NREL is a national laboratory of the U.S. Department of Energy

Office of Energy Efficiency & Renewable Energy

Operated by the Alliance for Sustainable Energy, LLC

This report is available at no cost from the National Renewable Energy

Laboratory (NREL) at www.nrel.gov/publications.

Contract No. DE-AC36-08GO28308

Technical Report

NREL/TP-7A40-83586

September 2022

U.S. Solar Photovoltaic System and

Energy Storage Cost Benchmarks, With

Minimum Sustainable Price Analysis:

Q1 2022

Vignesh Ramasamy

,

1

Jarett Zuboy,

1

Eric O’Shaughnessy,

2

David Feldman

,

1

Jal Desai,

1

Michael Woodhouse,

1

Paul

Basore,

3

and Robert Margolis

1

1

National Renewable Energy Laboratory

2

Clean Kilowatts, LLC

3 U.S. Department of Energy Solar Energy Technologies Office

NREL is a national laboratory of the U.S. Department of Energy

Office of Energy Efficiency & Renewable Energy

Operated by the Alliance for Sustainable Energy, LLC

This report is available at no cost from the National Renewable Energy

Laboratory (NREL) at www.nrel.gov/publications.

Contract No. DE-AC36-08GO28308

National Renewable Energy Laboratory

15013 Denver West Parkway

Golden, CO 80401

303-275-3000 • www.nrel.gov

Technical Report

NREL/TP-7A40-83586

September 2022

U.S. Solar Photovoltaic System and

Energy Storage Cost Benchmarks, With

Minimum Sustainable Price Analysis:

Q1 2022

Vignesh Ramasamy,

1

Jarett Zuboy,

1

Eric O’Shaughnessy,

2

David Feldman,

1

Jal Desai,

1

Michael Woodhouse,

1

Paul Basore,

3

and Robert Margolis

1

1 National Renewable Energy Laboratory

2 Clean Kilowatts, LLC

3 U.S. Department of Energy Solar Energy Technologies Office

Suggested Citation

Ramasamy, Vignesh, Jarett Zuboy, Eric O’Shaughnessy, David Feldman, Jal Desai,

Michael Woodhouse, Paul Basore, and Robert Margolis. 2022. U.S. Solar Photovoltaic

System and Energy Storage Cost Benchmarks, With Minimum Sustainable Price Analysis:

Q1 2022. Golden, CO: National Renewable Energy Laboratory. NREL/TP-7A40-83586.

https://www.nrel.gov/docs/fy22osti/83586.pdf.

NOTICE

This work was authored in part by the National Renewable Energy Laboratory, operated by Alliance for Sustainable

Energy, LLC, for the U.S. Department of Energy (DOE) under Contract No. DE-AC36-08GO28308. Funding

provided by the U.S. Department of Energy Office of Energy Efficiency and Renewable Energy Solar Energy

Technologies Office. The views expressed herein do not necessarily represent the views of the DOE or the U.S.

Government.

This report is available at no cost from the National Renewable

Energy Laboratory (NREL) at www.nrel.gov/publications.

U.S. Department of Energy (DOE) reports produced after 1991

and a growing number of pre-1991 documents are available

free via www.OSTI.gov.

Cover Photos by Dennis Schroeder: (clockwise, left to right) NREL 51934, NREL 45897, NREL 42160, NREL 45891, NREL 48097,

NREL 46526.

NREL prints on paper that contains recycled content.

iii

This report is available at no cost from the National Renewable Energy Laboratory at www.nrel.gov/publications.

List of Acronyms

ac alternating current

AD/CVD antidumping and countervailing duties

BESS battery energy storage system

BLS U.S. Bureau of Labor Statistics

BNEF BloombergNEF

BOS balance of system

CBP U.S. Customs and Border Protection

CPI Consumer Price Index

dc direct current

DOE U.S. Department of Energy

EPC engineering, procurement, and construction

GAAP U.S. Generally Accepted Accounting Principles

HVAC heating, ventilating, and air conditioning

IFRS International Financial Reporting Standards

ILR inverter loading ratio

IRR internal rate of return

kWh kilowatt-hour

LBNL Lawrence Berkeley National Laboratory

LCOE levelized cost of energy

LFP lithium iron phosphate

Li-ion lithium-ion

MMP modeled market price

MSP minimum sustainable price

MW

ac

megawatts alternating current

MW

dc

megawatts direct current

MSRP manufacturer’s suggested retail price

NEM net energy metering

NREL National Renewable Energy Laboratory

O&M operations and maintenance

PII permitting, inspection, and interconnection

PPA power-purchase agreement

PV photovoltaic(s)

PVCS PV combining switchgear

Q quarter

R&D research and development

RTE round-trip efficiency

SAM System Advisor Model

SAPC Solar Access to Public Capital

SEIA Solar Energy Industries Association

SETO U.S. Department of Energy Solar Energy Technologies Office

SG&A selling, general, and administrative

SOC state of charge

STC standard test conditions

UFLPA Uyghur Forced Labor Prevention Act

iv

This report is available at no cost from the National Renewable Energy Laboratory at www.nrel.gov/publications.

USD U.S. dollars

V

dc

volts direct current

W

ac

watts alternating current

W

dc

watts direct current

WRO withhold release order

v

This report is available at no cost from the National Renewable Energy Laboratory at www.nrel.gov/publications.

Executive Summary

The U.S. Department of Energy’s Solar Energy Technologies Office (SETO) aims to accelerate

the advancement and deployment of solar technology in support of an equitable transition to a

decarbonized economy no later than 2050, starting with a decarbonized power sector by 2035. Its

approach to achieving this goal includes driving innovations in technology and soft cost

reductions to make solar affordable and accessible for all. As part of this effort, SETO must track

solar technology and soft cost trends so it can focus its research and development (R&D) on the

highest-impact activities.

The National Renewable Energy Laboratory (NREL) publishes benchmark reports that

disaggregate photovoltaic (PV) and energy storage (battery) system installation costs to inform

SETO’s R&D investment decisions. For this Q1 2022 report, we introduce new analyses that

help distinguish underlying, long-term technology-cost trends from the cost impacts of short-

term distortions caused by policy and market events.

Market and Policy Context in Q1 2022

For the U.S. PV and energy storage industries, the period from Q1 2021 through Q1 2022

featured multiple market and policy events that affected businesses and customers throughout the

manufacturing and installation sectors. The ongoing COVID-19 pandemic caused or complicated

multiple issues. Prices jumped throughout the economy, with industry-specific events and trade

policies driving up PV and battery prices in particular. Change happened rapidly and fell

unevenly across stakeholders. This volatility increased the difficulty of producing representative

cost benchmarks. In accordance with established practices, we drew from updated data and

conducted interviews with numerous industry participants to develop the Q1 2022 cost estimates

shown in this report. Yet we acknowledge that these U.S average estimates do not reflect the

observations and experiences of all stakeholders during this period.

Purpose and Scope of the NREL Benchmarks

It is important to understand what the NREL benchmarks are and are not, and for what purposes

they should be used. The benchmarks are bottom-up cost estimates of all major inputs to typical

PV and energy storage system configurations and installation practices. Bottom-up costs are

based on national averages and do not necessarily represent typical costs in all local markets.

The primary purpose of the NREL benchmarks is to provide insight into the long-term

trajectories of PV and storage system costs, including which system components may be driving

installed prices and where there are opportunities for price reductions. The benchmarks are also

used to project future system prices, provide transparency, and facilitate engagement with

industry stakeholders.

NREL’s benchmarks are often compared with other PV and storage system cost metrics,

including reported prices and other modeled benchmarks. However, there is significant variation

within and between these metrics because of the various methods and assumptions used to

develop them, and different benchmarks are useful for different purposes.

It is also critical to understand the distinction between the two benchmark types analyzed in this

report: minimum sustainable price (MSP) and modeled market price (MMP). Table ES-1

summarizes the meaning, approach, and purpose of each benchmark in comparison to reported

vi

This report is available at no cost from the National Renewable Energy Laboratory at www.nrel.gov/publications.

market prices. Reported market prices and the MMP benchmark are affected by market and

policy conditions unique to the analysis period. Consistent with our previous benchmarking

efforts, our MMP benchmarks can be interpreted as the sales prices that a developer would have

charged in Q1 2022. In contrast, our MSP benchmark is a theoretical construct meant to capture

the long-term cost impacts of technological evolution while muting the impacts of policy

distortions and short-term market fluctuations. It does not represent dynamic market conditions

and should not be used for near-term policy or market analysis. MSP cannot be directly

observed; instead, it must be deduced from observable factors such as underlying costs, market

input prices (e.g., for feedstock), and feedback from industry stakeholders. In this benchmark

report, we apply several methods to infer MSP. Both MSP and MMP are calculated for

representative PV, storage, and PV-plus-storage systems in each market sector.

