment expenses, such as outings to

theaters or cultural events, are reimbursable if the person(s) entertained has a potential or actual business relationship with the University, or if the business

discussion will directly benefit the University. Employees must also follow any local tub policies when incurring entertainment expenses; an individual with

questions must contact his or her tub financial dean’s office. Entertainment expenses must be charged to object code 8450.

Individual meal

expenses while

traveling

Travelers will be reimbursed for reasonable individual meal expenses while on University business. Harvard will not reimburse for excessive meal costs that are not

substantiated by a complete and explanatory business purpose. Per IRS regulations, the University does not reimburse individual meal expenses for one-day travel

except when the travel time is greater than twelve (12) hours. Per diem rates may not be used for one-day travel.

Business meals with

others while traveling

Business meals are defined as meals with faculty, staff, students, donors, or other external parties during which specific documented business discussions take place.

Travelers must exercise fiscal responsibility when choosing restaurants; travelers should avoid high-end establishments unless circumstances dictate that such a

choice is appropriate, as when conducting University business with a major donor or foreign dignitary. Harvard will not reimburse for excessive meal costs that are

not substantiated by a complete and explanatory business purpose.

Alcoholic beverages*

Alcohol purchased at business meals should be kept to a minimum, and must be charged to object code 8450 (expenses ineligible for federal reimbursement). Some

local policies may have greater restrictions on the purchase of alcohol; travelers with questions must contact their tub financial dean’s office for details.

Nonstandard

fundraising expenses

The University recognizes the unique nature of certain travel, entertainment, and non-travel business expenses incurred for fundraising and development activities.

If these activities necessitate a deviation from stated policies, the individual must attach a brief explanation to the completed receipt report or expense form. A

letter from a Financial Dean is not required, except in the case of first-class air travel. The business purpose must indicate that the expenses are directly related to

development activity.

Not Reimbursable

In-room charges, etc.

The University will not reimburse travelers for personal expenses, such as, but not limited to, in-room video rentals, in-room alcoholic beverages, and recreational

charges (such as golf fees or exercise- room/health-club fees).

* See Appendix G for restrictions on travel expenses charged to federal awards

Travel Policy – Appendix E Page 1 of 1

Appendix E: Combined Business and Personal Travel

All travel charged to the University must have a bona fide business purpose that substantially and directly benefits

Harvard. A Harvard traveler can be reimbursed for all reasonable travel expenses of trips that are entirely business

related. When personal and business travel are combined, the department must determine if the trip was

primarily for University business or for personal travel. The ultimate issue is whether the primary motivation for

the trip was for business or personal reasons; the amount of time spent on business activities compared to the

time spent on personal activities is an important factor, but is not necessarily determinative. As a general rule,

however, if more days are spent on University business than on non-University business, the trip can be deemed

primarily for University business. When determining if a trip is related primarily to business or to personal

activities, units must consider the amount of trip time devoted to personal activities and to business activities, and

to whether any personal activities result in additional costs to the University.

If

a trip was primarily for business and, while at the business destination, the traveler extends his or her stay for a

vacation, made a personal side trip, or had other personal activities, the traveler can be reimbursed only for the

business-related travel expenses. These expenses include the travel costs of getting to and from the business

destination, lodging expenses incurred while conducting University business, and any business-related expenses at

the business destination. Incremental costs that result from combining business and personal activities may not be

reimbursed.

If a trip was primarily for personal reasons, such as a vacation, the cost of the trip (including travel to and from the

destination, lodging, and other miscellaneous expense) is a non-reimbursable personal expense. However, a

Harvard traveler may be reimbursed for bona fide University business expenses incurred during a personal trip,

such as conference fees. However, per IRS regulations, the scheduling of incidental business activities during an

otherwise personal trip, such as having lunch with a colleague at another University or attending one lecture

during a two-week trip taken with family, will not change what is really a vacation into a reimbursable business

trip. Travelers and approvers are expected to exercise fiscal responsibility and good judgment; your knowledge of

the particular circumstances will inform your determination.

The following grid gives examples to help travelers and approvers determine if a trip is related primarily to

business or to personal activities:

Trip more likely to be considered primarily

personal when:

Trip more likely to be considered primarily

business when:

An individual travels to celebrate holidays with her

family. During the two-week visit, she has two

meetings with colleagues to discuss research.

An individual attends a conference from Wednesday

through Friday, and he extends his stay through Sunday.

An individual participates in a family wedding

cerem

ony over the weekend. On Monday, he presents

a lecture at a university in the city where the wedding

was held.

An individual presents a two-week lecture series, and

she extends her stay for an additional three weeks to

collaborate with colleagues on research work.

An individual plans a three-week vacation in Italy.

Upon completion of the vacation, she plans a two-day

visit, partially funded by her grant, to a res

earch center

located in Paris.

An individual attends a procurement consortium

meeting from Monday through Wednesday, and he

schedules a tour of the sponsoring vendor’s facilities for

the following Tuesday.