The NREL benchmarks convert complex processes and inputs into highly simplified individual

estimates to facilitate the tracking and projecting of technological progress. However, no

individual estimate under any approach can reflect the diversity of the PV and storage

manufacturing and installation industries. For instance, MMP benchmarks are based on national

average costs and do not necessarily reflect the distinct experiences of engineering, procurement,

and construction contractors in local markets. The benchmarks also explicitly exclude certain

costs that reflect key system components for certain customers. For instance, many residential

customers finance their PV systems, yet the benchmarks exclude financing costs, which can

represent around 20% of reported market prices. These caveats should be considered when

interpreting the summary of results that follows.

vii

This report is available at no cost from the National Renewable Energy Laboratory at www.nrel.gov/publications.

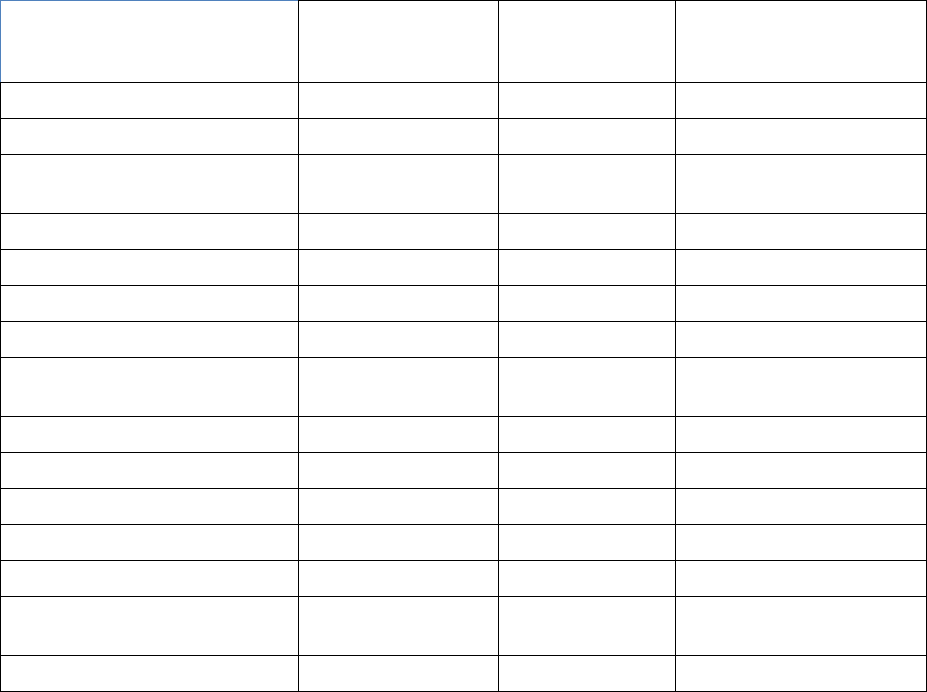

Table ES-1. Definitions of NREL MSP and MMP Benchmarks vs. Reported Market Prices

Minimum Sustainable

Price (MSP) Benchmark

Modeled Market Price

(MMP) Benchmark

Reported Market Prices*

Description Estimated bottom-up

overnight capital costs (i.e.,

cash costs)

1

of

representative PV and

storage components. To

mute the short-term impacts

of market and policy events,

MSP is modeled at the

lowest prices at which

product suppliers can remain

financially solvent in the long

term, based on input costs

that represent the lowest

prices each input supplier

can charge to remain

financially solvent in the long

term.

Estimated bottom-up

overnight capital costs

(i.e., cash costs) of

representative PV and

storage components

under market conditions

experienced during the

analysis period.

Reported prices quoted by

installers and paid by

customers for a range of

technologies and

configurations, often inclusive

of financing costs. Market

prices can include items such

as smaller-market-share PV

systems (e.g., those with

premium efficiency panels),

atypical system configurations

due to site irregularities (e.g.,

additional land grading) or

customer preferences (e.g.,

pest traps), and regulations

(e.g., unionized labor).

Approach Distorted input costs are

removed from model

calculations. If there is more

than one typical technology

or configuration, the most

common one is modeled.

2

Based on reported

market costs and prices

of different subcost

components for

representative systems.

MSP and MMP use the

same technology and PV

system and battery

configurations.

Price metrics aggregated

(e.g., median, mean) from

sources that collect market

price data.

Purpose Long-term analysis and

projections; informing R&D

investment decisions.

Near-term policy and

market analysis based on

disaggregated system

costs.

Near-term analysis based on

reported prices.

*Only summarized in this report. For reported market price details, see Barbose et al. (2021a).

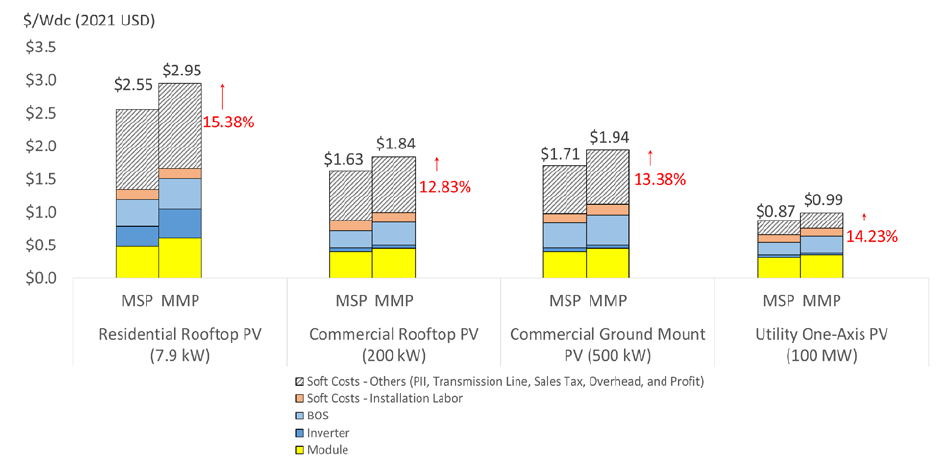

PV Benchmarks

Figure ES-1 compares our MSP and MMP benchmarks for PV systems in the residential,

commercial, and utility-scale sectors. The MMP benchmark is higher than the MSP benchmark

for all sectors, because the MMP benchmark captures the inflationary market distortion that

occurred in Q1 2022. The MMP benchmarks in Q1 2022 are also higher than comparable

benchmarks in Q1 2021 (not graphed) because of the market distortion in Q1 2022, although

1

Cash costs do not include any financing costs, which are often eligible to be included in a system’s cost basis for

calculating tax credits and depreciation. In the residential sector, costs have been observed related to the setup of

loan and lease products for customers as well as interest rate “buy-downs.” In the utility-scale space, common

financing costs also include construction loan interest payments and prepaid operations and maintenance (O&M)

contracts.

2

For example, in the residential sector, we model the installation of microinverters, although string inverters with dc

optimizers are also common.

viii

This report is available at no cost from the National Renewable Energy Laboratory at www.nrel.gov/publications.

different input parameters across the two years also affect the year-to-year comparison (see

Section 4.6).

For Q1 2022, our representative residential PV system uses microinverters and is installed by

small-scale installers. The MMP benchmark ($2.95 per watt direct current [W

dc

]) is 15% higher

than the MSP benchmark ($2.55/W

dc

) and 2% higher than our comparable microinverter-based

system benchmark from Q1 2021 in 2021 U.S. dollars (USD).

For commercial systems, our MMP benchmarks ($1.84/W

dc

for rooftop and $1.94/W

dc

for

ground mount) are roughly 13% higher than our MSP benchmarks ($1.63/W

dc

and $1.71/ W

dc

,

respectively), and they are approximately 8% higher than their counterparts in Q1 2021 in 2021

USD.

For utility-scale systems with one-axis tracking, our MMP benchmark ($0.99/W

dc

) is 14% higher

than our MSP benchmark ($0.87/W

dc

) and 6% higher than its counterpart in Q1 2021 in 2021

USD.

Figure ES-1. Q1 2022 U.S. PV cost benchmarks

Standalone Battery Energy Storage Benchmarks

Figure ES-2 compares our MSP and MMP benchmarks for standalone battery energy storage

systems in the residential, commercial, and utility-scale sectors. Again, for all sectors, the MMP

benchmarks are higher than the MSP benchmarks (and the comparable Q1 2021 benchmarks,

which are not graphed here), because the MMP benchmarks capture the inflationary market

distortion that occurred in Q1 2022. See Section 4.6 for the different input parameters in Q1

2022 vs. Q1 2021.

For residential systems, our MMP benchmark ($1,503/kWh) is 10% higher than our MSP

benchmark ($1,371/kWh) and 2% higher than its counterpart in Q1 2021 in 2021 USD.

ix

This report is available at no cost from the National Renewable Energy Laboratory at www.nrel.gov/publications.

For commercial systems, our MMP benchmark ($672/kWh) is 10% higher than our MSP

benchmark ($610/kWh). Because of a major change in system configuration between Q1 2021

and Q1 2022, the benchmark costs across those years cannot be compared directly.

For utility-scale systems, our MMP benchmark ($446/kWh) is 13% higher than our MSP

benchmark ($394/kWh million) and 12% higher than its counterpart in Q1 2021 in 2021 USD.

Figure ES-2. Q1 2022 U.S. standalone battery energy storage system (BESS) cost benchmarks

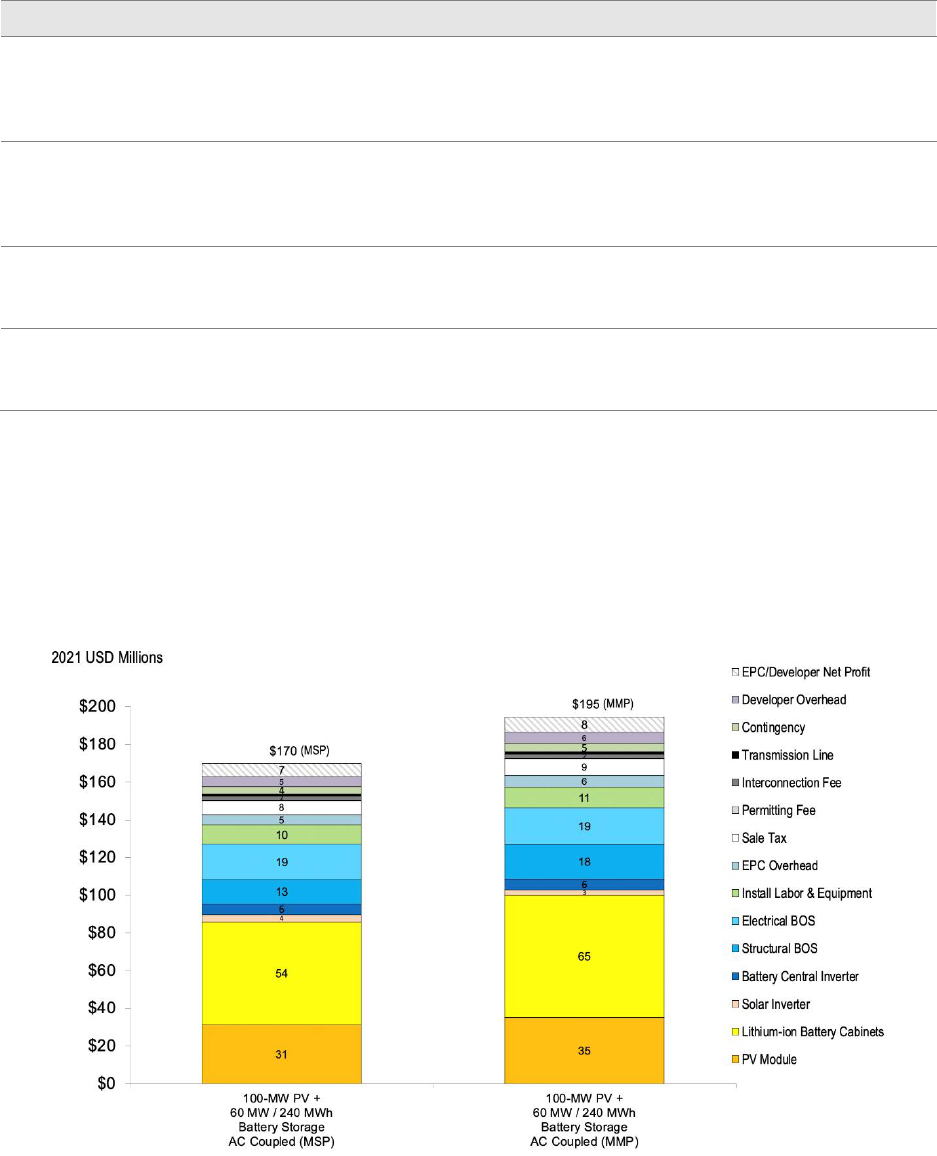

PV-Plus-Storage Benchmarks

Figure ES-3, Figure ES-4, and Figure ES-5 compare our MSP and MMP benchmarks—in total

system cost terms—for PV-plus-storage systems in the residential, commercial, and utility-scale

sectors. Again, the MMP benchmarks are higher than the MSP benchmarks (and higher than the

comparable Q1 2021 benchmarks, not graphed) for all sectors, because the MMP benchmark

captures the inflationary market distortion that occurred in Q1 2022. See Section 4.6 for different

input parameters in Q1 2022 vs. Q1 2021.

For residential systems, our MMP benchmark ($38,295) is 13% higher than our MSP benchmark

($33,858) and 6% higher than its counterpart in Q1 2021 in 2021 USD.

For commercial systems, our MMP benchmark ($1.44 million) is 13% higher than our MSP

benchmark ($1.27 million). Because of a major change in system configuration between Q1

2021 and Q1 2022, the benchmark costs across those years cannot be compared directly.

For utility-scale systems, our MMP benchmark ($195 million) is 15% higher than our MSP

benchmark ($170 million) and 11% higher than its counterpart in Q1 2021 in 2021 USD.

x

This report is available at no cost from the National Renewable Energy Laboratory at www.nrel.gov/publications.

Figure ES-3. Q1 2022 U.S. benchmark: residential PV-plus-storage system

Figure ES-4. Q1 2022 U.S. benchmark: commercial ground-mounted, alternating current (ac)

coupled PV-plus-storage system (4-hour duration)

xi

This report is available at no cost from the National Renewable Energy Laboratory at www.nrel.gov/publications.

Figure ES-5. Q1 2022 U.S. benchmark: utility-scale ac-coupled tracking PV-plus-storage system (4-

hour duration)

xii

This report is available at no cost from the National Renewable Energy Laboratory at www.nrel.gov/publications.

Table of Contents

1 Introduction ........................................................................................................................................... 1

2 Overview of the NREL Benchmarking Process ................................................................................. 2

3 Market and Policy Context in Q1 2022 ............................................................................................... 2

4 NREL Benchmarks’ Purpose and Scope ........................................................................................... 5

4.1 Meaning of the NREL Benchmarks .............................................................................................. 5

4.2 Purpose .......................................................................................................................................... 6

4.3 NREL Benchmarks Compared With Other Metrics ...................................................................... 6

4.4 Minimum Sustainable Price (MSP) and Modeled Market Price (MMP) Benchmarks ................. 9

4.4.1 Minimum Sustainable Price Benchmark ........................................................................ 10

4.4.2 MMP Benchmark ........................................................................................................... 16

4.5 Limitations .................................................................................................................................. 17

4.6 Changes to the NREL Benchmark in Q1 2022 ........................................................................... 18

5 Residential PV Model ......................................................................................................................... 19

5.1 Model Structure and Representative System Parameters ............................................................ 19

5.2 Model Output .............................................................................................................................. 22

6 Commercial PV Model ........................................................................................................................ 22

6.1 Model Structure and Representative System Parameters ............................................................ 22

6.2 Model Output .............................................................................................................................. 25

7 Utility-Scale PV Model ........................................................................................................................ 26

7.1 Model Structure and Representative System Parameters ............................................................ 26

7.2 Model Output .............................................................................................................................. 29

8 Residential Storage and PV-Plus-Storage Model ............................................................................ 31

8.1 Lithium-Ion Standalone Storage System Cost Model ................................................................. 32

8.2 PV-Plus-Storage System Cost Model .......................................................................................... 34

8.3 Model Output .............................................................................................................................. 35

9 Commercial Storage and PV-Plus-Storage Model .......................................................................... 35

9.1 Lithium-Ion Standalone Storage System Cost Model ................................................................. 36

9.2 PV-Plus-Storage System Cost Model .......................................................................................... 39

9.3 Model Output .............................................................................................................................. 40

10 Utility-Scale Storage and PV-Plus-Storage Model .......................................................................... 42

10.1 Lithium-Ion Standalone Storage System Cost Model ................................................................. 42

10.2 PV-Plus-Storage System Cost Model .......................................................................................... 46

10.3 Model Output .............................................................................................................................. 49

11 Operations and Maintenance ............................................................................................................ 50

12 Levelized Cost of Energy of Standalone PV Systems .................................................................... 54

13 Conclusions ........................................................................................................................................ 56

14 References .......................................................................................................................................... 58

xiii

This report is available at no cost from the National Renewable Energy Laboratory at www.nrel.gov/publications.