Travel Policy – Appendix F Page 1 of 1

Appendix F: Guidelines for Spousal/Family Member Travel

Expenses rel

ated to an employee’s spouse or other family members are not reimbursable unless there is a bona

fide business purpose for their presence on the trip. If there is no bona fide business purpose and the department

still wishes to reimburse the family members’ business expenses, those expenses must be processed as additional

pay to the Harvard employee.

Bona Fide Business Purpose for Spousal/Family Member Travel

. When an employee spouse/family

member who attends a function has a significant role in the business proceedings, or is involved in fund-

raising activities, this constitutes a business purpose under IRS regulations. In such cases, the University will

reimburse the business traveler for the spouse’s (or other family member’s) non-personal expenses directly

resulting from travel on University business. A spouse who attends a function is considered to have a business

purpose if he or she has a significant role in the proceedings or makes an important contribution to the

success of an event. Generally, protocol or tradition dictates when the participation of a high-level official's

spouse is required at official University functions, such as alumni gatherings, fund-raising, or ceremonial

activities, certain athletic events, and community events.

Non-Bona

Fide Business Purpose for Spousal/Family Member Travel

. The IRS has ruled that when a

spouse attends a meeting or conference as a companion and has no significant role or performs only incidental

duties of a social, clerical, or medical nature, then the attendance does not constitute a business purpose. The

following grid is provided to help determine if spousal/family travel is taxable or non-taxable:

Ex

penses more likely to be taxable

when:

Expenses more likely “bona fide” (non- taxable)

when:

No formal request for family member to

attend event(s)

Formal or official correspondence requests

spouse or other family members of Harvard

employees to make the trip or attend event(s)

Family members are not required to attend

meetings, given assignments in advance, or

make presentation at the event(s)

Spouses or other family members are

required to attend meetings, given

assignments in advance, or make

presentation at the event(s)

Family member performs only “helpful”

services, such as social, medical assistance, etc.

Family member performs “necessary”

services by acting as a representative of the

University in a substantial manner

Only Harvard employees and family

member attend event(s)

Non-Harvard individuals (alumni, donors,

recruits, etc.) attend event(s)

Family members participate in substantial

tourist activities

Family members do not participate in

tourist activities

Appendix G: Requirements for Travel Expenses Charged to Federal Awards Page 1 of 4

Appendix G: Requirements for Travel Expenses Charged to Federal Awards

As outlined in the Sponsored Expenditure Guidelines Policy

, travel-related expenses are allowable as

direct expenses when they provide a direct benefit to the sponsored award.

Unallowable travel expenses include, but are not limited to:

• Limousines

• Commuting or travel expenses when not on “travel status”

• Airfare above “lowest economy fare class” (coach or equivalent)

Domestic and foreign travel charged to a sponsored project must follow these guidelines as well as the

Harvard University Travel Policy and funding agency requirements, whichever imposes the greater

restrictions.

Travel expenses that directly support the sponsored project may be charged on an actual expense basis,

on a per diem or mileage basis in lieu of actual expenses incurred, or on a combination of the two,

provided the method used is applied to an entire trip and not to selected days of the trip.

In order to charge a business meal on a federal award, an itemized receipt should be presented even if

the total amount of the bill is less than $75. If an itemized receipt is not available, use a Missing Receipt

Affidavit (MRA), and:

• If the meal(s) did not include alcohol, the traveler must attest in writing that no alcohol was charged,

and the entire amount can be charged to the appropriate federal award.

• If the meal(s) did include alcohol and the traveler can attest in writing the alcohol cost, then the

alcohol portion of the meal costs, along with the applicable tax and tip, must be charged to a non-

sponsored account (using object code 8450). The remainder of the meal costs can be charged to the

appropriate federal award.

• If alcohol was included and the traveler CANNOT attest to the alcohol cost, then no portion of the

meal costs can be charged to a federal award.

Air Travel

2 CFR §200.474.3(d)

Lowest Economy Fare Class

Federal regulations require travelers to incur the lowest possible expense to the federal award; in most

circumstances, this is a non-refundable (restricted) economy class airfare.

Federal regulations require that airfare costs in excess of the lowest economy fare class are unallowable

except when such accommodations would:

(i) Require circuitous routing;

(ii) Require travel during unreasonable hours;

A

ppendix G: Requirements for Travel Expenses Charged to Federal Awards Page 2 of 4

(iii) Excessively prolong travel;

(iv) Result in additional costs that would offset the transportation savings; or

(v) Offer accommodations not reasonably adequate for the traveler's medical needs.

Once this criteria is met, the traveler must justify and document the exception for the use of business-

class or upgraded economy airfare to be allowable on a federal award. Complementary (no cost) upgrades

are allowed. The Federal Lowest Economy Airfare Travel Reimbursement Exception Form

must be

completed and signed by an authorized signer and submitted with the travel reimbursement documentation.