List of Figures

Figure ES-1. Q1 2022 U.S. PV cost benchmarks ...................................................................................... viii

Figure ES-2. Q1 2022 U.S. standalone battery energy storage system (BESS) cost benchmarks ............... ix

Figure ES-3. Q1 2022 U.S. benchmark: residential PV-plus-storage system ............................................... x

Figure ES-4. Q1 2022 U.S. benchmark: commercial ground-mounted, alternating current (ac) coupled

PV-plus-storage system (4-hour duration) ............................................................................... x

Figure ES-5. Q1 2022 U.S. benchmark: utility-scale ac-coupled tracking PV-plus-storage system (4-hour

duration) .................................................................................................................................. xi

Figure 1. Select price increase indicators, April 2021–April 2022 ............................................................... 4

Figure 2. Comparison of 2020 PV price metrics across sources and sectors ................................................ 7

Figure 3. Overview of bottom-up cost modeling input data ....................................................................... 12

Figure 4. CPI data and linear fit, 2002–2022, showing high deviation of data from fit during 2022 ......... 13

Figure 5. Example of calculating MSP inputs for a structural BOS cost .................................................... 15

Figure 6. Example of calculating MSP inputs for installation labor ........................................................... 16

Figure 7. Average 2020 residential PV market prices by state ................................................................... 18

Figure 8. Residential PV: model structure .................................................................................................. 19

Figure 9. Q1 2022 U.S. benchmark: 7.9-kW

dc

residential PV system cost (2021 USD/W

dc

) ..................... 22

Figure 10. Commercial PV: model structure .............................................................................................. 23

Figure 11. Q1 2022 U.S. benchmark: commercial PV system cost (2021 USD/W

dc

) ................................ 26

Figure 12. Utility-scale PV: model structure .............................................................................................. 27

Figure 13. Q1 2022 U.S. benchmark: utility-scale PV systems (2021 USD/W

dc

) ...................................... 30

Figure 14. Q1 2022 U.S. benchmark: standalone residential storage system ............................................. 33

Figure 15. Modeled dc- and ac-coupled system configurations ................................................................. 34

Figure 16. Q1 2022 U.S. benchmark: ac-coupled residential PV-plus-storage systems ............................. 35

Figure 17. Traditional commercial and utility-scale Li-ion energy storage components ........................... 36

Figure 18. Battery system components ....................................................................................................... 36

Figure 19. Q1 2022 U.S. benchmark: standalone commercial Li-ion battery storage system .................... 39

Figure 20. Q1 2022 U.S. benchmark: commercial ac-coupled PV-plus-storage systems (4-hour duration)

................................................................................................................................................ 41

Figure 21. Q1 2022 commercial PV-plus-storage system MSP benchmark (4-hour duration) in different

sites and the same site (ac-coupled) ....................................................................................... 42

Figure 22. Utility-scale standalone storage: model structure ...................................................................... 43

Figure 23. Q1 2022 U.S. benchmark: standalone utility-scale Li-ion battery storage system .................... 46

Figure 24. dc-coupled and ac-coupled PV-plus-storage system configurations ......................................... 48

Figure 25. Q1 2022 U.S. benchmark: utility-scale ac-coupled PV-plus-storage systems (4-hour duration)

................................................................................................................................................ 49

Figure 26. Q1 2022 utility-scale PV-plus-storage system MSP benchmark (4-hour duration) at different

sites and at the same site (ac-coupled) ................................................................................... 50

Figure 27. Q1 2022 residential, commercial, and utility-scale PV MSP O&M costs by category ............. 53

Figure 28. Q1 2022 residential, commercial, and utility-scale PV MMP O&M costs by category ............ 53

Figure 29. NREL-modeled PV LCOE over time ........................................................................................ 56

List of Tables

Table ES-1. Definitions of NREL MSP and MMP Benchmarks vs. Reported Market Prices ................... vii

Table 1. Select Events ca. Q1 2021–Q1 2022 ............................................................................................... 3

Table 2. Definitions of NREL MSP and MMP Benchmarks vs. Reported Market Prices ......................... 10

Table 3. Utility and Commercial Ground-Mount PV Cost Components for BOS Hardware, Installation

Equipment, and Transmission Lines ...................................................................................... 14

xiv

This report is available at no cost from the National Renewable Energy Laboratory at www.nrel.gov/publications.

Table 4. Residential PV: Modeled Cost Parameters in Intrinsic Units ....................................................... 20

Table 5. Commercial PV: Modeled Cost Parameters in Intrinsic Units ..................................................... 23

Table 6. Utility-Scale PV: Modeled Cost Parameters in Intrinsic Units ..................................................... 27

Table 7. Residential Storage Only: Modeled Cost Parameters in Intrinsic Units ....................................... 32

Table 8. Changes to Residential PV and Storage Models When PV and Storage Are Combined.............. 34

Table 9. Commercial Li-ion Energy Storage System: Modeled Cost Parameters in Intrinsic Units .......... 37

Table 10. Changes to Commercial PV and Storage Model When PV and Storage Are Combined ........... 40

Table 11. Utility-Scale Li-ion Energy Storage System: Modeled Cost Parameters in Intrinsic Units ....... 43

Table 12. Cost Factors for Siting PV and Storage Together Versus Separately ......................................... 46

Table 13. Changes to Utility-Scale PV and Storage Model When PV and Storage Are Combined ........... 48

Table 14. Summary of Key Modeled O&M Parameters ............................................................................. 52

Table 15. Q1 2022 LCOE Input Parameters and Results for Standalone PV, Based on MSP Benchmarks

(2021 USD) ............................................................................................................................ 55

Table 16. Q1 2022 PV and PV-Plus-Storage MSP and MMP Benchmarks (2021 USD) .......................... 57

1

This report is available at no cost from the National Renewable Energy Laboratory at www.nrel.gov/publications.

1 Introduction

The U.S. Department of Energy’s (DOE’s) Solar Energy Technologies Office (SETO) aims to

accelerate the advancement and deployment of solar technology in support of an equitable

transition to a decarbonized economy no later than 2050, starting with a decarbonized power

sector by 2035. Its approach to achieving this goal includes driving innovations in technology

and soft cost reductions to make solar affordable and accessible for all. As part of this effort,

SETO must track solar technology and soft cost trends so it can focus its research and

development (R&D) on the highest-impact activities.

The National Renewable Energy Laboratory (NREL) facilitates SETO’s decisions on R&D

investments by publishing benchmark reports that disaggregate photovoltaic (PV) costs and—

more recently—energy storage (battery) costs. Previous benchmark reports have sought to

provide estimates of typical costs for all system components plus a sustainable margin (from the

perspective of the developer/installer), relying largely on market prices for components. Using

market prices to track progress has pros and cons. Tracking market prices of PV and storage

systems is critical for understanding their competitiveness with other generation technologies.

On the other hand, PV and storage market prices are influenced by short-term policy and market

drivers that can obscure the underlying technological development that shapes prices over the

longer term. For example, recent events related to trade policy, inflation, and pandemic-related

supply chain constraints have pushed PV and storage prices up, even as those technologies have

continued to improve. Short-term market trends are important for the PV and storage industries,

as private-sector entities compete to improve their market share and profitability. SETO,

however, focuses on optimizing R&D investments over the longer term to continue driving

innovations in technology and soft cost reductions.

To support this longer-term perspective, NREL’s Q1 2022 benchmark report is introducing new

analyses, which help distinguish underlying, long-term technology-cost trends from the price

impacts of short-term distortions caused by policy and market events. By muting the impacts of

policy distortions and short-term market fluctuations, the new minimum sustainable price (MSP)

benchmarks provide an effective basis for long-term PV cost analysis. However, they do not

represent dynamic market conditions and should not be used for near-term policy or market

analysis. To help provide perspective on current market conditions, the report also provides

modeled market price (MMP) analysis, which is more in line with previous benchmark reports,

by using similar methods to track the costs of U.S. residential, commercial, and utility-scale PV,

energy storage, and PV-plus-storage systems built in Q1 2022. These methods capture the impact

of market trends during this period, and the results are meant to reflect typical component costs

as experienced by U.S. installers and passed on to U.S. consumers.

3

Additional details about the goals, methods, and limitations of the Q1 2022 benchmark report—

along with a brief discussion of this period’s unique market and policy context—are provided in

Sections 2, 3, and 4. Sections 5 through 10 present the results of our Q1 2022 capital cost

modeling for residential, commercial, and utility-scale PV, energy storage, and PV-plus-storage

3

All previous benchmark reports can be found at NREL’s Solar Technology Cost Analysis web page at

www.nrel.gov/solar/solar-cost-analysis.html

.

2

This report is available at no cost from the National Renewable Energy Laboratory at www.nrel.gov/publications.

systems. Section 11 presents the results of our operations and maintenance (O&M) cost analysis.

Section 12 uses our capital cost and O&M cost results to calculate the levelized cost of electricity

(LCOE) for PV and PV-plus-storage systems. Section 13 offers a summary and conclusions.

2 Overview of the NREL Benchmarking Process

NREL has been developing PV and storage system cost models over the past decade. Each year,

we adjust model elements based on industry trends—derived from research organizations and

sources such as the California net energy metering (NEM) database—as well as feedback from

stakeholders. In Q1 2022, we interviewed 21 stakeholders, including third-party research

organizations; PV installers and integrators; engineering, procurement, and construction (EPC)

developers; advocacy groups; intergovernmental organizations; and government agencies.

We align our model inputs as closely as possible to the analysis period, which for this report is

Q1 2022. We obtain most of the specific cost inputs (material costs, component and

subcomponent costs, installation rental equipment rates, and labor rates) from sources such as

RSMeans, the U.S. Bureau of Labor Statistics, RENVU, EcoDirect, altE Store, BloombergNEF

(BNEF), Wood Mackenzie, and the Solar Energy Industries Association (SEIA). Table 3 in

Section 4.4.1 provides an example of cost components that are populated using such sources. We

base additional inputs—particularly soft costs such as customer acquisition costs; overhead;

permitting, inspection, and interconnection (PII) costs; and profit—on analysis of multiple years

of industry interviews. Currently, we model the MSP of PV modules using NREL’s bottom-up

module cost model. We also tailor the configuration of our representative systems to the analysis

period. For example, for the residential PV sector in Q1 2022, we modeled small installers and

microinverters based on the market shares of these choices.

Once we configure our representative systems and populate our models using the hundreds of

inputs, the models yield disaggregated system cost results in terms of dollars per watt of direct

current ($/W

dc

), dollars per kilowatt-hour ($/kWh), and dollars per system. We then send these

results for validation to the stakeholders we interviewed. After making any necessary

adjustments based on stakeholder feedback, we produce a draft report, which we send to industry

stakeholders as well as NREL and SETO reviewers. We use feedback from this process to

finalize the report, and then we publish the report on NREL’s website, typically during the fourth

quarter of the year (e.g., Q1 2021 results were published in November 2021). See all the reports

at NREL’s Solar Technology Cost Analysis web page: www.nrel.gov/solar/market-research-

analysis/solar-cost-analysis.html.

3 Market and Policy Context in Q1 2022

The PV and energy storage industries are in constant flux, and each of NREL’s benchmark

reports has been produced within a unique historical context. By any measure, however, the

period from Q1 2021 through Q1 2022 was extraordinary. Dramatic market and policy events

affected businesses and customers throughout the PV and storage manufacturing and installation

sectors, with the ongoing COVID-19 pandemic causing or complicating issues. Change

happened rapidly and fell unevenly across stakeholders.

This volatility increased the difficulty of producing representative cost benchmarks. In

accordance with established practices, we drew from updated data and conducted interviews with

3

This report is available at no cost from the National Renewable Energy Laboratory at www.nrel.gov/publications.

numerous industry participants to develop the Q1 2022 cost estimates shown in this report. Yet

we acknowledge that these estimates do not reflect the observations and experiences of all

stakeholders during this period. Section 4 describes the purpose, meaning, and limitations of our

benchmarks in general. Below we give a brief, noncomprehensive overview of developments

that characterized the period from Q1 2021 through Q1 2022 and contributed to unusually

high—and highly variable—PV and storage market costs and prices in Q1 2022. Table 1 lists

select events that occurred during this period.

Table 1. Select Events ca. Q1 2021–Q1 2022

Event Date

Withhold release order (WRO) issued for PV products containing Hoshine polysilicon June 2021

Antidumping and countervailing duties (AD/CVD) circumvention investigation requested

by anonymous U.S. PV manufacturers

Aug 2021

Anonymous AD/CVD circumvention case dismissed Nov 2021

Bifacial PV exemption from Section 201 tariffs reinstated; tariffs reduced from 18% to 15% Nov 2021

Polysilicon spot price peak caused by constrained silicon metal and power in China Nov 2021

Uyghur Forced Labor Prevention Act (UFLPA) signed into law (enforced as of June 2022) Dec 2021

Section 201 tariffs extended with bifacial exemption and increased cell quota Feb 2022

Invasion of Ukraine by Russia Feb 2022

AD/CVD circumvention investigation requested by Auxin Solar Feb 2022

AD/CVD circumvention investigation initiated by U.S. Department of Commerce April 2022

Disruption of polysilicon supply and PV component shipping by COVID-19 lockdowns in

China

April 2022

Costs and prices jumped throughout the economy between Q1 2021 and Q1 2022, largely driven

by effects of the COVID-19 pandemic. Large influxes of government stimulus funds during the

pandemic helped drive strong demand for goods and services worldwide, while pandemic-

induced bottlenecks constrained supply (McCausland 2022, Thomsen 2022). As part of the

supply crunch, containerized freight prices rose as much as 190% between April 2021 and April

2022, finishing the period at a 130% increase (Mercom 2022). Russia’s invasion of Ukraine in

February 2022 drove global oil prices up further, which added to the economywide inflation

(Egan 2022, Kaplan and Hoff 2022). Between April 2021 and April 2022, the Consumer Price

Index (CPI) rose 9% (FRED 2022a), and global commodity prices rose 48% (FRED 2022b). The

PV industry felt the effects of these events in addition to PV-specific cost drivers. Spot prices

rose across the monocrystalline silicon PV supply chain between April 2021 and April 2022:

88% for polysilicon, 29% for cells, and 19% for modules (BNEF 2022). Figure 1 illustrates some

of the price increases that occurred during this period.

4

This report is available at no cost from the National Renewable Energy Laboratory at www.nrel.gov/publications.

Figure 1. Select price increase indicators, April 2021–April 2022

Sources: BNEF (2022), FRED (2022a, 2022b)

The U.S. PV industry was also affected by specific trade policies. In June 2021, U.S. Customs

and Border Protection issued a withhold release order (WRO) against Hoshine Silicon—

instructing U.S. ports to detain shipments containing silica-based products made by Hoshine and

its subsidiaries—because of published reports that Hoshine was using forced labor in China’s

Xinjiang Uyghur Autonomous Region (CBP 2021). In December 2021, this policy was

reinforced by the passage of the Uyghur Forced Labor Prevention Act (UFLPA), which

banned—beginning in June 2022—U.S. imports of products from China’s Xinjiang region unless

importers provide “clear and convincing evidence” that forced labor was not used in their

production (CBP 2022). The detainments and uncertainty associated with the WRO and UFLPA

further constrained module availability in the United States. In August 2021, an anonymous

group of U.S. PV manufacturers petitioned the U.S. Department of Commerce to investigate

whether Chinese PV manufacturers were circumventing antidumping and countervailing duties

by working in Malaysia, Thailand, and Vietnam. Although the Department of Commerce

rejected the petition in November 2021, the uncertainty created by the petition put additional

pressure on the U.S. module supply chain (Woodmac and SEIA 2022). In February 2022, Auxin

Solar filed a similar anticircumvention petition, which instigated a Department of Commerce

investigation at the beginning of Q2 2022; the impacts of that investigation, which have been

significant, are not considered in this Q1 2022 benchmark report. Also in February 2022, the

U.S. Section 201 tariffs were extended along with the tariff exemption for bifacial modules.

Average U.S. prices for monofacial monocrystalline silicon modules rose 9% between Q1 2021

and Q1 2022 (Woodmac and SEIA 2022). Component cost increases are reflected in our MMP

benchmarks in Sections 5–10.

0%

20%

40%

60%

80%

100%

120%

Apr-21 May-21 Jun-21 Jul-21 Aug-21 Sep-21 Oct-21 Nov-21 Dec-21 Jan-22 Feb-22 Mar-22 Apr-22

Percentage increase over April 2021

Polysilicon (spot) Cells (spot) Modules (spot) CPI Global commodities

5

This report is available at no cost from the National Renewable Energy Laboratory at www.nrel.gov/publications.

Component cost increases were a major topic during our Q1 2022 interviews with industry

stakeholders. In addition to stating that all prices had gone up since the previous year, residential

and commercial installers noted significant price increases specifically for modules, batteries,

electrical panels, circuit breakers, and wire. Utility-scale stakeholders mentioned significantly

higher prices for modules, inverters, site preparation, transformers, switchgears, copper, steel,

PVC, and shipping. Because of tight supply chains, obtaining components in a timely manner

could incur additional premiums, according to some interviewees. Some also stated that the

availability and price of components could change rapidly week to week and that module price

increases varied unevenly across installers. Large residential and commercial installers as well as

utility-scale installers reported that they could buy containerload quantities directly from module

manufacturers, which yielded the lowest costs. Smaller installers, however, said that they either

could not handle enough volume to obtain direct, containerload pricing, or that warehousing

costs for high-volume purchases were prohibitive. For this reason, smaller installers reported that

they paid higher module prices through distributors.

Our interviews also suggested that a tightening labor market contributed to higher costs for U.S.

PV systems in Q1 2022. The U.S. unemployment rate rose from 3.5% immediately before the

onset of the COVID-19 pandemic to 14.7% in April 2020 and then dropped again, reaching 3.8%

in February 2022. These fluctuations have been accompanied by an increased rate of workers

quitting their jobs, in a phenomenon that has been called the “Great Resignation” (BLS 2022a).

The tight labor market was reflected in EnergySage’s 2021 installer survey, which identified a

lack of trained labor as the most frequent barrier to growing installation businesses (EnergySage

2022). Our Q1 2022 industry interviews highlighted how higher labor costs contributed to higher

PV system costs. Multiple participants noted significantly increased labor costs and linked them

with labor shortages; in some areas, high demand for installations meant that workers could pick

and choose projects and demand higher wages. Some installers also reported that, because local

labor was unavailable, workers needed to travel to job sites—thus incurring additional costs for

items such as hotel rooms and meals.

4 NREL Benchmarks’ Purpose and Scope

In all industries, numerous metrics reflect product costs and prices. These metrics say different

things and are useful for different purposes. For instance, an investor may be interested in the

costs to produce a new product, a stock trader may want to know the real-time trading price of a

good, and a forecaster may seek a long-term average cost. It is therefore important to understand

what the NREL benchmarks are and are not, and for what purposes they should be used. This

section describes the meaning of the NREL benchmarks, their intended purposes, how they vary

from other market metrics, and their limitations. The final subsection notes changes to the

benchmark report in Q1 2022.

4.1 Meaning of the NREL Benchmarks

Industry, analysts, policymakers, and other stakeholders are interested in the prices of new

technologies and the underlying costs to produce those technologies. In the U.S. PV industry,

prices are readily observable and documented in resources such as Barbose et al. (2021a).

However, installed system prices do not provide insight into underlying system cost drivers.

Disaggregating installed system prices into underlying cost drivers requires identifying all

relevant inputs to PV installations and assigning costs to those inputs. Broadly, this cost

6

This report is available at no cost from the National Renewable Energy Laboratory at www.nrel.gov/publications.

disaggregation can be done through top-down or bottom-up cost modeling. Top-down modeling

observes a final price, then develops a method to distribute that price across individual cost

components. Bottom-up cost modeling estimates the costs of individual components based on

how they are made, then adds those costs up to a modeled total price.

The NREL benchmarks are bottom-up cost estimates of all major inputs to PV and storage

installations. Bottom-up costs are based on national averages and do not necessarily represent

typical costs in all local markets. As we discuss in Section 4.4, this year’s report includes two

distinct sets of benchmarks: MSP benchmarks and MMP benchmarks. MSP benchmarks can be

interpreted as the minimum sustainable price a company needs to charge to remain financially

solvent in the long term based on the minimum sustainable prices of all inputs. MMP

benchmarks can be interpreted as the actual sales price the company charges in the current

market. In a stable, balanced, competitive market that is free of limited-duration trade policy

distortions, MMP is equal to MSP.

4.2 Purpose

The primary purpose of the NREL benchmarks is to provide insight into the long-term

trajectories of PV and storage system costs. The NREL benchmarks inform and track progress

toward SETO’s Government Performance and Reporting Act cost targets. Industry analysts also

use NREL benchmarks to project future system prices. In addition, the benchmarks provide

insight into the disaggregated costs of individual system components. Analysts use disaggregated

costs to identify which system components are driving installed prices and where there are

opportunities for system price reductions.

The NREL benchmarks also provide transparency and facilitate engagement with industry

stakeholders. Other organizations provide bottom-up analysis of PV and storage component costs

for a fee, whereas NREL’s results are provided publicly and free of charge. Thus, all

stakeholders can observe and comment on our assumptions, methods, and results. Opinions

about the correct ways to calculate and report representative benchmark costs across the large,

diverse U.S. PV and storage markets will always vary. However, NREL continues to strive for a

consistent, transparent approach that can be used as a common foundation for understanding the

U.S. market by all stakeholders. Understanding assumptions and methods is critical; stakeholders

should not use the results without first understanding how they were developed and what they

mean. To enhance this effort, NREL is developing a complementary online cost modeling tool.

4.3 NREL Benchmarks Compared With Other Metrics

Cost and price metrics can vary significantly because of the various methods and assumptions

used in their development. Here, we illustrate that variation using PV metrics. Figure 2 compares

2020 metrics across several sources and all three PV market sectors. Each source contains

numerous details about data and methods, which are beyond the scope of this report to list in full.

Rather, we make several general observations to contextualize the benchmarks provided in our

current report; for more detailed study of PV cost and price tracking, see the sources listed

below.

7

This report is available at no cost from the National Renewable Energy Laboratory at www.nrel.gov/publications.

• The Lawrence Berkeley National Laboratory (LBNL) values are based on reported prices for

projects installed in 2020, and they include median values as well as 20

th

and 80

th

percentile

values (Barbose et al. 2021a, Bolinger et al. 2021).

• The SunPower, Sunrun, and Vivint data are the sums of reported average installation, sales,

and general and administrative costs averaged across four quarters in 2020, as derived from

shareholder reports (Barbose et al. 2021a).

• The EnergySage values are median price quotes in 2020, as calculated by LBNL from

EnergySage data (Barbose et al. 2021a).

• The Woodmac values are based on modeled turnkey prices averaged across quarters

(Barbose et al. 2021a, Woodmac and SEIA 2021).

• The NREL values are MMP benchmarks for a 7-kW

dc

residential system, a 200-kW

dc

commercial system, and a 100-MW

dc

utility-scale system (Feldman et al. 2021).

Figure 2. Comparison of 2020 PV price metrics across sources and sectors

Definitions of nonresidential systems vary across the sources, but in general, they include rooftop and ground-

mounted systems that are larger than residential systems, smaller than utility-scale systems, and are not installed on

residences. They often include systems that are defined as “commercial” systems.

As Figure 2 shows, price metrics can vary significantly within PV sectors, depending on the

sources of those metrics. Barbose et al. (2021a) attribute this variation to differences across

sources in underlying methods and inputs, including system vintage, system location, use of

price versus cost, which costs are accounted for, characteristics of installers, presence of value-

based pricing, system size, and system design.

Significant variation occurs even within the LBNL reported prices. The range between the 20

th

and 80

th

percentiles is about $1.60/W

dc

for residential systems, $1.70/W

dc

for small

8

This report is available at no cost from the National Renewable Energy Laboratory at www.nrel.gov/publications.

nonresidential systems, $1.30/W

dc

for large nonresidential systems, and $0.40/W

dc

for utility-

scale systems. Put another way, prices within the 20

th

to 80

th

percentiles are up to 20% different

from the median for residential systems, 40% different for nonresidential systems, and 30%

different for utility-scale systems. For example, it would not be unusual—based on these

reported data—to encounter a typical U.S. residential installation priced at $3.00/W

dc

and

another at $4.60/W

dc

in 2020. This range demonstrates the limitation of representing prices with

a single benchmark value. Tracking a single value consistently over time is a useful way to

gauge technological progress, but when interpreting such values, the underlying variability in

real-world prices should be kept in mind.

The largest absolute difference between NREL’s MMP benchmark and the median reported

LBNL price for a comparable system (about $1.1/W

dc

) is in the residential sector. There are three

primary reasons for this disparity. First, the NREL MMP benchmark is based on costs incurred

by a typical, experienced installer in a competitive market, whereas the U.S. residential

installation industry comprises around 3,000 firms—ranging from small, local installers with

diverse cost structures to large-scale firms whose prices reflect heterogeneous cost structures and

long-term market strategies. Second, the MMP benchmark includes costs only for a specific,

representative system installation. In contrast, reported prices may include premium system

features (e.g., premium inverters) and costs of complementary services such as additional

electrical work (e.g., building main panel upgrades), securing financing, additional roofing

services, and other home upgrades. Thus, the MMP benchmark can be compared to the

manufacturer’s suggested retail price (MSRP) of a car without any premium features. Just as

MSRP is consistently lower than actual car sales prices, so will MMP benchmarks be

consistently lower than average PV market prices. Third, NREL does not have robust data on

profit margins, and the profit margins reflected in reported system prices may be lower or higher

than NREL’s assumptions in any given year.

The differences between NREL’s MMP benchmark and comparable median reported prices are

smaller for the nonresidential sector ($0.4/W

dc

) and the utility-scale sector (up to $0.1/W

dc

).

Fewer companies work on nonresidential and utility-scale projects than on residential projects,

and the business operations, supply chains, and cost structures of the companies that take on

larger projects are different and more uniform than those of retail-oriented residential installation

companies—resulting in more standardized prices. This is particularly apparent for the utility-

scale values shown in Figure 2, which are relatively consistent across the reported and modeled

sources. The nonresidential sector is more heterogeneous than the utility-scale sector with regard

to installers, customers, and system sizes and types, so the variation across price benchmarks is

larger.

In summary, different price benchmarks are useful for different purposes. NREL’s benchmarks

are primarily used for long-term projections and insights into underlying cost drivers, whereas

reported market prices are useful for understanding real market dynamics. NREL benchmarks

should not be used for purposes better met by market prices and vice versa. For instance, if an

analyst wants to know the actual prices paid by real customers in a specific location at a specific

time, the analyst should use reported market prices. Conversely, if an analyst wants to

understand the trajectory of underlying cost drivers, the analyst should use NREL benchmarks

across multiple years.

9

This report is available at no cost from the National Renewable Energy Laboratory at www.nrel.gov/publications.

It is also critical to understand the distinction between NREL’s MSP and MMP benchmarks

when using the benchmark results. These two types of benchmarks are described next.

4.4 Minimum Sustainable Price (MSP) and Modeled Market Price

(MMP) Benchmarks

For the first time, this Q1 2022 report provides modeled capital cost results using two

benchmarks:

1. An MSP benchmark meant to identify the lowest prices at which product suppliers can

remain financially solvent in the long term, based on input costs that represent the lowest

prices that each input supplier can charge to remain financially solvent in the long term.

2. An MMP benchmark that maintains continuity with previous benchmark reports by

capturing the impact of market trends during Q1 2022, reflecting typical national system

costs as experienced by U.S. installers and passed on to U.S. consumers.

Both MSP and MMP are calculated for representative systems in each PV market sector. The

MSP benchmark reflects the lowest sustainable price based on a long-term view of market

conditions, whereas the MMP benchmark reflects the base price of the market price distribution

based on market conditions during the analysis period. Table 2 summarizes the meaning,

approach, and purpose of each benchmark in comparison to reported market prices (which are

only summarized in this report). The two benchmarks are described further in the following

subsections.

10

This report is available at no cost from the National Renewable Energy Laboratory at www.nrel.gov/publications.

Table 2. Definitions of NREL MSP and MMP Benchmarks vs. Reported Market Prices

Minimum Sustainable

Price (MSP) Benchmark

Modeled Market Price

(MMP) Benchmark

Reported Market Prices*

Description Estimated bottom-up

overnight capital costs (i.e.,

cash costs)

4

of

representative PV and

storage components. To

mute the short-term impacts

of market and policy events,

MSP is modeled at the

lowest prices at which

product suppliers can remain

financially solvent in the long

term, based on input costs

that represent the lowest

prices each input supplier

can charge to remain

financially solvent in the long

term.

Estimated bottom-up

overnight capital costs

(i.e., cash costs) of

representative PV and

storage components

under market conditions

experienced during the

analysis period.

Reported prices quoted by

installers and paid by

customers for a range of

technologies and

configurations, often inclusive

of financing costs. Market

prices can include items such

as smaller-market-share PV

systems (e.g., those with

premium efficiency panels),

atypical system configurations

due to site irregularities (e.g.,

additional land grading) or

customer preferences (e.g.,

pest traps), and regulations

(e.g., unionized labor).

Approach Distorted input costs are

removed from model

calculations. If there is more

than one typical technology

or configuration, the most

common one is modeled.

5

Based on reported

market costs and prices

of different subcost

components for

representative systems.

MSP and MMP use the

same technology and PV

system and battery

configurations.

Price metrics aggregated

(e.g., median, mean) from

sources that collect market

price data.

Purpose Long-term analysis and

projections; informing R&D

investment decisions.

Near-term policy and

market analysis based on

disaggregated system

costs.

Near-term analysis based on

reported prices.

*Only summarized in this report. For reported market price details, see Barbose et al. (2021a).

4.4.1 Minimum Sustainable Price Benchmark

Reported market prices and the MMP benchmark are affected by market and policy conditions

unique to the analysis period. In contrast, our MSP benchmark is meant to capture the long-term

cost impacts of technological evolution while muting the impacts of policy distortions and short-

term market fluctuations. The MMP benchmark described in Section 4.4.2 can be thought of as

the MSP distorted by short-term market and policy phenomena that occurred in Q1 2022.

4

Cash costs do not include any financing costs, which are often eligible to be included in a system’s cost basis for

calculating tax credits and depreciation. In the residential sector, costs have been observed related to the setup of

loan and lease products for customers as well as interest rate “buy-downs.” In the utility-scale space, common

financing costs also include construction loan interest payments and prepaid O&M contracts.

5

For example, in the residential sector, we model the installation of microinverters, although string inverters with dc

optimizers are also common.

11

This report is available at no cost from the National Renewable Energy Laboratory at www.nrel.gov/publications.

The MSP is an economic concept that was developed to estimate theoretical sustainable PV

prices and cost projections (Goodrich et al. 2013, Powell et al. 2013). The MSP cannot be

directly observed; rather, it must be deduced from observable factors such as underlying costs,

market input prices (e.g., for feedstock), and feedback from industry stakeholders. A

comprehensive understanding of MSP would require in-depth knowledge about the prices each

input supplier must charge to remain financially solvent in the long term within their complex

and ever-changing market and policy contexts—from the company that extracts raw materials to

component manufacturers, assemblers, and installers. For this reason, development of our MSP

benchmarks can be thought of as a journey of continuous improvement. For the Q1 2022 MSP

benchmarks, we apply two general approaches to infer MSP for the various PV and storage

system components: detailed bottom-up cost modeling and mitigation of distorted input values.

For all soft costs, including labor costs, we use the same values for the MSP and MMP

benchmarks, because we do not currently have a basis for differentiating these values using MSP

principles. These approaches represent initial efforts to characterize MSP. We will improve on

them in future benchmark reports with the help of feedback from PV and energy storage

stakeholders.

Detailed Bottom-Up Component Cost Modeling

We apply detailed bottom-up cost modeling to calculate module MSP. NREL has been applying

bottom-up cost modeling techniques across the PV supply chain for more than 12 years. Items

included within these models capture the variable and fixed costs experienced by firms following

the U.S. Generally Accepted Accounting Principles (GAAP) and the International Financial

Reporting Standards (IFRS). Figure 3 provides an overview of the bottom-up component cost

modeling input data. We first work with researchers and companies to define the process flow.

Then, we contact materials and equipment suppliers representing each step in the manufacturing

process to develop inputs for the top-left box in Figure 3. The inputs needed to calculate

depreciation include equipment throughput and price and floorspace requirements. The inputs

needed to calculate variable (or “cash”) costs include materials, utilities, labor, and maintenance.

Yield losses are also incorporated into the model calculations, as are location-specific cost

indices, including local labor and utility rates. Overhead and minimum sustainable profit margins

are included in the calculation of factory-gate MSP, and shipping costs are included in the

calculation of the final delivery price to PV and storage projects. For this year’s benchmark

report, we used bottom-up cost modeling only for modules. For additional details, see Smith et

al. (2021) and Woodhouse et al. (2020).

12

This report is available at no cost from the National Renewable Energy Laboratory at www.nrel.gov/publications.

Figure 3. Overview of bottom-up cost modeling input data

Addressing Distorted Input Values

Although all market prices fluctuate with near-term changes in supply and demand, aggregated

market prices in mature, competitive industries tend to follow long-term trends. Significant

deviations from these long-term trends provide evidence of temporary market distortions such as

supply shocks or significant policy reforms. These temporary distortions can provide important

information about real-time market conditions but muddle understanding of long-term price

trajectories. We use this basic concept to develop a rule for adjusting input prices that are

significantly distorted by temporary market and policy shocks.

The Consumer Price Index (CPI) provides evidence of significant pandemic-driven market

distortions in 2021 and 2022. As illustrated in Figure 4, the CPI in Q1 2022 was more than two

standard deviations above a linear fit to 20 years of CPI data. We interpret this deviation as

indicating a level of distortion that can separate PV and storage input prices from underlying cost

fundamentals. While we intend to continue refining our methodology over time, we propose to

use the rule of a two standard deviation variation from a 20-year linear fit as a criterion for

identifying periods of significant price distortion. We apply this approach to calculate costs

related to inverters, structural balance of system (BOS), electrical BOS, and transmission lines.

13

This report is available at no cost from the National Renewable Energy Laboratory at www.nrel.gov/publications.

Figure 4. CPI data and linear fit, 2002–2022, showing high deviation of data from fit during 2022

Data are from “Consumer Price Index for All Urban Consumers: All Items in U.S. City Average,” index 1982–1984 =

100, monthly, seasonally adjusted (FRED 2022a)

We show an example of our approach using utility-scale and commercial ground-mount systems.

Table 3 lists BOS hardware, installation equipment, and transmission line cost components for

these systems. We calculate prices for these inputs by excluding 2022 values and averaging

values for the period the data are available between 2017 and 2021 (typically 3–5 years of data).

Data are averaged because the available time series is inadequate to discern consistent time

trends; this method could be modified to make MSP adjustments based on a linear fit once

sufficient time-series data are available.

An example of our MSP calculation for these cost components is shown in Figure 5, for

preconstruction survey material and equipment costs. In the top panel of Figure 5, the high 2022

preconstruction survey material cost of $45 per acre is excluded, and the remaining 2017–2021

costs ($19, $22, $23, $24, and $35 per acre) are averaged to yield an MSP for this component of

$24 per acre. Thus, a preconstruction survey material cost of $24 per acre is input into our

bottom-up cost model as part of the MSP benchmark calculation. The bottom panel shows the

same process for the preconstruction survey equipment cost; here, the 2022 value is lower than

the MSP calculated by averaging the 2017–2021 values. We remove the 2022 value in all cases,

regardless of whether it appears to be high, low, or on-trend. We simply assume that 2022 is a

distorted year and that any costs in that year are distorted. We may refine this simplification in

future analyses.

14

This report is available at no cost from the National Renewable Energy Laboratory at www.nrel.gov/publications.

Table 3. Utility and Commercial Ground-Mount PV Cost Components for BOS Hardware,

Installation Equipment, and Transmission Lines

Preconstruction surveys

Staging

Access roads and parking

Security fencing

Temporary office

Storage box

O&M building

Site preparation (geotechnical

investigation)

Site

preparation

Site preparation (clearing and grubbing)

Site preparation (soil stripping and

stockpiling)

Site preparation (grading)

Site preparation (compaction)

Foundation for inverter/transformer/

PVCS (PV combining switchgear)

Structural

work

Trenches

Foundation for vertical support

Horizontal support structures

Welding or bolting

Module mounting

T-connection

U-joint and driveline

Tracker

Gearbox

Motor and controller equipment

Conduit, wiring

dc work

Grounding, dc cable

Junction/combiner boxes

Inverter house

Alternating current (ac) work

On-site transmission

PVCS

On-site transformer and substation

Site preparation (clearing and grubbing)

230-kV transmission line (4 miles):

tower

Tower: foundation installation

Tower: structure costs

Tower: top assembly

Conductor and cable

Misc. assembly units

Site preparation (clearing and grubbing)

35-kV distribution line (1 mile):

wood pole

Wood pole: foundation installation

Wood pole: structure costs

Wood pole: top assembly

Conductor and cable

Misc. assembly units

15

This report is available at no cost from the National Renewable Energy Laboratory at www.nrel.gov/publications.

Figure 5. Example of calculating MSP inputs for a structural BOS cost

We calculate MSP inputs for installation labor costs differently. Labor wage data from the U.S.

Bureau of Labor Statistics (BLS) are not available for 2022. Thus, we analyze labor wage data

for distortion through 2021 (Figure 6). During this period, all data points are within the two

standard deviation range. For this reason, we use the 2021 labor costs (adjusted for inflation) for

2022 in both the MSP and MMP benchmarks. This observation contributed to our decision to

assume that MSP is equal to MMP for soft costs.

Likewise, battery pack and battery inverter prices were unavailable for 2022, and historical data

for these components are insufficient to analyze anomalies. Thus, for the MMP benchmarks, we

simply adjust the prices of these commoditized items to 2022 rates by accounting for inflation.

For the battery pack MSP, we reduce the 2021 MMP by about 17% for 2022, based on the

average cost reduction rate of turnkey battery systems over the past 5 years (BNEF 2021). For

the battery inverter MSP, we reduce the MMP by 25% to eliminate the effect of the Section 301

tariff for residential and commercial systems; we assume that Section 301 tariffs do not apply to

battery inverters used in utility-scale systems, so no adjustment is made for those system types.

19

22

23

24

35

45

24

2017 2018 2019 2020 2021 2022

Preconstruction Survey - Material Cost ($/Acre)

MSP input

(avg of 2017-2021

reported values)

2022 reported value,

excluded from calculation

2017-2021 reported values,

included in calculation

13

15

14

9

10

11

12

2017 2018 2019 2020 2021

2022

Preconstruction Survey - Equipment Cost ($/Acre)

16

This report is available at no cost from the National Renewable Energy Laboratory at www.nrel.gov/publications.

Figure 6. Example of calculating MSP inputs for installation labor

Source: BLS (2022b)

4.4.2 MMP Benchmark

The Q1 2022 MMP benchmark employs methods like those used in NREL’s recent

benchmarking efforts, including the Q1 2021 report (Ramasamy et al. 2021). This benchmark

has been produced in conjunction with several related research activities at NREL and LBNL,

which are documented by Feldman et al. (2021), Barbose et al. (2020), Bolinger et al. (2020),

6

Chung et al. (2015), Feldman et al. (2015), and Fu et al. (2016).

The MMP benchmark includes bottom-up accounting for all necessary system and project

development costs incurred when installing PV and storage systems. It uses Q1 2022 costs and

excludes any previous supply agreements or contracts. We attempt to model the typical

installation techniques and business operations from an installed-cost perspective. All MMP

benchmarks include variation—accounting for the differences in size, equipment, and

operational use (particularly for storage) that are currently available in the marketplace. All

MMP and MSP benchmarks assume nonunionized construction labor; residential and

commercial PV systems predominantly use nonunionized labor, and the type of labor required

for utility-scale PV systems depends heavily on the development process. All MMP and MSP

benchmarks assume the use of monofacial monocrystalline silicon PV modules. Benchmarking

6

Lawrence Berkeley National Laboratory compares the bottom-up cost results of various entities, including

our results.

17

This report is available at no cost from the National Renewable Energy Laboratory at www.nrel.gov/publications.

using cadmium telluride or bifacial modules could result in significantly different results.

7

Likewise, the MMP and MSP benchmarks assume installation of containerized battery systems

shipped as cabinets that include lithium iron phosphate (LFP) battery packs and battery racks, as

well as a battery management system, thermal management system, and fire suppression system.

Our MMP benchmarks can be interpreted as sales prices that a developer would have charged in

Q1 2022. There is wide variation in developer profits; project pricing depends on region and

project specifics such as local retail electricity rate structures, local rebate and incentive

structures, the competitive environment, and overall project or deal structures. The profit

margins that we assume are meant to represent typical profit margins achieved over the long

term in a competitive market.

4.5 Limitations