Th

ere may be circumstances where there is a high likelihood that the itinerary may change; in these

situations it is appropriate to purchase a refundable (unrestricted) ticket. Include in the business purpose

section of the reimbursement request the reason for purchasing a refundable ticket.

Business Class Airfare or Upgraded Economy

I

f business class travel or upgraded economy is allowed under the Harvard Travel Policy but cannot be

charged to the federal award, the traveler may still fly business class or upgraded economy. However,

the difference in fare between the least expensive economy fare class and the business class fare must

be charged to a non-sponsored account. Business class airfare can only be charged to a federal award if

one of the Federal exceptions noted above is met. There are no exceptions to this rule.

The traveler must obtain, within one business day of booking the flight, a price quote for the economy

fare for the same itinerary. The economy class fare can be charged to the federal award and the

difference must be charged to a non-sponsored account. The Federal Lowest Economy Split Coding Job

Aid can be utilized to calculate the charges and retained as supporting documentation.

I

f the traveler does not obtain written documentation of the lowest available economy fare for the same

itinerary within one business day of booking the flight, then NO portion of the fare may be charged to the

federal award. Post-booking quotes are not allowed as substitute documentation.

Fly America Act

All air travel on federal awards must comply with the Fly America Act and use U.S. Flag Carriers even

when a less costly foreign flag carrier is available, unless the flight meets the circumstances and

exceptions described in the Harvard University Fly America Travel Reimbursement Exception Form.

Departments/local units need to retain documentation of the Fly America exceptions.

T

he Open Skies Agreement is an exception to the Fly America Act requirement and it allows travelers to

fly on airlines from the European Union, Australia, Switzerland and Japan under certain circumstances.

To determine if a flight meets the Open Skies Agreement criteria, see the Harvard Travel Services

International Travel page and scroll down to the

Fly America Act and Open Skies Agreement Decision

Tree.

Examples of allowable air travel expenses on federal awards:

• A researcher purchased an economy fare and it was upgraded to business class for free (no

additional costs)

• A research fellow traveled on a foreign airline but the ticket has a US carrier code (code share)

next to the flight numbers

A

ppendix G: Requirements for Travel Expenses Charged to Federal Awards Page 3 of 4

E

xamples of unallowable air travel expenses on federal awards:

• A PI purchased a non-stop business class ticket for domestic travel because the coach class

fare was not available and there were alternative flights available

• A PI booked a business class ticket for an 8 hour international flight on a US carrier and

charged the full fare to the federal award without any written documentation of an

exception

• A co-PI booked an economy airfare for a flight from Boston to Amsterdam on a European

carrier; purpose of the trip was to present a paper on a DOD-funded award.

• A post-doc purchased a ticket from a US Airlines website for attending a conference in

Vancouver, but the ticket has a foreign carrier’s code (code share) next to the flight numbers

(the seat does not qualify as US flag carrier)

A

irline incidentals

• Reasonable airline internet fees during travel related to an award are generally allowable cost

s

o

n federal awards

•

Some airlines charge fees for snacks, non-alcoholic drinks, pillows and blankets, etc. Where

permitted by local policies and budget, reasonable costs for these items are reimbursable.

Expense categories typically ineligible for Federal Reimbursement like entertainment (e.g. in-

flight movie) and alcohol cannot be charged to a federal award.

Local Business Meals

Meals consumed in the local environs (i.e. the Longwood Medical Area Campus, the affiliated hospitals,

or the Harvard Cambridge and Allston campuses) are rarely allowed to be charged to federal awards.

The Harvard University Travel policy may permit the expenditure of Harvard funds for these types of

expenses, but they are generally unallowable on federal awards. In these cases, the expense should be

charged to a faculty or departmental discretionary account or other appropriate non-federal account.

Examples of food charges that should not be directly charged:

• Researchers and/or staff meeting to discuss progress on the grant

• PI has lunch/dinner with a colleague to discuss research (the meal of the visitor, if they are on

travel status, may be charged to the award)

Local business meals may be directly charged to an award if they are linked to a formal meeting or

conference at which technical information directly related to the award is being shared or disseminated.

Note that specific federal sponsors may have varying terms and conditions that differ from the federal

definitions. Please refer to the award’s terms and conditions for any specific treatment of expenses.

Examples of meal charges that may be allowed as a direct expense:

• Lunch and refreshments are provided for a periodic all-day meeting with collaborators on a

program project where technical information closely related to that project is being shared.

There is a formal agenda and documented attendee list.

• A researcher is being recruited to fill an open position on a research grant and travels to Harvard

University local environs. Only the researcher’s meal may be charged to the grant since he/she is

on travel status.

In order to charge a business meal on a federal award, an itemized receipt should be presented even if

the total amount of the bill is less than $75. If an itemized receipt is not available, including the use of a

Missing Receipt Affidavit (MRA), and: